Journal of Financial Planning: June 2016

Amongst significant volatility since the second quarter of 2015, markets have struggled to remain near or above low single-digit performance across the asset class spectrum. Sources of return remain key for investors, as alpha has been hard to come by.

While the U.S. presidential election is front of mind, investors continue to make decisions based on the low interest rate environment and other macro events until a candidate is elected. Simply put, for financial advisers making investing recommendations, there is no shortage of issues to be mindful of when constructing portfolios.

Dislocation in the Energy Market

Since the fall of 2014, many risk assets—especially equities—have had above-average correlations to the price of oil. Oil peaked over $100 per barrel in early fall 2014 and hit intraday lows in the mid-$20s earlier this year before bouncing to the $38 to $42 range.1 The price of oil has had a ripple effect, negatively impacting commodity-exporting countries—most notably in emerging and frontier markets such as Brazil, Russia, and Nigeria.

Coupled with the fall in oil prices, the surge in the U.S. dollar has further crippled emerging and frontier markets as their own currencies plummet. Within the U.S., as of mid-February 2016, trailing 12-month energy high-yield defaults were expected to reach 9 percent. Furthermore, metals and mining high-yield defaults hit 13.8 percent, the highest sector default rate since 2002.2

Investors were keeping a close watch on OPEC talks of a potential production freeze, however no deal was reached by April 17, reportedly due to tensions between Saudi Arabia and Iran, according to various media reports. Advisers should be cautious of directional bets on the price of oil and commodities and stick to actively managed energy experts when working with clients wishing to allocate to the space.

China Re-Inventing Its Economy

Alongside the energy market dislocation is the ongoing transition of China from a manufacturing-driven economy to a services-based economy. Whether or not the numbers out of China can be taken legitimately, there is no doubt that GDP has slowed as the country navigates re-directing and re-inventing their economy.

As the Chinese economy struggles to implement a “soft landing,” advisers should expect China’s central bank, the People’s Bank of China, to reluctantly devalue the yuan to increase demand for Chinese goods and spur economic growth. The more aggressive monetary policy will provide leadership with a means to inflate their way out of the over-leveraged real estate market while further injections of liquidity stave off a total collapse of the banking system. At our firm, we expect Chinese equity markets to remain volatile and developed markets to outperform them, aided by currency strength relative to the yuan.

Diverging Strategies for Central Banks

In the post financial crisis world, central banks have taken on numerous tactics to stimulate growth, yet now those strategies are diverging. For the time being, the U.S. has stopped its quantitative easing and raised interest rates from 0 percent to 0.25 percent. The Federal Reserve met on March 16, and Janet Yellen called for proceeding with caution and gradual rate increases. Stocks climbed higher following her dovish comments. After the December meeting, it seemed likely that the Fed would raise rates two or three times in 2016. However, this is no longer the case. In March, Yellen noted that financial conditions have worsened. She also expanded the Fed’s focus to the global economy. The Fed will now consider a variety of factors outside the U.S. when making their interest rate decisions.

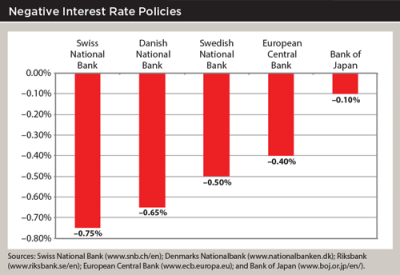

The European Union remains a few years behind the United States in lowering interest rates and quantitative easing. In early March, European Central Bank President Mario Draghi announced that the ECB would be cutting its deposit rate by another 10 basis points to negative 40 basis points, stated interest rates will stay lower for “an extended period of time,” and the potential for further cuts remains.3 Furthermore, Draghi announced the ECB would bring its monthly asset purchases to 80 billion euros.

With the divergent central bank actions, assets have begun flowing into U.S. treasuries and municipals, as the U.S. 10-year (trading at 1.75 percent) is significantly more attractive relative to negative interest rates in Germany, Japan, and Switzerland, for example (see the chart on page 35). As revealed in the Investment Company Institute’s long-term mutual fund data, global fixed-income flows crossed into negative territory in June 2015, and that trend has only continued while municipal assets reversed from small outflows in September 2015 to strong inflows through February 2016.4

Where’s the Alpha?

Investors continue to be frustrated with the lack of “alpha” available in their equity and hedge fund allocations. As shown in the chart above, mega stocks continue to drive performance in equity markets.

According to recent ICI data, total domestic equity and global/international equity ETF assets (in millions) slightly decreased in February compared to the same time last year, whereas hybrid and bond ETFs increased.5

The long-term mutual fund data provided highlights significant selling across all asset classes in December 2015, perhaps due to tax loss harvesting. Total world and total developed market equities reversed course with significant inflows in both January and February, while domestic equity mutual fund outflows continued.

Along the same lines as equities, hedge fund products are under scrutiny for underperforming over the past five years, despite charging higher fees. One reason for underperformance in active management, hedge fund, and long-only products is that “junky” names rebounded and many of these managers own the same crowded names. The S&P 500’s top 10 performing stocks thus far in 2016 were all negative performers in 2015. This kind of an environment—where fundamentally poor companies rally further and faster than fundamentally strong companies—is challenging for active equity managers. This caused even more pain for many long/short equity managers who were selling short the “junky” companies that rebounded and owned long the companies that didn’t participate in the market rally.

A Barclays’ survey of institutional investors and fund managers led to the same conclusion our firm holds; that is, hedge fund allocations will likely see outflows during 2016 due to performance fatigue.6 A Q3 2015 Novus study revealed that while the S&P was down roughly 10 percent for the quarter, the most crowded stocks held by hedge funds were down 22 percent. As alpha is hard to find in equity markets, many actively managed funds are buying and selling into the same securities, causing ever-larger swings in performance. This confluence of factors has stifled long/short equity managers’ performance and will continue to do so until correlation decreases, style investing such as value or growth returns, and small- and mid-capitalization companies are rewarded or punished based on their fundamentals.

The one sector outside of energy that has been impacted by macro factors, and most specifically political influences, has been health care. Health care reform in regard to the Affordable Care Act (ACA) differs amongst the remaining U.S. presidential candidates. The Republican candidates stated they would look to repeal ACA, while on the Democratic side Hillary Clinton would look to build out ACA, and Bernie Sanders would push for a single-payer system.7 Despite the S&P 500 health care index returning nearly 7 percent in 2015, the index has retreated the most of all sectors in 2016, returning –5.50 percent through the first quarter.

Illiquidity in the financial markets has investors concerned about credit strategies. As seen in Q4 2015, bonds would gap down five, 10, even 20 to 30 points in a day based on zero fundamental news. Large fixed-income mutual funds would need to sell large blocks, and positions would be marked down solely for technical reasons.

We’ve seen this trend continue with collateralized loan obligations (CLOs), as managers needed to meet investor redemptions, and technical factors once again caused markdowns in structured products. The Dodd-Frank reform has reduced bank balance sheets by making banks reluctant to carry risk capital and engage in proprietary trading. Dealer trading volume has declined since the financial crisis. In contrast, total corporate debt outstanding has risen sharply as a result of the low-rate environment. Investors had concerns that increased regulation could create an asset-to-liability mismatch in early 2014 and this, in fact, began to play out in 2015 as high-yield markets—and to a lesser degree, investment-grade corporates—sold off.

No More Easy Money

It is evident that investors are wary of markets in 2016. Now that the bull market since the financial crisis seems to be coming to an end, easy money and easy returns are no longer the case. Despite being positive on equities, investors and advisers should be aware that it could be more challenging to generate meaningful returns going forward.

In regard to fixed income, U.S. taxable investment-grade corporates, treasuries, and municipals provide a more stable environment in comparison to global fixed income, and market changes have made it more difficult for liquid alternatives to generate returns. So where are investors turning? Illiquid alternatives including private equity, venture capital, middle-market lending, real estate, and distressed debt should see more inflows. The illiquid nature of these investments makes them less subject to the turbulence that exists within public markets, and at our firm, we believe this will allow investors to generate significant alpha over time. The markets are difficult to navigate in today’s environment; investors should always strive for well-diversified asset allocations that suit their goals and objectives.

Grace Uniacke, CAIA, is a member of the investment research team at Massey Quick, an RIA based in Morristown, N.J., where she is responsible for supporting the team by preparing and maintaining research profiles of current and prospective investment managers across traditional equity, fixed-income, and alternative strategies. She regularly participates in manager due diligence calls and visits, and assists in the operations of two of the firm’s private fund offerings.

Endnotes

- According to Bloomberg data.

- See “U.S. High-Yield Energy Default Rate Hits 9 Percent in February,” from Fitch Ratings, at www.FitchRatings.com/site/fitch-home/pressrelease?id=999715.

- See “ECB Cuts Rates to New Low and Expands QE,” by Claire Jones, posted March 10, 2016 on Financial Times (FT.com).

- See the Investment Company Institute’s "Summary: Estimated Long-Term Mutual Fund Flows Data" dated Apr 13, 2016 and available at www.ici.org/research/stats/flows.

- See the Investment Company Institute’s “Exchange-Traded Funds February 2016” available at www.ici.org/research/stats/etf.

- See Barclays’ “Bracing for Impact: 2016 Global Hedge Fund Industry Trends and Allocation Outlook.”

- See Barclays’ “Cross Asset Research: U.S. Presidential Election—Issues That Matter for Equities.”

Learn More

Journal in the Round (live webinar event on June 22, 2016 from 2-3:30pm ET). Join writer Grace Uniacke, David Edwards (President of Heron Financial Group) to further discuss this year's presidential election and its impact on the economy. Talk and live Q and A will be moderated by FPA's Investment Planning Knowledge Circle host, Ray Benton. (Free to members/recording will be available for 3 months). Register HERE.