Journal of Financial Planning: April 2020

Randy Gardner, J.D., LL.M., CPA, RLP®, CFP®, is the director of education for the Garrett Planning Network.

Leslie Daff, J.D., is a state bar certified specialist in estate planning, trust, and probate law and the founder of Estate Plan Inc.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

Seventy percent of our clients do not have an estate plan in place.1 As a profession, we need to continue to inform our clients of the importance of having estate plans in place. Efficient and effective estate planning strategies will help our clients conserve their wealth and smooth the passing of assets from our clients to their loved ones and charities.

This article is a sequence of information and tables, starting with a basic estate planning framework and proceeding to summaries of recent federal estate planning developments and increasingly important state rules affecting estate planning.

Tax and Estate Planning Goals for Everybody, and the 0.2 Percent

Tax goals for everybody. All of your clients should seek to obtain beneficial income tax basis treatment and avoid an increase in the property tax value of real estate at death.

Tax goals for the 0.2 percent (the wealthy who are expected to owe estate tax). The most wealthy clients should seek to defer taxes to the second death using the marital deduction. They should also avoid owing gift, estate, inheritance, and generation-skipping transfer taxes using advanced planning techniques.

Non-tax goals for everybody. All of our clients should have these non-tax estate planning goals:

- Naming decision-makers to make financial decisions during incapacity and after death

- Desired distributions to whom you want, when you want, and in the way that you want

- Guardianship and probate avoidance

- Retention of financial benefits during life

- Retention of control of property after death

- Post-mortem planning flexibility

- Asset protection

- Simplicity and convenience for the survivors

Non-tax goals for the 0.2 percent. Help the most wealthy clients develop a plan that will help future generations of the family, such as dynasty trusts. Create programs that will enhance the family brand and leave a family legacy, such as private foundations and scholarship programs.

Basic Estate Planning Documents and Common Plan Designs

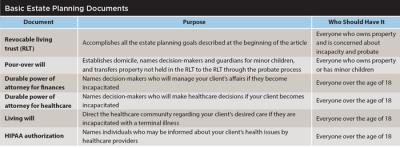

The table below walks you through common estate planning documents, explaining their purpose and who should have them.

Whether the client is married or single, explain, draft, and execute all the documents in the table and take steps to make sure the revocable living trust (RLT) holds, or is the beneficiary of, all the client’s property.

Most married clients create a joint RLT, which transfers the trust property to a survivor’s trust (with the option of disclaiming to a bypass trust or a qualified terminable interest trust (QTIP)) after the first spouse’s death, and transfers the remaining trust property to beneficiary-controlled trusts for the descendants, per stirpes (where each branch of a family receives an equal share of an estate) after the second death.

Married couples typically name the other spouse/grantor as the decision-maker when the first spouse/grantor becomes incapacitated or dies, and the adult children as the successor decision-makers.

Most single clients name a child, trusted friend, and/or a private fiduciary as decision-makers and leave their trust assets to children (if applicable), per stirpes, in beneficiary-controlled trusts or outright to multiple loved ones/charities.

Important Federal Estate Planning Developments

The SECURE Act. The Act’s 10-year rule for inherited IRAs will decrease the benefits of conduit trusts, lead to the establishment of more charitable remainder trusts, and increase the number of Roth conversions.

The Supreme Court decision in Kaestner. Kaestner, a North Carolina beneficiary, had no right to, and did not receive, any trust distributions from the New York trust, and the New York trust did not have a physical presence, make any direct investments, or hold any real property in North Carolina. In a unanimous decision, the U.S. Supreme Court held that the presence of in-state beneficiaries alone does not empower a state to tax trust income that has not been distributed to the beneficiaries where the beneficiaries have no right to demand that income and are uncertain to receive it. [For more on this landmark decision, see “State Income Taxation of Non-Grantor Trusts: An Overview and the Impact of the Recent Kaestner Decision,” by I. Richard Ploss, Esq. CPA, CFP®, TEP, in the December 2019 issue of the Journal.]

Tax affecting. The appraisers in two gift tax cases, Jones and Kress,2 used the income method rather than the net asset value approach to value two established businesses operating as S corporations. They reduced the income by applying a C corporation-level tax to the S corporation earnings so the S corporations could be contrasted to other C corporations that were used as comps in their appraisals.

Trust and estate income tax deductions. With the disallowance of miscellaneous deductions subject to the 2 percent floor by the Tax Cuts and Jobs Act, questions remain about deductions available when a trust or estate terminates. Net operating losses and capital losses may pass from an estate or trust when terminated and be deducted for AGI by the beneficiaries on their individual returns. And, according to the 2018 and 2019 Form 1041 (Schedule K-1) instructions, excess estate or trust deductions may pass to the individual beneficiaries and be deducted as miscellaneous itemized deductions.

Post-mortem actions affecting the value of charitable deductions. In Dieringer,3 the Ninth Circuit Court of Appeals held that the charitable deduction was the amount actually transferred to the charity, rather than the amount reported on the decedent’s Form 706, because the executor’s actions after the decedent’s death altered the decedent’s estate plan and the property’s value.

Out-of-Favor Advanced Planning Technique

Retirement planning language in trusts. Although stand-alone retirement trusts and conduit trust language prevent children of decedents from squandering the decedent’s retirement plan assets and provide asset protection to the beneficiary, the SECURE Act’s elimination of lifetime inherited IRAs has decreased their desirability.

In-Favor Advanced Planning Techniques

Qualified personal residence trusts (QPRTs) and spousal lifetime access trusts (SLATs). Now that the U.S. Treasury Department has clarified how the projected decrease in the applicable exclusion amount will be treated in the final clawback regulations,4 QPRTs and SLATs will likely be heavily used to take advantage of the high applicable exclusion amounts, while they last.

Life insurance trusts. Irrevocable life insurance trusts (ILITs) for those estates large enough to owe estate tax (and revocable life insurance trusts for smaller estates) may become popular strategies as a result of the SECURE Act’s elimination of lifetime inherited IRAs.

Charitable remainder trusts (CRAT or CRUT). For those clients who are charitably inclined and want to obtain the lifetime annuity feature of inherited IRAs, charitable remainder trusts are one alternative.

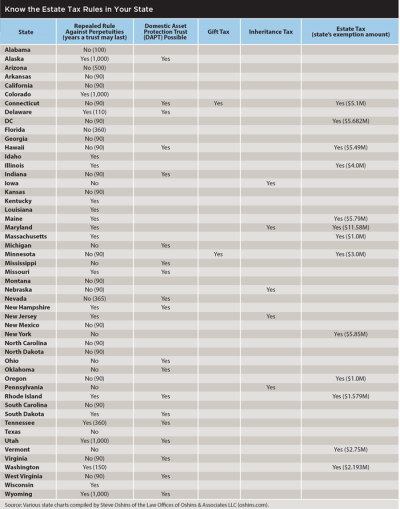

Domestic asset protection trusts (DAPTs) and special power of appointment trusts (SPATs). As more clients become concerned about losing their wealth to frivolous litigation, DAPTs in those states that allow them (and SPATs in the states that do not allow DAPTs) are the go-to strategies.

Dynasty trusts. With many states repealing the rule against perpetuities or increasing the number of years a trust may last, many individuals with substantial wealth are creating dynasty trusts that will support their families for generations to come.

Significant State Developments Affecting Estate Planning

Many of our clients do not think they need estate planning because their estates are not large enough to owe federal estate tax. This perception is inaccurate. Even the smallest estates can get entangled in the complex web of federal and state laws. State laws are often the starting point because they establish the client’s domicile. Where a client resides impacts their homestead exemption, property rights, and whether they are subject to state estate or inheritance tax laws (see the table below for details on state-specific estate tax rules).

Inconsistent federal and state treatment of QTIP elections. When a federal QTIP election is made, does it mean a QTIP election was also made at the state level in the 13 states that have an estate tax? Two cases, Seiden in New York and Taylor in Maryland,5 held that an election at the federal level and inclusion of trust property in the estate on the federal Form 706 of the second spouse to die does not necessarily mean that the property will be included in the second spouse’s estate on the state estate tax return.

The Uniform Electronic Wills Act. Currently available in Nevada, Indiana, and Arizona, the Uniform Electronic Wills Act allows the online execution of wills while ensuring a will’s authenticity. Advisers are required to make a will that is readable as text at the time the testator electronically signs the document, and the testator’s signature must be witnessed by two people who add their own electronic signatures.

Medicaid recovery and joint tenancy property. How much should Medicaid be allowed to recover from property owned in joint tenancy when a Medicaid recipient predeceases the other joint tenant? In In re Estate of Krueger, the lower courts concluded 100 percent of the property should be available, but the North Dakota Supreme Court held that 50 percent should be included because “an ordinary person would read ‘to the extent of [the decedent’s] interest’ as referring to a joint tenant’s fractional interest in the joint tenancy property rather than to a joint tenant’s undivided interest in the whole property.” 6

Access to digital assets (family and commercial photographs). In a New York case (In re Scandalios),7 the executor sought to access family and commercial photos from Apple directly, but Apple would not allow access. The court agreed with the executor and issued a court order that required Apple to allow the executor to access the decedent’s photographs stored on the Apple account. Make sure someone knows the user IDs and passwords for your clients’ digital accounts so a court proceeding will not be required to access them.

No contest clauses in wills and trusts. No contest clauses continue to have mixed success in the courts. One interesting case occurred in the Georgia appellate court case, In re Estate of Johnson. The clause stated: “should any beneficiary of this Will contest the validity of this Will or any provision thereof or institute any proceedings to contest … or to prevent any provision thereof from being carried out in accordance with its terms (whether or not in good faith and with probable cause),” the beneficiary will lose their share.8 The will identified the testator’s fiancée but called her his wife when designating her as fiduciary and beneficiary, but they never married. The testator’s sons brought an action to determine whether she qualified as fiduciary and a beneficiary under the document. The court regarded the proceeding as a prohibited contest, resulting in the sons losing their inheritance.

Although our clients’ estate planning goals and the documents they execute to achieve those goals have not changed significantly over the years, federal and state laws in the estate planning area are constantly changing. Keeping our clients informed of these changes is one of our most important responsibilities.

Endnotes

- See Caring.com’s 2020 Estate Planning and Wills Study at caring.com/caregivers/estate-planning/wills-survey.

- See www.ustaxcourt.gov/UstcInOp/OpinionViewer.aspx?ID=12011; and www.leagle.com/decision/infdco20190327f46.

- See cdn.ca9.uscourts.gov/datastore/opinions/2019/03/12/16-72640.pdf.

- For more on this, see “Strategies Under the Treasury’s Anti-Clawback Proposed Regulations,” by Randy Gardner and Leslie Daff in the January 2019 issue of the Journal.

- See mdcourts.gov/data/opinions/cosa/2018/2198s16.pdf

- See www.ndcourts.gov/supreme-court/opinion/2019ND42.

- See casetext.com/case/in-re-scandalios.

- See courtlistener.com/opinion/4673162/in-re-estate-of-robert-a-johnson.

Sidebar:

Advice We Find Ourselves Repeating Most Frequently

Here are snippets of advice we commonly provide clients, highlighting some of the most common estate planning situations:

Revocable Living Trust

“A will has a very short, useful life—basically, the length of the probate process, which is about one year following the death of the testator, while a revocable living trust benefits the grantor from the time he or she becomes incapacitated or dies until the final item of trust property is distributed to the last beneficiary, possibly 100 years or more.”

Destroy, Revoke

“Many clients are concerned that they are bound by the documents in their estate plan. While the client is alive, any of the documents in the estate plan can be revoked by shredding them or tossing them in the fire.”

Pour-Over Will

“A pour-over will is needed because it ensures the decedent does not die intestate, establishes domicile for the decedent, names guardians for minor children of the decedent, and brings into the trust what we call dangling property (property that was not transferred to the revocable living trust during the trust-funding process).”

Stepped-Down Basis

“Most people realize that property receives a stepped-up income tax basis at death, but they do not realize that property that has gone down in value in the decedent’s hands receives a stepped-down income tax basis.”

— R.G. and L.D.