Journal of Financial Planning: December 2021

Executive Summary

- Financial planners have long regarded diversification and asset allocation as essential tools for reducing portfolio risk for their clients. This is especially true for retired clients who regularly draw on their portfolios for income.

- Another essential tool for risk reduction, but one not adequately recognized by financial planners, is the inclusion of home equity in the retirement portfolio, as an asset along with, and similar to, investment securities. An essential aspect of the inclusion of home equity in the portfolio is a withdrawal strategy that, in a disciplined way, uses that asset.

- The inclusion of home equity as an asset in the portfolio is notional; the equity serves as a source of retirement income just like the other assets in the portfolio, according to the algorithm described herein; but there is no transfer of ownership, control, or management of the home.

- This paper consolidates the results of several previously presented research papers and recasts them into a novel approach to the meaning of “risk” for certain retirees. These retirees are those whose primary source of retirement income is a securities portfolio; typically, but not necessarily, a 401(k) account or a rollover IRA.

- This paper is primarily an instructional vehicle, both to help financial service professionals better understand this vital concept of risk reduction and to help them better educate their colleagues and their clients about the concept.

- Financial planners who have clients approaching, or having recently entered, retirement, should revise their understanding of how to view the volatility of securities portfolios. For clients who are mid-career and are building wealth (i.e., not distributing from their portfolios), short-term volatility generally does not present a significant risk.

- By contrast, for clients who are retired and are distributing primarily from a securities portfolio for their normal living expenses, short-term volatility is risk. The adverse effects of regularly distributing from a volatile portfolio can be substantially diminished by distributions from the home equity instead of the other portfolio assets whenever determined by the algorithm described. The term “risk” is only meaningful if expressed in terms of a chance, a probability, of a specific event adverse to the interests or well-being of the person bearing the risk. Risk, in the context of retirement, means the probability of cash flow exhaustion or the probability of a required significant reduction in lifestyle or spending level. The probability of such an event is the measure of the risk about which this paper is concerned.

- Examples are presented to illustrate the use of home equity as a component of the portfolio to increase the percentage of initial distribution from the securities in the portfolio to a level substantially above the traditional 4 percent and still retain an acceptably low risk of cash flow exhaustion.

- Financial planners who act in a fiduciary capacity should recognize the utility of the added diversification resulting from the inclusion of home equity in retirees’ portfolios, and should include this asset in fulfillment of their fiduciary duty of diversification of investments in order to reduce risk.

Phil Walker is a speaker, author, and 30-year veteran of the financial services industry. He is the vice president of strategic partnerships for the Retirement Strategies Division of Finance of America Reverse. His experience as a retirement strategist includes stops at MetLife, Morgan Stanley Smith Barney, and Merrill Lynch, a featured contribution to Financial Advisor Magazine (“The Boomer Effect”), and frequent speaking engagements with the Financial Planning Association.

Barry H. Sacks, J.D., Ph.D., is a practicing tax attorney in San Francisco. He has specialized in pension-related legal matters since 1973 and has published numerous articles on retirement income planning and on tax-related topics.

Stephen R. Sacks, Ph.D., is professor emeritus of economics at the University of Connecticut. He maintains an economics consulting practice in New York and has published several articles on operations research and on retirement income planning.

NOTE: Please click on the images below for PDF versions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Recent History and Recent Literature

Approximately nine years ago, “the conventional wisdom” was reversed by two papers published in this Journal (Sacks and Sacks 2012; Salter, Pfeifer, and Evensky 2012). In the ensuing years, several additional papers appeared in this Journal and elsewhere emphasizing the same message (Pfeiffer, Salter, and Evensky 2013; Wagner 2013; Pfeiffer, Schaal, and Salter 2014; Pfau 2016a; Pfau 2016b; Tomlinson, Pfeiffer, and Salter 2016; Hopkins 2018).

The conventional wisdom held that a retiree whose primary source of income is a securities portfolio should take distributions only from the portfolio, unless and until the portfolio is exhausted, and only then consider distributions from home equity. The articles and books that appeared during the ensuing nine years demonstrated that the probability of constant purchasing power cash flow survival throughout a 30-year retirement is substantially enhanced by the inclusion of home equity in the portfolio. The home equity is accessed by a reverse mortgage credit line, and income is distributed from the credit line instead of from the other assets in the portfolio. The income is distributed from the home equity not after the portfolio is exhausted, but in the year immediately following the year of negative investment performance of the portfolio. Hence the reversal of the conventional wisdom.

During most of that same nine-year period, there have been significant increases in the favorability of financial media articles about reverse mortgages. For example, see the discussion in Ecker (2014) citing articles in the New York Times and, more recently, the article by Clow (2020).

Another element of this recent history is that even FINRA, not a friend of borrowing for the purpose of investing in securities, recognized the reversal of the conventional wisdom. It did so in 2013 by removing a sentence from an “Investor Alert” that said that a reverse mortgage should only be used as a last resort. It did so shortly after receiving and reviewing the two 2012 papers cited above.

Despite this nine-year history, the community of financial service professionals has not been swift to recognize the results of the research described above. A recently completed survey by the University of Illinois (Lemoine 2020) set out, inter alia, two significant findings:

- Substantially fewer than half of all financial service professionals ever recommend a reverse mortgage for retirement income and security.

- The “compliance environment” has a significant impact on the likelihood of a financial service professional making a reverse mortgage recommendation.

With substantially fewer than half of all financial service professionals recognizing the utility of including home equity in the retirement income portfolio to increase asset diversity and to reduce retirement income risk, this paper is intended to provide an additional approach to understanding the risk inherent in the volatility of securities portfolios from which distributions are taken by retirees as the primary source of their income. It is also intended to encourage and better enable financial service professionals to educate their own clients about the benefit of such added diversity. In addition, where the “compliance environment” is hostile to the inclusion of home equity in the portfolio for retirement income sustainability, this paper can be one of several tools to help financial service professionals educate their compliance colleagues, and thus diminish, or even eliminate, that hostility. So long as that hostility continues, many clients will continue to be denied the opportunity to further and substantially reduce risk.

Mid-Career Clients and Accumulation; Retired Clients and Decumulation

This paper is directed to financial planners, particularly to financial planners who have clients who are approaching, or have entered, retirement. It is intended, with all due respect, to suggest a revision, a re-orientation, of a long-held “mindset.” The suggested revision is the following:

The long-held mindset of many financial planners, especially those most of whose clients are in mid-career, i.e., in the accumulation phases of their financial lives, has a strong focus on wealth building. To meet normal living expenses, the mid-career clients have regular income from their work. In the course of wealth building, particularly when the wealth being built is largely in the form of a portfolio of securities, the client can accept a great deal of volatility in his or her portfolio. The portfolio’s short-term volatility doesn’t have much long-term impact on the client’s wealth because, during this phase, the portfolio is not a source of distributions.

By contrast, retirees, by definition, do not have regular income from their work. Instead, the roughly 20 million retirees (and soon-to-be retirees) who are considered here need (or will need) to distribute from their accumulated wealth to meet normal living expenses. Those distributions are done frequently enough to be viewed as “short-term.” As explained in greater detail below, this frequency means that volatility is no longer distinguished from risk. For these retirees, volatility is risk.

Retirees and Their Risks

Which Retirees? The retirees (and soon-to-be retirees) considered here are part of the Baby Boomer1 generation and number about 20 million. These retirees share the following two characteristics:

- Their primary source of retirement income is from 401(k) accounts or other securities portfolios with values in the range of $500,000 to $1.5 million.

- They own their own homes and have no mortgage debt against them (Neuwirth, Sacks, and Sacks 2017, citing Tomlinson et al. 2016).2

What Risk? The term “risk” does not have a meaning in the abstract. Rather, the term “risk” implies a chance, a probability, of an event that is adverse to the interests or well-being of the person bearing the risk. As reported in a CPA survey and cited in Scruggs (2019), among the greatest concerns of retirees (and soon-to-be retirees) are the concerns about “running out of money” during retirement and about experiencing a required significant reduction in “lifestyle and spending level.” Expressed in terms of risk, “cash flow exhaustion” and required “significant reduction in lifestyle and spending level” are the adverse events that are at risk of occurring. The probability of these events is the measure of the “risk” about which this paper is concerned.

As noted above, one might ask whether, in the context of a securities portfolio, “volatility” is the same as “risk.” A very thoughtful article by Benz (2020) from Morningstar considers that question. To quote some of the salient points from that article:

“You certainly see the two terms used almost interchangeably in the investment arena. It’s also true that these terms—especially risk—have different meanings for different people.”

“. . . volatility usually refers to price fluctuation in a security, portfolio, or market segment during a fairly short time period—a day, a month, a year. . . .If you’re not selling anytime soon, volatility isn’t a problem . . .”

“The most intuitive definition of risk, by contrast, is the chance that you won’t be able to meet your financial goals and obligations . . .”

“However, it’s easy to see how the two terms have become conflated. If you have a short time horizon and you’re in a volatile investment, what might be merely volatile for another person is downright risky for you. That’s because there’s a real risk that you could have to sell out and realize a loss when your investment is at a low ebb.”

What is unique, what is particular, to the roughly 20 million retirees (and soon-to-be retirees) mentioned above is this: unlike other investors, these retirees are dependent on their securities portfolios as the primary source of their retirement income. Except as described below in this paper, they don’t have the luxury of “not selling anytime soon.” They need to sell securities from their portfolios to have the money on which to live.

As a result of needing to sell securities even if the portfolio is at a low ebb, for the retirees considered here, volatility is risk. It is easy to demonstrate, with simple mathematical examples, that the risk, i.e., the probability of the adverse event, i.e., running out of money during retirement, is particularly great if the downturns in the portfolio’s volatility cycle occur during the early years of retirement. This risk is known by the term “sequence of returns risk” (Pfau 2018).

Sequence of Returns Risk and Essential Messages for Retirees

The important point, indeed the essential point, is that the sequence of returns risk only applies to a portfolio from which distributions are being taken. In other words, the sequence of returns, i.e., the specific pattern of the volatility of the portfolio, poses a significant risk for retirees (i.e., for those who are taking distributions from their portfolios for a substantial portion of their income). The sequence of returns does not pose a significant risk for those who are not taking distributions from their portfolios. The irrelevance of the sequence of returns when the portfolio is not making distributions nor being added to is illustrated by an example in Appendix A.

For retirees, i.e., for those who are drawing from their portfolios, the essential messages are the following:

- Securities portfolios, particularly those that contain mostly stocks, are inherently volatile. A portfolio can only avoid volatility if it gives up most or all of its future growth.

- In planning for reasonably long retirements (of the order of 25 to 30 years), growth of assets is necessary to offset increases in cost of living (i.e., inflation). Therefore, stocks are necessary.

- When a portfolio is regularly making distributions, its volatility reduces the long-term value of the portfolio. The risk that the value of the portfolio would reach zero before the end of the retiree’s life, i.e., the risk of cash flow exhaustion, is the primary concern considered in this paper. (Echoing the words used above, cash flow exhaustion is the adverse event whose probability is the measure of risk.) In Appendix B, an example is shown comparing two initially identical portfolios with identical average annual rates of return, but one is volatile and the other is not. Distributions are made from each one, in identical annual amounts.

- There is a solution, i.e., a way to diminish the risk of portfolio exhaustion (hence cash flow exhaustion). That solution is the inclusion in the portfolio of another asset, one whose value is not correlated with the volatility of the securities’ values, to provide cash to the retiree at certain times, instead of the retiree having to take distributions from the portfolio’s securities at those times. The other asset, as has been noted, is home equity, accessed by means of a reverse mortgage credit line. There are several strategies for the use of home equity; this paper will compare the risk reduction that results from two of those strategies.

- As discussed in the final section of this paper, a fiduciary has a duty to diversify the assets held for a retiree. This paper demonstrates that, under the circumstances described, a fiduciary’s duty of diversification includes the duty to understand and properly include the retiree’s home equity in the portfolio of assets used to provide distributions of retirement income.

Message No. 1 and Message No. 2 are well understood. There is no need to elaborate on them here. Message No. 3 is illustrated in Appendix B. Message No. 4, relating to the retiree’s need for the inclusion of home equity in the portfolio, is illustrated in the graphs below, and Message No. 5 is discussed in the closing section of this paper.

Diminishing the Risk of Cash Flow Exhaustion: A Portfolio and Some Skipped Distributions

Skipping Some Distributions from the Portfolio. Before considering the inclusion of home equity in the portfolio, it is important, and very illuminating, to consider a simple, but extremely powerful, idea.3 The idea relates to a volatile securities portfolio, without the inclusion of the home equity, from which regular distributions are taken. (Regular distributions reflect exactly the situation of a portfolio—such as a 401(k) account or a rollover IRA—that is the primary source of a retiree’s retirement income.) The idea is that merely skipping a few annual distributions can have a substantial effect in making the portfolio last longer. In one sense, it is intuitively obvious: If two years of distributions are skipped, the portfolio will last two years longer. But think again: If the two years’ distributions that are skipped are distributions that follow years in which the portfolio has had negative or weak investment returns, perhaps the subsequent recovery of the portfolio (richer by the amount that was not distributed) might cause the extra duration to be more than two years. And that’s exactly what happens. The following example illustrates that point:

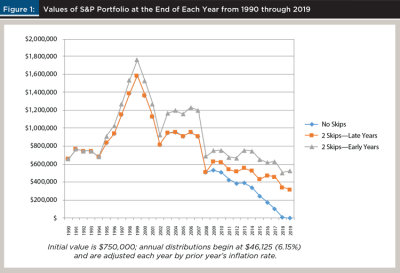

Start with a portfolio consisting entirely of the S&P 500 stocks, with initial value of $750,000. Distribute from this portfolio each year an amount that in the first year is $46,125 (i.e., 6.15 percent of the portfolio’s initial value) and is increased each year by the prior year’s inflation rate, so that the distributions all have the same purchasing power.4 Follow this portfolio’s value each year over the most recent 30-year period, which is from 1990 through 2019.

The investment returns during the 30-year period happen to include 21 years of positive returns and nine years of negative returns. Among the earlier years with negative returns are 1994 and 2002, and among the later years with negative returns are 2008 and 2015.5

The lowest line on Figure 1. The lowest line on the graph in Figure 1 shows the results of this program of annual distributions with no distributions skipped. It shows that, as of 2018, the portfolio’s value has reached zero; it has run out of money.

The middle line on Figure 1. As mentioned above, one way to reduce the likelihood of the portfolio’s running out of money might be to skip a year’s distribution, or even a few years’ distributions. Consider the effect on the portfolio of skipping a couple of distributions:

In the middle line on the graph in Figure 1, the portfolio’s value is shown, where distributions are skipped in two later years that follow years in which the portfolio had negative investment returns. So, the middle line on Figure 1 shows the value each year of the portfolio, where the distributions of the years 2009 and 2016 are skipped. Each of these years follow a year in which the portfolio’s investment return was negative. In this line, the portfolio has a value of about $339,000 in the year 2018, which is the year that the lowest line shows that the portfolio value has reached zero.

The top line on Figure 1. And finally, the top line on Figure 1 shows the value of the portfolio each year, where the distributions of the years 1995 and 2003 are skipped. Each of these years follow a year in which the portfolio’s investment return was negative. In this line, the portfolio has a value of about $556,000 in the year 2018, which is the year that the lowest line reached zero and the middle line reached a value of about $339,000.

At the end of the 30-year period, the lowest line, of course, remains at zero, the middle line stays at a value of over $300,000, and the top line stays at a value of the portfolio of over $500,000.

To reiterate, this example demonstrates that skipping just a few distributions from a volatile portfolio, especially after the portfolio has had negative investment returns, and especially in the early years of the series of returns, results in a greatly increased duration of the portfolio, that is, a greatly reduced risk of cash flow exhaustion.

Retiree Income When Portfolio Distributions Are Skipped

If home equity is included in the portfolio, it can serve as the source from which to distribute income while skipping distributions from the volatile securities.

In the example given above, two distributions were skipped.

Consider first the two early distributions skipped. The values (and years) of the two distributions that were skipped were $55,140 (1995) and $66,977 (2003). Although the early two distributions skipped were smaller than the later two distributions skipped (because of inflation), the future value (at 30 years after outset of retirement) would be greater. The two early distributions from the home equity (notionally included in the portfolio), brought forward as a notional debt of the portfolio to the year 2019 at a 4.5 percent annual rate, are approximately $158,600 and $135,500, respectively. The total is approximately $294,100. This amount is substantially smaller than the more than $500,000 left in the portfolio shown by the top line in the graph in Figure 1.

For completeness, consider the two later distributions skipped. The values (and years) of the two later distributions that were skipped were $80,123 (2009) and $88,187 (2016). These two later distributions from the home equity (notionally included in the portfolio), brought forward as a notional debt of the portfolio to the year 2019 at a 4.5 percent annual rate, are approximately $124,400 and $100,600, respectively. The total is approximately $225,000. This amount is somewhat smaller than the roughly $300,000 left in the portfolio shown by the middle line in the graph in Figure 1. Thus, using as the growth rate an estimate of the current rate of interest applicable to a reverse mortgage, it is reasonable to estimate that the retiree who takes advantage of the “distribution-skipping” strategy explored in this example would have cash flow throughout a 30-year retirement and a legacy substantially greater than a retiree who does not take advantage of such a strategy.6

Before moving on from this example, the psychological, or behavioral, consideration is important to examine. The retiree began retirement in 1990 with a portfolio of securities valued at $750,000, and took annual distributions from it of approximately $46,000, inflation-adjusted, in each of the first several years of retirement. When the year 1995 arrived, following the 1994 downturn in the securities portfolio’s value, there was more than $800,000 of value still in the portfolio. Thus, taking the $55,140 distribution, i.e., less than 7 percent of the portfolio, doesn’t “feel” like it’s raising a red flag. It doesn’t send a message about the risk of far future cash flow exhaustion. It is precisely the failure to recognize the risk that the near term (early in retirement) distributions from the portfolio, when it’s a little bit down, creates for long-term (late in retirement) cash flow exhaustion. This is exactly the type of education that financial service professionals should be providing to their clients. Describing and clarifying the nature and measure of this risk is the purpose of this paper.

Planning to Reduce the Retiree’s Risk: Strategies for Using the Home Equity

From the example just shown, it is reasonable to conclude that a way of reducing a retiree’s risk of cash flow exhaustion when a securities portfolio is the retiree’s primary source of retirement income is to skip some distributions from the volatile securities in the portfolio after the securities have had negative or weak investment returns. Of course, the retiree must have income to live on, which will come from the other asset in the portfolio, i.e., the home equity.

The example is based on one series of investment returns, for one 30-year period. That was a period in very recent history, indeed a recently completed 30-year period. The seminal work by William Bengen (1994), which developed the well-known “4 Percent Rule,” did so using data on 37 different 30-year historical periods, ending in 1993. But, no 30-year period’s investment returns match any other 30-year period’s investment returns. Therefore, of course, no future 30-year period will have investment returns that match any previous 30-year period. So, how is planning to be done to minimize the risk of cash flow exhaustion in the future?

To plan for the future, currently the most widely used approach is to simulate many future scenarios using Monte Carlo Simulation. Monte Carlo Simulation simulates thousands of different investment return sequences, and the analyst tries different values for the input parameters. (The input parameters are the initial portfolio value, the initial distribution rate, and the initial home value.) In the analysis presented below, three strategies are examined, using three parallel simultaneous spreadsheets. All three of the spreadsheets are run with the same set of input parameters and investment returns, several thousand times (and each time with a different set of investment returns). Each spreadsheet has 30 rows, which calculate the cash flow available for the 30 years of retirement.7

The same analysis is presented with three different sets of input parameters.

The algorithm and the analysis used have been described in Sacks and Sacks (2012) and in Neuwirth, Sacks, and Sacks (2017). The analysis is summarized in the endnote.8 The widely used premise, which is used here, is that cash flow is inflation-adjusted, so that it results in constant purchasing power from one year to the next. Income tax is treated as included in annual expenditures. Accordingly, when the income source is the home equity portion of the portfolio, i.e., the reverse mortgage credit line, which is not taxable, less income is needed. Thus, by keeping the inflation-adjusted income constant, the results are a bit more conservative than they appear.

In one strategy, called the “Coordinated Strategy,” the algorithm in the spreadsheet distributes the retirement income from the portfolio’s securities in each year following a year in which the securities had positive investment returns, and distributes the retirement income from the home equity portion of the portfolio in each year following a year in which the securities had negative or weak investment returns.9 This strategy mirrors the “distribution-skipping” approach shown in the example in Figure 1. For any given values of the input parameters, which are the initial distribution rate, the initial portfolio value, and the initial home value, the percentage of the simulated scenarios in which the inflation-adjusted cash flow fails to continue throughout the 30 years of retirement is the probability of cash flow exhaustion, i.e., the risk of cash flow exhaustion.

In another strategy, called the “Last Resort Strategy,” the algorithm used is to distribute inflation-adjusted cash flow exclusively from the securities portion of the portfolio until the securities are exhausted. Then, when the securities are exhausted, the home equity is added to the (now empty) portfolio as a last resort. Once the home equity is added and the credit line is established, inflation-adjusted cash flow is distributed from the credit line for the remaining years in the 30-year retirement, or, if earlier, until the credit line is exhausted. This strategy is, until the portfolio is exhausted, like the lowest line on Figure 1.

The third strategy in the analysis is the “Securities Alone Strategy.” In this strategy, the retiree’s cash flow is distributed exclusively from the securities in the portfolio, throughout the 30-year retirement, or, if sooner, until the securities are exhausted. The home equity is not used. This strategy is exactly the strategy shown in the lowest line of Figure 1.10

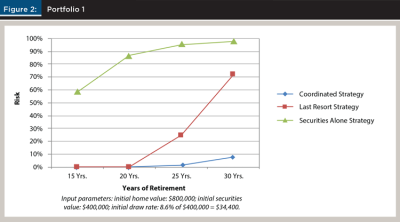

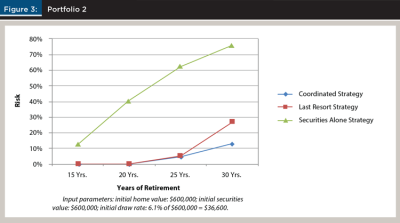

Using the set of parameters specified in each figure’s caption, the comparison of these three strategies is illustrated, for each of three sets of parameters, in Figures 2, 3, and 4. These three examples all have the same initial portfolio value, $1.2 million, but they have three different asset allocations. The initial distribution amounts are nearly identical in all three examples, and are chosen to result in approximately a 10 percent risk of cash flow exhaustion under the Coordinated Strategy.

Risk of Cash Flow Exhaustion (Comparing Portfolios with and without Home Equity and Comparing Strategies)

In Figure 2, where the initial home value is twice the initial securities’ value, the risk of cash flow exhaustion under the Last Resort Strategy, at 30 years into retirement, is about seven times as great as the risk under the Coordinated Strategy. The risk of cash flow exhaustion under the Securities Alone Strategy is nearly 10 times as great as the risk under the Coordinated Strategy.

In Figure 3, where the initial home value is equal to the securities value, the risk differentials are less dramatic but nonetheless significant.

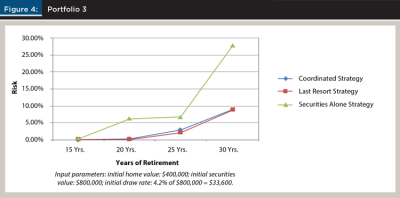

In Figure 4, where the initial home value is only half of the value of the initial securities in the portfolio, there is essentially no difference between the risk of cash flow exhaustion under the Coordinated Strategy and under the Last Resort Strategy. However, the risk of cash flow exhaustion at 30 years into retirement under the Securities Alone Strategy is close to triple the risk of either of the strategies in which the home equity is included in the portfolio and used as a source of income.

The conclusions to reach from these examples are the following:

- Expressed in terms of “Risk of Cash Flow Exhaustion” (rather than in terms of the more conventional “Probability of Cash Flow Survival”), these results have a substantially greater impact. Therefore, expressed in this way, they can be, and should be, better used by planners and better understood by their compliance colleagues. Also, in this way, these results can be better used to educate and advise planners’ clients.

- The choice of a 10 percent risk as an “acceptable” level of risk reflects a somewhat arbitrary trade-off between extreme security with low cash flow, on one hand, and greater risk with higher cash flow, on the other hand.

- It should also be noted that, under the Securities Alone Strategy (Figure 4), only with a 3.2 percent initial distribution rate can the 10 percent risk level be achieved, consistent with the observations in Pfau (2014).

A conclusion to reach from any example based on projections into the future is: Projections are based on current financial and economic conditions and on current estimates of future financial and economic conditions. Accordingly, it is essential that the retiree and their financial adviser monitor the evolution of those conditions. If the monitoring reveals changed conditions that require the retiree to adjust their spending level, it is easier to make small adjustments earlier in retirement than to have to make major revisions in later years.

Fiduciary Considerations

Many financial planners act in a fiduciary capacity for their clients. When their clients’ securities portfolios are held in accounts in ERISA-governed retirement plans (typically 401(k) accounts), the planners are subject to the ERISA fiduciary rules. Even when the accounts are not held in ERISA-governed retirement plans, the financial planner may choose to follow the ERISA guidance.

ERISA’s fiduciary rules are set out in Section 404(a)(1); the relevant language focused on here reads as follows:

“(1) . . . a fiduciary shall discharge his duties with respect to a plan solely in the interest of the participants and beneficiaries and—”

“(C) by diversifying the investments of the plan so as to minimize the risk of large losses . . .” [Emphasis added.]

When a retiree’s primary source of retirement income is the securities in a portfolio, and the securities incur a loss in the course of their volatility cycle, the retiree has the choice of selling securities from the portfolio or distributing from the other asset in the portfolio, that is, from their home equity. This choice reflects back to the previous section, “Retirees and Their Risks,” where the volatility of the portfolio is shown to actually be the risk. That is because, as noted in that section, the retiree who is distributing retirement income exclusively from the securities in the portfolio does not have the luxury of allowing the longer-term recovery of the portfolio to avoid the loss, except if the retiree has, and can use, the other asset in the portfolio: their home equity. In essence, if the financial adviser recognizes that the home equity is part of the retiree’s diversified portfolio, then the financial adviser can assist the client in using the home equity “to minimize the risk of large losses.” It is not much of a stretch to include the retiree’s risk of cash flow exhaustion, or risk of required significant reduction in current lifestyle and spending level, as a “risk of a large loss” within the meaning of this section of ERISA.

Within the last year or two before this writing, financial planners, including some large organizations, have begun to recognize the value of home equity in retirement income planning. It is hoped that many more will in the near future.

Citation

Walker, Philip, Barry H. Sacks, and Stephen R. Sacks. 2021. “To Reduce the Risk of Retirement Portfolio Exhaustion, Include Home Equity as a Non-Correlated Asset in the Portfolio.” Journal of Financial Planning. 34 (12): 82–97.

Endnotes

- The Baby Boomer generation is generally defined as those born between 1946 and 1964.

- Although the major benefit to retirement income brought by a reverse mortgage occurs when the home is owned by the retiree with no mortgage debt, some benefit can be derived even when there is some mortgage debt, so long as the mortgage debt is below about 30 percent of the home’s value. An illustrative example appears in endnote 6.

- The authors of this paper are grateful to Dr. Wade Pfau, who has written and spoken about the idea of skipped distributions and has introduced us to the way to demonstrate its power. See Pfau (2019).

- The initial distribution rate of 6.15 percent is chosen simply as an illustration and to match approximately the distribution rate used in Figure 3.

- These years with negative investment returns are chosen arbitrarily to illustrate the effect of skipping distributions in the subsequent years. The results would be similar, but not identical, if other years with negative returns were chosen and the distributions were skipped in the years following the years chosen.

- To return to the point made in endnote 2, consider the following situation, in which the retiree’s home is valued at $700,000 and has a $225,000 conventional mortgage. The retiree could obtain a reverse mortgage in the amount of $350,000, pay off the conventional mortgage, and use the remaining $125,000 as a line of credit, which could be used by the retiree in place of a couple of skipped distributions from the securities in the portfolio.

- The Monte Carlo assumptions are set out in Appendix C.

- The analysis for each set of input parameters proceeds as follows: The initial portfolio value and initial home value remain the same for each trial. A particular initial distribution amount is selected. The securities portion of the portfolio is Monte Carlo simulated for each year in a 30-year sequence of years, and the portfolio makes an inflation-adjusted distribution each year. The process is repeated 2,000 times. (Each repetition is a “trial.”) For each trial, it is determined whether distributions were able to continue throughout the 30-year period, or whether the money was exhausted before the end of the 30-year period. If, for any particular initial distribution amount, the number of trials in which the money was exhausted (before the end of 30 years) was 10 percent (i.e., 200 out of 2,000) or less, that meant that the 30-year risk of cash flow exhaustion was 10 percent or less.

- The reader might ask what happens when the algorithm requires the retiree to distribute income from the home equity, but the RMD (required minimum distribution) rule requires a distribution from the portfolio. The answer is that the RMD is taken from the tax-sheltered portfolio and then reinvested in a “mirror portfolio” outside of the tax-sheltered portfolio.

- Any strategy ignoring the value of home equity will have a higher failure rate than one that does not ignore home equity. That’s because adding home equity as an asset effectively increases one’s retirement funds. And given a fixed dollar distribution, any distribution strategy that starts out with more money will do better.

References

Bengen, William P. 1994. “Determining Withdrawal Rates Using Historical Data.” Journal of Financial Planning 7 (4): 171–180.

Benz, Christine. 2020, March 2. “Risk, Not Volatility, Is the Real Enemy,” Morningstar. www.morningstar.com/articles/340722/risk-not-volatility-is-the-real-enemy.

Clow, Chris. 2020, July 21. “As Reverse Mortgage Media Coverage Improves, Education Remains Key Priority.” Reverse Mortgage Daily. https://reversemortgagedaily.com/2020/07/21/as-reverse-mortgage-media-coverage-improves-education-remains-key-priority/.

Ecker, Elizabeth 2014, October 19. “Is the Media Coming Around to Reverse Mortgages?” Reverse Mortgage Daily. https://reversemortgagedaily.com/2014/10/19/is-the-media-coming-around-to-reverse-mortgages/.

Hopkins, Jamie. 2018, January 22. “Financial Advisors Should Avoid Error by Omission and Consider Reverse Mortgages.” InvestmentNews.

Lemoine, Craig. 2020, June 10. “Survey of Financial Professionals: Credit and Home Equity.” The Academy of Home Equity in Financial Planning.

Neuwirth, Peter, Barry H. Sacks, and Stephen R. Sacks. 2017. “Integrating Home Equity and Retirement Savings through the Rule of 30.” Journal of Financial Planning 30 (10): 52–62.

Pfau, Wade D. 2014. “Is the 4 Percent Rule Too Low or Too High?” Journal of Financial Planning 27 (8): 28–29.

Pfau, Wade D. 2016a. “Incorporating Home Equity into a Retirement Income Strategy.” Journal of Financial Planning 29 (4): 41–49.

Pfau, Wade D. 2016b. Reverse Mortgages: How to Use Reverse Mortgages to Secure Your Retirement. McLean, VA: Retirement Research Media.

Pfau, Wade D. 2018. Reverse Mortgages. 2nd ed. McLean, VA: Retirement Researcher Media: 12–17, 84–89.

Pfau, Wade D. 2019, December 10. “The Four Approaches to Managing Retirement Income Risk.” https://ssrn.com/abstract=3501673.

Pfeiffer, Shaun, John R. Salter, and Harold Evensky. 2013. “Increasing the Sustainable Withdrawal Rate Using the Standby Reverse Mortgage.” Journal of Financial Planning 26 (12): 55–62.

Pfeiffer, Shaun, C. Angus Schaal, and John Salter. 2014. “HECM Reverse Mortgages: Now or Last Resort?” Journal of Financial Planning 27 (5): 44–51.

Sacks, Barry H., and Stephen R. Sacks. 2012. “Reversing the Conventional Wisdom: Using Home Equity to Supplement Retirement Income.” Journal of Financial Planning 25 (2): 43–52.

Salter, John R., Shaun A. Pfeiffer, and Harold R. Evensky 2012. “Standby Reverse Mortgages: A Risk Management Tool for Retirement Distributions.” Journal of Financial Planning 25 (8): 40–48.

Scruggs, John T. 2019, “Asset Allocation and Withdrawal Strategies: Three Levers for Management of Retirement Outcomes.” Journal of Financial Planning 32 (6): 39–49.

Tomlinson, Joseph, Shaun Pfeiffer, and John Salter. 2016. “Reverse Mortgages, Annuities, and Investments: Sorting Out the Options to Generate Sustainable Retirement Income.” Journal of Personal Finance 15 (1): 27–36.

Wagner, Gerald C. 2013. “The 6.0 Percent Rule.” Journal of Financial Planning 26 (12).

Appendix A: The Portfolio with No Additions to It and No Draws from It

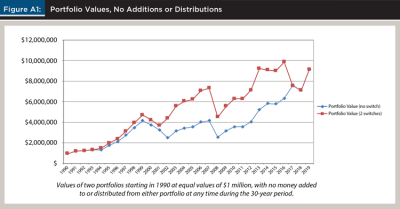

In this Appendix A, a graph is shown with two lines that indicate the values of a portfolio each year over the period of 30 years. The 30-year period is the most recently completed 30 years, from 1990 through 2019. At the beginning of the period, the value of the portfolios is $1 million. In the cases illustrated in these graphs, no money is added to the portfolio and no money is drawn from the portfolio over the course of the 30-year period. At the end of the period, the value of the portfolio is $9,141,039. In the lower of the two lines, the investment performance is exactly the performance of the S&P 500 for each year of the period. In the upper of the two lines, a couple of year’s investment returns are exchanged for a couple of other years’ investment returns. As a result, the shape of the upper line is different from the shape of the lower line. But, the end result, the value of the portfolio at the end of the time period, is exactly $9,141,039, as it is in the first graph. This is an illustration of the more general fact that when a securities portfolio has no money added to it or drawn from it over a certain period, the order, the sequence, of the returns makes no difference in the end value.

The lower line shows the portfolio increasing or decreasing at exactly the investment return rate of the S&P 500. The upper line has the same set of increases and decreases, but the sequence has a couple of switches. (The returns of the years 1994 and 2014 are switched, and the returns of the years 2002 and 2017 are switched.) But, despite the switches, the end values of the two portfolios are identical. This example is an illustration of the fact that when no money is added to or distributed from a portfolio, the sequence of returns makes no difference in the end value of the portfolio.

Appendix B

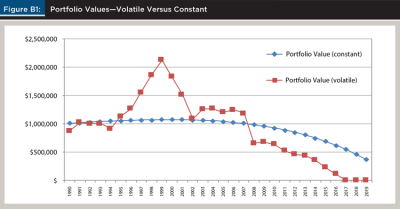

In this Appendix B, the graph in Figure B1 shows two lines, representing two portfolios, whose values at each year in a 30-year period are shown. The 30-year period is the recently concluded 30-year period, 1990 through 2019. Both portfolios are of value $1 million at the beginning of the year 1990. Both portfolios have identical distributions taken from them at the beginning of each year. The distribution from each portfolio begins with $60,000 in the first year and is then increased each year thereafter by a deemed inflation rate of 2.44 percent, which is the average, i.e., the geometric mean, of the actual inflation rates for the 30-year period.

The volatile portfolio is the S&P 500, so it increases and decreases each year (after the distribution is taken) by the actual investment return of the S&P 500. The non-volatile portfolio grows (after the distribution is taken) by the same amount each year, which is the average, i.e., the geometric mean, of the actual growth rate of the S&P 500 for the 30-year period, which is 7.65 percent).

The values of the Volatile Portfolio (S&P 500) and the Constant Portfolio, where both portfolios started at the same value ($1 million), and both had the same distributions taken from them.

The distributions began at $60,000 and grew with inflation. The Constant Portfolio grew at a constant rate, which was the average (geometric mean) value of the investment returns of the S&P 500. The result is that the Volatile Portfolio has lower value than the Constant Portfolio for 18 of the 30 years. One way to view these relative values is in terms of risk: that is, the Volatile Portfolio poses a 50 percent greater risk of lower relative value (i.e., 18 years versus 12 years) than the Constant Portfolio. Similar results were obtained for comparisons of other volatile and non-volatile portfolios.

Actual securities portfolios used for retirement income generally are volatile. Including home equity notionally as a non-correlated asset in the portfolio provides a substantial benefit by diminishing the risk of exhaustion that would result if regular distributions were made from the volatile securities portfolio.

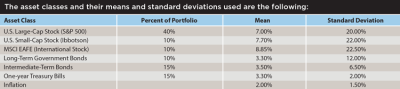

Appendix C

The Monte Carlo simulation is based on six asset classes in the securities portion of the portfolio. Each of these asset classes is individually simulated, and inflation, also, is simulated. All are assumed to have normal distributions, with the following means and standard deviations. The home equity notionally included in the portfolio is based on the initial value specified and is assumed to grow at a 2 percent annual rate. It is assumed to be accessed by a reverse mortgage credit line, the interest on which is equal to the one-year Treasury bill (simulated) plus a 2.5 percent margin. The securities portion of the portfolio is assumed to be rebalanced annually. (As a result of the rebalancing, bonds are sometimes sold at a loss, hence the standard deviation can spread the normal distribution into negative territory.)