Journal of Financial Planning: February 2015

Matt Hougan is president of ETF.com, where he oversees the company’s editorial, data and analytics efforts, and conferences.

The rise of the robo-adviser was a defining trend of 2014. These firms, which prefer to be called automated investment services, offer investors an easy way to gain exposure to low-cost, highly diversified portfolios that hew closely to the tenets of modern portfolio theory.

The largest of these firms, Wealthfront, has attracted $1.5 billion in assets and is bringing customers on at a rapid clip. Based in Silicon Valley, it has (more importantly) pulled in an astonishing $100 million in venture capital money. Its pitch is both simple and bold: aiming to be the next Charles Schwab; the next major disruptor of the financial marketplace, bringing better results and lower costs to individuals everywhere.

I think robo-advisers are one of the most important new developments in finance in the past 20 years. But are they a good thing? And are they an existential threat to financial advisers?

Let’s look at their value prop.

Wealthfront, to take one example, has built a simple, easy-to-use website. You go to wealthfront.com, answer five quick questions, and you’re presented with a well-diversified portfolio that broadly matches your perceived risk tolerance. It takes about 30 seconds.

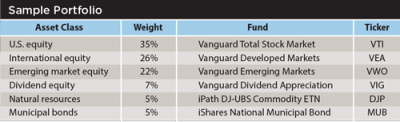

I am a very risk-tolerant investor, and when I answered those questions, it came back to me with a portfolio that looks like the table above.

I could quibble with a few of those choices. For instance, I prefer the iShares CORE Emerging Markets ETF (IEMG) to VWO because of IEMG’s inclusion of small-cap stocks, but overall, it’s hard to complain. The blended average expense ratio of those funds is just 0.13 percent. They are all solid ETFs, and the minimum investment with Wealthfront is just $5,000.

The website also has nice tools that help put this portfolio into context for me. For example, I know my median expected outcome for a 10-year $250,000 investment is $449,000, with a 13 percent chance of a loss. I can also see how my portfolio would have performed over the past 10 years.

If I were to sign up for an account, Wealthfront would manage the portfolio, rebalance it regularly, engage in tax-loss harvesting, and handle all custodial and trading fees for just 0.25 percent a year. Oh, and the first $10,000 I invest is free.

That’s a sensational offer, and I can get similar deals from other providers as well. Vanguard will even package core robo-portfolios with limited hands-on human guidance for 0.30 percent a year, in what you might call “bionic advice.” Charles Schwab will even give me a portfolio for free.

Robo-advisers aren’t going to transform the advisory landscape overnight, but they will have long-term ramifications. Advisers who have built their practice on delivering simple, sound portfolios—and who have not added value in other ways—will find bringing on new, younger clients difficult.

Advisers who want to thrive in this new environment will have to do one of two things: find a way to offer truly differentiated investment management, with high-conviction alpha strategies that are not accessible in a robo-adviser framework; or leverage the new tools available from robo-advisers to scale their business while focusing on the areas where they can make a real difference: comprehensive planning, behavioral guidance, and so on.

Robo-advisers are a major advancement in investment management. Portfolio tasks that previously required teams of highly educated and well-paid people can now be automated, distributed, and managed at scale. More investors will be better invested as a result. And the advisers who see that reality coming and adapt their business early will thrive.