Journal of Financial Planning: January 2019

Jamie P. Hopkins, J.D., LL.M., RICP®, CFP®, ChFC®, CLU®, is the director of retirement research at Carson Group. He was formerly a professor of retirement planning at The American College of Financial Services.

John. A Pearce II, Ph.D., is the VSB Endowed Chair in Strategic Management and Entrepreneurship and a professor of management at the Villanova School of Business at Villanova University.

Executive Summary

- For both do-it-yourselfers and those working with a financial planner, financial literacy is crucial to proper planning based on informed decisions.

- Recent research shows that Americans have low levels of retirement income literacy. Only 26 percent of retirement-age Americans passed a retirement income literacy quiz, indicating a lack of retirement income planning knowledge that limits clients’ participation in their own retirement decision-making and lowers their satisfaction with the process.

- Improved literacy scores are strongly correlated with key retirement income planning markers, such as having a retirement income plan in place, deferring Social Security, and making well-reasoned investments.

- The results of the survey and research reported in this study highlight a need for increased retirement income literacy because of its impact on the

quality of retirement planning.

In 2014, the first iteration of the RICP® Retirement Income Literacy Survey was used to test the retirement income literacy of Americans nearing or already in retirement. The initial data found the mean respondent score was 17.12 correct out of 38 questions, or an average score of 45 percent (Hopkins and Littell 2016).

In 2017, the survey was re-run with new respondents and yielded similar results: retirement-age Americans (ages 60 to 75) had the same low rate of retirement income literacy as they did three years prior. Some areas of knowledge showed slight improvement; however, only 26 percent of retirement-age Americans passed the literacy quiz with a score of 60 percent or higher, indicating a lack of retirement income planning knowledge.

This paper takes the 2017 retirement income literacy data a step further by analyzing the impact that retirement income literacy has on retirement income planning decisions, measurements of financial security, and retirement satisfaction. There are strong correlations between retirement income literacy and the amount of financial planning, measurements of financial security, and retirement satisfaction. The lack of literacy appears to reduce positive retirement income planning steps often seen as essentials to a secure retirement. Furthermore, the 2017 data showed a large divide in the literacy rates based on gender and wealth, highlighting the demographic impact on financial literacy and retirement income planning. America’s lack of retirement income literacy appears to be inhibiting better planning and, in some cases, causing individuals to make poorly informed decisions that negatively impact their retirement security.

This paper explains the findings from an analysis of the survey data and suggests actions that financial planners can take to anticipate the specific information needs of their clients and to improve their preparation for collaborating fully in retirement planning.

Retirement Income Planning Literacy as a Research Topic

Retirement income literacy is an important research topic because of the complexity created by the wide range of decisions and expertise that must be coordinated concerning an indeterminable period of time. To fully understand whether consumers can properly plan for retirement, it is important to know their levels of retirement income planning literacy. For both do-it-yourselfers and those working with a financial planner, a degree of financial literacy is crucial to proper planning and making educated decisions. The financial planner doesn’t just work up a retirement income plan and present it to the client for quick approval; the client must be involved in the process. Clients working with a financial planner can make better decisions and feel a sense of ownership in the decision-making process if they participate in the development of the plan.

Research has shown the benefits of making well-informed decisions concerning retirement income planning. Blanchett and Kaplan (2013) developed the concept of “gamma” by providing research that illustrated the value of making well-informed retirement income planning decisions over a baseline model of a 4 percent withdrawal rate with a 20 percent equity allocation portfolio. Their research showed that a retiree who made more informed decisions over the baseline model could generate nearly 22.6 percent more income in retirement without saving any additional money.

Also supporting the value of making better decisions is a concept developed by Vanguard in 2001 called the Vanguard Advisor’s Alpha, illustrating how financial advisers add value through relationship-oriented services like retirement income planning.1

Kinniry, Jaconetti, DiJoseph, Zilbering, and Bennyhoff (2016) found an improved retirement income spending strategy had the capacity to improve client returns; improved asset location decisions (including better utilization of IRAs) were shown to add value; and behavioral coaching improved client outcomes—not by trying to out-invest the market, but by making better-informed decisions. The benefit of behavioral coaching is amplified by the lack of retirement income literacy on the part of many people who act of out fear and make bad decisions when they do not have the proper framework or knowledge to make good decisions.

Literature Review

The existing research on literacy rates has primarily focused on general financial planning literacy, retirement savings knowledge, or literacy rates regarding specific retirement decisions such as deciding when to collect Social Security, how to maximize Medicare benefits, or the potential uses of reverse mortgages.

Research by the Consumer Financial Protection Bureau (CFPB) and the Financial Industry Regulatory Authority (FINRA) in 2013 reviewed the overall financial literacy of Americans and found disparity in financial capabilities across demographic groups in the U.S.2 The 2016 National Financial Capability Study (NFCS) evaluated financial knowledge by using a test of five basic financial literacy questions and found the national average was 3.16 correct answers.3 Lusardi (2012) determined that basic financial literacy was low among U.S. adults.

Defining financial literacy as a “specific set of human capital, which allows an individual to understand and effectively apply personal finance-related information to increase expected lifetime utility from consumption,” Huston (2010, page 110) and a number of contemporaries advocated that professional financial advisers build client knowledge of financial concepts and competencies in tandem with retirement planning (Lusardi and Mitchell 2009, 2011; O’Neill and Xiao 2012; Seay, Preece, and Le 2017; Bi, Finke, and Huston 2017). This is supported by repeated evidence of a link among an understanding of risk management, financial literacy, and sound retirement planning (Lusardi and Mitchell 2007; Van Rooij, Lusardi, and Alessie 2011; Lusardi, Samek, Kapteyn, Glinert, Hung, and Heinberg 2017).

With the advancing average life span of the population, financial planning research has pointed to the need to caution clients about making retirement decisions in advance of any physical and mental deterioration that they might experience with advanced age. A specific concern that financial planners have been advised to address is making clients aware that declining cognitive and financial literacy abilities tend to negatively impact retirees’ financial planning competency (Guillemette 2017).

Several research studies have supported the conclusion that a retiree’s possibly declining ability to understand and manage the complex financial implications of long-term decision-making puts time parameters on the relative attractiveness of various investment options. Specific discussions have involved client decisions pertaining to reverse mortgages, special forms of mortgages including interest-only choices, and long-term care insurance (Fishbein and Woodall 2006; Lusardi and Mitchell 2006, 2009, 2011, 2014; Robb and Woodyard 2011; Allgood and Walstad 2013; Lusardi and de Bassa Scheresberg 2013; Lusardi 2015; Robb, Babiarz, Woodyard, and Seay 2015; and Seay, Preece, and Le 2017).

Financial planners may want to incorporate financial literacy topics into the educational materials they provide prospective clients. A better understanding of risk factors helps clients make better investment decisions in anticipation of retirement or for financial support independent of pensions or Social Security after the nominal age for retirement (Dorn, Sharpe, Dickey, and Herring 2017). In fact, a client’s belief that he or she might never retire has been brought into question by research findings (Hatcher 2002). Hanna, Zhang, and Kim (2017) concluded that a person’s expectation that he or she will not retire is more likely to be linked to their lack of understanding about their financial situation in retirement than to their desire to work, their physical ability, or their actual financial condition.

Significant research has been conducted on the impact of basic financial literacy rates on retirement planning and savings decisions.

Mitchell and Lusardi (2015) served as a review of existing literacy research and implications; it also included a research survey of people around the world to determine if they had the fundamental knowledge of economics and finance to make effective personal finance decisions. Three basic financial questions were used to gauge literacy. The findings showed that literacy rates were low, both in the U.S. and globally. Literacy rates were shown to be particularly low among certain demographic groups, including women and the less-formally educated. Lastly, the research demonstrated that literacy was linked to better borrowing, saving, and spending patterns among individuals, highlighting the power of literacy to improve financial well-being.

Research specifically on comprehensive retirement income planning literacy, however, is lacking from the literature. To help fill this void, The American College New York Life Center for Retirement Income created the RICP® Retirement Income Literacy Survey, a 38-question survey focused on comprehensive retirement income planning literacy. The survey evolved from some of the existing theories and previous research in the literature and used two questions relating to retirement income planning originally used in the 2013 National Financial Capability Study. The complete literacy survey questionnaire is found at retirement.theamericancollege.edu/research/2017-ricp-retirement-income-literacy-survey.

Research Goal

The goal of this research was two-fold. First, to use the results of the retirement income literacy survey to gain a better understanding of how much those nearing and in retirement know about key retirement income concepts and strategies. The survey examined 12 areas of retirement income planning, including (1) distribution strategies; (2) tax efficiency; (3) investments; (4) long-term care planning; (5) Social Security; (6) housing options; (7) health care; (8) insurance products; (9) qualified retirement plans; (10) optimal retirement ages; (11) inflation; and (12) IRAs.

Secondly, to explore the impact of a higher level of retirement income planning literacy on planning, satisfaction, and preparedness. To accomplish this, the survey asked several attitudinal, planning, and behavioral questions. Although it is beneficial to have broad-based information about retirement income planning knowledge levels of Americans nearing retirement, it is perhaps more important to understand the benefit of literacy rates on planning and lifestyle satisfaction.

Research Methodology

The survey was conducted in 2014 and again in 2017. The 2017 survey data were collected over a two-week period from the middle of February to March 1, 2017. A stratified random sample from an online panel run by Research Now was surveyed using a 20-minute online interview. The 2017 survey consisted of 1,244 respondents between ages 60 and 75 with at least $100,000 of investable assets. The final data set was weighted by age, education, and asset levels to reflect the distribution of those characteristics among Americans ages 60 to 75 with at least $100,000 in investable assets based on the 2013 Survey of Consumer Finances. The literacy rate survey had a sampling error at the 95 percent confidence level of plus or minus 2.8 percent.

The original literacy questions were developed with the input of more than 20 retirement income planning researchers and practitioners. A pilot survey was run in 2014 and again in 2017 to test the questions with consumers to ensure that they were easily understood. In both years, slight modifications were made to the wording of a few questions for clarity. Additionally, two significant changes to questions were made because of changes in federal law.

Topline Survey Results

The 2017 retirement income literacy survey found that older Americans displayed a lack of knowledge on vital topics such as preserving assets, sustaining retirement income, investments, long-term care, Social Security, and annuities. Although literacy rates have improved slightly since the 2014 survey, only 26 percent of the respondents could pass the quiz with a score of 60 percent or greater. Furthermore, less than 1 percent of respondents scored between 91 and 100 percent; roughly 5 percent scored between 81 and 90 percent; and 8 percent scored between 71 percent and 80 percent. The largest range of scores for passing grades was between 61 and 70 percent, which accounted for 13 percent of all test takers and roughly half of all passing scores. Within specific topic areas, respondents demonstrated the highest level of knowledge about Medicare with an average score of 76 percent; they demonstrated the lowest level of knowledge about annuities, with an average score of 20 percent.

Results showed that differences in literacy scores were associated with a variety of demographic factors. For instance, 17 percent of women passed the quiz, versus 35 percent of men, and this difference was significant with a p value of < 0.01.

Differences in scores were also associated with differences in wealth, significant at the 1 percent level. Forty-nine percent of respondents with $1 million or more in investable assets passed the quiz compared to only 20 percent of those with less than $1 million in assets.

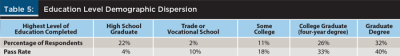

Education levels were also associated with statistically significant differences in literacy scores at the 99 percent confidence level, as 40 percent of those with a graduate degree passed the quiz compared to 9 percent of respondents without a college degree.

Retirement Income Literacy Rates

Overall, the respondents’ retirement income literacy scores were low. Across the 38 questions, the mean score was 47.47 percent correct. In 2014 the mean score was 45.1 percent correct. Although there was a slight increase in the literacy rate, this could have resulted from a change in wording to one question to improve readability. Once adjusted for the survey instrument change, there was no statistically significant improvement in the literacy scores.

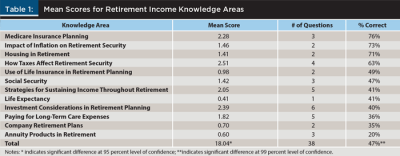

Literacy rates were broken into 12 retirement income knowledge areas, and responses were categorized in those areas, ranked from highest to lowest literacy scores: (1) Medicare insurance planning; (2) impact of inflation on retirement security; (3) housing in retirement; (4) effect of taxation on retirement security; (5) use of life insurance in retirement planning; (6) Social Security; (7) strategies for sustaining income throughout retirement; (8) longevity/life expectancy; (9) investment considerations in retirement planning; (10) paying for long-term care expenses; (11) company retirement plans; and (12) annuity products in retirement.4 Table 1 shows the mean scores for each of these areas.

Medicare planning rated as the highest knowledge area, with a mean score of 2.28 out of 3, or 76 percent correct. Three other areas graded as “high” literacy rate sections (deemed as more than 60 percent correct on average): impact of inflation on retirement security (73 percent); housing in retirement (71 percent); and effect of taxation on retirement security (63 percent). In the 2014 survey, the highest-performing areas also were Medicare, housing, and inflation.

The areas that received “low” literacy ratings (below 40 percent correct), were: paying for long-term care expenses (36 percent); company retirement plans (35 percent); and annuity products in retirement (20 percent). In 2014, the section with annuity product questions also had the worst performance rate with an average score of roughly 18 percent. The change in scores from 18 percent in 2014 to 20 percent in 2017 was not statistically significant at the 90 percent confidence level with a p value of > 0.1.

A statistically significant improvement was seen in the correct responses to one question. Question 21 asked about the safe withdrawal rate. Between 2014 and 2017, the correct answer of 4 percent as the historically safe withdrawal rate went up from 31 percent correct to 38 percent correct. The change from 2014 was statistically significant at the 95 percent confidence level. Although the research does not provide insight on why this response improved, the authors hypothesize it could be the result of a significant increase in popular media coverage of retirement income planning and the 4 percent withdrawal rule.

Attitudes about Retirement

In addition to literacy questions, respondents were asked attitudinal questions. When asked how confident the respondent was that he or she would have enough money to live comfortably through retirement, only 8 percent were not confident. Instead, most respondents rated themselves between 4 and 7 on a Likert scale of 1 to 7, with 1 being not at all confident, 4 being moderately confident, and 7 being extremely confident. Roughly 55 percent chose a 6 or 7 rating. The confidence levels of survey respondents were higher than that for the average person in the U.S. population, but that is explained, in part, by the investable asset requirement of $100,000 minimum to qualify for this survey.

Respondents also indicated high levels of self-reported knowledge. When asked: how knowledgeable would you say you are about retirement income planning, 88 percent responded they were moderately to extremely knowledgeable. However, of this same group, only 28.6 percent passed the literacy quiz with a score of 60 percent or higher. Although there was a huge misalignment between the level of knowledge and actual knowledge of survey respondents, those who claimed higher self-reported knowledge did better on the literacy quiz than those who reported low knowledge. The difference in literacy scores between those who reported being extremely knowledgeable and those who reported lower levels of knowledge was statistically significant at the 99 percent confidence level.

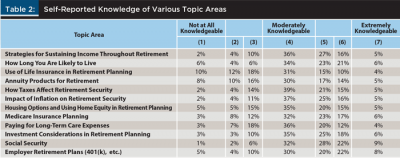

Respondents were also asked about their knowledge of 12 topic areas (see Table 2). Most areas had similar scores across the board. However, life insurance and annuities were the two lowest self-assessed knowledge areas. Annuities literacy was the lowest-performing area; the self-perceived knowledge appeared to match up more closely with actual knowledge in this instance. Although 66 percent of respondents listed themselves as moderately to extremely knowledgeable about annuities, those respondents only scored an average of 20 percent on the annuity questions.

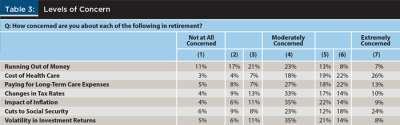

Respondents were also asked to rate their concern level across seven different categories: (1) running out of money; (2) cost of health care; (3) paying for long-term care expenses; (4) changes in tax rates; (5) impact of inflation; (6) cuts to Social Security; and (7) volatility in investment returns. Running out of money was of least concern to the group, while health care costs and potential cuts to Social Security were highest levels of concern (see Table 3).

Examining the levels of concern by gender revealed a divide. Roughly 51 percent of women were extremely concerned about cuts to Social Security, compared to 33 percent of men. This difference was statistically significant at the 99 percent level. Women showed higher levels of concern than their male counterparts in most of the topic areas, except running out of money.

Literacy Rates Across Demographic Groups

There were significant differences in retirement income literacy across key demographics, particularly wealth level, formal education, and gender.

Respondents were asked to estimate how much money they (and their spouse) had in total savings, not including a primary residence. The breakdown of ranges selected is shown in Table 4.

Those with higher levels of wealth demonstrated higher levels of retirement income literacy. Only 12 percent of those with the lowest level of wealth ($100,000 to $199,999) passed the quiz. However, 50 percent of respondents with $1.5 million or more in wealth passed the quiz. The differences between the wealth demographic breakdowns were statistically significant at the 95 percent level or higher, demonstrating the high correlation between wealth and literacy rates.

Another key demographic that was strongly correlated with retirement income literacy scores was the respondent’s level of formal education. As formal education increased, so did retirement income literacy rates (see Table 5).

Regarding gender, female respondents did significantly worse on the retirement income literacy quiz than their male counterparts. Female respondents also showed lower levels of self-perceived knowledge. Furthermore, women were much more likely to self-identify as cautious or risk-averse, showed more conservative responses to investment questions, were more concerned about retirement risks, and demonstrated lower levels of overall retirement planning.

Although there were no statistically significant differences in wealth or ages of respondents when comparing genders, male respondents did report a higher level of formal education with roughly 70 percent having completed a college degree or higher, compared to 60 percent of female respondents.

Eighteen percent of female respondents passed the literacy quiz with a median score of 16 out of 38, compared to 35 percent of male respondents who passed with a median score of 20 out of 38.

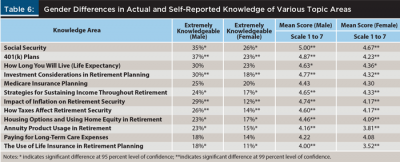

Both male and female respondents overestimated their knowledge about retirement income planning. On a Likert scale of 1 to 7, the mean score for male respondents was 5.15, and 4.74 for female respondents—both of which rated above the moderately knowledgeable level. The difference in self-reported knowledge between male and female respondents was statistically significant at the 99 percent confidence level with a p value of < 0.01. Almost across the board, female respondents indicated less self-reported knowledge than their male counterparts (see Table 6).

Another distinction between male and female respondents was their views on who the primary financial decision-maker was in their household. Roughly 65 percent of married male respondents reported being the primary financial decision-maker in the household; 35 percent of married male respondents responded that they shared the financial decision-making with their spouse.

Twenty percent of female respondents stated that they were the primary financial decision-maker, and 80 percent said they shared the decision-making with their spouse. Less than 0.5 percent of all respondents stated that they were not involved at all with financial decisions. This indicates a likely disconnect between a household’s male and female spouse. It appears that most male spouses believe they are the primary financial decision-maker, while most female spouses believe the decisions are shared by both.

About 39 percent of those who identified themselves as the primary financial decision-maker in the household passed the literacy quiz (male and female respondents), compared to 17 percent of those who stated that they shared the responsibility. The difference was statistically significant at the 99 percent confidence level. Delving further, 26 percent of women who self-identified as the primary financial decision-maker passed the quiz, compared to 12 percent who said they shared the decisions. These differences were also significant at the 99 percent confidence level.

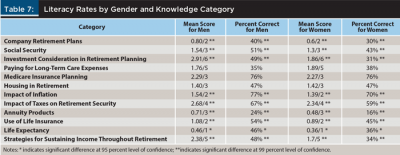

Across the 12 different areas tested, female respondents performed significantly lower statistically in all but three areas of knowledge and did not perform statistically better in any area than their male counterparts (see Table 7). However, when it came to long-term care, Medicare, and housing questions, both male and female respondents showed relatively even literacy rates.

There appears to be a disconnect between perceived knowledge and actual knowledge, as wells as a disconnect between one’s actual role in the household financial planning process and one’s financial literacy.

Key Findings and Correlations

Strong correlations exist between literacy rates and other indicators of financial sophistication. The survey results demonstrated the significant power of financial literacy: planning, confidence, and retirement satisfaction improved as literacy rates increased.

This is important knowledge for financial planners, as educating clients on retirement risks and strategies can help clients understand their plan better and feel more confident about their own retirement. For instance, among those who passed the literacy quiz:

- 46 percent were more likely to have a long-term care plan in place (compared to those who failed the quiz);

- 36 percent were more likely to feel confident that they could manage their own investments throughout retirement;

- 16 percent were more likely to have a written comprehensive retirement plan in place;

- 87 percent were more likely to take risks after doing research; and

- 8 percent were more likely to have an estate plan in place.

All of these differences were statistically significant at the 99 percent confidence level with a p value of < 0.01. Additionally, those who passed the literacy quiz were 11 percent more likely to feel confident about their own retirement than those who failed; the difference was also statistically significant at the 99 percent confidence level with a p value of < 0.01. As such, retirement income literacy correlated with consumers who did more planning, felt better prepared for retirement, and reported higher confidence levels about their situation.

Misperceptions exist between perceived knowledge and actual knowledge. There is a misalignment between self-perceived knowledge and actual retirement income literacy. Sixty-one percent of respondents indicated that they were highly knowledgeable about retirement income planning. Yet, only 33 percent of these individuals could pass the literacy quiz.

However, those who indicated they were not knowledgeable about retirement income planning (answering a 3 or below on a Likert scale with 1 being no knowledge at all and 7 being extremely knowledgeable) did far worse on the quiz, with only 8.6 percent passing it. Although there is a correlation between self-reported knowledge and actual literacy, a big gap still exists between what people say they know and what they actually know.

Retirement income planning is specialized knowledge that goes beyond basic financial principles. The survey included questions commonly used to gauge basic financial literacy. For example, the first question covers the basic understanding of inflation, of which 88 percent of respondents answered correctly. The second question was a basic question about the safety of investment returns between a single company stock and a mutual fund. Roughly 82 percent of respondents answered this question correctly. It appears that most respondents had a mastery of basic financial literacy. However, this contrasts with the results on the retirement income quiz. The mean retirement income literacy score was 47 percent, far lower than the mean score on the basic financial literacy score.

Implications for Financial Planners

There are three broad implications for financial planners from this study:

First, because of generally low financial literacy levels, financial planners should consider providing basic introductory material to current and prospective clients. Face-to-face meetings can then begin with an assessment of the materials, saving the planner time, and allowing the client to review the material at their preferred pace.

Second, financial planners should expect clients to have less knowledge on specific retirement income planning topics. As indicated by the survey results, client knowledge is likely to be especially low concerning annuity products in retirement, company retirement plans, paying for long-term care, and investment considerations in retirement planning.

Lastly, financial planners should consider the likelihood that their clients are more confident in their knowledge of financial planning for retirement than is warranted by their scores on the RICP® Retirement Income Literacy Survey. Rather than downplay the importance of quantitative issues, planners may wish to build justifiable confidence in their clients about their retirement planning based on their newly acquired understanding of the statistical and analytical underpinnings of the decisions they must make.

Conclusion

Although literacy rates improved slightly since 2014, only 26 percent of older Americans passed the financial literacy quiz in 2017. Results demonstrate a lack of knowledge on vital topics such as preserving assets and sustaining retirement income, investments, long-term care, Social Security, and annuities. Literacy rates are also highly correlated with more sophisticated planning, indicating that those who better understand key retirement income issues are more likely to have a well-developed retirement income plan in place. Furthermore, there are significant differences in literacy rates between men and women, college-educated and non-college-educated, and between wealthier and less-wealthy respondents, indicating the impact of demographics on literacy and retirement preparedness. Results of this survey serve as a reminder of the need for increased retirement income literacy, because of the correlation between literacy and better retirement planning.

Endnotes

- For the most recent Vanguard research on Advisor’s Alpha, see vanguard.com/pdf/ISGAA.pdf.

- See, “FINRA Foundation Releases Nation’s State-by-State Financial Capability Study,” at finra.org/newsroom/2013/finra-foundation-releases-nations-state-state-financial-capability-survey.

- See usfinancialcapability.org for full results of the Financial Capability in the United States study.

- The 2014 survey had 13 categories. In the 2017 survey, the questions relating to the early death of a spouse were integrated into other, more appropriate categories.

References

Allgood, Sam, and William Walstad. 2013. “Financial Literacy and Credit Card Behaviors: A Cross-Sectional Analysis by Age.” Numeracy 6 (2): 1–26.

Bi, Qianwen, Michael Finke, and Sandra J. Huston. 2017. “Financial Software Use and Retirement Savings.” Journal of Financial Counseling and Planning 28 (1): 107–128.

Blanchett, David, and Paul Kaplan. 2013. “Alpha, Beta, and Now… Gamma.” The Journal of Retirement 1 (2): 29–45.

Dorn, Mary E., Deanna L. Sharpe, Geri Dickey, and Dalisha D. Herring. 2017. “Understanding the Determinants of a Long-Term Care Insurance Purchase.” Journal of Financial Planning 30 (11): 38–46.

Fishbein, Allen J., and Patrick Woodall. 2006. “Exotic or Toxic? An Examination of the Non-Traditional Mortgage Market for Consumers and Lenders.” Consumer Federation of America white paper. Available at consumerfed.org/pdfs/Exotic_Toxic_Mortgage_Report0506.pdf.

Guillemette, Michael A. 2017. “Risks in Advanced Age: A Review of Research and Possible Solutions.” Journal of Financial Planning 30 (9): 48–55.

Hanna, Sherman D., Lishu Zhang, and Kyoung Tae Kim. 2017. “Do Worker Expectations of Never Retiring Indicate a Preference or an Inability to Plan?” Journal of Financial Counseling and Planning 28 (2): 268–284.

Hatcher, Charles B. 2002. “Wealth, Reservation Wealth, and the Decision to Retire.” Journal of Family and Economic Issues 23 (2): 167–187.

Hopkins, Jamie P., and David Littell. 2016. “Gauging America’s Retirement Income Planning Literacy: A Method for Determining Retirement Knowledgeable Clients.” Journal of Personal Finance 15 (1): 7–27.

Huston, Sandra J. 2010. “Measuring Financial Literacy.” The Journal of Consumer Affairs 44 (2): 296–316.

Kinniry Jr., Francis M. Colleen M. Jaconetti, Michael A. DiJoseph, Yan Zilbering, and Donald G. Bennyhoff. 2016. “Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha.” Vanguard Research. Available at vanguard.com/pdf/ISGQVAA.pdf.

Lusardi, Annamaria. 2012. “Numeracy, Financial Literacy, and Financial Decision-Making.” Numeracy 5 (1): article 2.

Lusardi, Annamaria. 2015. “Risk Literacy.” Italian Economic Journal 1 (1): 5–23.

Lusardi, Annamaria, and Olivia S. Mitchell. 2006. “Financial Literacy and Planning: Implications for Retirement Wellbeing.” Michigan Retirement Research Center Working Paper 2006-144. Available at dartmouth.edu/~alusardi/Papers/Financial Literacy.pdf.

Lusardi, Annamaria, and Olivia S. Mitchell. 2007. “Baby Boomer Retirement Security: The Role of Planning, Financial Literacy, and Housing Wealth.” Journal of Monetary Economics 54 (1): 205–224.

Lusardi, Annamaria, and Olivia S. Mitchell. 2009. “How Ordinary Consumers Make Complex Economic Decisions: Financial Literacy and Retirement Readiness.” National Bureau of Economic Research Working Paper No. 15350. Available at nber.org/papers/w15350.

Lusardi, Annamaria, and Olivia S. Mitchell. 2011. “Financial Literacy and Planning: Implications for Retirement Wellbeing.” National Bureau of Economic Research Working Paper No. 17078. Available at nber.org/papers/w17078.

Lusardi, Annamaria, and Olivia S. Mitchell. 2014. “The Economic Importance of Financial Literacy: Theory and Evidence.” Journal of Economic Literature 52 (1): 5–44.

Lusardi, Annamaria, and Carlo de Bassa Scheresberg. 2013. “Financial Literacy and High-Cost Borrowing in the United States.” National Bureau of Economic Research Working Paper No. 18969. Available at nber.org/papers/w18969.

Lusardi, Annamaria, Anya Samek, Arie Kapteyn, Lewis Glinert, Angela Hung, and Aileen Heinberg. 2017. “Visual Tools and Narratives: New Ways to Improve Financial Literacy.” Journal of Pension Economics & Finance 16 (3): 297–323.

Mitchell, Olivia S., and Annamaria Lusardi. 2015. “Financial Literacy and Economic Outcomes: Evidence and Policy Implications.” The Journal of Retirement 3 (1): 107–114.

O’Neill, Barbara, and Jing Jian Xiao. 2012. “Financial Behaviors Before and After the Financial Crisis: Evidence from an Online Survey.” Journal of Financial Counseling and Planning 23 (1): 63–79.

Robb, Cliff A., and Ann S. Woodyard. 2011. “Financial Knowledge and Best Practice Behavior.” Journal of Financial Counseling and Planning 22 (1): 60–70.

Robb, Cliff A., Patryk Babiarz, Ann Woodyard, and Martin C. Seay. 2015. “Bounded Rationality and Use of Alternative Financial Services.” The Journal of Consumer Affairs 49 (2): 407–435.

Seay, Martin C., Gloria L. Preece, and Vincent C. Le. 2017. “Financial Literacy and the Use of Interest-Only Mortgages.” Journal of Financial Counseling and Planning 28 (2): 168–180.

Van Rooij, Maarten, Annamaria Lusardi, and Rob J.M. Alessie. 2011. “Financial Literacy and Retirement Planning in the Netherlands.” Journal of Economic Psychology 32 (4): 593–608.

Citation

Hopkins, Jamie P., and John A. Pearce II. 2019. “Retirement Income Literacy: A Key to Sustainable Retirement Planning.” Journal of Financial Planning 32 (1): 36–44.