Journal of Financial Planning; October 2014

Mitch Anthony is founder and president of Advisor Insights Inc., and author of several books, including From the Boiler Room to the Living Room, The New Retirementality, and Your Clients for Life. Email author HERE.

Imagine overhearing a conversation between a parent and middle school age child, where the parent explained his or her scholastic expectations as: “Son, the average boy in seventh grade in America had a GPA of 2.85, and you had a GPA of 2.75. I only want you to prove that you are better than the average.”

What does the average have to do with the individual in question? Will this number become a distraction from the work and development that really matters? Shouldn’t the focus be on what this student is capable of?

The Ball and Chain

Years ago, I received a call from a very successful financial planner who was lamenting the “year in review” meeting. “Have you seen the Bill Murray movie, Groundhog Day? That’s what this meeting feels like … the same conversation happening over and over again,” he said. “How did we do against this index or that fund?”

“I have a question for you,” I said, cutting short his fulmination. “Who started this conversation that now drives you mad?”

“Ouch!” he objected. “I was calling you to find some comfort."

I responded: “I’m guessing that at some point, you asked this client at the prospect stage how his funds and investments were performing and made the assertion that you might be able to do better. And now I’m hearing a man bemoaning the fact that he has become victimized by a value proposition he sold in the first place.”

The conversation then moved to what measure—if not comparative returns—one could or should use to gauge progress with clients. This is an arena of thought and dialogue that needs to be transformed in the planner/client relationship. The issue is personal progress, and by personal I mean that it is going to be articulated uniquely for each client. For me, it might be ramping up the risk management aspects of my financial life. For someone else, it might mean finding ways to distribute more income toward charitable causes.

Progress is, by definition, a very personal issue because progress cannot be measured without first taking inventory of where you are now and where you would like to be in the future. The common dialogue in financial services has mistakenly placed greater emphasis on where you’d like to be than where you are at now to its own detriment. Could it be that clients have unrealistic expectations on future returns because they are being unrealistic with their current cash flows and spending habits? I’m not sure the two are directly connected, but I have my suspicions that some of the pressure being transferred to the adviser is the result of neglect and denial with current fiscal management. Progress is impossible to gauge without a clear picture of where one is at.

The Comparative Measure

It’s difficult to deny that this idea of a comparative measure concept is most likely rooted in arrogance—at some point, some fund manager or fund company looking at the average returns said, “We can do better.” And they may have done better for a while. In the July 2013 S&P study, “Does Past Performance Matter? The Persistence Scorecard,” only two out of 2,862 broad domestic stock funds were able to outperform their peers by remaining in the top quartile of funds over five consecutive 12-month periods. Nearly all (99.9 percent) managers who attempt to prove superiority fail over time. Those don’t sound like good odds for anchoring a financial relationship. All I can say for the S&P’s index is that it makes a poor standard by which to measure progress.

No matter what frame you are evaluating, there will always be managers in the top 10 percent, 25 percent, etc. The more pressing issue is, can an adviser identify the top-performing managers in advance? No matter what time frame you measure, the odds are quite high that the managers won’t repeat their performance. They are only dancing with the (Morning) stars for a short while.

I also suspect the comparative return conversation is grounded in greed—competition for assets under management leads many advisers to purposely sow dissatisfaction with prospects’ current investment results in order to have them transfer their assets to their practice. In doing so, not only are they acting in an unethical manner, they are making a promise that is impossible to keep. They who live by these numbers will die by these numbers.

It is not just the common practice of comparative measure that is problematic for the adviser/client relationship. Other mistakes in the “measure mythology” include:

Predicting the future by looking backward. Just because Clayton Kershaw has been lights out in his last four appearances for the Dodgers doesn’t mean he isn’t going to bomb in his next outing, or get injured. Do track records matter? Of course they do. But should you want to be held responsible for the unexpected? Of course you shouldn’t.

Veteran planners know it’s worth their time to explain to clients that they are not clairvoyant and that what happened yesterday is generally a poor indicator of what will happen today. Every fund has the disclaimer that “past performance is not an indicator of future results, etc.,” and yet many advisers continue projecting into the future based on “evidence” from the past five years. Clients need to be aware that underperformance is not just a possibility, it is an inevitability.

Measuring against broad market patterns instead of specific and unique client needs and wants. The opportunity for solidifying the relationship exists in measuring for and not against. “What return do we need and what amount of risk can we tolerate for your specific situation?” is a more applicable measure than, “How did we do against such and such an index?”

By measuring returns based on client needs and capabilities, we are measuring what matters most, and by virtue of life transitions, measuring dynamically. What kind of return a client aims for will change as his or her life situation changes. Another key link in the comparative measure ball and chain has been far too much emphasis on the quantitative aspects of progress and not enough on the qualitative aspects of progress.

Progress Report

I developed the progress report to help planners intensify their focus on the qualitative matters within their (and the clients’) locus of control, as opposed to returns compared to an index they have no control over and that has no personal bearing on their situation.

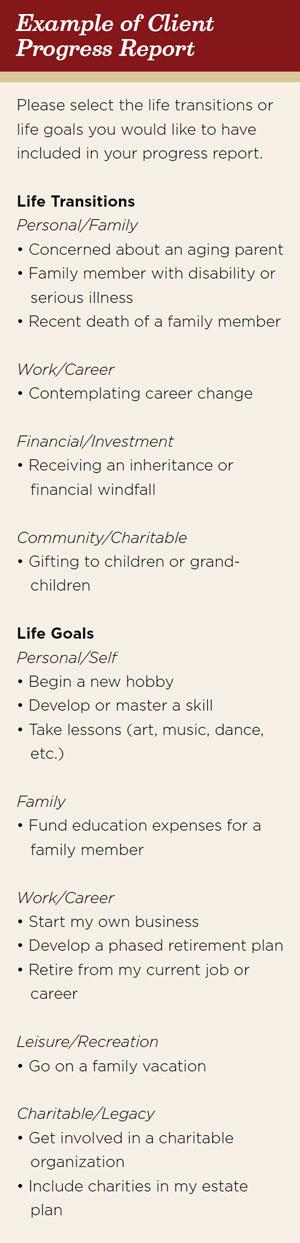

This year-in-review process takes into consideration all transitions and goals that have been articulated by the client in previous discussions. When clients disclose the transitions they are navigating through, they are describing the most important matters of their life on a single page. This experience will be unique to each client. These matters are germane to the planning conversation, because financial decision making is implicated in each matter.

In the progress report (see sidebar), the planner has the opportunity to input outtakes from the discovery conversation as well as steps they (and their firm) have to take to speed the clients’ progress in each particular matter. Clients are seeing in qualitative terms real progress at a very personal level. If you are tired of being measured year in and year out by only (or mostly) quantitative measures, then the onus is on you to move the measure for progress to the qualitative realm.

When clients see—in black and white—personal progress in every arena of their life tethered to wise financial decision making, I will venture to say that making 3 percentage points less than an index on a given year will have infinitesimal impact. Wouldn’t it be prudent to anchor your value in factors you can genuinely control and impact over time than to forces over which you have minimal control? So what if your strategies beat the indexes this year? If you hang your hat on it, your head will be on the line next year as well.

Introducing Pi

I’m not suggesting you bypass the quantitative measure altogether. I am suggesting that when you do measure numbers, it must be a more personal number that you are aiming for. It is here that I would like to introduce the Personal Index, or Pi for short. And yes, I’m hopeful that Pi makes for a fitting metaphor in this approach. By definition, Pi is the ratio of the circumference of a circle to its diameter. Pi (3.14159) is always the same, no matter which circle you use to compute it.

At the risk of mixing middle school math and Lion King metaphors, I suggest that the only number that matters in calculating the financial needs of your clients is the number that supports their “circle of life.” Metaphorically, Pi is an investment return that brings necessary growth without taking unnecessary risk. The number will vary from client to client, because it is a personalized index based upon life factors, assumed responsibilities, and individualized goals.

This idea is a work in progress, but I am offering it conceptually in hopes of provoking conversation about how we measure progress. We need to find ways of measuring progress that are not tied to forces we cannot control. It’s not good for the planner, and it’s not healthy for the client.

I have no plans to ever retire. I’m helping to support both my parents. I have one child in college and one in the mission field. One son just moved back temporarily to re-launch his career. My house is paid for. I have ideas I want to invest in. What rate of return makes sense for me? The most common response I hear would be, “It depends on how much investable capital you have.” Yes, but it also depends on how many financial obligations and opportunities I’m trying to balance. It also depends on how much risk I’m willing to take with capital that is earmarked, for example, for my parents’ support.

Your clients’ life situations are different from mine. Their obligations, goals, challenges, and opportunities make up a very personal portrait requiring individualized attention to detail. Their rate of return aimed for in their Pi is probably not going to be the same as mine. There is also a very good chance that “the number” is going to be found in the balance between meeting obligations and staying on track with goals.

“Mr. and Mrs. Client, for years this profession has measured progress by comparing your returns to the S&P 500 Index. If it was better than the average, we were successful. If it was lower, we were not. Your personal financial situation has very little to do with some index out there. We want to measure your progress at a very personal level. We want to make sure we’re assisting you to make wise decisions in all financial matters. If there is a number we’re going to shoot for, it’s going to be a number that helps you stay on track with your goals without subjecting you to unnecessary risks. The only number I’m interested in is one that helps you make personal progress.”

Personal financial planning requires personalized measures for progress. How you go about calculating this number is a work in progress, because it’s hinged to life transitions and changes in scenarios that never sit still. The rate of return you and your client agree to pursue isn’t as important as the fact that you are unfettering your practice from the comparative returns’ shackles and chains.

I recently talked to a financial planner whose firm has begun using a system that monitors what their individual clients said they would save, how much they did save, and how this discrepancy was going to impact their plan over time. The first time he used this report with a client was on the heels of having discussed that client’s returns. The epiphany for both this planner and his client was that the monitor numbers were much more relevant than the returns number. This sort of process is a window into the future of financial planning and, I hope, the beginning of the end of the comparative measure being used in the client conversation.

Let’s apply the questions for those seventh grade parents to your clients: What does the average have to do with the individual in question? Will this number become a distraction from the work and development that really matters? Shouldn’t the focus be on what this client is capable of?

Planners would do well to get their clients’ minds off industry averages and place the magnifying glass on establishing personal bests in overall financial performance—spending, saving, protecting, investing, and giving.

Sidebar: