Journal of Financial Planning: April 2025

NOTE: Please be aware that the audio version, created with Amazon Polly, may contain mispronunciations.

Bryan Powell is the executive director, practice management, at Janus Henderson Investors (www.janushenderson.com). He holds his Professional Coaching Credential through the International Coaching Federation while also being selected as a global ambassador through their Ignite Initiative, focused on creating pro bono coaching programs for nonprofit organizations that are in alignment with the United Nations 2030 agenda focused on humanitarian efforts. In addition, Bryan is a member of the Forbes Coaching Council, contributing thought leadership articles; was selected to the Harvard Business Review Advisory Council; and has been named a Top Voice on LinkedIn for Business Coaching, Team Building, and Career Development. He received his bachelor’s degree in economics from Cal State University and his master’s in organizational leadership from Colorado State University. He is pursuing a Ph.D. in performance psychology at Grand Canyon University.

NOTE: Click on images below for PDF versions.

Organizations across the financial services industry have dedicated significant time, attention, and resources to initiatives focused on increasing diversity. Wealth advisers have promoted these efforts through their vision statements, training programs, and other actions. And leaders in the industry regularly speak about the importance of making progress in this area. Yet despite all these efforts and proclamations, the financial services industry is falling short in its efforts to create diverse teams to support rapidly changing demographics.

The overall success rate of those entering the industry is disconcertingly low, ranging from 10 percent to 20 percent depending on the source, and it is even lower for female and minority entrants. The research highlights several reasons why women and members of minority groups are not joining the financial services industry, including limited visibility or contact with leadership, insufficient mentoring from successful advisers, and implicit bias, among others.

Where is the disconnect between the message and the results? Is it an industry problem, or is there something else occurring that is inhibiting the recruitment, training, and success of advisors who are not White males?

The Case for Inclusive Leadership

Regardless of where the disconnect originates, there is no question that something needs to change if we are to better serve financial planning professionals who have been excluded or faced unnecessary barriers in their attempts to thrive in the industry. For change to occur, leaders at all levels will need to expand their knowledge of how to recruit, support, and nurture female and minority wealth advisers.

Inclusive leadership theory could offer a path forward. The theory posits that organizational leaders who make each individual feel part of the team by embracing their uniqueness can build stronger, more successful teams. The competencies that define the theory include promoting a culture of openness, accessibility, and willingness to learn, enabling leaders to harness the possibilities of a diverse team through their range of personal experiences and backgrounds.

Before we discuss the applications of inclusive leadership theory in more detail, it is helpful to consider the history of diversity (or lack thereof) in the financial industry.

Does the Past Determine Our Future?

The wealth management industry has traditionally been dominated by White males, especially when it comes to wealth advisers. The first Black American to be designated a CERTIFIED FINANCIAL PLANNER® was LeCount Davis, and this did not occur until 1978 (Bisnoff 2020). Davis has stated that his success was forged with the odds stacked against him by building a client base that was 90 percent Black. In 2020, Kamila McDonnough was elected the first Black woman to serve on the CFP Board as chair-elect, which prepared her to take over as chair of the organization’s board of directors in 2022.

Following the Black Lives Matter movement, many large financial services organizations began to publicly report their diversity statistics. The former head of Merrill Lynch, Andy Sieg, informed Barron’s that out of the 17,500 advisers at the firm, only 4.5 percent were Black and 9 percent were Latino (Bisnoff 2020). UBS followed suit that same year, releasing diversity and inclusion data that revealed only 10 percent of the firm’s wealth adviser population comprised people of color. Lastly, Morgan Stanley found itself in the spotlight facing a lawsuit from a former employee, Marilyn Booker, who had been fired after serving 26 years at the firm as the global head of diversity (Kidwai 2020). Booker claimed she was terminated due to acts of retaliation and racial discrimination and alleged that Morgan Stanley does little to support its Black advisers to grow and succeed in the industry.

Research conducted by FlexShares in 2021 showed U.S. demographics are changing, and they anticipate that by 2045, less than half of the population will be White (49.7 percent), with Asian and Hispanic groups projected to increase to 7.9 percent and 24.6 percent of the population, respectively. In addition, between 2016 and 2019, Black and Latino family wealth grew at a faster rate than that of White families, and from 2000 to 2016, the number of Black and Latino college graduates saw significant increases of 75 percent and 202 percent, respectively. From a gender perspective, women are positioned to inherit a majority of the $30 trillion in wealth (Shammas 2024) that is expected to be transferred by the baby boomer generation, which researchers note is close to the annual U.S. gross domestic product. This shift in wealth is expected to occur by 2030, and it remains to be seen whether the industry will be prepared to serve this growing population of female investors.

The industry has yet to catch up to the growing diversity of the community it serves, with the diversity of wealth adviser positions lagging significantly behind the national demographic shifts described above.

The Wealth Management Industry Has a Diversity Problem

Research published by Zippia (2022) shows that in 2021, 69.11 percent of wealth advisers were male compared to 30.89 percent who were female. Looking back to 2010, the breakdown was 69.33 percent male and 30.67 percent female. Thus, in over a decade, with all the focus throughout the industry on increasing diversity, zero progress has been made. And the disparity goes beyond gender: As of 2021, 72.2 percent of wealth advisers are White, 9.4 percent are Hispanic or Latino, 8.3 percent Asian, and 5.6 percent are African American. Even with many organizations devoting time and budget to attracting, retaining, and creating teams that better reflect the makeup of the communities they serve, and with incentives in place for leaders who move the dial in creating diverse teams, we still have seen no progress. How can industry leaders take steps that will result in an impact that matches what they communicate?

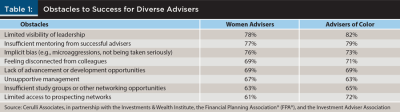

Research conducted by the consulting firm McKinsey & Company (2023) found that all companies in the U.S. spend roughly $8 billion combined, every year, on DEI efforts. Author Dr. Michelle Penelope King (2023) highlights in detail her experiences with prejudice and how systemic racism can prevent diverse candidates from advancing into senior leadership positions. Her findings align with those from a study conducted by Cerulli Associates and the Financial Planning Association (2024) focused on why women and members of minority groups are not joining the financial planning profession. Obstacles highlighted in both studies include minorities’ limited visibility or contact with leadership, insufficient mentoring from successful advisers, and implicit bias. Additional factors are referenced in Table 1.

The barriers outlined above demonstrate once again that even if firms have the best intentions regarding improving diversity, they are generally ill-prepared to support the success of female and minority advisers. This ties back to a lack of education and awareness: Leadership teams need to be better equipped to understand their diverse candidates so they can set them up for long-term success, just as they are comfortable doing with their White male counterparts. But what new behaviors do these leaders need to adapt, specifically? And how can they improve the effectiveness of their approach in today’s workplace?

Different skills are needed to support the values of diversity and inclusion in today’s workplace. First, leaders must take a collaborative and facilitative approach rather than rely on the old tactics of command and control. Projecting confidence in creating an environment that recognizes and appreciates differences in team members when it comes to gender, race, culture, age, and other factors takes yet another skill set. If financial services firms can create environments where these diverse candidates and team members feel respected and valued, they can be set up to succeed and begin to reverse the decades-long trend of no real progress.

Where Is the Commitment to Diversity Getting Lost?

Research on diversity, equity, and inclusion at financial services organizations finds strong commitment to diversity, as well a need for stronger metrics to drive progress. Research from the nonprofit independent organization Bank Administration Institute (BAI)—whose mission is to serve the financial services industry as a trusted resource to empower leaders to make smart business decisions and drive positive change—has focused on the fact that messaging from leadership on the importance of DEI initiatives is not matching the results. This indicates that more is needed beyond merely the professed support of leaders in the industry. There is inconsistency in how efforts are being measured from firm to firm as well, with employees believing there has been progress while the data does not match this perception.

BAI surveyed more than 475 employees at financial services firms, including human resources leaders. Among the respondents, 86 percent (BAI 2020) overall said they agree or strongly agree that their organizations are committed to diversity and inclusion. Notably, 86 percent of female employees and 87 percent of minority employees reported the same sentiments, demonstrating that even those populations being negatively affected by the lack of diversity believe the messages from leadership and feel the firm is moving in the right direction in their commitment to diversity.

Inclusive Leadership and a Way Forward

In recruiting the next generation of wealth advisers, leaders need to focus on educating both female and minority candidates so they better understand the role of a wealth adviser, what is required to be successful in the role, and the steps they can take to be successful in the industry. Recruiting efforts can be amplified in areas where those candidates are located, such as in high schools and on college campuses that have a highly diverse population. Firms can engage students on the availability of positions and recruit them for internship programs to provide early hands-on experience to both female and minority candidates. It is important for leadership to review their recruiting and hiring practices to focus on how they can spend their time differently to attract the diverse talent they speak about daily. This would support organizations’ ability to build a pipeline of candidates they can continue to educate, support, and eventually bring on as employees.

Second, the research discussed throughout this article highlights several obstacles identified by diverse wealth advisers currently working in the industry, including a limited visibility of leadership (78 percent women and 82 percent advisers of color), insufficient mentoring programs (77 percent and 79 percent, respectively), and implicit biases (76 percent and 73 percent, respectively). These findings raise the question: Once leaders have recruited a candidate to come into the industry, how can they support their success for the long term? Current diverse employees are telling the industry they are not getting the same support as their peers when it comes to access to growth and development opportunities.

Many firms’ HR departments provide mandatory DEI training for leadership, but most focus on awareness rather than action steps leaders can take to support diverse team members’ success. Training programs throughout the industry must focus on how leaders can reflect on their biases, ensure they spend consistent time with their diverse wealth advisers, and educate themselves on the cultural and experiential differences of these team members so they can gain an understanding of their background and an appreciation for their diverse thoughts and experiences. They should also include methods for leaders to hold themselves accountable to SMART metrics, so that, at a minimum, they can review their progress each month or quarter to identify opportunities for improvement rather than assuming their message is sufficient to drive change. In addition, firms should support leaders by forming groups to discuss progress and obstacles, and to hold each other accountable for reaching goals or identifying where change must occur to meet those goals.

Lastly, firms in the wealth management industry need to create a culture that celebrates diversity within their organizations so candidates and team members feel there is a safe and inclusive environment for them to thrive in their careers. In his book The Five Dysfunctions of a Team, Patrick Lencioni (2002) discusses the importance of creating connections through relationships as well as vulnerability-based trust. He states that, to build trust, there must be a connection built through understanding each other’s differences. When wealth advisers who join your organization feel there is a disconnect in how they are treated or valued, it may cause them to seek out a different environment where they feel the organization acknowledges and values their diverse experience.

The Benefits of Diversity for Organizations

There is ample quantitative evidence of the benefits of prioritizing diversity. Diverse and inclusive organizations outperform organizations that are less inclusive by 50 percent on average, and individual employee performance in a diverse company is 12 percent higher than in non-diverse firms (Sakpal 2019). Notably, a white paper published by Chief Executives for Corporate Purpose found that inclusive companies generate 2.3 times the cash flow of other companies (CECP 2018), are 1.7 times more likely to be innovation leaders, and are 70 percent more likely to capture new markets. In addition, research by Tapia and Polonskaia (2020) determined organizations that champion inclusive leadership are 87 percent more likely to make better decisions, and a study conducted by consulting firm Deloitte, which surveyed 245 global organizations, found inclusive teams are six times more likely to be innovative, six times more likely to anticipate change and respond effectively, and twice as likely to meet or exceed financial targets (Deloitte 2017). These findings reinforce the benefits of creating diverse teams across different industries and highlight the potential cost the wealth management industry faces by continuing to be behind the curve.

Conclusion

The wealth management industry has a diversity problem, with wealth advisers over its entire history having been mostly dominated by White males. Long-standing and deeply ingrained gender norms and industry demographics have contributed to women and minority groups feeling they are not part of the world of finance. At the same time, the wealth management industry has not been successful in recruiting and developing female or minority wealth advisers. Clearly, something needs to change.

Drawing on a range of sources, I highlighted three specific areas organizations can focus on to improve the diversity of their wealth advisory teams. By focusing on recruiting efforts in the right areas, building training and development programs that support behavior change for leaders within the industry, and creating a culture of diversity and inclusion that can be appreciated by diverse candidates, we can begin to take meaningful action to reverse the lack of progress the industry has made on improving diversity. This will also allow organizations to better reflect the diverse makeup of their communities, so wealth advisers match the gender and race of those they serve, enabling them to create wealth strategies that are better aligned with each client’s unique goals and experience.

References

BAI. 2020. “BAI Research on Diversity, Equity and Inclusion at Financial Services Organizations Finds Strong Commitment to Diversity, Need for Stronger Metrics to Drive Progress.” www.bai.org/news/bai-research-on-diversity-equity-and-inclusion-at-financial-services-organizations-finds-strong-commitment-to-diversity-need-for-stronger-metrics-to-drive-progress/.

Bisnoff, Jason. 2020. “Diversity in Wealth Management Still ‘Awful,’ Advisors Say.” Forbes. www.forbes.com/sites/jasonbisnoff/2020/10/13/diversity-in-wealth-management-still-awful-advisors-say/.

CECP. 2018. Diversity & Inclusion in Corporate Social Engagement: A CECP Accelerate Project. https://cecp.co/wp-content/uploads/2018/12/cecp_di_whitepaper_FINAL.pdf.

Cerulli Associates. 2024, January 16. “The Financial Industry Has a Headcount Problem.” The Cerulli Report – US Advisor Metrics 2023. www.cerulli.com/press-releases/the-financial-advisor-industry-has-a-headcount-problem.

Deloitte University Press. 2017. “Diversity and Inclusion: The Reality Gap.” In Rewriting the Rules for the Digital Age: 2017 Global Human Capital Trends. www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/central-europe/ce-global-human-capital-trends.pdf.

FlexShares. 2021. “Diversity Is Good Business for Advisory Firms: How Firm and Investor Preferences May Be at Odds.” https://go.flexshares.com/hubfs/2021%20-%20Diversity/2021%20Diversity%20Research%20White%20Paper-%20FINAL%20-%206-21-21.pdf.

Kidwai, Aman. 2020, June 18. “Former Morgan Stanley Diversity Head Sues, Alleging Race Discrimination.” HRDive.com. www.hrdive.com/news/former-morgan-stanley-diversity-head-sues-alleging-race-discrimination/580085/.

King, Michelle. 2023, May 16. “Who Benefits from Diversity and Inclusion Efforts?” Forbes. www.forbes.com/sites/michelleking/2023/05/16/who-benefits-from-diversity-and-inclusion-efforts/.

Tapia, A., and A. Polonskaia. 2020. The Five Disciplines of Inclusive Leaders: Unleashing the Power of All of Us. Berrett-Koehler Publishers.

Lencioni, Patrick. 2002. The Five Dysfunctions of a Team. New York: Jossey-Bass.

McKinsey & Company. 2023, March 8. “‘Show Me That This Is Possible’: Inspiring the Journey to Achieve Inclusion in the Workforce.”

Sakpal, Manasi. 2019, September 20. “Diversity and Inclusion Build High Performance Teams.” Gartner.

Shammas, Brittany. 2024, January 16. “The Wealth Transfer from Baby Boomers Mostly Benefits Women: Financial Advisors Pivot to a New, Growing Customer Base.” The Washington Post. www.washingtonpost.com/business/2024/01/16/women-economic-power-demographic-shifts/.

Zippia. 2022. “Wealth Management Advisor Demographics and Statistics in the U.S.” Zippia. www.zippia.com/wealth-management-advisor-jobs/demographics/.