Journal of Financial Planning: August 2022

Chris Heye, Ph.D., is founder and CEO of Whealthcare Planning and Whealthcare Solutions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on the images below for PDF versions

The greatest threat to the financial security of most older adults is not a recession, market correction, or inflation. It is rather the risks posed by health-related events and costs.

The evidence on both the realities and perceptions of health-related financial risks is stark and revealing. Roughly two-thirds of all bankruptcies in the United States are caused by the inability to pay medical bills.1 About 100 million people—or roughly 41 percent of U.S. adults—are in debt because of a medical or dental bill, and two-thirds of them have postponed the medical care they or a family member needs because of the cost.2

It is clear that (especially older) adults are aware of the financial risks posed by their health. Surveys consistently show that people in the United States are (much) more worried about high healthcare costs or a health event happening to a family member than they are about investment portfolio or other market-related or macroeconomic risks.3 As the population in the United States continues to age, diminished financial decision-making capacity has become one of the most significant health-related risks to the financial and retirement security of all Americans. In fact, The Wall Street Journal recently published an article declaring cognitive decline to be “baby boomers’ biggest financial risk.”4 While the statistics on the impacts of diminished capacity on personal finances are inherently difficult to measure, by all accounts the prevalence of sub-optimal financial decision-making, including financial exploitation, is large and growing.

Prevalence of Diminished Capacity

So how should we define diminished decision-making capacity, and how likely is it that an adult over the age of 60 is suffering from it? The Consumer Financial Protection Bureau defines diminished financial decision-making capacity as “a decline in a person’s ability to manage money and financial assets to serve his or her best interests, including the inability to understand the consequences of investment decisions.”5

On the other hand, the Alzheimer’s Association defines dementia as “a general term for loss of memory, language, problem-solving, and other thinking abilities that are severe enough to interfere with daily life.” An estimated 11 percent of adults over the age of 65 in the United States are living with Alzheimer’s—the most common form of dementia, and an additional 3 percent suffer from related illnesses, like vascular or frontotemporal dementia. So, roughly 14 percent of adults 65 and older in the United States have dementia.6 It’s safe to assume that anyone suffering from dementia is incapable of making sound financial decisions and can be considered as having diminished capacity.

Many older adults also suffer from what psychiatrists and neurologists refer to as mild cognitive impairment, or MCI (and sometimes also now described as mild neurocognitive disorder). MCI is different from dementia and “describes a level of cognitive decline that requires compensatory strategies and accommodations to help maintain independence and perform activities of daily living (ADL).”7

Adults with MCI are considered to be experiencing cognitive decline that goes beyond normal aging. It is reasonable to conclude that most if not all adults with MCI also suffer from diminished decision-making capacity. An estimated 15 percent of adults over 65 in the United States suffer from mild cognitive impairment (MCI).8

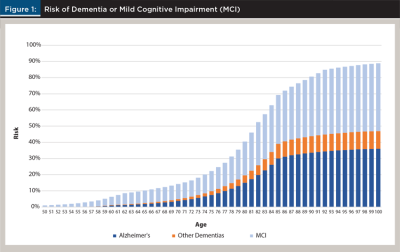

Together, the estimates for the prevalence of dementia and MCI suggest that about 29 percent of adults 65 and over in the United States suffer from diminished decision-making capacity. But these figures cover all adults over 65, and like many diseases, likelihood of having dementia or MCI increases with age. In other words, the chances that a 65-year-old adult has dementia or MCI is less than 29 percent, but higher for an 80-year-old.

Figure 1 provides estimates of the frequency of MCI and dementia by age. Roughly 10 percent of adults aged 65 have dementia or MCI. This percentage increases as we get older, accelerating rapidly as adults reach their mid-70s. By age 82, there is a greater than 50 percent chance that a person has either dementia or MCI. By the time a person reaches age 90, there is more than an 80 percent chance they have dementia or MCI.

But as difficult as these statistics may be to accept, the prevalence of diminished financial decision-making capacity is likely to exceed the percentages shown in the chart. A comprehensive study in 2009 found that financial decision-making mistakes follow a U-shaped pattern, with the peak age of financial decision-making occurring at around age 53.9 This suggests that difficulties with financial decision-making for many people begin well before the onset of a serious cognitive illness. In fact, a more recent study found that bill payments started being missed six years before an official diagnosis of dementia,10 implying that even “normally aging” adults may have difficulty making sound financial decisions.

Diminished Capacity and Behavioral Finance

We are also learning more about behavioral issues that can interfere with financial decision-making. Most of the research on behavioral finance has focused on the decision-making characteristics of “normal,” healthy individuals, and focused on the effects of various biases and heuristics. But what about individuals who struggle with more serious behavioral illnesses like anxiety or depression? We now know that these conditions can be every bit as consequential for decision-making as loss aversion or recency bias.

For example, since 2007, the American Psychological Association (APA) has conducted a survey seeking to understand the nature and prevalence of stress and anxiety. It has consistently found that people in the United States are more anxious about money than they are about their health, personal relationships, or family responsibilities.11 These high levels of anxiety do not appear to be good for financial decision-making. A study investigating relationships among “financial management behavior (FMB),” financial knowledge, and anxiety concluded that anxiety had a negative impact on financial decision-making behaviors.12

Another study seeking to identify behavioral determinants of the susceptibility to financial fraud found that high depression and low social-status needs fulfillment was associated with a 226 percent increase in financial exploitation.13 Being socially isolated implies having fewer people around who can monitor a person’s financial decisions, which in and of itself is a major risk factor. The increased social isolation brought on by COVID-19 has very likely made many adults even more vulnerable to poor financial decision-making exploitation.14

Even something as simple as overconfidence appears to adversely affect financial decision-making. One study determined that despite showing significant drops in their self-confidence in general, adults’ confidence in their ability to manage their finances, as well as confidence in their overall financial knowledge, did not decrease with declines in cognition.15 Another study found strong evidence of a link between overconfidence and unwise financial decisions.16 Specifically, it found that overconfident people are less likely to hold assets in most types of financial accounts.

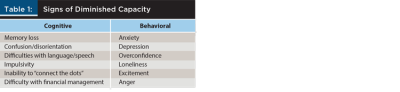

All of this research suggests that the scope of the cognitive and behavioral conditions that financial professionals are encouraged to monitor for and remediate, as broad as it is already, may still be too narrow. Table 1 provides a summary of both “cognitive” and “behavioral” traits that could suggest diminished decision-making capacity.

This seems like a lot to keep track of—and it is. But financial professionals with a fiduciary responsibility are required to protect their clients from all financial risks, not just investment portfolio fluctuations. We know that these health-related risks are in fact the ones that older adults care about the most.

But you don’t need to be a medical professional to successfully identify many of the signs of diminished capacity. Arguably the most important thing an adviser can do is to get to know their client. Understanding a client’s personality, decision-making style, and goals is obviously important for planning purposes. But it is also critical to protecting them from health-related threats like diminished capacity.

If you get to know your client well and communicate on a regular basis, there is a high probability that at some point you will notice one or more of the warning signs shown in the table above. And when that time comes, you can reach out to the client, their spouse, or other trusted contacts and remind them that it is your duty to act in their best interest and inform them of your concerns. You will not only be doing what is best for your client, but also addressing one of their greatest financial concerns.

Endnotes

- Himmelstein, David, Robert Lawless, Steffie Woolhandler, Deborah Thorne, and Pamela Foohey. 2019. “Medical Bankruptcy: Still Common Despite the Affordable Care Act.” American Journal of Public Health. 109 (3): 431–433. www.pnhp.org/docs/AJPHBankruptcy2019.pdf.

- Levey, Noam. 2022. “100 Million People in America Are Saddled With Health Care Debt.” Kaiser Health News. https://khn.org/news/article/diagnosis-debt-investigation-100-million-americans-hidden-medical-debt/.

- See for example Merrill Lynch’s “2017 Retirement Survey,” Franklin Templeton’s “2019 Retirement Income Strategies and Expectations (RISE) Survey,” or Edward Jones’s 2021 “The Four Pillars of the New Retirement.”

- Smith, Randall. 2021, June 6. “Baby Boomers’ Biggest Financial Risk: Cognitive Decline.” The Wall Street Journal. www.wsj.com/articles/baby-boomers-biggest-financial-risk-cognitive-decline-11622942343.

- Consumer Financial Protection Bureau. n.d. “Planning for Diminished Capacity and Illness.” www.consumerfinance.gov/consumer-tools/educator-tools/resources-for-older-adults/financial-security-as-you-age/planning-for-diminished-capacity-and-illness/.

- Alzheimer’s Association. “2019 Alzheimer’s Disease Facts And Figures.” www.alz.org/media/documents/alzheimers-facts-and-figures-2019-r.pdf.

- American Psychological Association. 2013. “Mild Neurocognitive Disorder.” www.psychiatry.org/File%20Library/Psychiatrists/Practice/DSM/APA_DSM-5-Mild-Neurocognitive-Disorder.pdf.

- American Academy of Neurology. 2018. “Practice Guideline Update Summary: Mild Cognitive Impairment.” www.aan.com/Guidelines/home/GuidelineDetail/881.

- Agarwal, Sumit, John C. Driscoll, Xavier Gabaix, and David Laibson. 2009. “The Age of Reason. Financial Decisions over the Life-Cycle with Implications for Regulation.” Brookings Papers on Economic Activity Fall 2009: 51–101. www.brookings.edu/wp-content/uploads/2016/07/2009b_bpea_agarwal.pdf.

- Nicholas, Laura, Kenneth Langa, Julie Bynum, and Joanne Hsu. 2021. “Financial Presentation of Alzheimer Disease and Related Dementias.” JAMA Internal Medicine 181 (2): 220–227.

- American Psychological Association. 2022. “Stress in America.” www.apa.org/news/press/releases/stress/index?gclid=Cj0KCQjw3IqSBhCoARIsAMBkTb1fDsb_m6-aaWc8tyUJcw5mMHECEWjanMzbLmM6RxvZEYYu-XW6mwgaAlf-EALw_wcB.

- Grable, John E., Kristy Archuleta, Megan Ford, Michelle Kruger, Jerry Gale, and Joseph Goetz. 2020. “The Moderating Effect of Generalized Anxiety and Financial Knowledge on Financial Management Behavior.” Contemporary Family Therapy 42: 15–24.

- Lichtenberg, Peter A., Laurie Stickney, and Daniel Paulson. 2013. “Is Psychological Vulnerability Related to the Experience of Fraud in Older Adults?” Clinical Gerontologist 36 (2): 132–146.

- See for example www.cnbc.com/2020/09/22/americans-have-lost-145-million-to-fraud-linked-to-covid-19.html.

- Gamble, Keith, Patricia Boyle, Lei Yu, and David Bennett. 2015. “Aging and Financial Decision Making.” Management Science 61 (11): 2603–2610.

- Shin, Su, and Andrew Hanks. 2019. “Effects of Overconfidence on Asset Holdings among Older Adults.” 2019 Academic Research Colloquium for Financial Planning and Related Disciplines. (Original publication September 21, 2018.) Available at: https://ssrn.com/abstract=3253215 or http://dx.doi.org/10.2139/ssrn.3253215.