Journal of Financial Planning: August 2024

Alberto Toribio del Pilar is a managing director and a key member of the leadership team at ButcherJoseph & Co. (https://butcherjoseph.com). He has over 20 years of global corporate finance and capital markets experience at industry-leading investment banks.

NOTE: Click on the image below for a PDF version.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Many professionals in financial planning may be familiar with the term “Silver Tsunami,” which generally refers to the significant number of business owners in the United States at or approaching retirement age, and, as such, are dealing with the issue of exit planning or considering the sale of their business. Of the approximately 77 million baby boomers in the United States, an estimated 12 million have ownership in privately held businesses.1

For many of these business owners, their financial planner is the primary trusted adviser they consult for guidance during significant life events. Financial planners aiming to advise business-owning clients on retirement and exit planning strategies should familiarize themselves with the tax advantages provided by Section 1042 of the Internal Revenue Code.

The Benefits of Section 1042

As an incentive to promote employee ownership and enhance employee retirement investment security, Section 1042 of the U.S. tax code provides the seller of a business, under specific circumstances, the ability to defer the recognition of long-term capital gains resulting from the sale of their business to an employee stock ownership plan (ESOP).

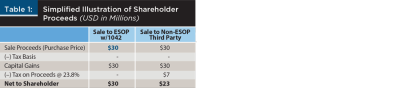

For instance, if eligible under Section 1042, a seller of a business with a taxable long-term capital gain of $30 million can defer recognizing that gain and, as such, defer taxes of approximately $7 million based on current applicable federal taxes. In other words, selling to an ESOP could allow a seller to retain about 23.8 percent more of their sale proceeds compared to selling to a traditional third party. This means the seller can invest a significantly larger amount of capital after the transaction. Moreover, an ESOP transaction can generate significant retirement investment value over time for employees participating in the plan and preserve a business owner’s legacy within their community.

Why Is Section 1042 Important to a Financial Planner?

A financial planner who can introduce an ESOP as an exit alternative to their business-owning clients can potentially provide extraordinary value during exit planning or retirement discussions. This is an opportune time for financial planners to help their clients understand how an ESOP transaction, coupled with comprehensive estate planning, can maximize the potential proceeds from the sale of a business. Furthermore, as acquisition activity by private equity groups declines and that of operating companies, particularly mature employee-owned companies, increases, the benefits of an ESOP become ever more relevant.

Private equity groups everywhere are addressing higher acquisition financing costs and calls from limited partners for a return of capital. On the other hand, larger mature ESOP-owned companies, many with large cash balances and plenty of borrowing capacity, are seemingly more active than ever in letting the mergers and acquisitions (M&A) market know that they are “open for business.”

What Is IRC Section 1042?

At its essence, IRC Section 1042 provides sellers of a business an opportunity for a “like-kind” exchange. The provision allows a taxpayer who sells qualified securities to an ESOP the ability to defer the recognition of the gain from the sale if they purchase qualified replacement property (QRP) within a specified period. The long-term capital gain on the sale of the qualified securities would be “recognized only to the extent that the amount realized on such sale exceeds the cost to the taxpayer of such qualified replacement property.”2

Expanding on the previous example, if our hypothetical seller purchases $30 million worth of QRP within 12 months after selling their stock to an ESOP, then the long-term capital gain recognized would be zero instead of $30 million. Consequently, the $7 million in federal taxes that otherwise would be due is deferred as long as the QRP is held.

The tax advantage provided by this section of the tax code increases in its appeal the higher the applicable state-level tax rate. The advantage provided by Section 1042 would seemingly appeal more to business owners in California, Minnesota, and New Jersey, among others, with relatively high marginal tax rates on long-term capital gains.

Fundamental Eligibility Requirements of Section 1042

To be eligible for a Section 1042 election, the following four statements must be true:

- Qualified securities must be sold to an employee stock ownership plan or an eligible worker-owned cooperative.3

- Immediately after the sale, the ESOP or cooperative must own at least 30 percent of the outstanding stock or 30 percent of the total value of all outstanding stock of the corporation.

- As of the time of the sale to the ESOP, the taxpayer must have held the qualified securities for at least three years.

- The taxpayer must file with the Secretary of the Treasury, along with tax returns, written statements of election, consent, and purchase as required by certain tax provisions related to the sale, in the same tax year in which the sale occurred.

Key Definitions Related to Section 1042

There are three important terms that a financial planner should be familiar with as it relates to Section 1042.

- Qualified securities are defined as employer securities issued by a domestic C corporation that has no stock outstanding that is readily tradable on an established securities market. This definition typically applies to most domestic, privately owned businesses organized as C corporations. One caveat, however, is that the securities in question must not have been received through a distribution from a qualified plan or a transfer pursuant to certain stock option plans. As such, securities obtained through incentive or bonus plans would not typically qualify.

- Qualified replacement property means any security, debt, or equity issued by a domestic operating corporation, public or private, that meets the Section 1042 threshold on passive investment income and is not part of the same controlled group of corporations as the corporation that issued the qualified securities being replaced. Though this definition is relatively broad, it excludes real estate, mutual funds, and government or municipal securities.

- Replacement period is the period of time starting three months before the sale of qualified securities and ending 12 months after the sale. Business owners must purchase qualified replacement property within this time frame to defer the recognition of gain. Key to financial planners, in this instance, is understanding that dollars used to purchase qualified replacement property need not be the actual proceeds from the sale of a business to an ESOP. As such, financial planners and their clients can integrate a potential sale of a business in the near term into present day financial planning discussions.

Implementing an ESOP Transaction

Typically, financial planners have a general sense of where their business-owning clients stand as it relates to exit or retirement planning. They may be privy to ongoing conversations between shareholders or family members related to ownership succession.

If a financial planner does not have a clear sense of the pertinent exit concerns of their business-owning clients, they should proactively inquire as to their clients’ intent to sell all or a portion of their business in the near or medium term. It can often be the case that after receiving unsolicited inquiries or bone fide offers from potential acquirers, a business owner, made aware of available resources, may ask a financial planner to provide access to their firm’s insights on current M&A activity or business valuations. Under these circumstances, the evaluation of an ESOP transaction as a sale alternative can provide valuable points of comparison, on an after-tax basis, for a business owner weighing an offer from a private equity group or another company.

A mathematical example may better illustrate the potential added value a financial planner can bring a business-owning client by introducing an ESOP transaction as a potential integral part of exit or retirement planning.

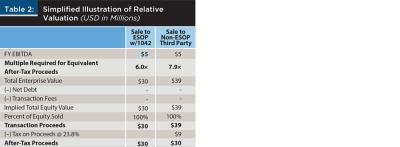

Let’s suppose our hypothetical business owner is considering an offer from a private equity group that would value their business at $30 million or six times earnings before interest, taxes, depreciation, and amortization (EBITDA) for its most recent fiscal year. Let’s also assume the seller’s adjusted basis in the stock of their C corporation is zero prior to the transaction. Assuming a marginal long-term capital gains tax rate of 20 percent and a net investment income tax rate of 3.8 percent, there would be approximately $7 million of federal taxes due on the sale, resulting in net after-tax proceeds of approximately $23 million. This example, of course, sets aside state taxation.

Now let’s assume that a sale to an ESOP, eligible for a Section 1042 election, can be completed at the same valuation as that of the private equity offer. Continuing with our simplified example, in the absence of federal taxes, the net consideration received by the seller would be $30 million for the ESOP transaction.

In a traditional sale to a private equity group, our hypothetical business owner would have to sell at nearly eight times EBITDA to end up with $30 million of value on an after-tax basis. Said differently, the hypothetical private equity group would have to increase its original bid of $30 million by more than 30 percent to match the value offered by a sale to an ESOP.

In the context of comprehensive, long-term financial planning, the potential incremental value available through a Section 1042 eligible transaction is incredibly material.

Liquidity Concerns in an ESOP Transaction

While the above illustration highlights the differential in obtainable value, it does not directly address the issue of liquidity (“cash at closing”) when comparing a traditional sale to a 1042-eligible ESOP transaction.

In a traditional sale of a business, the consideration paid a selling shareholder is usually entirely cash. An ESOP transaction, however, typically results in a mix of consideration, of which cash may represent one-third to one-half of the total purchase price. The remaining value due a seller is typically delivered in the form of promissory notes bearing market rates of interest, and some sort of economic interest in future equity value.

As such, an ESOP transaction usually does not provide the liquidity necessary to purchase the total amount of qualified replacement property a seller would need to take full advantage of a Section 1042 election. For those seeking to maximize the amount of cash proceeds received at the very time of closing a sale transaction, a traditional exit would seemingly be of greater interest.

However, financial markets have developed a solution to the mismatch between cash liquidity and the potential tax advantage available through the purchase of qualified replacement property under Section 1042. It is at this juncture that a financial planner can play an important role for their client.

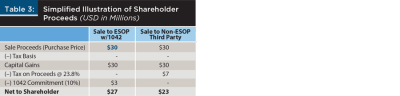

Taking our hypothetical example a step further, let’s assume that our business owner wants to sell to an ESOP, yet wants as much liquidity as possible. In this case, the seller can avail themselves of a customary Section 1042 monetization solution currently offered by numerous financial institutions.

It would be possible, through these monetization solutions, for our hypothetical seller to purchase up to $30 million of qualified replacement property through a margin account requiring a commitment of only 10 percent. The margin account facilitates a $27 million monetization loan that can be used, in combination with the $3 million commitment, to purchase the QRP necessary to maximize the Section 1042 benefit. The qualified replacement property serves as collateral for the monetization loan.

This arrangement would provide $27 million in value to the seller, or about $4 million more when compared to a traditional sale. The seller would be free to use 90 percent of the cash proceeds from the sale however they would like. The liquidity obtainable with a 1042-eligible ESOP transaction becomes more appealing if a seller factors in the 20 percent to 40 percent reinvestment, or “roll-over,” customary in a sale to a private equity group.

The incremental value offered by an ESOP transaction is still material when the 10 percent monetization commitment is factored in. A financial planner familiar with the fundamental aspects of Section 1042 would be very well positioned to help plan the QRP strategy most appropriate for their client.

Cost of a Section 1042 Monetization Solution

In the example above, the seller would hold: (1) a $30 million portfolio of QRP earning interest income based on a spread to a variable reference rate; and (2) an obligation to repay a $27 million monetization loan with an interest expense also based on a spread to a variable reference rate. Given these relative holdings, there may be a “carry” or a spread between interest received and interest paid by the seller under this structure.

If the carry is negative (that is, the interest expense on the monetization loan is greater than the interest income on the QRP portfolio), the modest cost of the structure over time would be much less than the taxes otherwise payable. A helpful exercise to view this carry cost in its proper context would be to estimate the number of years it would take before the cumulative negative carry of the selected QRP monetization solution equals the total federal taxes that would have otherwise been due at the time of the sale transaction.

In our running example, let’s assume the $30 million QRP portfolio earns 5.0 percent in interest income annually and the $27 million monetization loan has an interest rate of 6.5 percent. This implies that the annual cost of the 1042 QRP monetization strategy would be $255,000 annually. Given the federal taxes that would otherwise be payable in a traditional sale, it would take 28 years before the carrying cost of the 1042 ESOP QRP monetization solution would equal $7 million.

It is important to remember that depending on the applicable reference interest rates and the respective spreads to those rates, the carry in a 1042 ESOP QRP monetization solution may be zero.

Protecting Principal in a Monetized QRP Portfolio

A core duty of a financial planner is to help their clients preserve their investment principal. Given most securities fluctuate in value over time based on market conditions and global interest rates, a common strategy to mitigate the potential for loss of principal in a 1042 QRP monetization strategy is to construct a portfolio comprising floating rate notes issued by corporations with high-quality credit ratings. These floating rate notes have coupon rates that fluctuate in tandem with relevant reference rates, thus generally providing for market values over time that approximate the par face value of the notes.

Financial planners can help structure the optimal QRP portfolio and monetization strategy for their client in the context of overall financial planning. A financial planner can help identify the issuers and securities for QRP that have the best prospects in terms of underlying operating performance and credit quality. Moreover, it is up to the discretion of a seller, given their personal financial planning objectives, to determine the extent to which they avail themselves of the benefits of Section 1042. A seller can elect Section 1042 treatment for a portion of the proceeds received through an eligible ESOP transaction. There is room to customize the application of Section 1042.

If a business owner is contemplating a complete or partial sale of their business, a financial planner can play an important role in helping a seller prioritize their financial planning objectives, quantify their financial liquidity needs, explore the available exit alternatives, and implement the optimal post-sale investment strategies. Given the potential added value, a comprehensive exit planning process should ascertain if the facts and circumstances allow for an eligible ESOP transaction and a Section 1042 election.

Endnotes

- Dodd, Trey, Butcher Joseph, and Brian Beaulieu. n.d. “The ‘Silver Tsunami’ and Its Effect on The M&A Landscape.” ButcherJoseph & Co. https://butcherjoseph.com/wp-content/uploads/2022/05/Silver_Tsunami_White_Paper.pdf.

- IRC Section 1042 (a)(3).

- As defined by IRC Section 4975(e)(7).