Journal of Financial Planning: January 2025

Randy Gardner, J.D., LL.M., CPA, RLP, CFP®, AEP (Distinguished), is the founder of Goals Gap Planning, LLC and the Gardner Foundation.

Julie Welch, CPA/PFS, CFP®, AEP (Distinguished), is the managing shareholder of Meara Welch Browne, P.C., an accounting firm in the Kansas City area. Together, they authored 101 Tax Saving Ideas (Eleventh Edition).

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Now that the election is behind us, our attention is on the incoming administration of President Donald J. Trump and a new Republican-controlled Congress, and the potential tax changes that may come into play. Throughout his campaign, Trump laid out his tax plans for the coming four years. With a cooperative Congress, advisers should prepare their clients to maximize the benefits from the expected changes.

Tax Cuts and Jobs Act (TCJA)—Version Two

For better or worse, Congress will likely extend most of the provisions from the TCJA. The better includes: the 20 percent qualified business income (QBI) deduction for pass-through entities (the thresholds for 2025 are $394,600 for married individuals filing joint returns and $197,300 for others); the high gift, estate, and generation-skipping tax exclusion amounts ($13.99 million in 2025); the 37 percent maximum ordinary income individual tax rate; and the flat 21 percent corporate tax rate. All of these are scheduled to sunset in 2026, which is now unlikely to occur.

As for the worse, the following negative TCJA provisions will likely continue:

High standard deductions, but no exemption deductions and fewer itemizers. The standard deductions for 2025 will be $30,000 for married couples filing jointly, $15,000 for singles, and $22,500 for heads of household. However, under pre-TCJA rules, a married couple with two children would have had deductions of $35,800 ($15,000 standard deduction and four $5,200 exemption deductions). A larger family would have had even larger deductions.

Fewer itemizers. The combination of the $10,000 state and local tax (SALT) limitations and higher standard deductions has reduced the percentage of taxpayers itemizing deductions from 35 percent to 10 percent.

One of the casualties of this combination is first-time home buyers. The pre-TCJA mortgage interest and real estate tax deduction incentives will likely not be available. The mortgage interest deduction is expected to remain limited to $750,000 of debt (down from $1 million under pre-TCJA law). A married couple with a 6 percent, $300,000 mortgage subject to the SALT limitation will likely have itemized deductions of $28,000 (($300,000 × 6 percent) + $10,000), $2,000 less than the 2025 standard deduction of $30,000 for married couples filing jointly. The monthly rent the couple is paying on a similar property is likely less than the mortgage payment, meaning the couple will continue to rent.

Note on the SALT limitation: Trump and Congress remained ambiguous during the campaign months regarding the SALT limitation. Trump vowed to “get SALT back,” which could mean keeping or eliminating the cap. Millions of taxpayers would benefit if the cap was eliminated, but removing the cap would make Trump’s already expensive plan (projected deficits of $3 trillion over 10 years according to Tax Foundation estimates) even more expensive. Many states have helped alleviate the SALT issues on business income by instituting an elective pass-through entity (PTE) tax. This allows the state PTE tax to be deducted at the business level, effectively bypassing the $10,000 SALT deduction cap for individual taxpayers.

2 percent floor on miscellaneous itemized deductions. TCJA eliminated the 2 percent floor on miscellaneous itemized deductions, which had a significantly adverse impact on investors and employees who pay for covered expenses out of pocket. The disallowed deductions include: investment adviser fees; investment and professional licensing, association, and journal dues; internet and phone costs; tax preparation fees; hobby-related deductions; employee home office deductions; unreimbursed employee travel, mileage, meals, and lodging expenses; and countless other work- and investment-related expenses. If the TCJA disallowance of these deductions is extended, employees should consider incorporating or becoming independent contractors (more on this later).

Campaign Promises

During his campaign, Trump promised several changes that would be welcomed by the affected taxpayers.

No income tax on tip income. Speaking to culinary and hospitality workers in Nevada, Trump promised to eliminate the income tax on tip income. Presumably, the workers would still be subject to payroll (FICA) taxes.

Example: A single, 12 percent-tax-bracket server earning wages of $24,000 and tips of $36,000 would save income taxes of $4,320 ($36,000 × 0.12). It’s also important to note that the benefit may be less significant for lower-income individuals who could potentially lose some of the earned income credit.

No income tax on overtime pay. Under a proposal made by Alabama State Senator Sam Givhan and endorsed by Trump, employees who qualify for overtime by working more than 40 hours per week would not be subject to income tax on their overtime pay. The proposal was signed into law for Alabama state income tax purposes but failed when it was introduced in the U.S. Senate.

Example: If enacted at the federal level, a 22 percent-tax-bracket worker who earns $64,000 of regular pay and earns an additional $24,000 in overtime pay (10 hours per week × 50 weeks × $48 per hour (time and a half rate)) will avoid federal income tax of $5,280 ($24,000 × 0.22).

No tax on Social Security benefits. Trump promised to reverse the tax policies of Presidents Ronald Reagan and George H. W. Bush by eliminating the taxation of a beneficiary’s taxable Social Security benefits, 85 percent of which may be taxable currently. Presumably, this would apply to recipients who are retirees, disabled, children, spouses and former spouses, and surviving parents.

Example: A single, 75-year-old, 22 percent-tax-bracket retiree who receives $30,000 of Social Security benefits and has $100,000 of retirement, investment, and Social Security income will avoid income tax that would be owed under current law of $5,610 (($30,000 × 85 percent) × 0.22).

Should Workers Incorporate?

Usually, business owners form business entities to obtain a legal shield. However, as a result of the election, self-employed owners and employees with flexible employers may turn to business entities because of the unrestricted business deductions, fringe benefits, and more favorable tax rates due to the qualified business income deduction and the maximum 21 percent corporate income tax rate (compared to 37 percent for individuals). During the campaign, Trump discussed reducing the corporate tax rate from 21 percent to 20 percent, with a potential further reduction to 15 percent for companies that manufacture products in the United States. The 15 percent rate would be created by reinstating a form of the domestic production activities deduction (DPAD) at 28.5 percent ((1 − 0.285) × 0.21 = 0.15).

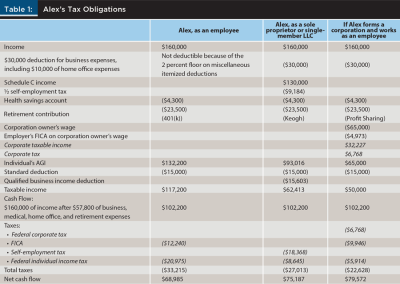

Example: Alex, a single employee, earns $160,000, has $20,000 of unreimbursed business-related expenses (cell phone, internet, mileage, office supplies, and organizational dues), incurs $10,000 of expenses from working at home, and contributes $4,300 to a health savings account and $23,500 to a retirement account. If Alex’s employer treats Alex as an independent contractor rather than an employee, Alex’s tax obligations would change as follows.

Alex’s taxes as an employee would decrease by $6,202 ($33,215 − $27,013) or 19 percent ($6,202 / $33,215) by working as an independent contractor and $10,587 ($33,215 − $22,628) or 32 percent ($10,587 / $33,215) if Alex takes the additional step of incorporating.

Why do these differences occur? As an employee, Alex cannot deduct the employee-related expenses and home office deduction, and Alex is subject to FICA on the HSA and 401(k) contributions. Alex does have more income counting toward an eventual Social Security benefit ($160,000, compared to $120,055 ($130,000 × 0.9235) as a sole proprietor and $65,000 as a corporate employee.

Operating in the corporate form reduces taxes the most because the business expenses, home office expenses, health savings account contributions, and retirement contributions avoid income tax and FICA. For a sole proprietor, the health savings account and retirement contributions do not reduce the self-employment tax. There are dozens of additional benefits the corporation could offer that avoid FICA and income tax, including dependent care assistance, group-term and split-dollar life insurance, adoption assistance, and an in-the-home fitness facility.

There are downsides to operating in the corporate form, including the compliance costs and the potential for double taxation. In the Alex example, the corporation accumulated $25,459 ($32,227 − $6,768) that was taxed at 21 percent (rather than the 22 percent individual rate). The corporation could distribute this accumulation as a qualifying dividend at favorable capital gain rates or, if the corporation is sold after five years of operations, the gain from the sale could be excluded under Section 1202.

Additional Possible Business Changes

Increase bonus deprecation back to 100 percent. Many businesses had become accustomed to immediately deducting the full cost of eligible capital investment. Bonus depreciation for 2024 was 60 percent of the assets’ cost, which drops to 40 percent for 2025. Under Trump’s proposal, 100 percent bonus depreciation would be restored, allowing businesses to reduce their taxable income by 100 percent of new equipment purchases and other qualifying items.

R&D expensing. Currently, businesses must capitalize expenditures for research and development (R&D) and amortize the costs over five years. Prior to 2022, R&D costs could be expensed as incurred. Trump discussed eliminating the requirement to capitalize the R&D expenses, thus allowing the expenses to be deducted immediately.

Business interest deduction limitation. The business interest expense deduction limitation generally restricts the deductibility of net business interest expense to 30 percent of a taxpayer’s adjusted taxable income. The calculation of adjusted taxable income is currently made after deducting depreciation. Trump’s proposal would allow depreciation to be added back to adjusted taxable income in making the calculation, as the calculation was done before 2022.

Keep your eyes on Congress. With Republican control of Congress, Trump’s tax agenda could be enacted as soon as 2025.