Journal of Financial Planning: July 2022

Anne Duke, Ph.D., CPA, is associate professor of accounting at the University of North Georgia. She received her bachelor of business administration in accounting, a master of accountancy, and her Ph.D. in housing and consumer economics (with a concentration in financial planning) from the University of Georgia.

NOTE: Click on the images below for PDF versions

Many of your clients may have lived frugally and consistently saved for retirement by utilizing tax-deferred qualified plans. As they approach retirement (post age 59½), they are likely to continue to save and desire to save. They are most accustomed to living frugally and saving. Clients such as these may have acquired great wealth held in qualified plans. They may prepare their own tax returns. They may not have considered the possibility of estate taxation. They may not know that the “rules” regarding distributions for beneficiaries changed significantly at the end of 2019. They only plan to continue saving.

However, these clients might want to consider taking elective distributions from their qualified plans. It may be more strategic to accelerate distributions for clients who desire to reduce the marginal tax rate on all future distributions—whether for themselves or their beneficiaries. It might also be advantageous to accelerate distributions for clients who desire to transfer tax-free wealth to beneficiaries or to reduce the size of their estate. If a high level of growth is anticipated, it may be advantageous to use a Roth conversion to transfer funds to a Roth IRA, where the future growth will not be taxed. The goal of this article is to identify the issues financial planning professionals and clients should consider when deciding whether or not to begin elective distributions from qualified plans.

What Is a Qualified Plan?

A qualified retirement plan meets all of the requirements of the Internal Revenue Code Section 401. Examples include traditional IRAs, rollover traditional IRAs, 401(k)s, 403(b)s, 457s, SARSEPs, SEP IRAs, and SIMPLE IRA plans (IRS 2022a). Earnings or wages placed in these accounts are not subject to federal income tax in the year of contribution. Upon distribution, these funds and subsequent earnings are subject to taxation.

Avoiding taxation on distributions from these funds is impossible, with the exception of qualified charitable distributions (discussed later). Because the funds accumulate and grow in qualified retirement accounts, clients do not pay tax on the invested assets nor the growth of those assets until they distribute the funds. Making non-deductible traditional IRA contributions is possible, but the focus here is tax-deferred qualified plans.

Choices Regarding Distributions

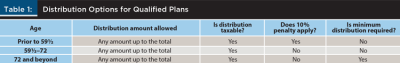

Distributions from qualified plans are always permissible, regardless of age, until the account is depleted. However, prior to age 59½, distributions are subject to income tax and a 10 percent penalty for early distribution. There are limited exceptions to the penalty for specific family emergencies such as an excess of medical, education, or adoption expenses (IRS 2022b). The penalty also does not apply upon inheritance of the retirement accounts. Beyond the age of 59½, distributions are penalty free. Beginning at age 72, required minimum distributions (RMD) begin. Table 1 summarizes the distribution options for qualified plans.

Reasons Not to Take Elective Distributions

Before discussing the powerful reasons for starting elective distributions, we must discuss 10 significant reasons for not doing so. Financial planners, tax and estate professionals, and clients need to be aware of these negative impacts of having too much income.

- The distributions are fully taxable. This reason alone might cause clients to prefer not to take distributions. Many clients might prefer only to take distributions when required by law, deferring taxation for as long as possible. In the case of early distribution, the taxation would also include the 10 percent penalty.

- The distributions, combined with other income, might move a client into a higher marginal tax bracket. Many clients oppose having any income taxed at a higher marginal rate. If income is likely to be lower after retirement or future beneficiaries will be in a lower marginal tax bracket, postponing distributions might be beneficial.

- The distributions might lead to higher taxation of Social Security benefits. This situation is rare. Most clients have other sources of income that make 85 percent (the maximum) of their Social Security benefits taxable. However, if a client has low income, elective distribution could make the difference. Currently, the maximum taxation of Social Security benefits occurs when half of the benefits and all other income exceed $34,000 if single and $44,000 if married filing jointly (IRS 2022c).

- Medicare Part B premiums might increase. In 2022, the standard cost of Medicare Part B is $170.10 per enrollee per month. The cost per month increases to $238.10 when adjusted gross income (from two years prior) exceeds $91,000 if single and $182,000 if married filing jointly. As income increases, the monthly cost of Part B continues to increase and, in 2022, can reach $578.30 (Medicare 2022). Clients might prefer to avoid paying a higher monthly premium for Medicare Part B.

- The distributions might cause the client to incur a higher long-term capital gains tax rate or the 3.8 percent surtax on net investment income. Table 2 shows the 2022 long-term capital gains tax rate for various levels of taxable income and marital status (Ruane 2021).

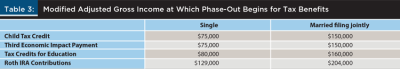

The 3.8 percent surtax on net investment income begins when a client has net investment income (e.g., dividends, interest, and capital gains) and their modified adjusted gross income exceeds $200,000 if single and $250,000 if married filing jointly (IRS 2022d) - The elective distributions might reduce or eliminate other tax benefits, including the child tax credit, tax credits for education, receipt of economic impact payments, and the ability to make Roth IRA contributions. Table 3 shows when the phase-out begins, in 2021, for the child tax credit (IRS 2022e), tax credits for education (IRS 2022f), receipt of the third economic impact payment (IRS 2022g) and, in 2022, the ability to make Roth IRA contributions (IRS 2022h). Clients might strongly prefer not to lose these benefits

- Your clients may prefer to make qualified charitable distributions (QCD), which are not taxable, rather than elective taxable distributions. If your client has a charitable intent, they should consider QCDs rather than taxable distributions. A QCD is a non-taxable distribution made directly by the trustee of a retirement account to a 501(c)(3) non-profit organization. A client must be at least age 70½ to authorize these distributions, and a receipt for the contribution is needed. The maximum annual exclusion for QCDs is $100,000 per taxpayer. If a married client and spouse are both eligible, then each can contribute $100,000 annually (IRS 2022b). QCDs count as required minimum distributions (RMD). So, QCDs allow your client to fulfill a charitable intent, shrink the balance in their qualified plans, and fulfill their RMD requirements without creating taxable income. Notably, in order for QCDs to count as RMDs, the charitable distributions must be made earlier in the tax year than the RMD.

- Another reason for your client to postpone distributions is if they would need to raid the qualified plan in order to pay the tax on the distribution. Having to pay the taxes from the qualified plan further reduces the potential for future growth within the plan.

- Clients should leave some funds in qualified plans and consider taking distributions when medical expenses become exorbitant. If a client has a high level of deductible medical expenses, such as long-term care when chronically ill (IRS 2022i), taking distributions equal to those deductions will not increase taxable income.

- Other uncertainties might lead a client to postpone elective distributions. The actual financial benefit from taking elective distributions is impossible to forecast accurately due to variable movement of financial markets, unanticipated changes in tax law, and uncertain life expectancy. As recent events confirm, other uncertainties that influence financial outcomes include war, pandemics, supply chain disruptions, and inflation.

Reasons to Consider Distributions

Once your client understands the negative impacts of increasing taxable income by taking elective distributions from qualified plans, the positive reasons can be considered. Positive reasons include to avoid accelerated future taxation of beneficiaries caused by the SECURE Act, to facilitate Roth conversions, to fund a 529 plan, to reduce future RMDs and taxation for a surviving spouse, to reduce estate size and facilitate gift splitting, to prepare for potential future tax code changes, and for consumption. Seven reasons for beginning elective distributions are as follows:

1. Avoiding Income Tax Acceleration Due to the SECURE Act

Possibly the most significant reason for considering elective distributions from qualified plans is to limit the negative tax impact of the SECURE Act. The Setting Every Community Up for Retirement Enhancement Act negatively changed the rules for distributions from inherited qualified plans and applies for decedents who die after January 1, 2020 (Congress.gov 2019). The act implemented a “10-year rule” on these distributions.

Before the SECURE Act, qualified account plans could allow designated beneficiaries to distribute balances slowly (stretch them) over their own lives thus deferring taxation. This stretch also provided some financial security for the life of designated beneficiaries. This was very attractive to clients who desired to leave an inheritance and financial security for their designated beneficiaries (Seamon 2021). However, due to the SECURE Act, designated beneficiaries are now required to distribute all funds in inherited qualified plans over a maximum of 10 years. In certain cases, beneficiaries who are spouses, disabled, chronically ill, or younger than the age of majority are considered to be “eligible designated beneficiaries” and are still allowed to stretch distributions.

While we generally think of an inheritance as a blessing, distributing a large qualified plan account balance over a 10-year period could cause a hardship. Large and fully taxable distributions combined with a beneficiary’s employment income could raise taxable income to the point that the marginal tax rate is very high and other beneficial tax credits, such as the tax credits for education and the child tax credit, are phased out (see Table 3). Clients may have a strong desire to avoid this situation for their beneficiaries. The hardship to beneficiaries can be reduced or eliminated if clients take elective distributions from qualified plans during their life. The elective distributions taken by a client during their life are taxed to the client, and the remainder is not taxed to beneficiaries.

2. Converting Funds to a Roth IRA

Another powerful reason for clients to take elective distributions from qualified plans during their life is to facilitate Roth conversions. Roth conversions (or “back-door” Roth conversions) must be accomplished following specific guidelines (IRS 2022j). Essentially, funds are distributed from qualified plans, taxed, and moved into Roth IRAs. Once funds are placed in a Roth IRA, they will not be taxed again. In addition, as long as the funds are held in a Roth for five years, the growth in the account will also never be taxed. Roth conversions can be completed by younger clients as the converted funds are not subject to the 10 percent penalty on early distributions. Roth IRAs become increasingly attractive as greater growth is anticipated. This is because the greater growth will never be taxed. They also become more attractive when higher future marginal tax rates are anticipated. This is because the future distributions will not be subject to the higher tax rates.

Due to the SECURE Act mentioned previously, beneficiaries who inherit Roth IRAs still must distribute the entire account balance within 10 years. However, these distributions are not subject to tax. Therefore, they will not increase the modified adjusted gross income of beneficiaries and cause other potential tax benefits to be reduced or eliminated. In addition, if the beneficiaries wait to take distributions for the full 10 years, the growth of the account during the 10-year period also is not taxed (Lange 2020).

In addition, if a client anticipates that their estate will be subject to estate tax, the Roth conversion is beneficial because paying the tax on the conversion reduces the gross estate.

Another reason for retirees to hold funds in a Roth is that the funds can be distributed to pay for expenses such as a new roof, new car, vacation, etc. without causing any tax to be owed or an increase in taxable income. On the other hand, if distributions are not needed, clients can allow funds to grow in a Roth for their entire lifetimes. There are no required minimum distributions from Roth accounts. Reducing RMDs can help limit the future monthly cost of Medicare Part B (Lubinski 2021).

There is no limit on the amount that can be converted from a qualified plan to a Roth. There are no age, income, or compensation restrictions. However, funds have to be available to pay the tax on the conversion.

3. Funding a 529 Plan

Taxable, elective distributions from qualified plans could allow for greater contributions to 529 plans. A 529 plan is an account used to save for future education expenses of a beneficiary (elementary, secondary, and post-secondary). While there is no federal tax deduction for contributions to 529 plans, some states allow state tax deductions and credits (Delorme 2019). As with Roth IRAs, the funds invested in a 529 plan grow and are distributed tax-free as long as they are used to pay qualified education expenses of the beneficiary (IRS 2022f). Taking elective distributions from qualified plans to fund 529 plans also has the advantages that it reduces future RMDs from the qualified plan and reduces the future hardship to beneficiaries caused by the SECURE Act.

4. Reducing Future RMDs and Taxation for Surviving Spouse

Another benefit of taking elective taxable distributions is to reduce future RMDs. Individuals who have reached the age of 72 must take RMDs from their qualified plans. The annual amount of RMDs for an individual is the account balance of their qualified plan accounts at the end of the prior year divided by the IRS-determined life expectancy. These distributions are taxable and can raise income levels to the point that the marginal tax rate is very high, the monthly cost of Medicare Part B increases, and other tax benefits are phased out or eliminated. RMDs cannot be avoided.

The tax hardship caused by RMDs is even more brutal for a surviving spouse. Surviving spouses are very often the designated beneficiary of their spouses’ qualified plans. Fortunately, surviving spouses are qualified designated beneficiaries and can, even after the SECURE Act, stretch distributions over their own life expectancies. However, if a surviving spouse has a similar age to their spouse, which is likely, the taxable income generated will be very similar. What causes the increased hardship for surviving spouses is that, in years following the year their spouse dies, they will most often use the single filing status (Lubinski 2021). Because of RMDs, taxable income remains at the same level as when they were married filing jointly. However, with the single filing status, marginal tax rates are higher, the monthly cost of Medicare Part B is higher, and there is an even greater chance other tax benefits will be phased out or eliminated. Elective distributions from qualified plans reduces future RMDs—whether for the account holder, the surviving spouse, or future beneficiaries.

5. Reducing Estate Size and Facilitating Gift Splitting

At the date of death, most estates are not subject to estate tax. This is because the value of most estates is less than the unified credit. Estate tax is only paid when the value of the estate (and any past taxable gifts) exceeds the unified credit. For 2022, the unified credit is $12,060,000 per person. Also, when the first spouse is deceased, their unused unified credit can be (if portability is properly elected) passed to the surviving spouse (IRS 2022k). Therefore, for a married couple, the combined unified credit is $24,120,000. Because of the large unified credit, few estates are subject to estate tax in 2022.

However, a sunset provision in the 2017 Tax Cuts and Jobs Act automatically resets the unified credit to $5,000,000 per person (indexed for inflation) on January 1, 2026. Additionally, Congress may make radical changes in how estates are taxed in the future. For example, on September 13, 2021, the House Ways and Means Committee proposed lowering the unified credit amount to $6,020,000 per person effective January 1, 2022 (Endsley and Galloway 2021).

Estate tax rates in 2022 begin at 18 percent but quickly increase to 40 percent (Mengle 2022). Clients who anticipate their estates will be subject to estate tax should immediately begin estate planning. Estate planning may involve elective distributions from qualified plans. One simple way to avoid some or all estate tax is to make lifetime gifts via gift splitting. Funds must be removed from qualified plans, and taxed, before they can be used for gift splitting.

Gift splitting allows each person annually to give non-taxable gifts of up to $16,000 (2022) of assets to another person. Gifts can be made to multiple individuals each year if preferred. For example, a couple with two children and five grandchildren (seven beneficiaries) over a 10-year period could transfer $2,240,000 ($16,000 × 2 spouses × 7 beneficiaries x 10 years). Through gift-spitting, over time, clients can greatly reduce the size of their estates.

6. Preparing for Future Tax Code Changes

It is uncertain what changes will be made in the future to the laws regarding qualified plans. As an example of a potential change, the Build Back Better Act, which was approved by the House of Representatives but has not been approved by the Senate, included provisions (in certain situations) to require immediate distribution of qualified plan balances in excess of $10,000,000 (Congress.gov 2021). Another aspect of the Build Back Better Act is that it eliminates future Roth conversions for high-income taxpayers. Although the Build Back Better Act may never become law or may be significantly amended, similar future changes could make it advantageous for clients to take elective distributions in the current year.

7. Facilitating Consumption

In addition to the financial reasons mentioned above, clients might want to take elective distributions from qualified plans in order to make human capital investments (e.g., education or business ventures) in themselves or others. They might also take distributions as a necessity or a luxury.

Conclusion

Once clients fully understand the potential positive and negative impacts of taking elective distributions from qualified plans, they can decide how to proceed. Each client needs assistance from a knowledgeable and caring team of experts. The team should ideally include a financial planner, tax professional, and estate planning expert, all working together and sharing critical information.

Considering uncertainty about the future and the impossibility of perfect prediction, clients should make wise and informed incremental decisions. For each client and each tax year, the goal might be to find the exact amount of funds to distribute from qualified plans without increasing the marginal tax rate, the future cost of Medicare Part B, the taxation of Social Security, or the phasing-out of other benefits. This analysis could occur in early November of each year, permitting time for elective distributions by December 31. Clients should strongly consider taking these distributions as Roth conversions; however, other assets need to be available to pay the increase in tax. In addition, if the client has a charitable intent and is eligible, qualified charitable distributions should be utilized.

Some clients might feel so strongly about reducing future taxation for beneficiaries that they desire to take greater elective distributions from qualified plans despite increases in marginal tax, the cost of Medicare Part B, and other hardships. In these cases, the team of experts can help the client understand how all of the parts of the tax system work together.

The decision to take elective distributions from qualified plans is not an easy one. Clients and professionals should understand all of the costs and benefits of doing so and work together in a timely and detailed manner to achieve the best results.

References

Congress.gov. 2019, June 3. “H.R.1994 - 116th Congress (2019–2020): Setting Every Community Up for Retirement Enhancement Act of 2019.” www.congress.gov/bill/116th-congress/house-bill/1994.

Congress.gov. 2021, November 19. “H.R.5376 - 117th Congress (2021–2022): Build Back Better Act.” www.congress.gov/bill/117th-congress/house-bill/5376.

Delorme, Luke. 2019. “College Savers: What Is the Expected Tax Alpha of 529 Plans?” Journal of Financial Planning 32 (11): 44–52.

Endsley, Anya, and Katherine Galloway. 2021, November 8. “House Democrats Propose Estate and Gift Tax Law Changes: Important Estate Planning Implications.” JD Supra. www.jdsupra.com/legalnews/house-democrats-propose-estate-and-gift-5692346/.

Internal Revenue Service. 2022a, February 5. “A Guide to Common Qualified Plan Requirements.” www.irs.gov/retirement-plans/a-guide-to-common-qualified-plan-requirements.

Internal Revenue Service. 2022b. “Distributions from Individual Retirement Arrangements (IRAs).” www.irs.gov/pub/irs-pdf/p590b.pdf.

Internal Revenue Service. 2022c. “Social Security and Equivalent Railroad Retirement Benefits.” www.irs.gov/pub/irs-pdf/p915.pdf.

Internal Revenue Service. 2022d, March 16. “Questions and Answers on the Net Investment Income Tax.” www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax.

Internal Revenue Service. 2022e. “IRS updates the 2021 Child Tax Credit and Advance Child Tax Credit.” www.irs.gov/pub/taxpros/fs-2022-17.pdf.

Internal Revenue Service. 2022f. “Tax Benefits for Education.” www.irs.gov/pub/irs-pdf/p970.pdf.

Internal Revenue Service. 2022g, January 27. “Third Economic Impact Payment.” www.irs.gov/coronavirus/third-economic-impact-payment.

Internal Revenue Service. 2022h, March 16. “Amount of Roth IRA Contributions That You Can Make for 2022.” www.irs.gov/retirement-plans/plan-participant-employee/amount-of-roth-ira-contributions-that-you-can-make-for-2022.

Internal Revenue Service. 2022i. “Medical and Dental Expenses.” www.irs.gov/pub/irs-pdf/p502.pdf.

Internal Revenue Service. 2022j. “Contributions to Individual Retirement Arrangements (IRAs).” www.irs.gov/pub/irs-pdf/p590a.pdf.

Internal Revenue Service. 2022k, March 16. “Estate Tax.” www.irs.gov/businesses/small-businesses-self-employed/estate-tax.

Lange, James D. 2020. “Why Your Clients Need to Do Roth IRA Conversions Before Year-End.” Journal of Financial Planning 36 (10): 39–41.

Lubinski, Phil. 2021. “The Reality of Liquidation Order for the Mass Affluent.” Journal of Financial Planning 34 (10): 44–48.

Medicare. 2022, February 8. “Part B Costs.” www.medicare.gov/your-medicare-costs/part-b-costs.

Mengle, Rocky. 2022, March 16. “Estate Tax Exemption Amount Goes Up for 2022.” Kiplinger. www.kiplinger.com/taxes/601639/estate-tax-exemption-2022.

Ruane, William. 2021. “Revenue Procedure-21-45.” IRS. www.irs.gov/pub/irs-drop/rp-21-45.pdf.

Seamon, Cassidy J. 2021. “Kissing the Security Blanket Goodbye: How the SECURE Act Will Affect IRA Beneficiaries’ Long-Term Financial Security.” Boston College Law Review 62 (1): 357–389.