Journal of Financial Planning: July 2024

Jon Dauphiné spearheads the Foundation for Financial Planning’s (https://ffpprobono.org/) efforts to develop and grow pro bono financial planning programs for people in need, engaging thousands of CERTIFIED FINANCIAL PLANNER™ professionals to provide free service through FFP’s volunteer platform, ProBonoPlannerMatch.Org, and leading the movement to foster a pro bono tradition in financial advice.

NOTE: Click on the Tables and Equations below for clearer PDF versions.

I witnessed the power of pro bono service for the first time as a young student at Harvard Law School. I began volunteering at a pro bono legal clinic in a low-income area, and the first client I ever had was a single mom of three kids whose family was being threatened with eviction during that cold Boston winter. Without legal representation, she would have been defenseless against her landlord, but with pro bono assistance she had access to justice. Her landlord had failed in multiple ways to provide habitable living conditions, and with our help, she was able to keep a roof over her family’s head because her advocates understood housing law.

Like our legal system, our financial system is complex and hard to navigate—and many Americans lack access to objective, fiduciary advisers. That’s why it is inspiring to see the momentum that the pro bono movement is gaining within the financial planning profession. Each year, thousands of CFP® professionals donate their time and talent to help underserved people navigate their financial challenges and learn skills that can help them increase their economic prosperity. I lead the Foundation for Financial Planning (FFP), and our mission is to expand pro bono service, engaging more advisers and firms to help even more families in need.

One force driving this movement is the rising generation of new, “next-gen” planners. I’ve observed a clear trend when speaking with students seeking to join the profession or advisers under the age of 35—they have a strong desire to provide pro bono service, to ensure sound financial advice can reach beyond high-net-worth clients to families of more modest means.

Dr. Dorothy Durband, Ph.D., AFC, a professor of financial planning at Texas Tech University, observes that many of her students tend to focus on purpose and meaning in their careers. With funding from FFP nearly 10 years ago, Durband created a pro bono curriculum and is now working with a team to update and enhance it. The curriculum includes information on how to set up a pro bono clinic where students, under supervision from professors or CFP® professional volunteers recruited by the school, advise other students or underserved members of the local community.

“The students are so enthusiastic about this experiential learning,” notes Durband. “It gives them direct client interaction, hands-on counseling experience, the opportunity to co-create goals and plans, and advancement of both their hard and soft skills—including building client trust and rapport, self-awareness, and how to think on their feet.” Durband adds that pro bono engagements can be especially useful in teaching next-gen planners how to work in settings that may involve conflict (for example, between a couple); that demand critical thinking and problem solving; that may entail high emotion but require the adviser to be responsive and not reactive; and that demand “cultural humility” and occasionally the need for an adviser to say they don’t know the answer but can find it.

When advisory firms come to the Texas Tech campus to recruit, Durband says they seek out students who have practical experience, especially those who have worked directly with pro bono clients. In turn, she advises students to seek employment at firms that support their advisers who want to provide pro bono service. “Pioneering firms understand that pro bono work generates goodwill in the community . . . while also sharpening the skills of the advisers who volunteer to do it. It makes for better advisers, and it gives the firm a better understanding of the community in which they work, as well as an opportunity to model good corporate citizenship and foster local connections that can ultimately benefit the business.”

The passion that many students feel for pro bono work continues once they become newly minted CFP® professionals. Dennis Elias, CFP®, is a great example. His parents immigrated from El Salvador, and he witnessed how hard it was for his family to navigate the U.S. financial system with little knowledge of personal finance and no help. He gravitated to the financial planning program at Virginia Tech University because he saw firsthand the need and the potential for great financial advice to transform the lives of people across the income spectrum.

“I wanted to help not just high-net-worth families, but also struggling folks who had little margin for error in their finances and nowhere else to turn,” says Elias. At 27, he began volunteering at a local nonprofit funded by FFP, where he became a financial mentor for people in need. Over time, he served three different pro bono clients, meeting with them as often as weekly, especially one client who was deeply affected by the COVID-19 crisis. This client’s family had lost most of their income due to the pandemic, had mounting medical bills, and was in danger of losing their home. Elias educated the client on the basic concepts of finance, worked with her on budgeting, cash flow, and debt management; and together with the nonprofit staff where he was volunteering, he helped secure housing assistance for the family. The family kept their home, dramatically reduced their debt, and over time achieved much greater financial stability.

“The greatest thing I can offer my pro bono clients is empathy and support,” notes Elias. “With few resources, it can be so difficult for them to find someone to help who isn’t trying to gouge or prey on them. When they realize I’m truly just there to help with no strings attached, it’s a ‘wow moment’ for them—they are so grateful. But I benefit so much as well.”

Elias credits pro bono work with making him a better adviser overall. “Providing pro bono, I had direct client contact much earlier than I did in my role as a paid adviser. I had to deal with very diverse clients and issues, speak with poise and empathy, build trusting relationships, apply creative thinking . . . it really built my confidence as a professional, which also made me a more effective employee at my firm,” he says.

FFP’s recent research, The Case for Pro Bono Financial Planning—based on a survey of almost 1,200 CFP® professionals completed last year—quantifies the power of pro bono work to foster next-gen advisers’ professional development and to afford firms that encourage pro bono a competitive edge.

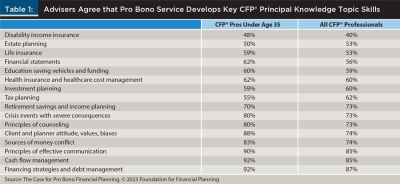

FFP asked CFP® respondents who had provided pro bono if their service helped to develop various specific skills and issue knowledge that constitute the principal knowledge topics required by CFP Board for certification. We found overwhelming agreement that pro bono work developed skills across 15 of these critical knowledge topics, with next-gen advisers (those under age 35) even more emphatic that their service bolstered skills. See Table 1.

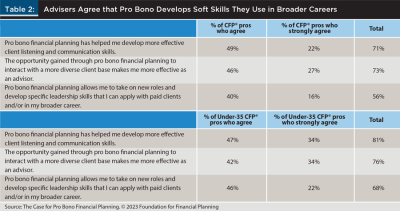

Just as CFP® professionals reported gaining skills from pro bono service in very specific areas, they also told us they developed key “soft skills” that are invaluable to their broader careers. A majority of all advisers reported that pro bono work sharpened their skills communicating with clients, interacting with diverse individuals, and leading in new roles while learning new issues, making them better planners overall. Next-gen advisers were most likely to report improved soft skills; for example, a striking 81 percent of that group reported that pro bono work improved their holistic client communication skills. See Table 2.

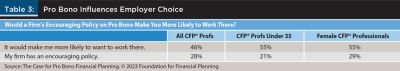

FFP’s research also showed that when advisory firms support and encourage their advisers to do pro bono work, they can gain a competitive advantage in the war for next-gen talent. Fifty-five percent of CFP® professionals under the age of 35 said that they would be more likely to go work at a firm that had an encouraging policy on pro bono for its advisers—but only 21 percent said that their current firm did, a whopping 34-point gap that cutting-edge firms can leverage if they adopt more supportive policies and practices. See Table 3.

Dennis Elias notes that his current firm provides him with eight paid hours of work time to devote to his pro bono engagements each quarter, a benefit that means a lot. He says firms should view pro bono as a “great training ground that improves adviser skills, which in turn benefits the firm and its paid clients as well.” He also points to the impact that supporting pro bono can have on a firm’s culture. “It means so much more for a firm to encourage pro bono financial advice than it does to have a ‘volunteer day’ where everyone goes to the soup kitchen,” notes Elias. “Because providing financial advice means we are giving essential life skills to people in need, who in turn can benefit their families and their communities—there’s a big amplification effect. It highlights that the core product of our firm is indispensable for people from all walks of life.”

Durband notes, too, that “pro bono is the hallmark of a true profession,” and indeed, almost 80 percent of advisers told FFP that they are motivated to do pro bono work because they want to give back to a profession that has given so much to them. The CFP Board now recommends that all CFP® professionals provide at least 20 hours of pro bono service each year. As more next-gen planners join the ranks of the adviser workforce, the pro bono movement is poised to grow dramatically, which will benefit thousands more families in need, but also the advisers themselves and the profession overall.

Pro Bono: How Can Next-Gen Advisers Engage?

Foundation for Financial Planning (FFP) makes it easy for CFP® professionals to get involved in our pro bono mission. Here are simple steps advisers can take to start helping families who need financial advice . . . but can’t afford it.

- Take FFP’s free, one-hour online introductory course to pro bono financial planning volunteerism at https://portal.kaplanfinancial.com/partner/FFP-ProBono. CFP® professionals receive a CE credit. Advisers can also browse additional FFP skills-building webinars, all free, on our Volunteer Resource Center at https://ffpprobono.org/volunteers/.

- Sign up to volunteer at FFP’s ProBonoPlannerMatch.Org, the nation’s only online pro bono opportunity clearinghouse. Here, CFP® professionals can register, then browse and connect to opportunities posted by more than 150 different nonprofits seeking volunteers to help their constituents. Each qualified adviser connecting to an opportunity is automatically covered by FFP’s complimentary E&O liability insurance coverage. And if you know of any nonprofits who would like to start a pro bono program, FFP has resources to help them get started at https://ffpprobono.org/wp-content/uploads/2022/08/FFP-Nonprofit-Outreach-Overview.pdf.

- Support the pro bono cause with a charitable, tax-deductible donation to FFP by visiting https://ffpprobono.org/support-pro-bono/donate-now/. FFP receives the top ratings from the nation’s leading charity evaluators, Charity Navigator and Guidestar/Candid.

- Encourage your firm or employer to sign on as an FFP RIA Impact Partner (https://ffpprobono.org/support-pro-bono/ria-impact-partners/) or Corporate 100 Club member (https://ffpprobono.org/support-pro-bono/corporate-partnerships/). FFP offers many resources that firms can use to support advisers who do pro bono work.

- Stay informed by signing up for FFP’s monthly e-newsletter at https://ffpprobono.org/get-updates/.