Journal of Financial Planning: July 2024

Patrick M. Ryle, J.D., LL.M., CPA, CMA, is an assistant professor of accounting and finance at Dalton State College. He holds research interests in accounting, finance, taxation, technology, security, and privacy. Professor Ryle has authored numerous publications and teaches finance, accounting, taxation, and business law classes.

Mark A. McKnight, Ph.D., CFE, is a professor of accounting at the University of Southern Indiana’s (USI) Romain College of Business. He has published over 30 peer-reviewed journal articles. Dr. McKnight teaches classes in financial accounting, managerial accounting, business analytics, forensic accounting, and financial statement analysis and has served as accounting program coordinator and chair for the Department of Accounting and Finance at USI.

Brett L. Bueltel, J.D., CPA, is an associate professor of accounting at the University of Southern Indiana’s (USI) Romain College of Business. Dr. Bueltel teaches classes in tax, financial accounting, managerial accounting, and business law and serves as the assurance of learning coordinator for the USI Romain College of Business.

Christian G. Koch is a professor of finance at the North Carolina State University’s Poole College of Business. He teaches classes in foundations of financial management and investments. His academic research is at the intersection of wealth management, financial planning, and financial literacy.

Michael P. D’Itri is a professor of logistics and supply chain management at Dalton State College where he teaches classes in operations management and integrated materials management. Although Dr. D’Itri’s primary research interests are in production scheduling, he has also done work on exchange rate risk management and other types of math modeling. He has coauthored articles that have appeared in the International Journal of Physical Distribution and Logistics Management, the International Journal of Purchasing and Materials Management, and Competition Forum.

NOTE: Click on the Tables and Equations below for clearer PDF versions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Financial planners representing families and small businesses know all too well that more Americans should be sufficiently saving for retirement. The SECURE 2.0 Act (Setting Every Community Up for Retirement Enhancement Act) contains over 100 provisions designed to enhance American savings practices. Passed on December 29, 2022, it created many new opportunities and obligations for employers and employees.

Kobe (2010) noted that almost 20 million workers were not then participating in employer-sponsored plans, and only about 5 million people made contributions to individual retirement accounts (IRAs) each year. A slight majority of American households headed by individuals between ages 55–64 do not have any retirement savings, and those who do have a median of only around $109,000 saved (Svynarenko 2019). As recently as 2018, parents tended to spend approximately twice as much on financially supporting their adult children as they did on saving for retirement (Merrill Lynch 2018).

As several of the critical provisions of this act go into effect in 2024 and beyond, complying with and taking advantage of its provisions is a genuine and current challenge for clients and their advisers. For this reason, it is essential to reexamine several of its key provisions. As the SECURE 2.0 Act is wide-ranging in scope, planners must remind clients of the many retirement-related obligations imposed by the act and key provisions that first go into effect in 2024 and beyond. For this reason, and as a reminder to clients and practitioners, we examine several critical requirements of the act that advisers and their clients need to know for 2024 and beyond.

Through the passage of successive pieces of legislation, the SECURE Act in 2019 and the SECURE 2.0 Act in 2022, Congress has enhanced the American retirement savings regulatory regime to bolster the retirement practices of millions of Americans. The SECURE 2.0 Act is a sweeping regulatory reform measure designed to help Americans better prepare for a secure retirement. It contains multiple provisions designed to enhance American retirement savings and implements these measures over several years, from 2023 to 2026 and beyond.

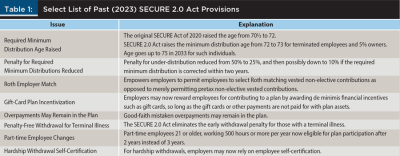

Review of Prior SECURE 2.0 Act Provisions

Some of the provisions have already gone into effect. Others go into effect in 2024, 2025, and 2026. As a result, before examining changes that impact the future, it is helpful to quickly describe the changes that went into effect in 2023. As of the time of writing (2024), these changes are now operable. First, Congress increased the required minimum distribution (RMD) age to 72 instead of 70½ in 2020 with the original SECURE Act. It then increases the RMD age to 73 in 2023 (which applies in practice to those who turn 73 in 2024) and then 75 years of age beginning in 2033.

In 2023, the SECURE 2.0 Act also reduced the penalty for under-distribution of retirement accounts from 50 percent down to 25 percent and 10 percent if corrected within two years. In 2023, the act permitted vested contributions to be Roth instead of pretax. Also, it allowed employers to provide de minimus incentives to employees (such as gift cards) for participating in retirement plans. Other 2023-effective provisions state good-faith mistaken overpayments to a plan may remain in a plan, early withdrawal for a terminal illness may be made without a 10 percent penalty, employers may rely upon employee self-certification for hardship withdrawals, and part-time employees aged 21 years or older are now eligible after two years instead of three.

The SECURE Act of 2019 provides small businesses with tax credits that can help defray the costs of setting up a retirement plan for employers. The SECURE 2.0 Act of 2022 amends the original SECURE Act by increasing the size of eligible employers from those with 50 employees or fewer to 100 employees or fewer. For such employers, companies can obtain a subsidy of up to $250 per non-highly compensated employee to defray the costs of setting up a retirement plan.1 The subsidy is up to three years, for a maximum of $5,000 per year for the ordinary and necessary costs of implementing a simplified employee pension (SEP), SIMPLE IRA, or another qualified plan (Commito 2022). This subsidizes, as a 100 percent credit (up from a previous 50 percent credit), the costs of establishing a plan, thus reducing IRS tax liability on a dollar-for-dollar basis. Additionally, small businesses may receive a tax credit of $500 for adding an auto-enrollment feature to an existing or new plan.2

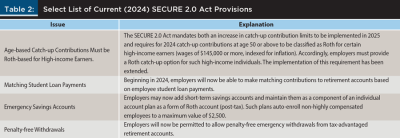

Current SECURE 2.0 Act Provisions

Age-Based Roth Catch-Up Provisions Extended to 2026

Advisers need to know about recent changes to the provision to increase age-based catch-up provisions beginning January 1, 2024. Meanwhile, the SECURE 2.0 Act mandates that catch-up contributions be classified as ROTH contributions, as opposed to pretax contributions, for certain high-income earners (wages of $145,000 or more, indexed for inflation). Accordingly, under the original mandate of the SECURE 2.0 Act, employers must have provided a Roth catch-up option for such high-income individuals and must have done so by January 1, 2024. This implementation compliance date has been extended (Eickman 2023, 4).

The Department of the Treasury and the IRS implemented this delay after receiving and considering public feedback revealing concerns about the length of the implementation transition period. In response to the concerns of plan administrators, record keepers, and organizations, the IRS has established an administrative transition period of two years. This transition period effectively delays the implementation of this requirement until January 1, 2026, as announced by the IRS through Notice 2023-62.3

Emergency Savings through Pension-Linked Savings Accounts (PLESAs)

Through the SECURE 2.0 Act, Congress rolled out newly created emergency savings accounts for workers. On January 12, 2024, the IRS released initial guidance to assist employers in understanding and complying with the implementation of newly created pension-linked emergency savings accounts (PLESAs). These PLESAs create a short-term savings account that is maintained as a component of an individual plan as a form of Roth account, and which only accepts contributions that are so designated.

Emergency Penalty-Free Withdrawal Provisions 2024

In addition to creating PLESAs, the SECURE 2.0 Act also amended the Employee Retirement Income Security Act (ERISA) to permit emergency withdrawals from tax-advantaged retirement accounts. This provision, which goes above and beyond newly created PLESAs, permits employees to take emergency personal expense distributions of an amount equal to or less than the lesser of $1,000 or the excess of an individual’s accrued benefit under a tax-advantaged retirement plan over $1,000.4 Under ERISA §801, employees will be entitled to make such withdrawals without being required to demonstrate the existence of a need or an emergency.5 Moreover, such employees will not be assessed a 10 percent early distribution penalty on a withdrawal of up to $1,000 before age 59½. Taxpayers are permitted three years to repay the withdrawal. During these three years, no further emergency withdrawals are permitted (Geller 2023, 72).

Matching Student Loan Employer Payments

Beginning in 2024, the SECURE 2.0 Act provides a new option to benefit millions of American taxpayers. The act provides that employers can now make matching contributions to retirement accounts based on employee student loan payments. Such matching contributions must be made available to all plan participants, and employees will be required to annually certify to the employer that such student loan payments have been made.

529 to Roth Conversions

Starting in 2024, the SECURE 2.0 Act grants owners of 529 accounts a new opportunity to help children or grandchildren prepare for retirement. Under the SECURE 2.0 Act, account owners may now roll $35,000 or less of 529 funds that have not been used to fund educational expenses to a Roth IRA. This Roth IRA must be donated to the beneficiary of the 529 plan and may not revert to the account owner. This can be done without the standard 10 percent penalty imposed for non-qualified withdrawals. It also can be done without the burden of creating additional taxable income.

Some key requirements include that the account must have been open for more than 15 years. Further, funds contributed within the past five years are disqualified from such a transfer. Finally, contributions are subject to annual Roth limitations. Due to annual Roth limitations ($7,000 for tax year 2024), it will take at least five years to complete a proper 529 to Roth tax conversion.

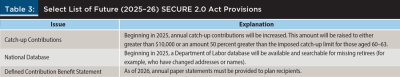

Future SECURE 2.0 Act Provisions

Retirement Lost and Found (ERISA §523)

The SECURE 2.0 Act significantly alters the retirement plan responsibilities of employers and, in so doing, takes direct action to help resolve a long-standing problem of lost and unclaimed retirement accounts. As working patterns have changed and as individuals change jobs today at a much higher rate than in generations past, many accounts get lost in the transition when people change jobs. For this reason, the SECURE 2.0 Act directs the Department of Labor (DOL) to create a searchable national retirement plan database to assist individuals in locating and retrieving retirement accounts associated with former employers.6

While it is the DOL that must set up and operate the lost and found database (dubbed “the Retirement Savings Lost and Found”), it is employers who must report and populate this database (Corbin 2022, 1). Employers must, beginning January 1, 2025, provide the DOL with the name of the employer’s plan; the name and address of the plan administrator; notice of changes in name, address, and identity of administrator; any change, merger, consolidation, or division of plan in the past year7; and the name and taxpayer ID of each participant and former participant of the plan who (1) was reported as terminated and deferred vested and who was paid full benefits during the year;8 (2) received a mandatory cash-out during the plan year that was sent to an IRA, and in such a situation, must report the name, address, and contact information of the IRA vendor; or (3) received a deferred annuity contract during the year, whereby all contact information of the annuity vendor must be provided.

These provisions are designed to assist employees if employers offload their retirement accounts to third-party providers on the cessation of employment and reunite missing plan participants with their hard-won retirement account savings. It should be noted that retirement plans that are, under Section 203 of ERISA, not subject to minimum vesting provisions (including government and church plans) are exempt from this reporting requirement.

Catch-Up Provisions and Part-Time Worker Changes

Beginning in 2025, the SECURE 2.0 Act increases annual catch-up contribution limitations. This amount is increased to either $10,000 or an amount 50 percent greater than the imposed catch-up limit for those aged 60–63 (rising to $11,250 in 2023). Beginning in 2025, rules related to part-time worker retirement plans have changed. Whereas, in the past, employers must have permitted part-time employees who have completed at least 500 hours of service to participate after three years, the SECURE 2.0 Act reduces this period, and, as a result, such employees must now be permitted to participate in the retirement plan after two years. It remains permissible to make employer contributions only once employees reach 1,000 hours.

Opt-Out Replaces Opt-In: Auto-enrollment and the SECURE 2.0 Act

The focus of the SECURE 2.0 Act is on new plans. Effective January 1, 2025, the SECURE 2.0 Act requires that employers automatically enroll employees in a defined contribution plan. The act requires that employers auto-enroll new employees (who do not opt out) at an investment level of 3 percent per year and then increase that amount annually by 1 percent through auto-escalation to a terminal amount of at least 10 percent. Employers will provide a default fund for employees to invest in if they fail to choose a fund (Cummings 2022, 23). One of the reasons Congress decided to require opt-out versus opt-in is because it works. Opt-out numbers are, on a relative basis, low. Additional items to be aware of include an exception for small businesses with 10 or fewer employees, and current 401(k) and 403(b) plans are exempt from the law as grandfathered plans.

State Law Concerns

There are currently 18 states that require employers to set up a retirement plan (Ulrich 2023). Such legislation often requires that if such companies fail to do so, they will have to contribute to a state-run plan. For many employers, the SECURE 2.0 Act incentive plan may provide highly desired relief from such an outcome by incentivizing the creation of a private retirement plan and thereby circumventing further entanglement with state government regulatory authorities. It may be better to establish and manage one’s plan than to engage with state governments and the associated oversight on an ongoing basis.

One example related to state law differences relates to college savings accounts—known as 529 plans. The SECURE 2.0 Act allows up to $35,000 in a 529 account to be eligible for conversion into a Roth IRA account owned by the beneficiary without triggering federal income tax. Many states offer 529 plans that vary widely from state to state. However, the degree to which this rollover will trigger taxation at the state level will differ from state to state because this transfer could be considered an “outbound rollover” that is taxable in certain states (such as California).

An additional state consideration relates to “catch-up” contributions, as participants in 401(k), 403(b), or 457(b) plans who earn wages over $145,000 must have any catch-up contributions to be characterized as Roth contributions. “This could pose a significant problem for those government plans not offering a Roth option, because changes in state laws and/or union contracts may be required to allow compliance with act Section 603” (Adkins and Henderson 2024, para. 26).

Conclusion

As the SECURE 2.0 Act imposes numerous new obligations on employers, it also provides several key benefits that advisers and small business clients may want to take advantage of. One of the most critical provisions allows small business clients to leverage available tax credits to offset pension-plan startup costs. Financial planners, CPAs, and other advisers must be prepared to counsel small business clients, family businesses, and retirement plans on navigating the many challenges of the SECURE 2.0 Act. With a commitment to helping Americans have better retirement years and a strong focus on client-focused service, the SECURE 2.0 Act can help build a better tomorrow for millions of Americans.

Endnotes

- IRC, §45E(b)(1).

- IRC, §45T.

- Internal Revenue Service, Notice 2023-62, Guidance on Section 603 of the SECURE 2.0 Act concerning Catch-Up Contributions, Washington, D.C.: Guidance on Section 603 of the SECURE 2.0 Act concerning Catch-Up Contributions Notice 2023-62.

- IRC, §72(t)(2)(I)(iii)

- ERISA, §801(C)(1)(A)(ii).

- 29 USC §1153.

- IRC, §6057(b)(1)-(4).

- IRC §6057(a)(2)(C)

References

Adkins, Nell, and Charlene Henderson. 2024, January 1. “SECURE 2.0 Developments and Guidance for 2024.” The Tax Adviser. www.thetaxadviser.com/issues/2024/jan/secure-2-0-developments-and-guidance-for-2024.html.

Commito, Thomas F. 2022. “SECURE 2.0 Act to Enhance Retirement Savings.” Journal of Financial Service Professionals 76 (4): 10–13.

Corbin, Kenneth. 2024. “Congress Passed Emergency Savings Accounts for Workers in 2022. The DOL Just Explained How They’ll Work.” Barrons. Dow Jones Institutional News. New York: Dow Jones & Company Inc.

Cummings, Bridger. 2022. “SECURE 2.0 Act.” Journal of Financial Planning 35 (7): 23–24.

Eickman, Matthew. 2023. “IRS Delays Roth Catch-up Contribution Requirement.” 401(k) Advisor 30 (9): 4–5.

Geller, Sheldon M. 2023. “First Look at the Secure Act 2.0 of 2022.” The CPA Journal 93 (1/2): 70–73.

Kobe, Kathryn. 2010. “Small Business Retirement Plan Availability and Worker Participation.” Economic Consulting Services, LLC/SBA Office of Advocacy. https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=ffad31789d7cfb03dae4da82b1ac2f73fa4660ea

Merrill Lynch. 2018. “The Financial Journey of Modern Parenting: Joy, Complexity and Sacrifice.” www.ml.com/the-financial-journey-of-modern-parenting.html.

Svynarenko, Radion. 2019. “Retirement Planning Versus Family Support: What Drives Peoples’ Decisions?” University of Kentucky Theses and Dissertations. https://uknowledge.uky.edu/hes_etds/72/.

Ulrich, Ronald. 2023, October 1. “The SECURE 2.0 Act and Its Impact on the Retirement Plan Landscape.” Journal of Accountancy. www.journalofaccountancy.com/issues/2023/oct/the-secure-2-0-act-and-its-impact-on-the-retirement-plan-landscape.html.