Journal of Financial Planning: June 2023

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on the images below for PDF versions.

The Journal of Financial Planning and the Financial Planning Association conducted the annual Trends in Investing survey in February and March. The survey asked respondents about the investment products they use or recommend to their clients, and the changes they expect over the next 12 months. We also asked specific questions about their use of alternative investments.

We received 191 qualified responses to the survey. Seventy percent of respondents manage investments for their clients on a discretionary basis, and 21 percent implement investment recommendations on a nondiscretionary basis. Nine percent of respondents make investment recommendations but don’t implement them on behalf of their clients.

ETFs on Top

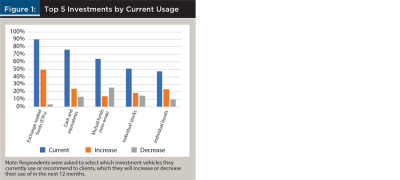

Over 90 percent of respondents said they were currently using or recommending exchange-traded funds with their clients, and half expect to increase their usage over the next 12 months.

Global ETFs brought in $754 billion in 2022, according to Morningstar.1 U.S. exchange-traded fund inflows reached nearly $77 billion in the first quarter of 2023, according to Morningstar’s Ryan Jackson.2 International stock ETFs brought in about $30 billion in the same period, he reported in April.

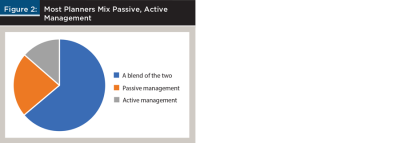

Passively managed funds continued to garner market share in 2022, with index funds adding about $747 billion in new dollars to reach 38 percent of the market, Morningstar reported. Our survey revealed investment professionals strongly believe in the value of using both active and passive investing strategically, as 64 percent said they use a blend of both to capture the best overall investment performance for their clients. Twenty-three percent favored passive only, while just 14 percent said they use active only.

Turn to Alts

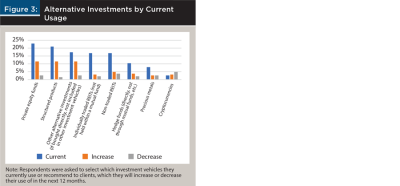

The 2023 Trends in Investing survey revealed investment professionals have diverse approaches to using alternatives for their clients. Twenty-eight percent said they were actively investing in or searching for alternatives for their clients’ portfolios. Thirty percent of respondents said they were familiar with these types of vehicles but didn’t intend to invest in them, while 19 percent said they were keeping up with current research on alternatives and potentially dedicating a portion of their clients’ portfolios to the asset class in the next 12 to 24 months but hadn’t done so yet.

Private equity was the leading alternative asset class (23 percent) followed by structured products (21 percent). Respondents were allowed to identify other asset classes that weren’t listed as survey options; 3 percent said they were investing in real estate (outside of REITs), and 1 percent indicated they were using private debt.

Aaron Hodari, CFP®, CIMA, said private debt is quickly becoming one of the top alternative products used by investment professionals. Hodari is chief investment officer and a managing director at Schechter Wealth.

“Historically, private debt has very low volatility and very high cash yields. On top of that, most of the private debt market is floating rate. So in a year like last year, when we got rising interest rates really hurting bonds, private debt—in absolute terms—had positive performance,” he explained in an interview.

However, he questioned just how “alternative” private debt is.

“You can call it an alternative, but is it really? Public debt is a publicly traded and liquid debt. Private debt is a private non-traded loan. They’re both loans to companies that generally have a maturity, an interest rate, and other similar features. There’s public debt that gets paid off and public debt that defaults and companies go into bankruptcy, and private debt follows similar paths. In a way, it’s a very similar underlying exposure, [but] because of the fact that it’s illiquid, it’s an alternative.”

Interval funds were also mentioned briefly in our survey. These new products offer a “transparent, easy way to use alternatives,” and tend to have lower fees than other products in the private market, according to Hodari.

“For an adviser who wants to get into alternatives, it’s hard to imagine your first alternative will be the typical eight- to 12-year private equity locked-up fund that you’re not going to know how it’s performing for four to five years. The interval fund structure allows advisers to dip their toes into the market in a much more flexible way,” he said.

He believes advisers’ adoption of alternatives is bound to increase as innovation in the space increases the variety of products available to meet clients’ objectives.

“Innovation happens, but not everyone knows this innovation is happening. It takes a while for the information to get in their hands, to understand the innovation that’s happened in the landscape,” Hodari said.

Alts Objectives and Objections

Among respondents who are using alternatives on behalf of their clients, 55 percent cited diversification as one of their objectives, followed by 41 percent who are looking for risk mitigation. Roughly one quarter counted upside growth potential (25 percent), protection against inflation (24 percent), or income generation (23 percent) among their objectives.

Respondents cited several concerns about using alternatives for their clients, namely lack of liquidity (48 percent) and fees and expenses (41 percent).

Hodari acknowledged that these are typical concerns for investment professionals to hear from investors, but he said, “when we talk to a client, we never get that push back. The reason is before we make a recommendation of an investment, we’ve already set the stage through financial planning for what does our portfolio need to do over time? What are our cash flow needs?”

Investment professionals who use alternatives strategically aren’t locking up significant portions of their clients’ portfolios in the asset class, Hodari said, which gives them the flexibility to draw from other assets.

“Even in retirement, when a typical client is taking 4 percent of a portfolio per year, if you have 20 percent of the portfolio locked up, that is not going to impact that ability to take withdrawals. While you need to be mindful of [liquidity] and plan around it based on the client’s situation, if you’re being judicious in the usage of illiquidity, that is not a challenge from a portfolio manager perspective.”

He added that “performance is reported net of fees and expenses, so when you’re comparing options for a client, the net return that the client keeps, that’s ultimately what should matter.” Furthermore, competitive pressure and scalability of alternative products are driving down expenses.

“Managers will sometimes accept a lower fee in order to grow their business. It’s not always a limited market size and opportunity, so depending on the strategy it can be a very large pot if they build the right structure and product, and they don’t need to capture every fee on a small amount of dollars. They’d rather capture a smaller percentage fee on a larger absolute one in a larger pool if the strategy has capacity,” he explained.

In short-form responses, some survey respondents indicated doubts about long-term performance, or concerns about compliance or broker–dealer limitations, as obstacles to alternatives investing. Hodari acknowledged that some types of alternatives don’t have the track record to justify investment, but “by and large, in real estate, private equity, and private debt, the returns are there and the data’s there to show it.”

Hodari stressed that alternatives are an important part of the diversification strategy for a client’s investment portfolio.

“When you look at a capital market expectation study from any economist, it includes alternative investment asset classes well beyond stocks and bonds. If you’re trying to build a diversified portfolio and capture return in multiple market environments, lower correlation with the stock market, and increase the chances for success, diversifying your exposures across more asset classes that have a positive expected return is, in my opinion, the only way to really properly build a portfolio to meet that client’s plan.”

Planners do have to be aware of fees associated with alternative investments, as well as unique tax implications and how much illiquidity a client’s portfolio can withstand, but Hodari believes that combined with financial planning, the diversification afforded by alternatives give planners a better chance of securing good outcomes for their clients.

“I think advisers, by and large, get nervous about doing something different but, in our experience, we have not had push back. Clients embrace it, and we’ve seen growth in our business because of it,” he said. “Just like in any asset class, you need to be diversified. Not every investment is going to work out, and we’ve used alternatives that have had poor performance and alternatives that have had great performance.”

Endnotes

- See www.morningstar.com/views/blog/funds/global-etf-mutual-funds-disparity.

- See www.morningstar.com/articles/1148451/march-punctuates-uneven-first-quarter-for-etf-flows.