Journal of Financial Planning: March 2024

Ivory Johnson, CFP®, ChFC, is the founder of Delancey Wealth Management LLC (www.delanceywealth.com). Mr. Johnson has a B.S. in finance from Penn State University, has been certified by the Digital Asset Council for Financial Professionals, and is a member of the CNBC Financial Advisor Council.

The comedian George Carlin once remarked, “Give a man a fish and he will eat for a day. Teach him how to fish, and he will sit in a boat and drink beer all day.” Along those same lines, our financial markets and the well-being of many American households have mirrored the public assistance proffered by rampant deficit spending and access to cheap capital.

Congress is used to bailing out the banks and corporate interests because that inflates financial asset prices that benefit the donors who keep them employed. In the wake of COVID-19, they were naive enough to give money to the people who really needed it, to lots of people who didn’t need it, and to some people who didn’t even ask for it. Lo and behold, their constituents spent every dime and caused inflation. Now everyone must pay the price, whether that’s in the form of dairy products or nest eggs; we just don’t know when it’ll happen.

For every action, however, there is a reaction. We all assumed that interest rates would either decline or remain the same once the Federal Reserve paused interest rate hikes in September 2023, but the opposite initially occurred before a favorable CPI report, one that assumed healthcare premiums had declined by 30 percent, coaxed rates back down. For a moment, the central bank lost control of a bond market that spent two months as the interest rate arbiter. Something isn’t everything, but everything is something.

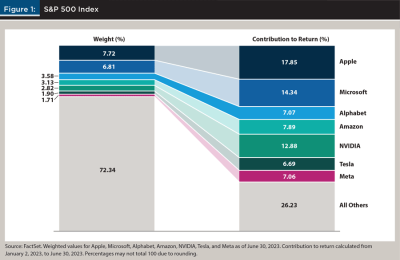

Despite this, the market has been undeterred, numb to the unsavory reality that corporate profits have been slowing, that the cost of capital is still high, and the economy, absent infrastructure spending and $95 billion (about $290 per person in the United States) worth of employee retention credits, is not all it’s cracked up to be. Those who bother to peel back the onion recognize that close to 30 percent of the S&P 500, a weighted index, is represented by seven stocks that delivered total returns of more than 80 percent of the 2023 returns (see Figure 1). If you removed the shares of the seven, the index would be close to flat (Foster 2023). In other news, the Russell 2000, aggregate bond indices, mid-caps, and small-caps were all negative coming into November 2023. As one would say in Brooklyn, we got your 60–40 diversified portfolio right here.

Meanwhile, the battered and bruised bitcoin bros are back in business. It seems that bitcoin is indeed correlated with the global money supply, and that it is to the advantage of investors to exchange fiat currency growing in abundance for bitcoin that will retain its scarcity. Lo and behold, this year’s triple-digit rebound is a consequence of the Fed’s tightening losing steam on a rate-of-change basis, which is to say the rate at which they raise rates has declined.

New Avenues to Buy Bitcoin

Until January, and with a few notable exceptions, the mainstream brokerage firms did not offer retail investors a vehicle to buy bitcoin. Instead, outside of the crypto exchanges that have come into question in the wake of FTX (Yaffe-Bellany 2022) and BlockFi (Sigalos and Goswami 2022) bankruptcies, investors were largely relegated to the Grayscale Bitcoin Trust (GBTC). Currently, Grayscale operates like a closed-end fund whose NAV is a function of supply and demand for the fund itself, not the underlying assets that maintain a fixed supply. This may lead to a premium or a discount that is grossly inefficient. An ETF, on the other hand, would redeem bitcoin coins at the sale of the ETF and purchase coins upon a purchase that creates a point-to-point performance.

The SEC repeatedly denied Grayscale’s application to become a spot ETF because they cannot prevent manipulation (Banerji 2022). More specifically, the commission based its disapproval of the VanEck Bitcoin Trust filing on the inability of the exchange to establish “that it has a comprehensive surveillance-sharing agreement with a regulated market of significant size related to spot bitcoin.” The SEC went on to state that all approved spot ETFs for other asset classes have “at least one significant, regulated market for trading futures on the underlying commodity” and “the ETF listing exchange has had a surveillance sharing arrangement with that market” (Peirce and Uyeda 2023).

In the absence of that relationship, the agency believed that a would-be manipulator could trade on the futures market and manipulate the bitcoin ETF and that the futures market was not of significant size. Van Eck has argued in its own attempt to offer a bitcoin ETF that the SEC has not required exchanges proposing to list and trade similar products to show that the ostensibly significant market relevant to each filing meets the test it applies to spot bitcoin ETFs or, for that matter, adequately explained why it has not applied and still does not apply this two-part test when determining whether a futures market related to any other commodity-based ETFs such as gold, silver, platinum, palladium, and copper is significant.

Oddly enough, and for the sake of inconsistency, the SEC did approve the futures-based Pro Shares Bitcoin Strategy ETF (Sorkin et al. 2021). Instead of owning the actual bitcoin, this security buys futures in the same market the SEC deems insignificant, the same venue that investors argue disallows them point-to-point participation in the price movement of the coin. Please note that futures are essentially a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. Moreover, a component of a future contract’s value is the amount of time investors have before the contract will expire worthless. For these purposes, they are a clumsy approach to a long-term participation in bitcoin because the ETF must roll over the futures contract.

Imagine a parking meter that has allotted an hour for a person to park. A meter with 58 minutes will inherently be more valuable than one with seven minutes remaining. The rolling over effect is a result of selling the futures contract with seven minutes left to purchase another with 58 minutes to maintain a position. This in turn creates an inevitable drag on performance that a spot ETF would avoid. All these left proponents of a spot ETF puzzled as to why the commission did not even apply the test to a bitcoin ETF when it approved the commodity-based ETF.

Don’t look now, but the D.C. Circuit Court of Appeals ruled in August 2023 that the SEC was “arbitrary and capricious” in its decision to reject Grayscale’s attempt to convert its roughly $17 billion Grayscale Bitcoin Trust (GBTC) into a spot ETF (Willmer 2023). Grayscale argued that “the bitcoin futures ETF surveillance arrangements should also be satisfactory for Grayscale’s spot ETF, since both products rely on bitcoin’s underlying price.”

The court’s panel of judges essentially agreed that Grayscale showed that its proposed bitcoin ETF is “materially similar” to the approved bitcoin futures ETFs. That’s because the underlying assets—bitcoin and bitcoin futures—are “closely correlated” and because the surveillance sharing agreements with the CME are “identical and should have the same likelihood of detecting fraudulent or manipulative conduct in the market for bitcoin.” These developments were a precursor for the SEC to approve the first U.S.-listed exchange-traded funds to track bitcoin in January 2024 (Yaffe-Bellany 2024).

It’s worth noting that this horse was already itching to escape the regulatory barn last year when Fidelity allowed crypto trading in retail accounts through the subsidiary Fidelity Digital Assets (Huang 2023). Unlike many of the crypto exchanges that trade 24 hours a day, Fidelity limits trading to hours between 4 a.m. and midnight. The scope of services is limited in comparison to its competitors, but it is noteworthy that 40 million account holders have the option.

Fidelity has gone as far as allowing the 23,000 employers who custody $2 trillion in 401(k) assets with the firm to offer bitcoin to their employees. Given the 404(c) requirements and the fiduciary responsibility of the employer, it’s doubtful that many plans will allow digital assets as an option. Please note that an option available to one employee must be available to all employees, including those on the verge of retirement for whom bitcoin may be considered unsuitable by the regulators.

The infrastructure, however, has been built, and that is significant for an asset class that has a ceiling on the number of available coins. Metcalfe’s law states that the value of a network is the proportionate square root of users. If you have two phones, there can only be one connection, with five phones there can be 10 connections, and with eight phones there can be as many as 28 lines.

This is as much a story about the adoption rate as it is the suspicious regulatory pretense. There were 5 million users of crypto in 2016 and today there are 425 million users (Statista 2023), which is the fastest adoption of a technology in the history of mankind. In fact, per a 2021 Grayscale Bitcoin Investor Survey that suggested one-fourth of investors with $10,000 already have crypto, 50 percent bought it for the first time in 2021 and 77 percent of investors surveyed said they would be more likely to buy it if an ETF were available.

A hoax has been defined as an act intended to trick or dupe, a moniker often associated with bitcoin and cryptocurrencies overall. Suffice to say, however, that pranks rarely become codified into ETF products, futures contracts, or investments offered through our most esteemed retail investment houses. In January, CBOE Digital became the first U.S.-regulated crypto native combined exchange and clearinghouse to enable both spot and leveraged derivatives trading on a single platform. CBOE Digital will first offer financially settled margined contracts on bitcoin and ether and plans to expand its product suite to include physically delivered products later, subject to regulatory approvals.

In 1970, Lockheed Martin was not only the nation’s largest defense contractor, but it was essentially bankrupt after blowing through $400 million in bank loans. In the book The Creature from Jekyll Island, G. Edward Griffen explains that management, stockholders, and labor unions descended upon Washington and told politicians that, without a bailout, 31,000 jobs and untold economic growth would disappear.

The answer was a $250 million government bailout that put the company 60 percent deeper into debt. It also meant that Congress had to steer contracts to the company to make the loan look more pleasing to the taxpayers’ eyes because they would pay for it with higher taxes and the loss of their purchasing power. If socialism only works until you run out of other people’s money, then you’d better create a central bank that never runs dry.

For what it’s worth, that this weathered can keeps getting kicked further down the street of fiscal incompetence is materially important. Hedgeye Research noted in its Nov. 10 edition of Early Look that the federal debt increased to $33.7 trillion in 2023. “To put it another way, the government has borrowed more than three times the 2008 bailout this year to fund its deficits,” according to Hedgeye Research.

The United States government has a deficit that represents 7.3 percent of GDP (Miller 2023) and must pay $10 trillion (about $31,000 per person in the United States) in interest alone on our debt over the next 10 years (Luhby 2023). This comes at a time when our unfunded liabilities are estimated to be over $100 trillion (about $310,000 per person in the United States) (Kolber 2022) and consumers hold a record $17 trillion in debt (Cox 2023). What mechanism will investors pursue to hedge against the possibility that Uncle Sam will resort back to expanding liquidity, or at the very least, reducing the rate at which he tightens as he has done in 2023?

Bitcoin has the potential to become a risk management tool, a disruptive technology with a vast target market of consumers who don’t even know they want the product yet. Call it the first version of the iPhone if you will: slower, fewer features, and a less efficient version of something we didn’t need but couldn’t live without today. Bitcoin may or may not be a fad—history will be the arbiter of that negotiation—but it is certainly worth a competent investigation from the financial services community.

References

Banerji, Gunjan. 2022, June 30. “SEC Rejects Grayscale Attempt to Turn Bitcoin Fund Into ETF.” The Wall Street Journal. www.wsj.com/articles/sec-rejects-grayscale-attempt-to-turn-bitcoin-fund-into-etf-11656617147.

Cox, Jeff. 2023, May 15. “Consumer Debt Passes $17 Trillion for the First Time Despite Slide in Mortgage Demand.” CNBC. www.cnbc.com/2023/05/15/consumer-debt-passes-17-trillion-for-the-first-time-despite-slide-in-mortgage-demand.html.

Foster, Lauren. 2023, November 6. “Apple, Nvidia, and the Rest of Big Tech Have Been Winners. Now It’s Time for the S&P 500’s Other 493 Stocks.” Barron’s. www.barrons.com/articles/stock-market-apple-big-tech-72ae9591.

Huang, Vicky Ge. 2023, August 27. “The ‘Fidelity Mafia’ Behind Big Crypto.” The Wall Street Journal. www.wsj.com/finance/currencies/the-fidelity-mafia-behind-big-crypto-953ad00e.

Kolber, Vince. 2022, December 20. “How Much Washington Really Owes: $100 Trillion.” The Wall Street Journal. www.wsj.com/articles/how-much-washington-really-owes-100-trillion-debt-social-insurance-expenditure-medicare-medicaid-treasury-11671571955.

Luhby, Tami. 2023, September 6. “Federal Budget Deficit Expected to Nearly Double to around $2 Trillion, Government Watchdog Says.” CNN. www.cnn.com/2023/09/06/politics/federal-budget-deficit/index.html.

Miller, Rich. 2023, October 3. “Why Americans Are Concerned About the Budget Deficit – Again.” Bloomberg. www.bloomberg.com/news/articles/2023-10-03/why-us-federal-budget-deficit-is-a-worry-again-and-will-remain-so.

Peirce, Hester M., and Mark T. Uyeda. 2023, March 10. “Statement Regarding the Commission’s Disapproval of a Proposed Rule Change to List and Trade Shares of the VanEck Bitcoin Trust.” SEC.

Sigalos, MacKenzie, and Rohan Goswami. 2022, November 22. “Crypto Firm BlockFi Files for Bankruptcy as FTX Fallout Spreads.” CNBC. www.cnbc.com/2022/11/28/blockfi-files-for-bankruptcy-as-ftx-fallout-spreads.html.

Sorkin, Andrew Ross, Jason Karaian, Sarah Kessler, Stephen Gandel, Michael J. de la Merced, Lauren Hirsch, and Ephrat Livni. 2021, October 18. “Bitcoin Comes to the Big Board.” The New York Times DealBook. https://www.nytimes.com/2021/10/18/business/dealbook/bitcoin-etf-proshares.html.

Statista. 2023. “Number of Identity-Verified Cryptoasset Users from 2016 to June 2023.” www.statista.com/statistics/1202503/global-cryptocurrency-user-base/.

Willmer, Sabrina. 2023, October 23. “Grayscale Gets Court Order in Fight with SEC on Bitcoin ETF.” Bloomberg. www.bloomberg.com/news/articles/2023-10-23/grayscale-gets-court-order-in-fight-with-sec-over-bitcoin-etf.

Yaffe-Bellany, David. 2022, November 11. “Embattled Crypto Exchange FTX Files for Bankruptcy.” The New York Times. www.nytimes.com/2022/11/11/business/ftx-bankruptcy.html.

Yaffe-Bellany, David. 2024, January 10. “Regulators Approve New Type of Bitcoin Fund, in Boon for Crypto Industry.” The New York Times. www.nytimes.com/2024/01/10/technology/sec-bitcoin-approval-exchange-traded-funds.html.