Journal of Financial Planning: March 2024

Tammy Breitenbach is a Carson Coaching executive business coach. She previously served as the principal consultant of Catalyst Partners, which she founded in 2008 after seven years of director-level experience in financial services. She specializes in providing business counsel and leadership advice to owners of independent RIAs to help them grow more profitable businesses. Carson Coaching is the official coaching partner of the Financial Planning Association.

JOIN IN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Someone I know might leave her adviser because of a rough experience. During tax time—after she’d already been a client for nearly a year—she realized he never explained to her what meetings or interactions to expect throughout the year, and he hadn’t even offered a review meeting yet.

It felt like there was something she should be doing, but she wasn’t sure. When she called the adviser’s office, she felt awkward because she didn’t know exactly what she was asking for and the person who took her call didn’t make her feel that she was listening or trying to understand.

I hear stories like this and then I think of many of my coaching members who are dog tired, planning for their clients’ every eventuality as they would for their own family. I wish this person had a financial adviser like this, who she could feel confident was taking care of things, who communicated proactively, and who didn’t leave her worrying.

Morningstar recently published research on why clients “break up” with their adviser and the top two reasons were quality of financial advice and services and quality of relationship with the adviser (Labotka 2023).

Morningstar recommends that the No. 1 way to not get fired is to better understand your clients and their specific needs and goals. I’ll add to that: let them know what type of experience to expect and take every opportunity to enhance that client experience with their needs in mind. You can do this by having a consistent, repeatable onboarding process during which you set expectations, having a proactive and caring front line, and being easy to work with. All these are ways that, no matter how many times you interact with your clients, they feel as though you’re serving them like you’d serve a member of your own family.

Enhancing your client experience isn’t just about adding more services or doing events—those are important things you should be doing anyway—it’s really about taking advantage of every interaction to enhance their feeling of enjoying being your client and the peace of mind it brings. The first impression and the subsequent client relationship is made or broken within those first six months with a client.

From a purely relationship-oriented standpoint, everybody in your firm should be demonstrating they actually do care. This starts from the beginning with your onboarding process and your front line, and continues during crucial moments, many of which are brief but must be made meaningful and memorable.

A Consistent, Repeatable Client Onboarding Process

Your onboarding process sets the tone for the entire client relationship. It’s during your onboarding process that you should set expectations and let your clients know what meetings are coming up so they don’t ever have to wonder. In fact, you should schedule your 45-day check-in call with your client within a week of them signing their paperwork, their mid-year check-in five months after signing, and their annual review 11 months after signing. The person I mentioned earlier in the article didn’t do any of that.

During the onboarding process, you want to show them your menu of services and go over your systems and processes. Set clear expectations of timelines. You can do this in your welcome email to new clients, which should be sent within two days of receiving all their account paperwork. Your welcome email should include:

- Online client portal login instructions

- Link for them to complete a personal questionnaire

- Access to your new-client guide

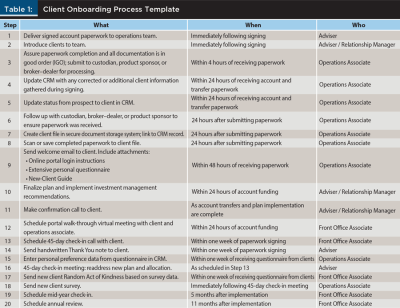

Internally, you want to define the steps in your process and the timeline in which that step will be performed, and identify the stakeholder who will perform that process. An example of a 20-step process—as well as the people in charge of each step—is outlined in Table 1.

If you haven’t developed a consistent client onboarding process yet, or even some of the items you’ll need for it (such as your new-client guide or personal questionnaire), this should be your first order of business.

The First Line of Relationship Management: The Client Relationship Specialist

A few years ago, our Carson Coaching team hired a client relationship specialist. Our very own Katie Trout is a former elementary school teacher who has added new dimensions to the experience for our coaching members (and our team, really, but that’s a whole different article!). Katie puts herself in the seat of our coaching members (who are our clients) and goes above and beyond to solve their problems and anticipates their needs so she can add extra value for them.

Let me give you a few examples. We’re adjusting fees up to current rates for some members and Katie has been doing outreach to communicate this to them. She saw some notes I’d made about one such client having some junior advisers who might benefit from some of our services. So, Katie pinged me to ask what I thought about her reaching out and offering to spend 15 or 20 minutes with each of the junior advisers to offer them some of our resources. This made it so much easier for me to ease into the fee conversation with him because, instead of focusing on the fee increase, he’s more focused on our service and unlocking extra value from our relationship.

Katie is an educator still—and somewhat of a coach in her own right. Our members reach out asking for a certain resource, and Katie will send them what they’ve asked for, plus two or three other related resources that might be of value.

This position is critical. When you’re hiring your firm’s client relationship specialist, it’s great to bring on people who have had success in other customer service roles or roles that require empathy, compassion, and communication (we can’t recommend former teachers enough). You can also use assessments like KOLBE or DiSC to identify people who would be great at interacting with people. You can also include the following questions in your interviews:

- What do you enjoy most about working with customers/clients?

- How have you previously handled a conflict with customers/clients?

This position is critically important. You might have someone who has the technical skills for the role, but who doesn’t genuinely enjoy interacting with others and making them feel valued and heard. This situation has cost many an adviser dearly and it’s a problem you can’t ignore.

Back to the woman who feels bewildered and uncertain with her current financial adviser. She had called in to ask a question about her 401(k) allocation and if the adviser would be able to help with it, but she was worried she was asking too much. After taking a long time to explain her question, the relationship specialist told her the adviser would call her back. But when he did, all he knew was that the woman had called. None of the information she’d given the client services person had been transmitted. What’s worse is the adviser didn’t reach her and had to leave a voicemail. Enter the phone tag. The timid client started second-guessing her needs and didn’t call the adviser back; instead, she remained unsure. This is a recipe for exactly what Morningstar was talking about—the client disengaging and slipping away because of a subpar relationship. And that particular adviser will likely never know exactly where things went wrong.

This was a crucial moment in which they failed—layer on top of that a weak onboarding experience, and there goes that client.

You need someone in the client relationship specialist role who thrives on helping clients and being a facilitator of information who can vibe with them. Someone who can make the client feel like they don’t have to explain the same thing again when the adviser calls back. Someone who listens and anticipates needs. This will make the difference between OK service and great service.

4 Ways to Be Easier to Work With

Being accessible and easy to work with isn’t just about exceptional advice or being up on industry knowledge—it’s about having practical communication and processes that make things easier for your clients.

I offer you four ways to be more accessible and easier to work with:

1. Clean up and simplify communications. I’ve read many client communications that are too detailed and too long, leaving the client wondering what the point was until the very end. Having clear and concise communication is the easiest way to be more accessible and easier to work with. Our industry has been guilty of complicated and confusing jargon. Forbes reports that concise communication is an important factor in your firm’s success (Binder 2020).

One way to ensure you’re clear is to review any client communication through the lens of your client. Be clear, instructive, and direct. Identify what questions they might have when reading the communication. If there are instructions, include direct links. Finally, be clear about what you want them to do with the information and tell them what the next steps are.

2. Organize 15-minute touch-base calls. In the last year, this has been something that has been well-received by clients of my coaching members: 15-minute touch-base calls with all of the top-tier clients once a year, in surge fashion. A plain old phone call works perfectly for this. This is not a review meeting, and there should be no agenda. One of my members had his client relationship manager schedule these 15-minute calls using the script, “[Adviser name] is scheduling 15-minute calls to just check in and answer any questions or discuss any items you need her to know about.” It wasn’t superficial or random and most clients took her up on the offer. And the ones who didn’t take her up on the offer said they appreciated the gesture.

These touch bases can be an opportunity for your clients to address anything on their mind that they may not have wanted to bother you with. They can also make your review meetings go faster and give you an opportunity to add value.

3. Simplify your processes. This is especially critical when it comes to documents. Examine your process for gathering information from your clients. How many steps do they have to go through? List them clearly. If you ask them to go to a certain website page, insert the link directly to it.

4. Keep clients updated. Always let clients know what’s going to happen in advance to put them at ease that you’re orchestrating everything needed. This is especially helpful with new clients. Like I said earlier, their perspective of the new relationship is set in those first six months, and you need to create the expectation that you’re on top of everything. If information gathering or moving money is taking longer than you told them it would, give a quick call or email acknowledging this fact. That’s establishing trust. The timeline on Table 1 can help keep you on track.

Bringing It All Together

In the end, building lasting and mutually beneficial relationships with your clients is really what it’s all about. While offering exemplary financial advice and services is essential, the quality of your client relationship, and the way you make them feel, can be the deciding factor of whether they stay.

Keep in mind that the client experience journey starts with your onboarding process and client relationship specialist. So, designing repeatable processes and finding the right person for that seat is critical. That person—and your whole team, really—should anticipate client needs, facilitate solutions to their problems, and be accessible and helpful.

Deepening relationships with your clients can increase retention and referrals. The acquaintance I mentioned at the beginning of this article is looking for a new adviser who leads her through planning and has a helpful receptionist. Anticipate your clients’ needs, engage with them well in crucial moments, and you will create easier and longer-lasting relationships.

References

Binder, Zach. 2020, June 3. “The Importance of Being Concise.” Forbes. www.forbes.com/sites/theyec/2020/06/03/the-importance-of-being-concise/?sh=52f147aa17c5.

Labotka, Danielle. 2023, April 12. “Why Do Investors ‘Break Up’ With Their Financial Adviser?” Morningstar. www.morningstar.com/financial-advice/why-do-investors-break-up-with-their-financial-adviser.