Journal of Financial Planning: March 2025

Peter Parlapiano, AEP, EA, CFP®, ChFC, is a partner at Franklin, Parlapiano, Turner and Welch LLC (www.fptwllc.com), a firm that specializes in serving high-net-worth clients from Fortune 500 energy companies. He earned his Bachelor of Business Administration in finance at Texas Christian University and went on to receive both a Master of Science degree in personal financial planning and an M.B.A. from Texas Tech University. He is also a member of the Houston Financial Planning Association, Houston Estate and Financial Forum, and Entrepreneurs’ Organization (EO).

JOIN IN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click the image below for a PDF version.

One of the most difficult things for RIA owners is hiring the right people for the right roles. Furthermore, as firms grow, they will need additional staff members to help serve current and future clients. According to Schwab, over the next five years, RIA firms will need to hire more than 70,000 staff members.1 Over the past five years, 75 percent of firms have hired every year. Additionally, firms ranked recruiting staff members as their third highest priority.

The average RIA firm has nine employees, which makes either hiring or firing an employee an important decision.2 More than 1 million employees work for RIA firms, but roughly 93 percent of RIA firms have fewer than 100 employees.3 The cost of employee turnover not only can be financially expensive but also can impact employee morale. According to the Society of Human Resource Management (SHRM), the cost of replacing an employee is estimated to be 60 percent of the employee’s salary.4 However, the total cost of replacement, including training and the loss of productivity, can increase to 90 to 200 percent of the employee’s salary.

I have met business owners who talk about how they met someone for lunch and wanted to make them a job offer right on the spot. Although some people can make a stellar first impression, it is difficult to know how they will interact with potential coworkers and if they have the technical skills required for the role. In addition, financial planning is stewarding the accumulation of resources that individuals have spent their whole lives working for; it is imperative to find the right candidate.

Although the firm I work for has been around for 20 years, over time, we decided we needed to upgrade our hiring process. We were going through some turnover of employees who had retired and some employees who didn’t work out. To solve this problem, I devised a case study approach for prospective job candidates. The idea of the case study was to ascertain which candidates had the skills required for various job descriptions. Resumes can present a candidate in a flattering way but may not reflect reality. We have used the case study method for all roles within our firm, and it has improved the quality of the candidates, reduced the length of the interview process, and increased our employee tenure.

Work with Recruiters to Improve Your Talent Pipeline

It is important to identify and attract the right candidates. Many RIA firms don’t have the time or energy to handle recruiting without help. We have tried recruiting on our own, but we found candidates who were a little desperate for a job or didn’t have the right interpersonal or technical skills. To identify candidates who potentially would be a good fit, we have partnered with recruiters to assist.

We have had success using recruiters in the financial planning profession as well as recruiters in industries such as accounting, legal, or even healthcare, where there are similarities to financial planning in terms of confidentiality, attention to detail, and client service. Recruiters can identify candidates who are passively looking for roles even though they haven’t communicated it with their current employer.

Recruiters generally charge 20 to 30 percent of the candidate’s first-year salary. The fee is only paid if you hire a candidate presented by the recruiter. People (including myself) may recognize this is a hefty fee, but the wrong hire can literally ruin a firm. If you hire a candidate a recruiting firm presents and it doesn’t work out, you generally have a period of 30 to 90 days to replace the candidate or receive a partial refund of the recruiting fee. As with anything else, terms can be negotiated. Also, I have generally worked with more than one recruiter at a time as all recruiters have different networks of candidates. Rarely will I see the same candidate from more than one recruiter, but it’s crucial to ensure the candidate only has one representative. If they are working with two recruiting firms, you could end up paying two recruiting fees!

Recruiters screen candidates, help them with their resume, and talk with them to see what they are looking for in terms of their next role. Recruiting software platform Gem found recruiters will screen 74 applicants for every individual hired.5 Having said this, it is also important to be patient. It can take many months to find the right candidate. Also, at times, recruiters may promote certain candidates, and if you don’t believe the candidate is a good fit, you should be firm with the recruiter to let them know.

How to Implement Case Studies in the Hiring Process

We have altered our hiring process as a result of utilizing the case study method. We will review a resume from a recruiter, and if the candidate looks suitable, I will set up a phone interview. If that goes well, we agree on a date and time for me to send them the case study. I give candidates 24 hours to complete the case study, which is designed to be real-world oriented and often is based on real client experiences. Typically, it is best for the candidate to complete the case study over the weekend when they are not working and have fewer distractions. Prospective candidates are told the case study may take four to six hours to complete.

The case study will be separated into different parts. For example, for a paraplanner role, the case study presents a narrative of a couple with children, a summary of their financial situation with some information regarding their investment accounts, and a tax projection.

The case study is sent as a Word document, and in the instructions, I ask candidates to type out their answers in a different color font (believe it or not, some candidates don’t follow these instructions) and clearly articulate their reasoning and logic (just like in the real world, the case study isn’t multiple choice). The paraplanner study case will include a tax estimate with multiple mistakes the candidate has to identify. For example, the name of the clients may be misspelled or a note on the tax estimate may not tie to a specific number. For any candidate who works with client billing, the case study will include our ADV and fee schedule and ask questions about calculating the client’s quarterly fee.

Advisers have case studies within their own firm. For example, clients email advisers all the time with questions regarding investments, estate planning, income taxes, insurance, etc., that could be used as potential questions for a case study. If a firm focuses on insurance products or annuities, the case study could use insurance illustrations of different insurance policies or annuity contracts to evaluate which product may be best for a client and explain why. (Advisers would have to work with their compliance adviser to ensure client information is redacted and no confidential information is shared.)

In addition to the technical skills, case studies test a candidate’s soft skills. A case study could include an email from a client who recently had a parent pass away to demonstrate whether the candidate picks up on this information and how they respond to it or if they directly go to the analysis. The main objective of the case study is to test attention to detail, critical thinking, written communication skills, and ability to follow through.

After the case study is completed and the candidate has done well, I will invite them in for an interview. During the interview, I will go over the case study with the candidate and sometimes will change the facts of the case study questions to see how they respond to different fact patterns and think on their feet. If the interview goes well, we will conduct a background check (usually the recruiter will offer to do this) along with checking references, and if everything goes well, we will make a job offer to the candidate. This approach consolidates the timeline both for the firm and the candidate.

Some recruiters have objected to the case study after an initial phone interview with the candidate. We have learned some people present very well on paper and can interview well but, when tested, don’t perform as well as expected. Recruiters will also point out that roles at other firms don’t require the candidate to complete a case study. I explain that the case study allows the candidate to get a glimpse of what their real day-to-day role will look like (very few roles allow for this). For example, one time, we had a woman who performed extremely well on the case study but then mentioned it was not the type of work she wanted to do. Learning this early was a win for both sides.

A case study serves two functions. The first is for the firm to ascertain the candidate’s skills, and the second is for the candidate to better understand what their job role will entail. Also, if I am looking for long-term employees, asking them to spend four to six hours is not a large investment if they intend to stay with a firm for many years. It may be a good idea to work with current employees who have the role and ask for their feedback on the case study to ensure what is being tested is relevant to the actual job or propose questions they would ask.

Case Studies in Action

The case study has been incredibly valuable since we have had numerous false starts with candidates. For example, we had a candidate who worked for one of the big four accounting firms, looked great on paper, and had a phone interview that went well. I explained to the candidate multiple times that the case study would take four to six hours to complete. When the candidate sent it back to me, I realized they had rushed through the case study as some of the questions went unanswered. When I asked them how much time they spent on it, they said they had squeezed it in over their lunch break.

In another case, a candidate and I agreed that I would send them the case study on Saturday and they would have 24 hours to complete it. On Monday morning I still had not received anything. They told me they had forgotten they had company in town over the weekend and forgot all about the case study. In a rare instance, I actually gave the candidate a second chance, and even then, the candidate only did a portion of the case study.

One candidate we had primarily Googled all the answers, and if we asked a question about Medicare, they had ChatGPT-like answers elaborating on the history of Medicare, which president enacted the program, etc., and didn’t directly answer the questions.

Sample Case Study Questions

Below are sample questions that have been previously used in case studies.

Financial Planner

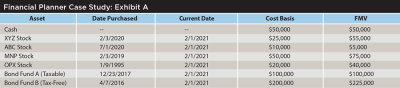

Question 1: In looking at exhibit A, what decisions can be made in their brokerage account to help their tax situation? (Ignore the underlying investments.)

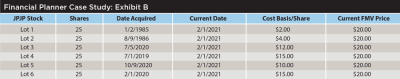

Question 2: John sends you an email with an outside Charles Schwab account he previously had (exhibit B). He wants to sell 75 shares of JPJP stock. Rate the lots in order from the lowest tax impact to the highest tax impact. Assume tax rates in the base tax case (Part II tax projection).

Client Service Associate/Administrative Assistant

Candidates are provided with the custodian paperwork needed to complete this part of the case study.

Task 1: Account opening document (IRA application). The Parikh family has just signed up to become clients at Franklin, Parlapiano, Turner, and Welch. The family is excited to be working with their new financial planner. They have had a long meeting with their financial adviser where their adviser recommended they open an IRA account. The Parikh family consists of the husband (Hymavathsay) and his wife (Aakanksha). In addition to this, they have three children (Pavan, Ankur, and Rishi). The IRA account will be in the name of Hymavathsay. The financial adviser has decided the three children will be equal primary beneficiaries of the IRA account that is established, with the “2004 Parikh Family Trust” being the contingent beneficiary.

Task 2: Transferring assets form. The Parikh couple is transferring assets from their Morgan Stanley account to their Fidelity brokerage account. Their Fidelity brokerage account number is 646-739238, and their Morgan Stanley brokerage account number is 263-9472495378. The Morgan Stanley brokerage account is titled in Hymavathsay’s name as an individual account, and the Fidelity account will be a joint account. (They both will be owners of the joint account.) The account instructions from the adviser are to transfer the entire account.

Results of Case Study Implementation

The pass rate for candidates who complete a case study varies depending upon the role. We have administered almost 40 case studies since we began implementing it with an overall pass rate of about 43 percent. The pass rate by role can vary dramatically. For our administrative admin role, the pass rate is 100 percent. For our paraplanner role, the pass rate is 45 percent. The lowest pass rate has been for our office manager position, at about 40 percent (given it entails many different roles in one). This demonstrates the case study can be used to identify those who have the capability to perform well in the role.

When comparing the tenure of employees who took the case study to those who didn’t, the results are fairly staggering. The average tenure of employees after we implemented the case study (through the end of 2024) is 3.5 years, compared to 1.3 years before we implemented case studies in our interview process. On average, RIA firms experience a 36 percent staff turnover due solely to performance reasons.6

Some firms like to use different assessments for hiring. For example, personality and work-style assessments (e.g., Kolbe, DiSC) can be used as supplements in the hiring process. Adding a case study to these types of assessments could help the firm truly understand the skills, personality, and work style of a potential candidate.

Conclusion

As firms add employees, they will need to select and retain staff members who have the skills required to excel at their role. Given the high cost of hiring the wrong employee, both financially and to team morale, it is important to find the right fit. If firms are looking to hire, they should evaluate partnering with recruiters to create a pipeline of potential candidates, develop and administer a case study for a job candidate based on the role, and seek input from current employees to craft real-world questions. The case study allows the candidate to decide if the role will be the type of work they will enjoy and allows the firm to evaluate the skills of the candidate. More importantly, the case study method could increase employee tenure and ensure firms have the right people in the right seats.

Endnotes

- Welsh, J. 2024, December 11. “The Scramble for Talent at RIAs Is Just Beginning: Schwab.” InvestmentNews. www.investmentnews.com/rias/the-scramble-for-talent-at-rias-is-just-beginning-schwab/258587.

- Randall, S. 2024, June 21. “There Were More RIAs in 2023 Than Ever Before, but What Does a Typical Firm Look Like?” InvestmentNews. www.investmentnews.com/rias/there-were-more-rias-in-2023-than-ever-before-but-what-does-a-typical-firm-look-like/254680.

- Waddell, M. 2024, July 8. “What the RIA Industry Looks Like Now, in 4 Charts.” ThinkAdvisor. www.thinkadvisor.com/2024/06/21/what-the-ria-industry-looks-like-now-in-4-charts/.

- Fox, A. 2023, December 21. “Drive Turnover Down.” HR Magazine. www.shrm.org/topics-tools/news/hr-magazine/drive-turnover.

- Niderost, S. J. 2025, January 16. “10 Takeaways from the 2025 Recruiting Benchmarks Report.” Gem [blog]. www.gem.com/blog/10-takeaways-from-the-2025-recruiting-benchmarks-report.

- Shidler, Lisa. 2024, February 27. “Plague of Failed Hires at Strapped RIA Firms ‘Come Back to Bite Them’ Making the Process of Closing Bandwidth Deficits Falter, Two New Studies Show.” RIABiz. https://riabiz.com/a/2024/2/28/plague-of-failed-hires-at-strapped-ria-firms-come-back-to-bite-them-making-the-process-of-closing-bandwidth-deficits-falter-two-new-studies-show.