Journal of Financial Planning: November 2022

Randy Gardner, J.D., L.L.M., CFP®, CPA, RLP, AEP (Distinguished), is the founder of Goals Gap Planning, LLC, a continuing education provider for CFP® professionals, CPAs, and attorneys, and the director of education for the Garrett Planning Network. He is also the coauthor (with Julie Welch) of the forthcoming 11th edition of 101 Tax Saving Ideas.

Creyton Gardner is a manager at Goals Gap Planning, LLC.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on any images below for PDF versions

When individuals retire early voluntarily or involuntarily, or incur debt that creates a cash flow burden in excess of their cash inflows, they may need to draw on their retirement plans before age 59½ to make ends meet. To avoid the 10 percent early distribution penalty, participants for decades have resorted to substantially equal periodic payments (SEPPs). The IRS issued Notice 2022-6 in March 2022 clarifying and improving the options available to participants. In this notice, retirement plans include qualified plans, individual retirement accounts (IRAs), and nonqualified annuities.

SEPP General Rules

The basic rules have not changed. SEPPs from qualified plans avoid the 10 percent early distribution penalty only if the participant has turned 55 or will turn 55 during the year and has separated from service from their employer. SEPPs from IRAs at any age avoid the 10 percent early distribution penalty even if the participant is still employed. Participants must use one of three methods to calculate the SEPP amount: the required minimum distribution (RMD) method, the fixed amortization method, or the fixed annuitization method.

Once commenced, payments generally must continue under the same method until the later of age 59½ or five years. Over the years, numerous authorities have reminded us of the cost of not following this rule and some ways around it. In the Arnold case (TC 1998), the taxpayer increased withdrawals after turning 59½ but before five years had passed, and had to pay the 10 percent penalty on all pre-59½ distributions. In Revenue Ruling 2002-62, the IRS allowed participants who were concerned about exhausting their IRA accounts after the tech stocks decline in 2001 to do a one-time change from the annuity or amortization withdrawal method to the more conservative RMD method. In Benz (TC 2009), the U.S. Tax Court held that the taxpayer did not modify the SEPPs when they took a distribution from the same IRA for higher education expenses (another exception to the 10 percent rule).

Strategy One: Because retirement accounts are not aggregated to determine the account balance for calculating the SEPP amount, one frequently used strategy is to break the retirement account into two or more accounts before commencing SEPPs and take SEPPs from one of the accounts. The other account continues to accumulate for retirement but is available if the participant needs to take additional distributions during the SEPP period for any reason.

Notice 2022-6 Clarifications and Improvements

IRS Notice 2022-6 applies to any series of payments commencing on or after January 1, 2023, and it may be used for a series of payments commencing in 2022.

Under the required minimum distribution method, the annual payment is determined by dividing the account balance at the end of the prior calendar year by the number of years from the chosen life expectancy table for that distribution year. Under this method, the account balance, the number of years from the chosen life expectancy table, and the resulting annual payments are redetermined for each distribution year. This redetermination of the annual payment is not considered a modification of the series of substantially equal periodic payments, provided that the required minimum distribution method continues to be used and the same life expectancy tables continue to be used unless there are changes with regard to a spouse or other designated beneficiary.

Strategy Two: One of the opportunities offered by the Notice provides that, for participants using the RMD method to compute their SEPPs, using the updated 2022 tables will not be treated as an impermissible modification of the payment stream. For example, under the old Single Life Expectancy Table, the life expectancy of a 55-year-old participant with a $1 million dollar IRA account is 29.6, producing a distribution for 2022 of $33,784 ($1,000,000 / 29.6). Under the new table, the life expectancy is 31.6, producing a distribution of $31,646 ($1,000,000 / 31.6). A participant who wanted to slow down the distribution rate, perhaps because they were concerned about draining the account, might change the calculation to the longer life expectancy. Someone preferring a higher distribution would continue calculations under the old table.

Under the fixed amortization method, the annual payment is the amount that will result in the level amortization of the account balance using one of the permitted interest rates. Once the account balance, the number of years from the chosen life expectancy table, and the resulting annual payment are determined for the first distribution year, the annual payment remains the same in each succeeding distribution year. The number of years that is used to apply the fixed amortization method is the entry from the table for the participant’s age on the participant’s birthday in the first distribution year (and, if applicable, the spouse or other designated beneficiary’s age on the designated beneficiary’s birthday in that year).

Under the fixed annuitization method, the annual payment for each year is determined by dividing the account balance by an annuity factor that is the present value of an annuity of $1 per year beginning at the participant’s age and continuing for the life of the participant (or the joint lives of the participant and designated beneficiary). The annuity factor is derived using the mortality tables found in Reg. § 1.409(a)(9)-9(e) and a permitted interest rate. Once the account balance, the annuity factor, and the resulting annual payment are determined for the first distribution year, the annual payment remains the same in each succeeding distribution year.

For the fixed amortization and fixed annuitization methods, the account balance must be determined in a reasonable manner based on the facts and circumstances. The account balance will be treated as determined in a reasonable manner if it is the account balance on any date within the period that begins on December 31 of the year prior to the date of the first distribution and ends on the date of the first distribution.

Strategy Three: The participant can pick a high or low balance depending on whether they want a higher or lower payment. Initiating payments later in the year may give the participant a bigger range of values to choose from.

The life expectancy tables that can be used to determine distribution periods under the required minimum distribution method and fixed amortization method are the following: the Uniform Lifetime Table; the Single Life Table in § 1.401(a)(9)-9(b); or the Joint and Last Survivor Table in § 1.401(a)(9)-9(d), which can be used even if the designated beneficiary is not the spouse. The number of years that is used for the required minimum distribution method for a distribution year is the entry from the table for the participant’s age on the participant’s birthday in that distribution year. If the Joint and Last Survivor Table is used, the age of the designated beneficiary on the designated beneficiary’s birthday in the distribution year is also used.

The designated beneficiary rules refer to the rules that apply for RMDs from retirement plans. The designated beneficiary must be the actual individual named as the designated beneficiary in the plan documents. If the participant has more than one beneficiary, the identity and age of the designated beneficiary used for purposes of each of the methods are determined under the rules for determining the designated beneficiary for purposes of Section 401(a)(9)—generally the oldest beneficiary. The designated beneficiary is determined for a distribution year as of January 1 of the distribution year, without regard to changes in the designated beneficiary later in that distribution year or designated beneficiary determinations in prior distribution years.

Example from the Notice: If an IRA owner starts distributions from an IRA in 2023 at age 50, and applies either the required minimum distribution method or fixed amortization method using the Joint and Last Survivor Table for the IRA owner and the designated beneficiary, and the beneficiaries on January 1, 2023, are 25 and 55 years old, the number of years used to calculate the payment for 2023 would be 40.2 (the entry from the Joint and Last Survivor Table for ages 50 and 55), even if later in 2023 the 55-year-old is eliminated as a designated beneficiary. However, under the required minimum distribution method, if the 55-year-old beneficiary is eliminated or dies in 2023, that individual would not be taken into account in future distribution years (and if there is no designated beneficiary in a future year, the Single Life Table in § 1.401(a)(9)-9(b) is used for that distribution year).

The interest rate used for the fixed amortization method or the fixed annuitization method can be no more than the greater of: 5 percent; or 120 percent of the federal mid-term rate for either of the two months immediately preceding the month in which the distribution begins.

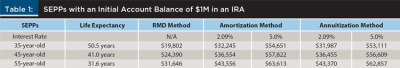

Strategy Four: This change represents the most significant planning opportunity in the Notice as prior guidance only allowed a maximum rate of 120 percent of the federal mid-term rate, which in March 2022 was near a historic low at 2.09 percent. The impact of various assumptions is shown in Table 1. Visit https://apps.irs.gov/app/picklist/list/federalRates.html to determine the current rate.

Table 1 illustrates the difference in initial withdrawal amounts for different ages, interest rates, and calculation methods. The initial account balance is assumed to be $1 million.

The FIRE-influenced, 35-year-old professional had a successful career for 10 years but burned out. Withdrawals range from $19,802 to $54,651 from the $1 million IRA.

The financially strapped, 45-year-old parent wants to help their kids through college without taking out loans. Withdrawals range from $24,390 to $57,822 from the $1 million IRA.

The 55-year-old empty nester wants to pay off the home mortgage by age 66. Withdrawals range from $31,646 to $63,613 from the $1 million IRA.

Modifications of the Account Balance

A participant will be treated as making a modification to a series of periodic payments if there is a modification to the account balance after the valuation date chosen above. A modification occurs if there is: any addition to the account balance other than by reason of investment experience, any transfer of a portion of the account balance to another retirement plan, or a rollover of the amount received by the participant. If such a modification is made, it will trigger the recapture tax resulting in all previously avoided early distribution penalties being due.

Relief from the recapture tax is provided if the required distributions under the method selected exhaust the entire account prematurely. Also, similar to the relief provided in Revenue Ruling 2002-62, a participant who begins distributions using either the fixed amortization method or the fixed annuitization method is permitted in any subsequent distribution year to switch to the RMD method to determine the payment for the distribution year of the switch and all subsequent distribution years. This change in method is not treated as a modification.

As a final suggestion, before electing SEPPs, participants should be reminded they are drawing down the savings account they may need to support them in their retirement. Meeting current needs is necessary, but individuals need to balance their current needs with their long-term goals.