Journal of Financial Planning: October 2024

NOTE: Please be aware that the audio version, created with Amazon Polly, may contain mispronunciations.

Daniel Razvi, Esquire, is senior partner and chief operating officer at Higher Ground Financial Group, a virtual-only financial advisory firm operating out of the Washington, D.C., area serving clients across the nation with a focus on customized tax-based planning solutions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

The Tax Cuts and Jobs Act of 2017 (TCJA) was the biggest overhaul of the tax code since 1986. While some provisions were “permanent” changes, there are a number of items that revert back to pre-2018 rules at the end of 2025. This means we have less than two years to take advantage of certain tax planning strategies. It is true that Congress could act and adjust some or all of these provisions, but it is wiser to make plans assuming that does not happen before the deadline.

Below are some of the most impactful changes that will happen effective January 2026, and a list of some tax rules that are not expiring.

Individual Rates Reverting to 2017 Levels

This is probably the most talked-about provision in the TCJA. Most income tax brackets are indeed reverting to their 2017 levels: The 12 percent bracket jumps to 15 percent, 22 percent raises to 25 percent, 24 percent increases to 28 percent, and the top tax bracket increases from 37 percent to 39.6 percent, for example. Table 1 shows the 2024 married filing jointly brackets and the corresponding increases that will take effect in 2026.

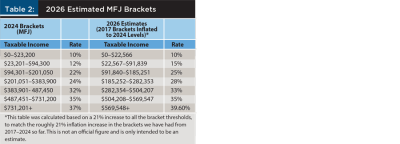

What is being talked about less is that the brackets will also likely be shrinking. This is because the TCJA didn’t only change the rates, but also in many cases expanded the brackets. Keep in mind that in 2026, the brackets will be increased for inflation. However, that inflation increase will not be announced for another couple of years. It is highly likely that the final inflated brackets will still (in most cases) be quite a bit smaller than today’s brackets.

Table 2 shows the 2024 rates on the left (again married filing jointly). On the right, there is an estimated chart of what the brackets might be in 2026, assuming 2017 brackets are adjusted for inflation through 2024.

Look, for example, at the 24 percent bracket. Currently, if a married couple makes above $201,000, they would be in the 24 percent bracket. But they have over $180,000 of “room” in that same bracket to do Roth conversions or make additional income without going into a higher bracket. In 2026, not only will they be in the 28 percent bracket, but they also lose over $100,000 of “room” since the bracket tops out at just over $282,000. This is a huge deal for those planning big Roth conversions, or other large taxable distributions, after 2026.

To be fair, there are certain scenarios in which the changing brackets could work out in a client’s favor. But in the majority of cases for high-income earners, the expiration of the TCJA will result in a tax increase in 2026.

Deduction and Credit Changes

There are a number of changes to deductions coming in 2026. The standard deduction will be cut in half. This will likely result in more filers choosing to itemize. The good news is that there are more itemized deductions available with expiring TCJA provisions. The mortgage interest deduction limit will raise to $1 million and there will no longer be a restriction on deducting HELOC interest (under TCJA, the homeowner could only deduct if the money was used for home improvement). In 2026, taxpayers will once again be able to deduct unreimbursed employee expenses, legal fees, and (in what will be a boon to residents of high tax states such as California) unlimited deductions return for SALT (state and local taxes paid).

The child tax credit will revert to 2017 levels, but the personal exemption allowance will return. PEP (personal exemption phaseout) and PEASE (itemized deduction limitation) will both return in 2026, which means some taxpayers with higher incomes may not be able to itemize or claim personal exemptions.

Finally, the limit on charitable deductions will be reduced from 60 percent (current) to 50 percent of AGI in 2026. This means that taxpayers with large charitable giving plans should consider gifting over the next two years to take advantage of the higher limit. However, very large charitable contributions will still be able to be spread out over five additional years. The option still exists for QCDs (qualified charitable distributions) directly from IRAs if the taxpayer is over age 70½, up to $105,000 per year as an “above the line” deduction, which will not count toward the 50 percent AGI limit.

Alternative Minimum Tax (AMT)

While the corporate AMT was permanently repealed, the individual AMT remains in place. The thresholds were higher during the TCJA, but once 2026 rolls around, those thresholds go back to 2017 levels. The calculation for AMT is beyond the scope of this article, but suffice it to say that many more individual taxpayers will once again be subject to alternative minimum tax in 2026.

Estate Tax Changes

In 2024, the estate tax exemption is $13.6 million per person. This will drop roughly in half in two years when the TCJA expires. Taxpayers with assets that are above $6–7 million should strongly consider making estate planning adjustments to minimize the impact of the reduced deduction. Even if a client has assets of less than $6 million, they may still be impacted if they are young enough that their assets are likely to grow above that exclusion before they pass away. The estate tax is not an insignificant tax; 40 percent of the total estate value above the exemption will be taxed at death. And if they have IRA/401(k) funds, it is a double whammy. The estate tax is calculated first on the gross amount of the IRA, and then the total amount of the IRA is still taxed at income tax levels, in effect creating a “double tax” on the IRAs. Not only that, but beneficiaries can only spread out the IRA income tax over a maximum of 10 years, since the “stretch IRA” was repealed by the SECURE Act of 2019. Under current tax law, an IRA is the worst possible asset to leave to (non-charity) beneficiaries.

Business Tax Changes

The corporate tax rate (for C corporations) was permanently changed to a 21 percent flat rate. This does not expire in 2025. The main tax break for flow-through companies (S corps and LLCs), however, is expiring. That means these flow-through businesses will no longer get the 20 percent deduction known as the qualified business income (QBI) deduction. Because of this, it may be advantageous for some small business owners to consider switching to C corp tax structures in two years.

Bonus depreciation has already begun to phase out and will completely phase out by 2026. Starting in 2026, employers will also no longer be able to get a credit for paid employee leave. There are some fringe benefits such as moving expenses and bicycle reimbursements that will be deductible again, however, and the limits on losses for flow-through companies will be relaxed as well.

Four Tax Strategies to Take Advantage of Immediately . . . and Over the Next Two Years

1. Roth conversions and other shifts to tax-free status. As a client approaches retirement, deferred taxes will be their enemy. Having money in a 401(k) or IRA is equivalent to being in a business partnership with someone who can choose their own ownership percentage of your company at any time without your approval. When a client defers taxes, they are basically saying to the government, “I know what the taxes would be today. I’m choosing not to pay them, and you can charge me whatever you want someday when I am forced to take it out.” This is not a good deal for most taxpayers, especially as we know the rates are increasing and brackets shrinking in just two years.

Fortunately, the tax code provides two very efficient methods of exiting that partnership with the IRS and moving the funds from taxable (IRA) to tax-free. Those two methods are Roth conversions and permanent life insurance. Prior to 2010, life insurance was the only option, but now Roth conversions are becoming very popular. Generally speaking, if the priority is legacy, a life insurance policy is still more efficient today. But if retirement income is the priority for the IRA funds, a Roth conversion is likely more efficient.

A Roth conversion works by taking a portion of the IRA and recharacterizing it as a Roth IRA. This triggers a 1099 from the custodian at the end of the year, and taxes will be due at the taxpayer’s current income bracket. It is normally best to pay the tax bill from some other account, rather than the IRA. (This is because you cannot contribute a large amount into the Roth in a future year, but a withdrawal can always be taken from the Roth if needed to refill whatever bucket was used to pay the taxes.) Once the IRA is converted to Roth, there are no RMDs and no tax on the future gains, during one’s lifetime or at death.

There are two “five-year rules” to be aware of for Roth conversions. If a client is under age 59½, they will need to wait five years to touch that Roth account (even the principal they paid tax on). Regardless of their age, they will need to wait five years to touch the future growth that happens after conversion. So if they are age 60 and convert $100,000 to Roth, pay the tax from some external account, and in two years the account is worth $120,000 due to market growth, they can withdraw up to $100,000 tax-free but they need to leave the extra $20,000 of growth in the account for another three years.

Because taxes are going up in two years, for most taxpayers it is a massive advantage to convert to tax-free as much as practically possible before the TCJA expires. That way they are getting a “discount” on the taxes. The more tax-free assets a client has during retirement, the less of an impact there will be from cascading taxes in the future (this is when increasing RMDs trigger tax on other income such as capital gains or Social Security).

2. Charitable remainder unitrust (CRUTs). One way to come up with the money to pay taxes for a Roth conversion is to utilize a CRUT (charitable remainder unitrust). With this particular type of irrevocable trust, a client can donate highly appreciated stocks, real estate, or even business interests to the CRUT and not only defer capital gains on the sale, but also receive a large income tax deduction (based on age; roughly 50 percent at age 68). This deduction can be used to offset taxes on a Roth conversion. In addition, the taxpayer receives a pension/income from the trust (normally 5 percent of the balance each year), which is taxable. Upon death, the remainder of the CRUT balance goes to charity. For taxpayers with charitable legacy plans, a CRUT is a great way to maintain income for the future, remove the assets from the estate today, and still get a big tax deduction to use toward Roth conversions or for any other purpose.

3. Corporate restructuring. Taxpayers who own flow-through companies such as LLCs or S corps should strongly consider moving to a C corp structure once the 20 percent QBI deduction expires. For many businesses, especially if there is more income being generated than the owner is spending on lifestyle, a flat 21 percent tax on corporate income can save a lot of money, as opposed to a K-1 distribution taxed at the 39.6 percent personal income rate for example. The pitfall to be aware of is the “double tax,” where future distributions out of the corporation are taxed again as dividends. However, with proper planning, this double tax can be somewhat minimized through the creative (legal) use of corporate deductions, fringe benefits, loans, and step-up in basis upon death.

4. Estate planning. Taxpayers with close to or above $6 million in total assets should consider taking advantage of the last two years of higher exclusions, to give away assets to irrevocable trusts. Any exemption used while the TCJA is still in effect is not lost; these exemptions will not be “clawed back” after the TCJA expires. Keep in mind that you can help clients avoid estate tax or capital gains, but not both—if you shift real estate or stocks into an irrevocable trust they are removed from the client’s estate, but their beneficiaries may still owe capital gains tax. The only exception to this rule is for life insurance. Death benefits are always free of income and capital gains tax, whether inside or outside an irrevocable trust. This makes life insurance an extremely powerful tool in estate planning.

The TCJA expiry in 2025 will bring a whirlwind of tax law changes. It is important to dive deep and understand how these changes will affect your clients personally. Working with a tax attorney to develop a strategic plan can help to minimize taxes for the long term, especially for taxpayers at the higher income or asset thresholds that will be most affected by the changes.

Sidebar

Tax Changes At a Glance

What Is Changing in December 2025

- Individual tax rates revert back to 2017 levels (and the brackets shrink!)

- Standard deduction drops in half

- Charitable deduction limit drops from 60 percent to 50 percent of AGI

- 20 percent deduction for pass-through businesses goes away

- $10,000 limit for SALT (state and

local tax) deduction goes away - Estate tax exclusion drops roughly

in half - Mortgage interest deduction limit

of $750,000 increases to $1 million - Home equity deduction restrictions

go away - Individual AMT (alternative minimum tax) thresholds return to 2017 levels

- Child tax credit drops in half

- Unreimbursed employee expenses deductible again

- PEP and PEASE limits return

- Bonus depreciation goes away

What Is Not Expiring in December 2025

- 3.8 percent net investment income tax stays the same

- 21 percent flat tax for C corp income stays the same

- Capital gains rates stay the same (but will be linked to ordinary

brackets again) - Corporate AMT (alternative minimum tax) was repealed permanently

What We Can Do to Prepare

- Roth Conversions

- CRUTs

- Corporate Restructuring

- Estate Planning

Read Next

“Net Present Value Analysis of Roth Conversions,”

Edward F. McQuarrie, September 2024