Journal of Financial Planning: April 2016

Executive Summary

- This article explores six different methods for incorporating home equity into a retirement income plan through the use of a reverse mortgage. Generally, strategies that spend the home equity more quickly increase the overall risk for the retirement plan. More upside potential is generated by delaying the need to take distributions from investments, but more downside risk is created because the home equity is used quickly without necessarily being compensated by sufficiently high market returns.

- Meanwhile, opening the line of credit at the start of retirement and then delaying its use until the portfolio is depleted creates the most downside protection for the retirement income plan. This strategy allows the line of credit to grow longer, perhaps surpassing the home’s value before it is used, providing a bigger base to continue retirement spending after the portfolio is depleted.

- Use of tenure payments or one of the coordinated spending strategies can also be justified as providing a middle ground, balancing the upside potential of using home equity first and the downside protection of using home equity last.

- A key theme is that there is great value for clients to open a reverse mortgage line of credit at the earliest possible age.

Wade D. Pfau, Ph.D., CFA, is a professor of retirement income at The American College and a principal at McLean Asset Management. He is a two-time recipient of the Journal’s Montgomery-Warschauer Award. He hosts the Retirement Researcher website (www.RetirementResearcher.com).

The use of a reverse mortgage to supplement portfolio withdrawals as a part of retirement income strategy is a fascinating topic and a number of counterintuitive findings are slowly entering into the financial planning profession. Since 2012, the Journal of Financial Planning has served as the primary outlet for a series of research articles demonstrating the potential use and value of reverse mortgages as part of a comprehensive retirement income strategy. The studies published in the Journal could very well lead to the strategic use of home equity in a retirement income plan to become the next hot topic for client and adviser education, similar to how Social Security claiming strategies have been ubiquitous in recent years.

For most Americans, home equity and Social Security benefits represent the two biggest assets on the household balance sheet, frequently dwarfing the available amount of financial assets. Even for wealthier clients, home equity is still a significant asset that should not automatically be lumped into a limiting category of last-resort options once all else has failed.

Sacks and Sacks (2012) led the advances in the literature on reverse mortgages by demonstrating how a strategy that coordinates the draws from a reverse mortgage line of credit throughout retirement can significantly increase the probability of success, relative to the conventional wisdom that a reverse mortgage line of credit only be opened and used as a last resort option after other resources have been depleted.

Salter, Pfeiffer, and Evensky (2012) and Pfeiffer, Salter, and Evensky (2013) followed suit, independently confirming how their coordinated glide path strategy for home equity use could also increase the success probabilities for a variety of withdrawal rates. Wagner (2013) represents a fourth key study, which garnered greater respect for the reverse mortgage term and tenure options in addition to draws from the line of credit.

Pfeiffer, Schaal, and Salter (2014) later provided a more detailed analysis about two options using home equity last in retirement, with the difference being whether the reverse mortgage is opened early or when it is first needed. They found that establishing the HECM line of credit early is especially advantageous in low interest rate environments.

Despite the significant contributions of these past studies, there is room for another investigation of the U.S. government’s Home Equity Conversion Mortgage (HECM) program. This study aimed to bring further clarity to what these past studies found by pushing deeper into the underlying analysis about how these strategies impact spending and wealth.

Past studies generally struggled with how to explain the combined impacts of home equity use on sustaining a retirement spending goal as well as preserving assets for legacy. When describing the impacts on legacy, past studies generally focused on the median amount of legacy wealth and struggled with how to make proper comparisons in cases when the full spending goal was not met. One objective for this study was to focus on the wider distribution of potential outcomes to better understand the combined impacts for spending and legacy.

Past studies also struggled with how to simulate the random future fluctuations for the key variables that will impact the results. Although past studies employed Monte Carlo simulations for stock and bond returns, none of these studies simulated the future paths of interest rates, nor did they link future bond returns to future interest rates. This misses the ability to see how changing interest rates impact line-of-credit growth, the amount of credit available when delaying the decision to open a reverse mortgage, and the interplay of growth in the line of credit or loan balance for the reverse mortgage and the return on bonds in the investment portfolio. Some studies also provided scenario testing with regard to whether interest rates are fixed at high, medium, or low levels in the future, however the present study allowed a deeper analysis by simulating interest rates and linking them to future bond returns.

This study also provided random simulations for future home prices, while past studies used a fixed growth assumption for future home prices. Home prices are another key variable because they impact the amount of credit available when delaying the option to open a line of credit. Home prices are also a pivotal piece of the puzzle to determine whether the non-recourse aspects of reverse mortgages will become binding.

To be clear, the combined effects of future market returns, future interest rates, and future home prices tend to work together in rather complicated ways because of some non-linearities existing with the use of a reverse mortgage. By simulating all the relevant variables, this study sought to help make greater sense about how reverse mortgage strategies can work in a retirement income plan.

When given a choice for meeting a particular year’s spending goal using either a portfolio withdrawal or using a draw from the reverse mortgage line of credit, the ultimate impact on legacy wealth is unknowable in advance. The best we can do is study the distribution of outcomes with different strategies and then choose the strategies with which we are most comfortable in terms of the combined impacts on spending and legacy. Choosing the portfolio as the spending source will impact the ultimate legacy amount in a random way that depends on the realized market returns that spending would have experienced in the subsequent years of retirement, had it stayed in the portfolio. The opportunity cost of portfolio spending is whatever market returns (good or bad) it would subsequently experience. The impact of spending from the reverse mortgage line of credit relates to how future interest rates will impact the ultimate loan balance due.

Reverse Mortgage Non-Linearities

Could assets left within the portfolio grow more quickly than the reverse mortgage loan balance? To answer this question fully requires introducing an important non-linearity. A reverse mortgage is a non-recourse loan. Should the loan balance ultimately exceed 95 percent of the appraised value of the home when payment is due (which Pfau (2014) demonstrated was a reasonably likely outcome for retirements starting when interest rates are low), then the ultimate legacy reduction impact of some home equity draws could be $0. The likelihood that this happens depends on both the random path of future interest rates and future home prices.

Another important non-linear aspect of home equity use is the synergetic aspects that can be created through its treatment as a buffer asset to mitigate sequence of returns risk for the retirement portfolio.

Bengen (1994) ushered in the modern study of sustainable withdrawals from investment portfolios within the realm of financial planning. His 4 percent rule came about as the answer to which initial spending rate that provides a spending amount subsequently adjusted for inflation could be sustained historically for 30 years from an investment portfolio with 50 to 75 percent stocks. His study provided a research simplification that has guided much subsequent research, though it must be clear that this constant inflation-adjusted spending from a volatile investment portfolio is a unique cause of sequence of returns risk in retirement. This is why the 4 percent rule is the 4 percent rule. Even when the average market return over a 30-year period is reasonable, the sustainable spending rate can still be low if a poor sequence of market returns is experienced early in retirement. This pushes up the withdrawal rate as a percentage of the remaining lower balance required to continue meeting the spending goal, which creates a hole for the portfolio and prevents it from growing even when the overall market subsequently recovers.

If spending is allowed to decrease in response to poor market returns, this mitigates sequence risk by reducing the spending percentage relative to what is left. Alternatively, overall spending does not necessarily have to decrease if part of the spending goal can instead be covered through an alternative buffer asset. This is where the reverse mortgage fits into the puzzle. Reducing portfolio draws when markets are down by sourcing that spending from elsewhere is another effective method for mitigating sequence risk. That sequence risk reduction is the source of the synergy and was precisely the objective of the coordinated spending strategies developed by Sacks and Sacks (2012) and Salter, Pfeiffer, and Evensky (2012).

For these reasons, when using Monte Carlo simulations to study different coordinated spending strategies in retirement, there will not be one superior strategy. Sometimes strategies that use up the reverse mortgage line of credit as quickly as possible will perform best. In other cases, strategies that delay home equity use for as long as possible will be proven the winners. Coordinated strategies that draw occasionally from a line of credit can also do well. Even more, strategies that systematically use home equity through retirement by creating a tenure payment may perform best.

The objective for this study was to analyze these different possibilities in order to provide planners and their clients with a deeper context for considering how to incorporate home equity into a retirement income strategy.

Overview of the HECM Reverse Mortgage Program

A number of overviews about the HECM reverse mortgage program are available. However, the government frequently modifies program rules; therefore, anything written before September 2013 will be describing conditions rather different from today. At that time, the government streamlined the program to offer a single HECM option, eliminating what had previously been two options: the HECM Standard and HECM Saver.

More recently, new safeguards have been created to reduce the initial amount of available credit, to protect non-borrowing spouses who are under age 62 when a reverse mortgage begins, and to provide financial assessments to assure that borrowers will be able to meet the requirements for property taxes, insurance, and home maintainance to keep the mortgage from foreclosing. Johnson and Simkins (2014) provided an up-to-date introduction, and Giordano (2015) provided a comprehensive treatment for how the HECM program works.

Reverse mortgages have a relatively short history in the U.S. The first one was offered by a bank in Maine in 1961. In 1989, the federal government systematized reverse mortgages through the HECM program under the auspices of the department of Housing and Urban Development (HUD). In recent years, HUD has frequently updated the administration of the HECM program to help ensure that any problems are corrected and reverse mortgages are used responsibly. The basic objective is to create liquidity for the home value so it can be used more efficiently in retirement.

Eligibility. Requirements to become an eligible HECM borrower include age (at least 62); equity in the home (any existing mortgage can be paid off with loan proceeds); financial resources to cover tax, insurance, and maintenance expenses; no other federal debt; competency; and the receipt of a counseling certificate from a Federal Housing Authority (FHA)-approved counselor for attending a personal counseling session on home equity options.

The property must serve as the primary residence, meet FHA lending codes, and pass an FHA appraisal to be eligible. Up to $625,500 of a home’s value can be applied to a reverse mortgage.

Initial available credit. The important factors for determining how much credit is available through the HECM include the appraised home value; the age of the younger spouse (for joint owners, one spouse must be at least 62); a lender’s margin; and the 10-year LIBOR swap rate. The lender’s margin and 10-year swap rate sum to the “expected rate.” This is used with the age of the younger spouse to determine the principal limit factor (PLF), or the percentage of the home’s value that may be borrowed. In the example described in the methodology section, the initial available credit is 52.4 percent of the home’s value.

Upfront costs. When the line of credit is opened, fees include a 0.5 percent upfront mortgage insurance premium payment (when first-year borrowing is less than 60 percent of the line of credit, which is the case for all scenarios in this study); loan origination fees; and other closing and settlement costs. These fees can be paid in cash or borrowed from the available line of credit. Recently, lenders have been providing more options regarding the acceptance of a higher margin rate accompanied by lower origination costs and the ability to have ongoing service costs covered by the lender’s margin.

Ongoing credit and loan balance growth. The principal limit that can be borrowed against will grow automatically at a variable rate equal to the lender’s margin, a 1.25 percent mortgage insurance premium (MIP), and subsequent values of one-month LIBOR rates. Any outstanding loan balance also grows at this rate. The line of credit almost always grows at this rate as well, with rare exceptions when there are set-asides for servicing costs that grow at a different rate. Those exceptions do not apply herein, so that total principal limit, loan balance, and remaining line of credit all grow at the same variable rate (see Pfau’s March 2015 Journal column “Understanding the Line of Credit Growth for a Reverse Mortgage” for a detailed explanation of this point). The total principal limit equals the sum of the loan balance and the remaining line of credit. Once enough is borrowed so that the loan balance equals the principal limit, no further borrowing is possible except if a tenure payment was chosen or if some loan balance is repaid.

These LIBOR rates are the only variable part for future growth, as the lender’s margin and MIP are fixed at the beginning. A key feature of the HECM program is that it is a non-recourse loan. No matter how much is borrowed, the amount due cannot exceed 95 percent of the home’s appraised value when repayment is due.

Spending options. For the adjustable rate versions of HECM loans most common today, the proceeds from the reverse mortgage can be taken out in combination of any of these four ways:

- Lump-sum payment: take out a large amount initially, though not necessarily the full amount available, perhaps to pay off existing mortgage or to use as HECM for purchase.

- Tenure payment: works similar to an income annuity with a fixed monthly payment guaranteed to be received for as long as the borrower lives and remains in the home.

- Term payment: a fixed monthly payment is received for a fixed amount of time.

- Line of credit: home equity does not need to be spent initially, or ever. A number of strategies involve opening a line of credit and then leaving it to grow at a variable interest rate as an available asset from which to draw to cover a variety of contingencies later in retirement.

Loan repayment. Although portions of the loan balance may be repaid without penalty at any time, the loan balance does not have to be repaid until the borrower (and eligible non-borrowing spouse, when applicable) have left the home, either through death or by moving. Heirs can then generally arrange to have up to 12 months to repay the loan balance, or to otherwise hand over the keys to the home and walk away if they believe the loan balance is significantly higher than the appraised value and the potential selling price for the home. The loan balance can be repaid by selling the home, however, heirs wishing to keep the home could repay the loan balance with other funds or by seeking a traditional mortgage to refinance the reverse mortgage.

Taxes. Distributions from the HECM are treated as loan receipt and are not taxable. Distributions from the HECM are not included in the Adjusted Gross Income, which may help with tax bracket management and may impact the taxation of other government benefits in retirement. When the loan balance is repaid, heirs might have to pay taxes on any non-recourse funds received in excess of the home’s appraised value. Heirs may also be able to take a deduction for the portion of the repaid loan balance that covers interest due. A tax professional should be consulted for more specifics on a particular client’s case.

Methodology

Reverse mortgage strategies were simulated using 50,000 Monte Carlo simulations for 10-year bond yields, equity premiums, home prices, short-term interest rates, and inflation. Stock and bond returns were calculated from simulated bond yields and equity premiums above bond yields. The details of the underlying market simulations are provided in the appendix.

These simulations reflect the lower bond yields available to retirees today, but they do include a mechanism for interest rates to gradually increase over time, on average. Bond returns were calculated from the simulated interest rates and their changes. Stock returns were calculated by adding a simulated equity premium on top of the simulated interest rates.

All strategies were simulated with the same asset allocations and portfolio returns in order to make the results comparable. Strategies were simulated with annual data, assuming withdrawals were made at the start of each year, and annual rebalancing was used to restore the targeted asset allocation. No fees were deducted from remaining portfolio assets at the end of the year.

Without much loss of generality, this also required assuming that home equity draws and growth in the principal limits and loan balances were calculated annually instead of monthly. An annually rebalanced asset allocation of 50 percent stocks and 50 percent bonds was used so that greater emphasis could be made on exploring different uses for home equity.

In October 2015, the 10-year LIBOR swap rate was 2.01 percent, and the one-month LIBOR rate was 0.20 percent. With an assumed 3 percent lender’s margin rate, this led to an expected rate of 5.01 percent, which translated into a principal limit factor of 52.4 percent for an assumed 62-year-old borrower.

For the baseline study, a home value of $500,000 was used. At loan origination, this required an initial mortgage insurance premium of 0.5 percent, or $2,500. Other assumed origination and closing costs combined for a total initial cost of $5,000 when the loan was initiated. Except for the strategy in which the line of credit is drawn down first before spending from the investment portfolio, this initial cost was assumed withdrawn from the portfolio rather than added to the loan balance.

The initial effective rate for principal limit growth added the 0.20 percent one-month LIBOR rate to the 3 percent margin and the 1.25 percent ongoing mortgage insurance premium, which was 4.45 percent initially. This was a variable rate that subsequently fluctuated based on simulated short-term interest rates.

The client held a $1 million portfolio in a tax-deferred investment portfolio. To provide a basic understanding about the impact of taxes, a marginal tax rate of 25 percent was applied to any portfolio distributions. Distributions from the HECM reverse mortgage did not require any tax payments. The withdrawal rate reflected post-tax, inflation-adjusted spending goals as a percentage of the initial portfolio balance. For instance, a 4 percent withdrawal rate represents $40,000 of spending from the $1 million portfolio. The spending amount subsequently grows with the simulated inflation rate. If this distribution is taken from the portfolio, the withdrawal in real terms is $40,000 / (1 – .25) = $53,333 to cover taxes as well. If taken fully from the HECM, only $40,000 is needed.

Within each simulation, home prices grew randomly, and the HECM line of credit grew randomly in response to changing short-term interest rates. In each simulation, spending was sourced from the appropriate asset as based on the rules for that strategy. When a strategy called for spending from a depleted asset (the financial portfolio or home equity), the other asset was used instead, when still available. After both assets were depleted, shortfalls below the spending goal were tabulated to provide a negative legacy wealth value. This was the real value of the spending shortfall without applying any investment returns or discount rates. Doing this was important to reflect the magnitude of failure with a strategy. Legacy wealth was calculated as the remaining portfolio balance plus any remaining home equity at the end of retirement. Remaining home equity was calculated as 95 percent of the home’s value at the end of retirement less any balance due on the reverse mortgage loan. Because of the non-recourse features of the HECM program, remaining home equity cannot be negative, even if the loan balance exceeds the home’s value.

Seven retirement income strategies were considered, six of which involved spending from a HECM:

Ignore home equity. This was the only strategy not comparable with the others, because it made no use of the home equity. The strategy was only used to indicate a baseline probability of plan success when home equity is not used.

Home equity as last resort. This strategy represented the conventional wisdom thinking regarding home equity. It was the only home equity strategy that delayed opening a line of credit with a reverse mortgage. The investment portfolio was spent first. If and when the portfolio was depleted, a line of credit was opened with the reverse mortgage and spending needs were then met with the line of credit until it was fully used. The PLF was calculated using the current PLF table for the updated age and simulated interest rate value at the future date, assuming the same underlying 3 percent margin rate.

Use home equity first. This strategy opened the line of credit at the start of retirement, and retirement spending was covered from the line of credit first until it was fully used. This allowed more time for the investment portfolio to grow before being used for withdrawals after the line of credit was depleted.

Sacks and Sacks coordination strategy. This strategy opened the line of credit at the start of retirement, and spending was taken from the line of credit, when available, following any years in which the investment portfolio experienced a negative market return. No efforts were made to repay the loan balance until the loan became due at the end of retirement.

Modified coordination strategy. This strategy was modified from the original strategy described in Pfeiffer, Salter, and Evensky (2013) to remove the cash reserve bucket. This strategy performed a capital needs analysis for the remaining portfolio wealth required to sustain the spending strategy over a 41-year time horizon. Spending was taken from the line of credit when possible, whenever the remaining portfolio balance was less than 80 percent of the required wealth glide path. Whenever investment wealth rose above 80 percent of the glide path value, any balance on the reverse mortgage was repaid as much as possible without letting wealth fall below the 80 percent threshold, in order to keep a lower loan balance over time and provide more growth potential for the line of credit. The line of credit was opened at the start of retirement.

Use home equity last. This strategy differed from the “home equity as last resort” strategy only in that the line of credit was opened at the start of retirement. It was otherwise not used and left to grow until the investment portfolio was depleted.

Use tenure payment. This strategy opened the line of credit at the start of retirement and used the tenure payment strategy. With an initial home value of $500,000, an expected rate of 5 percent, and an age 62 start, annual tenure payments from the line of credit were $17,972. Any remaining spending needs were covered by the investment portfolio when possible.

Results

Results are presented for each strategy assuming an asset allocation of 50 percent stocks and 50 percent bonds. Results are displayed for years in retirement, allowing the retirement duration to be interpreted either as the date of death for the client, or at the date in which the client leaves their home and must repay the reverse mortgage loan balance.

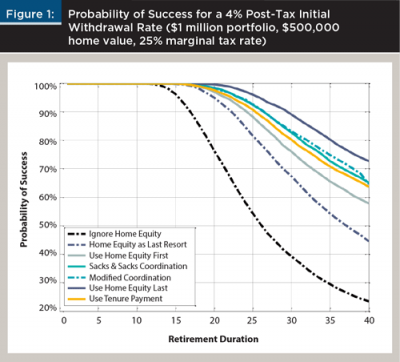

Figure 1 shows the probability that the expenditure objectives for a 4 percent post-tax initial spending rate can continue to be met as retirement progresses (although it only represents a starting point for the analysis, because it considers only one point in the distribution of outcomes). With a 25 percent marginal tax rate, this would imply a gross withdrawal rate of 5.33 percent in the first year of retirement, if distributions are taken solely from the investment portfolio.

In Figure 1, a strategy that ignores home equity was included as a reference point. And with higher expenditures to cover taxes, the baseline shows that the success rate for the retirement spending goal was only about 40 percent by the 30th year of retirement.

The other strategies were all comparable, because they allowed home equity to be used to meet spending goals. Of the six strategies that used home equity, the strategy supporting the smallest increase in success was the conventional wisdom of using home equity as a last resort and only initiating the reverse mortgage when it was first needed. This confirms the Sacks and Sacks (2012) original finding. Meanwhile, the strategy that used home equity as a last resort, but which opened a line of credit at the start of retirement in order to let the line of credit grow before being tapped, provided the highest increase in success rates. Especially when interest rates were low, the line of credit would almost always be larger by the time it was needed when it was opened early and allowed to grow, than when it was opened later. Meanwhile, the benefits from the other four strategies fell somewhere in between. Success rates increased as one adjusted from using home equity first, to using the tenure option, to using either of the coordination strategies.

The basic understanding derived from Figure 1 is that strategies that open the line of credit early but then delay its use for as long as possible offered increasing success rates as more line of credit was available to be drawn from if and when it was needed. This benefit from delay was sufficient to counteract the reduced sequence risk created by using the line of credit in a more coordinated way over time.

What about Legacy Value?

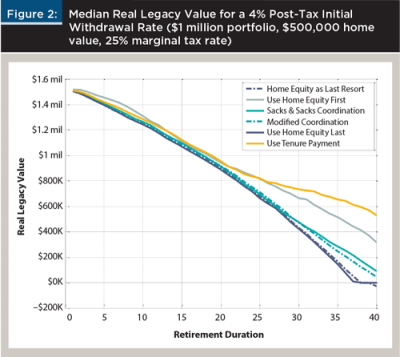

The probability of success was not the only relevant measure for outcomes. Clients may be concerned about the combined legacy value of their assets when using a reverse mortgage. Legacy value was defined by any remaining portfolio assets plus any remaining home equity after the reverse mortgage loan balance had been repaid. When assets were depleted (the portfolio and the entire line of credit), legacy values were counted as negative by summing the total spending shortfalls that would manifest either as reduced spending or as a need to rely on ones’ heirs for additional support while alive as a form of “reverse legacy.” Taxes to be paid by heirs were not included in the numbers shown for the next three figures, which examine the range of legacy values. These figures are shown for the six strategies that do incorporate home equity, so they are all comparable.

Median wealth outcomes are most comparable to what has been shown in previous research, although past studies have struggled to make results comparable by not accounting for negative legacy values when there were spending shortfalls. As shown in Figure 2, median legacy values remained close for the first 20 years of retirement. Spending home equity first provided the highest legacy value, and spending home equity last provided the smallest legacy value.

For the median outcomes, the investment portfolio grew more quickly than the outstanding loan balance on the reverse mortgage, so that clients were served best by preserving their portfolio as much as possible while spending down home equity first. As retirement progressed, after about 25 years, the legacy value for the tenure payment option changed slope and started supporting significantly more legacy. This was a combined result of the partial home equity use preserving the portfolio longer, as well as the fact that eventually tenure payments entered into the non-recourse aspect of the reverse mortgage, as the income continued for as long as the client was in their home even if the loan balance had already exceeded the line of credit. It is the only HECM option that allowed this.

The other important observation to make from Figure 2 is that legacy values became level at $0 when home equity was used last, reflecting situations in which spending was still possible from the line of credit, although the line of credit had already grown to be worth more than the home. Such spending had no impact on legacy.

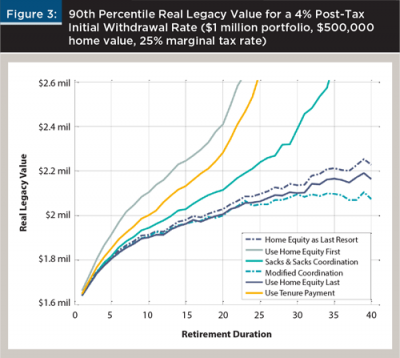

Figure 3 shows the combined real legacy values at the 90th percentile of outcomes. These were cases when the investment portfolio performed extremely well throughout retirement. In these cases, what the figure demonstrates, is that if one could count on outsized investment returns, there was benefit from using the line of credit more quickly, as the portfolio grew more quickly than the loan balance.

The strategies for using home equity first, the tenure strategy, and the Sacks and Sacks coordination strategy all leaned toward a quicker use of home equity than the other strategies, which supported higher combined legacy values. Next was the last resort option, which was located where it is because of its ability to save on ever having to pay the upfront costs for a reverse mortgage that would not otherwise be used. The final two strategies opened the line of credit initially but ended up using it very rarely if at all, and so these provided the smallest relative advantages for legacy value.

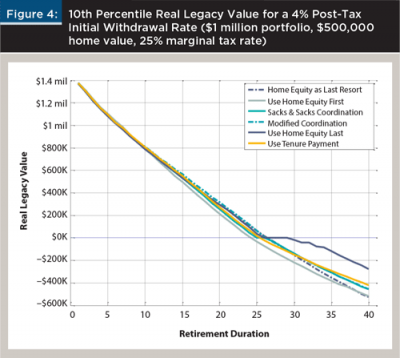

Figure 4 shows results for the 10th percentile of outcomes. These were the bad luck cases for market returns and sequence risk in which planning generally focuses. In these cases, legacy values reached $0 by about 25 years in retirement. Spending down home equity first became the riskiest strategy, as the delay in having to start tapping the portfolio hadn’t sufficiently helped if financial markets were still significantly down a few years into retirement. When retirements lasted longer, spending home equity last (after opening the line of credit early) did the best to continue supporting spending even after financial assets were depleted.

For some years, there was a better chance to benefit from a line of credit that exceeded the home value, and then helped to slow the eventual portfolio shortfalls that arose once both retirement resources had been fully depleted. The tenure option also provided some income to reduce the size of shortfalls even after both resources were depleted, which happened at the 10th percentile of outcomes.

Conclusions

This study explored six different methods for incorporating home equity into a retirement income plan through the use of a reverse mortgage. Generally, strategies that spend the home equity more quickly increased the overall risk for the retirement plan. More upside potential was generated by delaying the need to take distributions from investments, but more downside risk was created because the home equity was used quickly without necessarily being compensated by sufficiently high market returns.

Meanwhile, opening the line of credit at the start of retirement and then delaying its use until the portfolio was depleted created the most downside protection for the retirement income plan. This strategy allowed the line of credit to grow longer, perhaps surpassing the home’s value before it was used, which provided a bigger base to continue retirement spending after the portfolio was depleted. Using home equity last did reduce upside potential, because when markets were strong the portfolio grew faster than the loan balance.

Frequently, this line of credit growth opportunity served a stronger role than the benefits from mitigating sequence risk through the use of coordinated strategies. Nonetheless, use of tenure payments or one of the coordinated strategies could also be justified as providing a middle ground, balancing the upside potential of using home equity first and the downside protection of using home equity last. These coordinated strategies could occasionally provide the best outcomes for legacy in some simulated cases when they best balanced the trade-off between using home equity soon to provide relief for the portfolio, and delaying home equity use so the available line of credit was larger.

For future research, important considerations to also factor in include different retirement spending goals, different retirement tax rates, and different fee combinations for upfront cost and margin rates. Past research has already established the increased value provided by the HECM when interest rates are low and when home equity is larger relative to the portfolio size, but it would also be intriguing to further examine these factors within the broader model provided in this study. It is important to note that strategies that open a line of credit and leave it unused run counter to the objectives of lenders and the government’s mortgage insurance fund. One day these opportunities may be eliminated.

References

Bengen, William P. 1994. “Determining Withdrawal Rates Using Historical Data.” Journal of Financial Planning 7 (4): 171–180.

Giordano, Shelley. 2015. What’s the Deal with Reverse Mortgages? Pennington, N.J.: People Tested Media.

Johnson, David W., and Zamira S. Simkins. 2014. “Retirement Trends, Current Monetary Policy, and the Reverse Mortgage Market.” Journal of Financial Planning 27 (3): 52–59.

Pfau, Wade D. 2014. “The Hidden Value of a Reverse Mortgage Standby Line of Credit.” Advisor Perspectives (December 9).

Pfeiffer, Shaun, John R. Salter, and Harold R. Evensky. 2013. “Increasing the Sustainable Withdrawal Rate Using the Standby Reverse Mortgage.” Journal of Financial Planning 26 (12): 55–62.

Pfeiffer, Shaun, C. Angus Schaal, and John Salter. 2014. “HECM Reverse Mortgages: Now or Last Resort?” Journal of Financial Planning 27 (5): 44–51.

Sacks, Barry H., and Stephen R. Sacks. 2012. “Reversing the Conventional Wisdom: Using Home Equity to Supplement Retirement Income.” Journal of Financial Planning 25 (2): 43–52.

Salter, John R., Shaun A. Pfeiffer, and Harold R. Evensky. 2012. “Standby Reverse Mortgages: A Risk Management Tool for Retirement Distributions.” Journal of Financial Planning 25 (8): 40–48.

Wagner, Gerald C. 2013. “The 6.0 Percent Rule.” Journal of Financial Planning 26 (12): 46–59.

Citation

Pfau, Wade D. 2016. “Incorporating Home Equity into a Retirement Income Strategy.” Journal of Financial Planning 29 (4): 41–49.

Learn More

CE Credit Opportunity: Listen to Wade Pfau's April 6, 2016 webinar, "Leading Retirement Researcher Makes 'New' Case for Low-Cost Reverse Mortgage".