Journal of Financial Planning; August 2013

Betty Meredith, CFP®, CFA, CRC®, is the director of education and research at InFRE, where she oversees incorporation of research findings and best practices into InFRE’s certification study and professional continuing education programs.

What we’ve got here is a failure to communicate.” (Cool Hand Luke, 1967). However, our failure isn’t a failure to communicate; it’s a lack of best practices, products, software, and retirement plan design that appropriately addresses the retirement income planning and risk management needs of the middle market. What we’ve got here is a failure of the financial planning industry to help the middle market make informed retirement decisions when they need it most.

In my April 2013 Journal column, “Still MIA: Comprehensive Best Practices for the Mid-Market”, I referred to the Society of Actuaries (SOA) study “The Impact of Running Out of Money in Retirement,”1 which concluded that running out of money is too large of a risk to self insure. This follow-up column highlights another recent SOA paper, “Middle Market Retirement: Approaches for Retirees and Near-Retirees,”2 which spells out the models most used today by individuals, professionals, and other service providers, and evaluates how well they meet the retirement income and risk management planning needs of the middle market.

The U.S. middle market is defined in 2009 SOA-sponsored research as representing approximately 12 million, or 11 percent of all households, headed by people 50 to 75 years old who are approaching or currently in retirement and have a net worth between $50,000 and $1 million. It excludes the 25 percent of this age group with less income and assets, and the 15 percent with more.3

Models Applied Today

Most of today’s retirement income strategies or models focus on how to manage investable assets to provide a retirement income stream with a high probability of lasting at least 30 years. For most people in the mid-market, their largest financial assets (in order of financial value) are the present value of their future Social Security and/or pension benefits, their home equity, and then their IRA and/or defined contribution savings, according to “The Impact of Running Out of Money in Retirement” study. Only the last of these assets are potentially “manageable” over time by financial professionals, and in most cases it has the least value of the three. Most of today’s asset-oriented retirement income models aren’t designed to address the retirement income and risks management needs of the mid-market.

According to the SOA’s “Middle Market Retirement” paper, the retirement analysis/advice models commonly used today can be categorized as follows:

Asset management models that focus almost exclusively on retirement asset value targets, where the investment objective is to meet income and growth and/or legacy intentions. Other retirement risks are minimally considered. Sub-categories include:

- Pure asset allocation models

- Asset allocation models, such as Monte Carlo, that are adapted to provide retirement income (the approach used by most securities firms today)

- Bucket strategies, where assets are divided and managed according to an identified risk profile and time period for anticipated withdrawals

- Asset liquidation models that consider tax and other characteristics to arrive at a distribution plan

- Target date funds where assets are managed according to a common risk profile

- Rule of thumb models, such as the 4 percent rule, or the invest-conservatively-and-live-off-the-interest rule

Income and cash-flow models that focus on producing a smooth, sustainable income stream that preserves income and asset values. Financial-product focused, this approach generally provides little consideration of other retirement risks or life circumstances. Sub-categories include necessary versus discretionary expense models that are geared to securing lifetime income sources for necessary expenses and use of riskier investments for discretionary expenses, and cash flow models that take into account expenses and multiple income sources.

Risk management models that focus on providing risk management, income security, or preservation of assets by evaluating key risks beyond mortality and financial risk. Most software today evaluates retirement risks in isolation from one another. Sub-categories include:

- Integrated models that cover multiple risks and provide recommendations for how solutions can address a combination of risks

- Step-wise models that address one risk at a time until funds run out based on a consumer’s priori-tized risks

- Non-integrated models that evaluate multiple risks as standalone decisions

Holistic models that evaluate a host of risks and decisions together, including lifestyle decisions as well as those that are non-financial, to provide a financially sound life plan. Sub-categories include integrated financial models (only a few software packages actually do this), and multi-disciplinary models that provide an evaluation of the whole person or entire family and that make both financial and non-financial recommendations. Sophisticated software versions do not exist today for multi-disciplinary models; however some consumer or professional software packages do holistically provide guidance for individuals in the second half of life.

How to Evaluate Models for Use with the Middle Market

The centerpiece of the SOA’s “Middle Market Retirement” paper is a chart comparing the previous models to what your mid-market clients need you to do for them. It states whether the model includes, usually includes, sometime includes, usually doesn’t include, or doesn’t include addressing various issues from the perspective of the mid-market, including tax issues, as well as:

Financial management issues

- Investment risk

- Inflation risk

- Order of pay-down of assets

- Disposition of IRAs, 401(k)s, etc.

- Projection of future assets

- Projection of future cash flows

- Debt (including mortgage) management

- Social Security claiming

- Defined benefit plan option choice

- Annuitization

- Disposition of life insurance

- Use of reverse mortgage

Life risks

- Risk of living too long

- Long-term care risk

- Catastrophic illness costs

- Death of a spouse

- Inability to work for pay

- Family member’s unexpected needs

- Care for disabled family members

- Loss of guaranteed income

Life choices

- When retirement can/should begin

- Post-retirement career changes

- Lifestyle/expense management

- Home downsizing or relocation

- Choices of both couples addressed

- Change in marital status

- Gifts/bequests/education funding

- Non-financial legacies

Applicability

- Pre-retirement (accumulation)

- Early retirement

- Late retirement

- Affluent households

- Upper-middle income households

- Lower-middle income household

Other characteristics

- Low cost per use

- Small time commitment per use

- Independent use by consumers

I highly recommend reviewing the complete version of this information that begins on page 7 of the report, where you’ll get a clearer picture of how well the models apply to different market segments. You’ll find that the asset management models most used today don’t include what we should be evaluating to help middle market clients make informed decisions.

Which Models Are Best for the Middle Market?

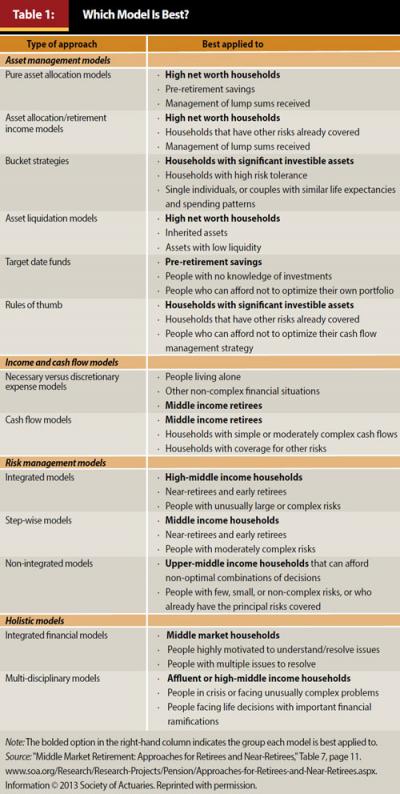

The most effective retirement analysis/advice approaches in practice today for use with the mid-market are the income and cash flow, risk management, and holistic models (in other words, not the asset management models). However, new and improved approaches and products are still needed. The market segment most appropriate for each approach is bolded in Table 1.

More Is Needed

Most retirement income planning today is adapted from models used to accumulate assets. These approaches are not relevant to the needs of people with few manageable assets who need to make critical decisions regarding the timing of retirement and risk management.

Many gaps and problems still exist with the software available to planners for use with the mid-market. Retirement income planning and risk management needs to be holistic so that it incorporates cash flow, assets that don’t need to be managed over time, risk management, and life choices. Most planning resources today only address subsets of these approaches.

Planners don’t have the comprehensive resources and planning tools needed to properly serve this market. We could use the help of the academic community in developing new approaches, products, software improvements, and retirement plan design ideas.

Endnotes

- Access “The Impact of Running Out of Money in Retirement” study, a November 2012 project by the Society of Actuaries Committee on Post Retirement Needs and Risks, the Urban Institute, and the Women’s Institute for a Secure Retirement, at www.soa.org/Research/Research-Projects/Pension/Running-Out-of-Money.aspx.

- Access the March 2013 paper “Middle Market Retirement: Approaches for Retirees and Near-Retirees” at www.soa.org/Research/Research-Projects/Pension/Approaches-for-Retirees-and-Near-Retirees.aspx.

- See the April 2009 paper “Segmenting the Middle Market: Retirement Risks and Solutions Phase I Report” at www.soa.org/Research/Research-Projects/Pension/Research-Segmenting-Market.aspx.