Journal of Financial Planning: December 2017

Executive Summary

- Approximately 25 percent of all women over the age of 65 are widows. Nearly one out of five widowed women either remarry or enter into a committed relationship within 25 months of a spouse’s death.

- Financial planners face the possibility that widowed clients will switch financial planners at remarriage or upon entering a committed relationship.

- This study provides evidence of a technique that can be used to increase the financial confidence of widowed clients who are considering remarriage, and as a result, reduce the likelihood a widowed client will leave the financial planner-client relationship.

- Financial confidence was found to be positively associated with pre-commitment documentation, pre-commitment discussions, resiliency, and adaptability.

- Of particular interest in this study was the role working with a financial planner prior to entering a marriage or long-term partnership played in shaping financial confidence outcomes. Working with a financial planner was found to be positively associated with pre-commitment documentation, pre-commitment discussions, and financial confidence.

- Outcomes for clients who worked with skilled financial planners—those who exhibited empathy and communication skills—were almost twice as high compared to the less-skilled professionals.

John E. Grable, Ph.D., CFP®, holds an Athletic Association Endowed Professorship at the University of Georgia, where he serves as director of the Financial Planning Performance Laboratory. He was founding editor of the Journal of Personal Finance and founding co-editor of the Journal of Financial Therapy. His research interests include financial risk-tolerance assessment, evidence-based financial planning, and behavioral financial planning.

Carrie L. West, Ph.D., teaches in the communication department at Schreiner University in Kerrville, Texas. Being widowed at age 29 with two young sons inspired her research area in communication of bereaved spouses and families.

Linda Y. Leitz, Ph.D., CFP®, has been a financial professional since 1979. She helps individuals and small businesses with their long-term financial goals. She is the author of The Ultimate Parenting Map to Money Smart Kids and We Need to Talk—Money and Kids After Divorce.

Kathleen M. Rehl, Ph.D., CFP®, is an authority on widows and their financial issues. A widow herself, she is the author of the award-winning book, Moving Forward on Your Own: A Financial Guidebook for Widows.

Carolyn C. Moor is the founding director of Modern Widows Club, a non-profit leading a movement to enable and empower widows to become mentors, leaders, and advocates in their communities. She has been featured in The Wall Street Journal, Orlando Sentinel, Houston Chronicle, NPR, PBS, HuffPostLIVE, TLC, and The Oprah Winfrey Show.

Michele N. Hernandez is the founder and executive director of the Soaring Spirits Loss Foundation, a motivational speaker, freelance writer, and creator of widowsbond.com and the Widow Match program. Since the death of her husband in 2005, she has made reaching out to other widows her personal mission.

Susan Bradley, CFP®, is the founder of the Sudden Money® Institute, which trains financial advisers and other professionals in financial transitions planning, a set of processes and tools for managing the human dynamics of financial change. She is co-author of Sudden Money: Managing a Financial Windfall.

A renewed effort among researchers over the past decade has focused on better understanding the value financial planners add to their clients’ well-being. The traditional thought has been that financial planners contribute to a client’s financial situation by improving portfolio performance, which has traditionally been measured with investment metrics, such as alpha. Historically, financial planners have used their knowledge, skills, and connections to help their clients make better portfolio choices. Optimized choices were commonly thought to result in lower management costs and increased flexibility when reacting to market conditions. Over time, these advantages have been eroded by products and services that allow consumers to obtain similar advice and returns with lower costs (Epperson, Hedges, Singh, and Gabel 2015).

Rather than focus on the benefits of financial planning strictly from an alpha viewpoint, several studies have examined other elements of a client’s situation that improve when working with a financial planner. Within the broader population, there is evidence to suggest that financial professionals are effective in helping their clients: (a) deal with daily financial stress (Britt, Lawson, and Haselwood 2016); (b) increase wealth over the life span by recommending strategies that smooth income and consumption (Grable and Chatterjee 2014; Hanna and Lindamood 2010; Warschauer and Sciglimpaglia 2012); and (c) increase portfolio and tax efficiency (Blanchett and Kaplan 2013; Brenner 1998).

Two concepts that emerged from these studies include gamma and zeta. Gamma can be used to quantify the additional value someone can obtain by making more informed financial planning decisions. Blanchett and Kaplan (2013) noted that financial planners add at least 1.50 percent in alpha-like returns above and beyond what would normally be expected in a portfolio. Zeta is a measure of the level of household wealth volatility. Grable and Chatterjee (2014) extended the work of Blanchett and Kaplan by showing that those who work with financial planners exhibit approximately 3 percent less wealth volatility over time.

The evidence showing a positive wealth effect associated with financial planning is robust. What is less well known is whether working with a financial planner is beneficial in other ways. Britt et al. (2016) documented that financial planners provide counseling advice that generally reduces the financial stress experienced by their clients. Others have noted that communication and interpersonal skills play a vital role in creating client trust and commitment, with clients who are engaged in deeper relationships with their financial planner reporting greater life satisfaction (Carpenter 2012; Sharpe, Anderson, White, Galvan, and Siesta 2007).

The present study was undertaken to further this line of inquiry by testing whether the interpersonal skill of a financial planner (i.e., a qualitative factor) is associated with a client’s engagement in improved financial planning behavior, as well as increased financial confidence.

The sample used for this study included widowed women who had remarried or entered into a long-term committed partnership.1 This is an important subpopulation of financial planning clients. According to the U.S. Census Bureau,2 approximately 25 percent of all women over the age of 65 are widows. Of these women, nearly 10 percent have, since the death of their spouse, gone on to either remarry3 or enter into a committed relationship.

Schneider, Sledge, Shuchter, and Zisook (2011) provided insights into the dating and remarriage status of recently widowed individuals. Nearly one out of five widowed women were either remarried or in a committed relationship within 25 months of a spouse’s death. Younger women were found to be more likely to become involved in a new romance, although negative feelings regarding remarriage and dating were present. Schneider and his associates noted that “dating and remarriage are common and appear to be highly adaptive behaviors among the recently bereaved” (p. 51). This can put some financial planners at risk, if and when their widowed clients shift financial planners (and assets under management) upon remarriage.

Very little is known about this growing population, especially from a financial planning perspective (Rehl, Moor, Leitz, and Grable 2016). Harris (2017) noted, however, that “the risk of widowhood is real and the effects are much more than financial” (p. 34). He pointed out that working with widows can be challenging because often they switch planners or become fearful of making financial mistakes.

A primary contribution of this study is to help the financial planning community document another value of financial planning: building financial confidence among vulnerable populations.

Background Review

Widows represent one of the fastest-growing market segments for financial planners. According to Waymire (2017), widows, as a group, are expected to control trillions of dollars in assets within the next 30 years. This can be viewed positively or negatively. On the positive side, widows tend to need and want professional financial planning help when conceptualizing the next stage of life. On the negative side, it has been estimated that 70 percent of widows will change their current financial planner (Waymire 2017). A primary factor driving the decision to change planners is remarriage and entering into a new committed relationship. Widows often elect to engage the services of their new partner’s financial planner.

The decision to shift assets from one financial planner to another is often predicated on the level of trust and commitment within the original planner-client engagement (Sharpe et al. 2007). A financial planner’s interpersonal skill is one indicator of how strong the trust and commitment effect is in practice. It is known that a client-centered approach results in greater client retention (Elliott 2013).

Specifically, financial planners who exhibit empathy, listening skills, and an understanding of the client’s fears and desires are generally in a better position when developing a committed relationship with their clients (Grable and Goetz 2017). Such skills are particularly relevant when dealing with widowed clients because, as a group, they are likely to experience a meaningful change in their financial status (Weaver 2010), while simultaneously transitioning from making financial decisions with their late spouse, to making financial decisions alone, and to possibly learning how to make those decisions again, but with a new partner. Because of these unique life circumstances, widows may be especially reliant on a trustworthy and empathetic professional.

Outcomes directly associated with high-level interpersonal skills include proactive client financial planning actions. For example, one would expect a widowed client who is (a) considering remarriage, and (b) working with an empathetic financial planner to engage in more pre-commitment financial planning discussions and document preparation. These actions, in turn, should be related to enhanced financial confidence, including financial satisfaction.

Conceptual Framework

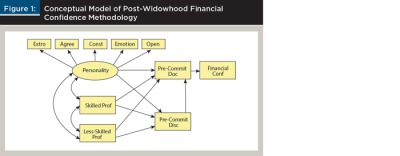

Figure 1 illustrates the conceptual framework tested in this study. The key outcome variable is the financial confidence of remarried and committed relationship widows (labeled “Financial Conf” in Figure 1). Financial confidence was used in the model as an indicator of the stability of the planner-client relationship. Clients of financial planners who reported high levels of confidence after working with their planner should be less likely to shift assets to a new planner. On the other hand, lower levels of confidence after working with a financial planner may indicate a higher likelihood of changing planners. This hypothesis stems from the work of Lusardi and Mitchell (2011) and others (e.g., Robb, Babiarz, and Woodyard 2012) who noted that those who are more financially savvy and confident tend to be more stable in their behavior and choice outcomes, especially in relation to planning for retirement.

As illustrated in Figure 1, a client’s personality and planner status (working with a skilled planner, labeled “Skilled Prof,” or a less-skilled financial professional, labeled “Less-Skilled Prof”) were hypothesized to be associated with the number of pre-commitment (i.e., prior to marriage or entering into a long-term partnership) discussions (under the “Pre-Commit Disc” section) engaged in with a widow’s significant other and financial planning behavior (Pre-Commit Doc).

Personality was measured with five variables: (1) extroversion (Extro); (2) agreeableness (Agree); (3) conscientiousness (Const); (4) emotional stability (Emotion); and (5) openness to new experiences (Open). For the purposes of this study, personality was used as an indicator of a respondent’s temperament, trait dispositions, risk tolerance, and emotional stability. In the model, personality was a latent construct, which explains the arrows from personality to the five personality variables. Pre-commitment discussions and document development were then hypothesized to be associated with post-widowhood financial confidence. The dual arrow lines in the model represent a hypothesized covariance among variables.

As will be discussed in more detail later in the paper, findings from this study are noteworthy because they suggested that financial planners who attempt to learn about a widowed client’s unique situation help the client engage in more proactive financial planning behavior and more financial discussions with their significant other. Although indirect, the findings also indicate that the use of a skilled and empathetic financial planner is associated with post-widowhood financial confidence.

Methodology

Data source and sample. Data were collected using an online survey. The survey was distributed to networks of widows, primarily to members of the Modern Widows Club (MWC), a 501(c)(3) non-profit founded in 2011, and Soaring Spirits International (SSI), a 501(c)(3) non-profit founded in 2008. The survey was available in mid-2016 and remained open for three weeks. Advertising for the survey was conducted using MWC and SSI listserves and partnerships with social media sites for widows. A drawing for one of six $50 Amazon or Visa gift cards was offered. For the purposes of this study, the analysis was delimited to include only women and those who had since married or entered into a long-term partnership at the time of the survey.

While the survey was open to any widow regardless of nationality, 91 percent of those who completed the survey lived in the United States. The remainder were from Canada (5 percent), the United Kingdom (2 percent), and other countries including Australia, South Africa, Nigeria, Ireland, Scotland, Kenya, Spain, Switzerland, Greece, India, Romania, Luxembourg, Venezuela, Kenya, Israel, France, Italy, and Singapore (2 percent).

The final sample size, adjusting for delimitations and missing data, was 690. Nearly all respondents were a first-time widow; however, about 3 percent of respondents reported being widowed more than once. The average age of respondents was 48.66 years, although the range in ages was large (18 to 89 years). About one-third of respondents were widowed when they were in their 50s. Less than one-third of respondents were widowed in their 40s. Those who were widowed in their 30s and 60s represented 17 percent and 14 percent, respectively, of the sample. Only 4 percent and 3 percent were widowed in their 20s and 70s, respectively.

Variables. The endogenous outcome variable was a respondent’s financial confidence after entering into a long-term relationship or marriage. The specific question used to measure confidence was: “How do you feel about your overall financial situation since you married again or entered your long-term relationship?” Five choices were provided: (1) much less financially confident; (2) less financially confident; (3) about the same level of financial confidence; (4) slightly more financially confident; and (5) much more financially confident. The mean, median, and standard deviation for the item was 3.49, 3.00, and 1.00, respectively.

Pre-commitment discussions were evaluated with the following question: “If you and your new spouse/long-term partner talked about money issues before your commitment to be together, check any of the following topics you talked about together.” Eleven topics were provided, in addition to an “other” category that allowed respondents to report something else. Examples of discussion topics included where they would live, levels of outstanding debt, and money history (including previous money problems and successes). An index of money discussions was created by adding together all the items marked. The mean, median, and standard deviation of the index was 5.33, 5.00, and 3.49, respectively.

Financial planning behavior was estimated using an index of pre-commitment documentation. The model was developed based on responses to the following question: “When you married again or entered your long-term partnership, if you created or updated any of the following documents, please check these below.” Options included (1) advanced health care directive; (2) cohabitation agreement; (3) deed to property; (4) financial plans; (5) long-term care plans; (6) prenuptial agreement; (7) trust; (8) will; and (9) other, which was an open-ended response. The summed mean, median, and standard deviation for the index was 1.28, 1.00, and 1.60, respectively.

A latent construct called “personality” was developed using a confirmatory factor analysis within the structural equation model (described in more detail below). A respondent’s personality was hypothesized to consist of five manifest variables: (1) extroversion; (2) agreeableness; (3) conscientiousness; (4) emotional stability; and (5) openness to new experiences. Each of these dimensions was measured using the 10-Item Personality Inventory (TIPI) (Gosling, Rentfrow, and Swann 2003). The TIPI has been widely used in the literature as a measure of traits that are relatively stable across the life span. Someone with high personality scores in each of the dimensions was thought to exhibit positive characteristics, including resiliency, creativity, and adaptability. Within the model, personality was hypothesized to be associated with the use of a financial planner, as well as directly associated with a respondent’s engagement in pre-commitment discussions and documentation development.

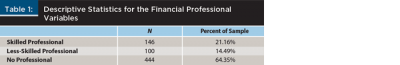

Finally, respondents were asked if they had worked with a financial professional before they remarried or entered into their long-term partnership. Three response categories were provided: (1) yes, and the financial professional asked about my new relationship and discussed special financial issues to consider before I married again or entered my long-term partnership; (2) yes, but the financial professional did not ask about my new relationship or discuss special financial issues to consider before I married again or entered my long-term partnership; and (3) no, I didn’t work with a financial professional. Each response category was recoded as a dichotomous variable, with the first category titled “skilled professional,” the second category titled “less-skilled professional,” and the third category titled “no professional.” Table 1 shows how the respondents were split among these categories.

The skilled professionals were thought to represent empathetic financial planners. The type of financial professional used by a respondent was hypothesized in the model to be directly associated with engagement in pre-commitment discussions and documentation development.

Analysis. The model was tested using a structural equation modeling (SEM) technique with AMOS for SPSS 24.0. SEM relies on both observed and latent variables to identify pathways between and among variables. For the purposes of this study, the technique was used to discover associations among the variables. The causality of the paths was not specifically addressed. As shown in the model, personality was a latent variable thought to be described by five manifest variables. The hypothetical relationships among these variables were tested using confirmatory factor analysis within the SEM. The five square boxes in the model represent observed or measured variables. The single-arrow lines were the tested links between constructs. The dual-arrowed lines represent the possibility of covariance between observed variables. Error terms associated with each endogenous variable (i.e., pre-commitment discussions, pre-commitment documentation, and financial confidence) were represented with the small circles with arrows.

Results and Discussion

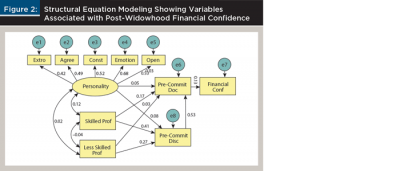

Figure 2 shows the results of the test. The numbers in the figure represent standardized beta coefficients for each of the hypothesized relationships in the model. The circles with arrows (e1, e2, etc.) represent error terms of the predicted variables. Based on statistical norms, the overall model was found to be robust. The normed fit index (NFI) and comparative fit index (CFI) were 0.934 and 0.938, respectively. The root mean square error of approximation (RMSEA) was 0.056. Each path in the model was found to be statistically significant at the p< 0.01 level. The only non-significant association in the model was the covariance between personality and working with a less-skilled professional (p = 0.315).

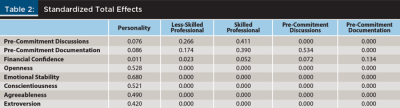

The standardized total effects (i.e., a combination of direct and indirect effects) are shown in Table 2. Several noteworthy relationships were present in the data:

The strongest association with financial confidence was found to be with pre-commitment documentation. Those who reported creating or updating important financial planning documents prior to entering marriage or a long-term partnership were more confident in their post-widowhood financial situation.

Pre-commitment discussions were also found to be positively associated with post-widowhood financial confidence.

The association between pre-commitment documentation and pre-commitment discussion was particularly strong. Those who were actively engaged in discussions with their significant other prior to marriage or before entering the relationship reported drafting more financial planning documents.

A respondent’s personality was found to be positively associated with pre-commitment documentation, pre-commitment discussions, and post-widowhood financial confidence. In general, those who exhibited resiliency and adaptability were more likely to review and update important financial planning documents, engage in more discussions with their significant other, and report being financially confident.

Of particular interest in this study was the role working with a financial planner prior to entering a marriage or long-term partnership played in shaping financial confidence outcomes. Although working with a financial planner was found to be positively associated with pre-commitment documentation, pre-commitment discussions, and financial confidence, the effect was most pronounced for those titled “skilled professional” in this study. The standardized effects were nearly double for the skilled professionals compared to the less-skilled professionals. It does appear that those who work with a financial professional who inquired about the new relationship and special financial issues (for example, playing the role of financial therapist)—they were empathetic—may be in a better position to prompt a widow to review important financial planning documents and engage in more deep and meaningful discussions. Those widows whose financial professionals exhibited client-centered communication practices were found, in this study, to report being more confident in their post-widowhood financial situation.

It does look as if the delivery of skilled financial advice is associated with better outcomes for those who have been widowed. Skilled financial professionals appear to add value by helping their clients deal with the emotional complexities associated with being a widow and the equally challenging aspects of entering a new marriage or committed relationship. It may also be true, as noted by Collins (2012), that financial professionals reduce the emotional and financial burdens associated with implementing needed recommendations. The pathway from skilled advice-giving to enhanced client confidence is an important finding from this study (McClune 2010).

Financial Planning Implications

The implications of this study are important for financial planners. As fiduciary standards are becoming more prevalent through the Department of Labor fiduciary standard and revised standards from the Certified Financial Planning Board of Standards Inc., doing what is deemed to be in the client’s best interest can include delving into areas that seem qualitative and secondary to the essence of financial planning, such as inquiring about the status of a new relationship or asking questions that sometimes prompt an emotional client response. Yet, as shown in this study, incorporating qualitative aspects in practice can become a key element to developing a strong planner-client relationship.

The shift to a more client-centered approach necessitates higher levels of interpersonal communication competence in order for financial planners to successfully navigate the merging of the qualitative and quantitative needs of their clients. The onus may be construed to be on the financial planner to determine if widowed clients have the confidence to advocate for protecting their financial well-being in the event a new relationship moves toward marriage.

The results from this study give support for the notion that financial planners should consider adding services or processes for existing and prospective clients. The data from this study showed that widows who engage in pre-commitment discussions about financial issues are more likely to have pre-commitment documentation of these issues. Counseling and advising on financial issues and potential elements in marital agreements and cohabitation agreements can be a valued-added service offered by financial planners or someone on the financial planner’s staff. These services can also open avenues for professional collaborative relationships with attorneys who draft estate documents and marital agreements.

This study provides additional support to the observation that financial planners are no longer merely the providers of quantitative enhancements for their clients. Competing on the basis of added alpha or other investment metrics may no longer be sufficient to keep clients engaged. As shown here, skilled financial planners may have a competitive advantage in the marketplace by shaping qualitative client perceptions.

Widowed clients who viewed their financial planner as being caring, empathetic, and a good listener also reported greater financial confidence. This implies that financial planners who have a desire to create stronger relationships with clients ought to reevaluate their qualitative planning skills.

Widows are a group in need of financial assistance. An opportunity exists for financial planners who have such skills. Widowhood and remarriage are two life events that simultaneously include an increase in the number of financial decisions being made, changes to identity, adapting future goals, and the emotional challenges of ending and/or beginning a spousal relationship. As shown in this study, financial planners who first deal with the emotional context of these decisions will likely be in a better position to develop confidence among this population of clients.

Some financial planners may decide that dealing with the emotional complexity involved in a widow’s situation to be beyond their scope of practice. As an alternative to building qualitative interpersonal and communication skills for this niche population, a financial planner may still be in a position to help clients who are widowed. One alternative involves partnering with a financial therapist. A financial therapist is trained and skilled in both financial counseling and mental health interventions. Larger firms might consider hiring a financial therapist or financial coach/counselor, or helping existing staff obtain specialized certifications such as the Certified Financial Transitionist® designation (suddenmoney.com/what-is-a-ceft, of which a co-author of this paper is a founder) or an emerging certification being created by the Financial Therapy Association (financialtherapyassociation.org). As the widowed population continues to expand, more of these skilled planners will likely be needed.

Endnotes

- Some of these women were no longer partnered due to the death of the new spouse/partner or because the new relationship had dissolved; for example, when major financial differences caused a split.

- See “Families and Living Arrangements,” table A1 available at https://www.census.gov/data/tables/2016/demo/families/cps-2016.html.

- See “Marital Events of Selected Group Quarters Populations: 2009–2011” available at census.gov/prod/2012pubs/acsbr11-19.pdf.

References

Blanchett, David, and Paul Kaplan. 2013. “Alpha, Beta, and Now… Gamma.” The Journal of Retirement 1 (2): 29–45.

Brenner, Lynn. 1998. “When You Need a Financial Expert.” New Choices 38 (8): 81–82.

Britt, Sonya L., Derek R. Lawson, and Camila A. Haselwood. 2016. “A Descriptive Analysis of Physiological Stress and Readiness to Change.”

Journal of Financial Planning 29 (12): 45–51.

Carpenter, Michael T. 2012. “Improve Client Trust and Communication in Volatile Markets.” Journal of Financial Planning’s Practice Management Solutions Magazine. Available at OneFPA.org/Journal/Pages/Improve-Client-Trust-and-Communications-in-Volatile-Markets.aspx.

Collins, J. Michael. 2012. “Financial Advice: A Substitute for Financial Literacy?” Financial Services Review 21 (4): 307–322.

Elliott, Robert C., 2013. “Regaining Client Trust Requires Further Commitment by Wealth Managers.” Journal of Wealth Management 16 (1): 81–84.

Epperson, Teresa, Bob Hedges, Uday Singh, and Monica Gabel. 2015. “Hype vs. Reality: The Coming Waves of ‘Robo’ Adoption.” A.T. Kearney report, available at www.atkearney.com/financial-institutions/robo-advisory-services-study.

Grable, John E., Swarn Chatterjee. 2014. “Reducing Wealth Volatility: The Value of Financial Advice as Measured by Zeta.” Journal of Financial Planning 27 (8): 45–51.

Grable, John E., and Joseph Goetz. 2017. Communication Essentials for Financial Planners: Strategies and Techniques. Hoboken, N.J.: Wiley.

Gosling, Samuel D., Peter J. Rentfrow, and William B. Swann Jr. 2003. “A Very Brief Measure of the Big-Five Personality Domains.” Journal of Research in Personality 37 (6): 504–528.

Hanna, Sherman D., and Suzanne S. Lindamood. 2010. “Quantifying the Economic Benefits of Personal Financial Planning.” Financial Services Review 19 (2): 111–127.

Harris, Bill. 2017. “Preparing Clients for Widowhood.” Journal of Financial Planning 30 (4): 34–35.

Lusardi, Annamaria and Olivia S. Mitchell. 2011. “Financial Literacy and Planning: Implications for Retirement Wellbeing.” National Bureau of Economic Research working paper No. 17078, available at nber.org/papers/w17078.

McClune, Sheila. 2010. “Consumer Demographics: What Do Financial Planning Services Consumers Look Like Now?” Journal of Financial Planning 23 (3): 4–7.

Rehl, Kathleen. M., Carolyn C. Moor, Linda Y. Leitz, and John E. Grable. 2016. “Widows’ Voices: The Value of Financial Planning.” Journal of Financial Service Professionals 70 (1): 53–60.

Robb, Cliff A., Patryk Babiarz, and Ann Woodyard. 2012. “The Demand for Financial Professionals’ Advice: The Role of Financial Knowledge, Satisfaction, and Confidence.” Financial Services Review 21 (4): 291–305.

Schneider, Daniel S., Paul A. Sledge, Stephen R. Shuchter, and Sidney Zisook. 2011. “Dating and Remarriage over the First Two Years of Widowhood.” Annals of Clinical Psychiatry 8

(2): 51–57.

Sharpe, Deanna L., Carol Anderson, Andrea White, Susan Galvan, and Martin Siesta. 2007. “Specific Elements of Communication that Affect Trust and Commitment in the Financial Planning Process.” Journal of Financial Counseling and Planning 18 (1): 1–17.

Warschauer, Tom, and Donald Sciglimpaglia. 2012. “The Economic Benefits of Personal Financial Planning.” Financial Services Review 21 (3): 195–208.

Waymire, Jack. 2017. “5 Financial Planning Tips for Working with Recent Widows.” Seeking Alpha, posted July 7 at seekingalpha.com/article/4079384-5-financial-planning-tips-working-recent-widows.

Weaver, David A. 2010. “Widows and Social Security.” Social Security Bulletin 70 (3): 89–109.

Citation

Grable, John E., Carrie L. West, Linda Y. Leitz, Kathleen M. Rehl, Carolyn C. Moor, Michele N. Hernandez, and Susan Bradley. 2017. “Enhancing Financial Confidence Among Widows: The Role of Financial Professionals.” Journal of Financial Planning 30 (12): 38–44.