Journal of Financial Planning: January 2012

It’s hard not to be romantic about baseball,” muses Brad Pitt (as general manager Billy Beane) in the Hollywood version of Michal Lewis’s Moneyball. Surprisingly, Pitt manages to romanticize both sabermetrics—the specialized analysis of baseball through empirical evidence and statistics—and coaching. In one highlight of the film, the ivory-tower Pitt descends into the Oakland A’s locker room to sell sabermetrics to his skeptical team. Coaching is clearly an acquired, not innate, talent for this general manager.

Marketing financial services dependent on asset class correlation, actuarial risk, and the time value of money can be as tough as selling sabermetrics. Although financial advisers require little adaptation to statistics (they love them), when it comes to selling those stats, survey after survey shows advisers rate their marketing effectiveness as low.

The account aggregation firm ByAllAccounts released one of the more recent surveys last October, confirming this fact.1 The survey found that slightly fewer than half of advisers consider their overall marketing strategy somewhat effective or effective. More than a quarter rate their marketing strategy as somewhat ineffective, and 6.3 percent think it’s not effective at all. The rest claim neutrality on the matter.

These dim statistics come at a time when industry experts Pershing Advisor Solutions and Moss Adams LLP argue that the adviser of the future must give “near-exclusive focus to clients and revenue-generating activity.”2

Marketing Coaches Come in Many Disguises

Financial planner turned business coach Diane MacPhee, CFP®, of DMAC Consulting Services LLC in Manahawkin, New Jersey, agrees that most financial advisers lack confidence in their marketing abilities. Unfortunately for these advisers, finding a coach who will “enter the locker room” with them takes a bit of research.

The first hurdle involves nomenclature. “Few people are pure marketing coaches or even call themselves a marketing coach per se,” says MacPhee. Most of the people who actually do marketing coaching refer to themselves as business coaches or life coaches or work with a PR/marketing firm that includes marketing coaching as part of its services. Most do something in addition to marketing.

Marie Swift, president and CEO of Impact Communications in Kansas City, Missouri, which includes marketing coaching as one element of the firm’s business, concurs. Swift and MacPhee typify two of the niches in which a planner might find the coaching he or she seeks—Swift being a PR/marketing consultant who functions as a coach and MacPhee being a business coach who includes marketing and business development as part of her practice.

Swift finds it necessary to add a few more distinctions, particularly between a marketing coach, a sales coach, and a PR consultant. Marketing coaches help advisers obtain referrals and new clients. Sales coaches assist advisers in closing a sale; these coaches were more popular when financial planning was a more transaction-oriented business. And finally, PR consultants function as a subset of marketing, helping position their clients in the media, for example, by pitching stories to journalists.

Kenneth Unger, president of Million Dollar Producer Inc. in the greater Sacramento, California, area, adds yet another distinction—that between training and coaching. Training provides planners information—plenty of the what. Coaching adds implementation to the information and includes the how, when, and why with the what. “Lots of training never gets to the level of coaching,” says Unger. “Buying a marketing system or newsletter service does not equal coaching.”

Marketing Is Only One Part of Your Game Plan

The second hurdle in finding a marketing coach to fit the needs of your firm entails an acceptance that successful marketing cannot be accomplished in a silo. Of all the experts and practitioners interviewed for this article, none offered marketing advice outside a broader package of services.

As an example, Unger offers a yearlong Executive Coaching Program that includes: (1) three information-intensive, two-day seminars, (2) monthly webinars to back up and refresh any information overload, (3) monthly one-on-one customized coaching over the phone with all participants, and (4) free materials including how to do seminars, sample tax reports, monthly letters, and special topic reports. Despite his firm’s name, Unger’s obsession is not sales but best practices. He works to build a marketing program around his clients’ skill sets so that the two reinforce each other. Marketing is merely the right skill set made visible. With this adage in mind, Unger has clients review a lengthy checklist of the services top-producing advisers provide for their clients.

Planners who show up for an Executive Coaching Program might be amazed to find as much emphasis placed on tax planning as on marketing. “We show advisers deeper and deeper levels of how to review a client’s tax return,” Unger explains. “How can advisers offer tax-advantaged products without doing detailed reviews of their clients’ tax returns?”

Like Unger’s firm, Pershing Advisor Solutions (PAS) uses an extensive checklist of services in working with its clients. According to Kim Dellarocca, director of marketing and head of practice management for PAS in Jersey City, New Jersey, Pershing’s Healthcheck asks clients more than 130 questions about their firms’ operations, compliance, marketing, and human resources. A few sample questions include:

- Is your client relationship management (CRM) system fully integrated with your asset allocation, portfolio management, financial planning, and reporting systems?

- How often do you contact clients during the year? (written, electronic, phone)

- How many claims have you had against your errors and omission policy in the last three to five years?

- Do you have a select group of “centers of influence” (for example, legal firms or CPA practices) from which you receive a steady stream of referrals?

- When bad news is reported about the markets, do you proactively communicate with your clients?

- Do you use checklists and written policies to minimize compliance risks?

- How many of your staff members have a clearly written job description?

- On average, how frequently do you refresh or add new content to your website?

- Do you segment your clients by revenue (or profitability) to your firm, and provide a corresponding tiered pricing model?

Before a firm adds new clients, Dellarocca says the primary question that underscores the marketing success potential is: “Are the proper mechanisms in place to support the growth of the firm?” If not, PAS asks its clients to clarify their business goals, then puts those goals through a stress test using the above diagnostics, and finally comes back to the goals with a documented client development plan. Only after this strenuous process will the PAS relationship manager (coach) and the client come together to execute the plan.

The third hurdle advisers face is accountability. Dellarocca says, “The relationship manager is the steady drum that builds accountability into client goals.”

MacPhee could not agree more; accountability is the primary value-add that separates coaching from consulting. She hired a coach herself to help her transition from financial planner to business coach. “What I got out of being coached was a comfort level with changing my career path,” she says. “I also learned about the accountability factor—one call a month to my coach.”

In her role as business coach, MacPhee doubled up on the accountability factor. She calls her clients twice a month to check on their progress.

In addition she asks them to send her a weekly accountability form. Weekly progress … no excuses! But her clients drive the agenda. “Tell me what you need to work on,” she says. And she never pushes clients to do things they hate: “I tell marketing clients, don’t do seminars if you hate public speaking. Try writing monthly letters or doing one-on-one lunches. Do what fits for you!”

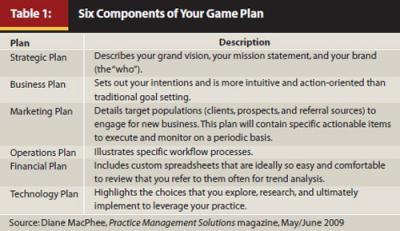

So when it comes to expectations when hiring a coach, keep in mind that marketing is often only one component of a larger game plan (see Table 1), and you should anticipate a little accountability along the way—that’s really what you’re paying for.

Marketing Advice

For Unger, the key to successful marketing lies in proactive, regular communication—mailings, meetings, and seminars. He recommends a minimum of monthly mailings to clients, with the subject matter determined by the current economic climate and the media’s reaction to that climate. Mailings can address timely topics like the Roth IRA conversion or the gifting of IRA assets to charity, allowances for which change with newly enacted or expiring laws.

Additionally, he recommends that planners meet with clients anywhere from one to four times a year depending on the complexity of the client’s financial situation. Regular educational seminars (four to six annually) round out his communication counsel. These seminars might include updates on the economy or year-end tax strategies. Now is a particularly good time to address long-term estate planning with the lifetime estate tax exemption set at $5 million through the end of 2012.

MacPhee, on the other hand, believes financial seminars are overrated. As she says, “So many are held that I think seminars are kind of played out. I think it’s better to gather a small group of four to six clients and ask them each to bring a friend for an informal gathering at the adviser’s office or even a restaurant.”

In particular she coaches planners on how to become comfortable with her top four opportunities for generic marketing:

- Relationships with local media

- Public speaking for those comfortable with it (not just seminars, but dinners and community-wide forums as well)

- Professional networking with attorneys and accountants (only a few are necessary)

- A formal system for client referrals

“Marketing is not about being pushy or promotional; it’s about letting people know who you are, what you do, and who you do it for,” MacPhee says. She asks all clients she coaches, “What do you do with clients to encourage referrals?”

Building referrals can be challenging. Swift believes that investment in marketing automation technology (MAT)—electronic database systems that help you segment, manage, and score prospective clients—is a crucial prerequisite to the referral process. MAT should be integrated into an adviser’s CRM system, and has often been referred to as a CRM system with a marketing engine built on top, to assist in the “lead nurturing” process.

The advantage of MAT has been documented. In the ByAllAccounts survey,3 three-quarters of advisers who use MAT consider their marketing strategy somewhat effective, effective, or extremely effective. This compares with only 48.2 percent of the advisers, who don’t use MAT, who claim the same sentiment. However, Dellarocca notes that many planners fail to use their CRM system beyond the contact management function. Pershing has identified eight functions crucial to an effective CRM system. In the process the company discovered that the “sales/pipeline management” function measuring the effectiveness of marketing campaigns and prospect development tends to be one of the least developed components among financial planners’ systems.

In addition to the investment of time and staff in the development of a firm’s MAT or CRM, Dellarocca sees niche marketing as an effective method of generating referrals for two reasons. First, by focusing on particular prospect groups (for example, surgeons, pilots, small-business owners) the adviser becomes more efficient at meeting the needs of these groups. Second, this expertise builds credibility among other prospects in these groups, leading to more referrals from within the group.

Group members feel that you “get them” when you focus on a certain niche. Dellarocca recalls one client with a niche practice serving women. In addition to the usual financial seminars for women many planners offer, one of Pershing’s coaches advised this client to offer a poker night simply to teach women how to play poker. The event was a big hit and increased the financial savvy of the women at the same time.

In addition to niche marketing, Pershing’s coaches often bring like-minded advisers together to share ideas and best practices. In these situations the advisers end up coaching each other on everything from segmented marketing to business succession planning.

Whatever the approach to generating referrals, the importance of frequent communication between planner and client cannot be overemphasized. A survey of 470 financial advisers conducted by the FPA Research Center quantified the amount of time necessary to generate new clients. Key findings reported in FPA’s Research Spotlight4 included the following:

- The most common amount of time planners dedicate to client communication each week is 10–14 hours. The greatest success in adding new clients, however, went to those who spend 30–34 hours a week communicating with clients.

- Advisers who frequently communicate with clients at group functions or by blog/forum/social media had the highest percentages reporting gains of new clients in the previous year.

- The most successful reasons for communicating (in terms of planners who added clients using them) were to educate clients on a particular topic and to discuss finances related to a life-changing event.

- The type of content included in the communication did not provide a clear, distinguishing difference in whether planners gained or lost clients in the previous year.

When you are sold on the need for more communication with clients, how do you find a coach to mentor this process for you?

How to Find a Coach and How Much to Expect to Pay

Swift recommends several ways to find a coach whose skills include marketing. One is to check with your broker-dealer or custodian to see if they have a group coach or individual coaches. For example, TD Ameritrade has a list of consultants it has vetted and recommends to financial advisers.

Another way is to check out www.VirtualSolutionsforAdvisors.com, a consortium of independent coaches and consultants whose founding members created an easily accessible, centralized database of outsourcing solutions and resources for financial planners. Use of the database is free and includes more than a dozen marketing firms. Still another way is to search for marketing webinars from FPA’s Virtual Learning Center (www.FPAnet.org/Professionals/Learn/VirtualLearningCenter).

When considering a coach or consultant, Swift suggests advisers ask direct questions:

- Do you work primarily in financial services?

- What services do you offer?

- What is your experience with financial advisers the size of

my firm? - What is a typical case for you?

- Do you work solo or as part of

a team? - How often will we talk?

- Do you help with implementation of the marketing plan?

- If we reach the limits of your expertise, do you refer clients elsewhere?

- How do you charge?

Coaches may be more cost-effective than business consulting firms, notes Swift, and planners might pay anywhere from $600 to $1,200 per month or $120 to $300 per hour. Expect a variety of charging techniques. Unger’s Executive Coaching Program charges an annual fee, and MacPhee typically engages in six-month contracts. Both professionals have large percentages of clients who renew those contracts multiple times.

Another way to gain perspective on coaching costs is to visit the website sponsored by CoachInc.com, www.FindaCoach.com, and go to “Looking for a Coach.” Interested parties can further click on either business or personal coaches and then divide their search by subcategory (business plan, marketing strategies, branding, etc.), goal (time management, conflict management, increased sales, etc.), country, and fee amount (all listed by monthly fee).

CoachInc.com, an online company headquartered in Bradenton, Florida, is the parent company of Coach U, the leading global provider of coach training programs. MacPhee, currently two months away from becoming a Professional Certified Coach (PCC) through the International Coach Federation (ICF), highly recommends the program for people interested in being coaches.

Conclusion

Why consider a coach if you’re in need of marketing guidance? The ultimate benefits are accountability and communication. The coach holds you accountable and helps you communicate with your clients. As Unger says, “There are only two rules to being successful in this industry: (1) always be meeting with clients, (2) always remember rule No. 1.”

The other advice to remember is Unger’s distinction between training and coaching. Financial services coach Barbara Kay, LPC, RCC, of Barbara Kay Coaching in Wheaton, Illinois, makes a similar distinction between consulting and coaching. Although there is a large amount of overlap between the two, Kay notes that in a consulting approach the client follows and the consultant teaches, whereas in a coaching approach the client leads and the coach promotes.

This distinction between consulting/training and coaching parallels Lao Tzu’s famous definition of a good leader (coach), penned well over 2,000 years ago: “As for the best leaders, the people do not notice their existence. The next best, the people honor and praise. The next, the people fear; and the next, the people hate…. When the best leader’s work is done the people say, ‘We did it ourselves!’”

Jim Grote, CFP®, is a financial writer whose articles have also appeared in Bloomberg Wealth Manager, Family Business Review, Financial Advisor, MorningstarAdvisor.com, and Planned Giving Today. He can be reached at jimgrote@hotmail.com.

Endnotes

- ByAllAccounts Inc. 2011. “Advisory Trends in Marketing and Business Development” (October).

- Pershing Advisor Solutions and Moss Adams LLP. 2007. “Fast Forward: The Advisor of the Future” (November).

- ByAllAccounts, ibid.

- Nelson, Christina. 2010. “Communication Styles and Business Growth.” Research Spotlight (Third Quarter).