Journal of Financial Planning: July 2015

George Nabeshima, Ph.D., CFP®, CLU®, ChFC ®, is a practitioner working with individuals and families to achieve their financial goals. He has been working in the financial services profession since 1995. His research interests include how psychological factors are related to financial decision making.

Martin Seay, Ph.D., CFP®, is an assistant professor at Kansas State University. His career objective is to provide impactful research into consumer financial issues while educating ethical, thoughtful, and well-rounded financial planners. His research focuses on consumer borrowing decisions and how psychological characteristics inform financial behavior.

Executive Summary

- Research was conducted to examine the relationship between personality traits and net worth using data from the 2010 panel of the Health and Retirement Study.

- Linear regression results identified extroversion and conscientiousness traits as being positively associated with net worth, whereas the agreeableness trait was negatively associated with net worth.

- These findings contribute to the financial planning field by showing how mental preferences expressed outwardly though personality traits are related to wealth accumulation.

- Planners can use the information from this study to help formulate strategies that assist clients in growing and managing wealth.

Personality can be defined as the set of organized characteristics held by individuals that uniquely influence their cognitions, motivations, and behaviors in various situations (Ryckman 2004). In other words, personality is an outward expression of one’s mental preferences and predispositions (Briggs Myers, McCaulley, Quenk, and Hammer 2009).

The purpose of this research was to examine the association between personality traits and wealth accumulation as measured by individual net worth.

Wealth accumulation affects individuals through both economic and non-economic means. Accumulated wealth can provide for economic security, consumption ability, and protection against income loss. Wealth can also increase the avaliablity of future financial options (Mitchell and Mickel 1999). Non-economic benefits of wealth accumulation include acquiring prestige and satisfying social status objectives (Rose and Orr 2007; Tang 1992). Due to the importance of net worth on various aspects of life satisfaction, past research has sought to understand what factors are associated with net worth development (Ozawa and Yeo 2011).

Previous wealth accumulation academic studies have focused on demographic factors (Ozawa and Yeo 2011; Ruel and Hauser 2013). These studies have found factors such as age, income, and education as significant variables positively related to accumulated wealth levels (Bryant and Zick 2006; Campbell and Kaufman 2006; Diaz-Gimenez, Quadrini, Rios-Rull, and Rodriquez 2002; Ozawa and Yeo 2011; Ruel and Hauser 2013). These types of studies have also reported that (1) males generally have higher net worth levels than females; (2) married households accumulate more wealth than single households; and (3) whites have higher net worth levels than non-whites. However, nearly all researchers have acknowledged that demographic characteristics alone are not sufficient for determining wealth because people with similar demographic characteristics accumulate radically different net worth levels (Ameriks, Caplin, and Leahy 2003). The goal of this research is to contribute to the understanding of what personality traits—in addition to demographic variables—are associated with wealth accumulation.

Literature Review

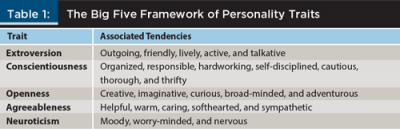

One personality classification system with broad acceptance within the psychology field is the Big Five framework (McCrae and Costa 1989; 2008). The Big Five framework identifies five separate and distinct personality trait categories. These trait categories include extroversion, conscientiousness, openness, agreeableness, and neuroticism. Table 1 provides a list of associated tendencies related to each of the trait categories in the Big Five personality framework.

Personality has been found to play a crucial role in how people make decisions, as well as how individual outcomes differ (Bensi, Giusberti, Nori, and Gambetti 2010). For example, studies have identified personality to be associated with school performance (Lievens, Ones, and Dilchert 2009), health-related choices (Bogg, Voss, Wood, and Roberts 2008), work performance (Caplan 2003), and occupation decisions (Briggs Meyers et al. 2009).

Regarding the research associating personality with financial decision making, using a sample of 2,800 households in the Netherlands, Nyhus and Webley (2001) found that higher extroverion scores were associated with less savings. They also found the agreeableness trait as inversely related to saving behavior. Later studies by Duckworth and Weir (2010; 2011) did find conscienousness to be positively correlated to savings and lifetime earnings, while higher levels of neuroticism decreased lifetime earnings.

Other studies have also noted an association between personality and income (Roberts, Kuncel, Shiner, Caspi, and Goldberg, 2007; Sutin, Costa, Miech, and Eaton, 2009; Viinikainen, Kokko, Pulkkinen, and Pehkonen, 2010).

Viinikainen et al. (2010) found that the extroversion, openness, and conscientiousness traits were associated with higher incomes and higher earning professions. They also noted the neuroticism trait was negatively associated with income. A potential explanation for this relationship was identified by Sutin et al. (2009). Those researchers concluded that the extroversion and conscientiousness traits tend to be associated with higher levels of career success—generally resulting in high incomes for individuals, while the neuroticism trait is negatively related to career success. Sutin et al. also identified the openness trait as being related to prestige variables, which is also related to higher incomes.

According to the doctrine of traits, differences in personality traits produce differences in behaviors and decision making outcomes (Kihlstrom 2013). This does infer an association between personality and net worth; however, the direction of association is not expressed in the trait doctrine. However, literature discussed previously regarding the influence of personality on saving, spending, and income does provide some guidance to the direction of the personality/net worth relationship. The extroversion, openness, and agreeable traits are all known to be associated with higher incomes. This indicates a potential positive relationship between these traits and net worth (Viinikainen et al. 2010). Neuroticism, on the other hand, is negatively related to income based upon past research implying a negative association with net worth (Duckworth and Weir 2010).

Past research regarding spending and saving behavior scores also supports the potential of a positive association between the conscientiousness trait and higher net worth levels (Duckworth and Weir 2010; 2011), while higher scores in extroversion and agreeableness should be associated with lower levels of net worth (Nyhus and Webley 2001; Verplanken and Herabadi 2001). However, the higher spending behavior by those with higher extroversion scores may be offset by their positive association with higher incomes.

Methodology

Data and sample. This study used the 2010 RAND data file version of the Health and Retirement Study (HRS), as well as 2010 panel data from the Psychosocial Lifestyle Questionnaire survey.

The HRS dataset is a national, longitudinal survey conducted by the Survey Research Center at the University of Michigan (National Institutes of Health 2007). The RAND dataset is a cleaned, processed, and streamlined variable collection of HRS data (RAND Center for the Study of Aging 2011). For the purposes of this research, data from the Psychosocial Lifestyle Questionnaire, which contains the critical information related to a respondent’s personality, was merged with the RAND dataset for analysis.

Variables. The dependent variable in this research was net worth. The independent variables of interest for this study were personality traits. Personality traits were measured using the MIDI personality scoring framework (Lachman and Weaver 1997).

The trait score for extroversion was calculated by averaging responses represented by five adjectives (outgoing, friendly, lively, active, and talkative).

The agreeableness trait was also calculated by averaging responses based on five adjectives (helpful, warm, caring, softhearted, and sympathetic).

Conscientiousness was evaluated by averaging responses represented by seven adjectives (organized, responsible, hardworking, self-disciplined, cautious, thorough, and thrifty) with three additional reverse-coded words (reckless, careless, and impulsive).

Openness used the average of seven adjectives (creative, imaginative, intelligent, curious, broad-minded, sophisticated, and adventurous).

Neuroticism was assessed using the average responses of three adjectives (moody, worrying, and nervous) and one additional reverse-coded adjective response (calm). Scores were calculated with a range between one and four, as long as at least half of the adjectives representing each personality trait were answered with higher numbers representing higher trait scores.

Reliability was measured using Cronbach’s alpha scores, which were: 0.75 for extroversion, 0.79 for agreeableness, 0.68 for conscientiousness, 0.80 for openness, and 0.71 for neuroticism. While the Cronbach’s alpha for conscientiousness was slightly low, these scores indicate that the measures have acceptable reliability (Field 2013).

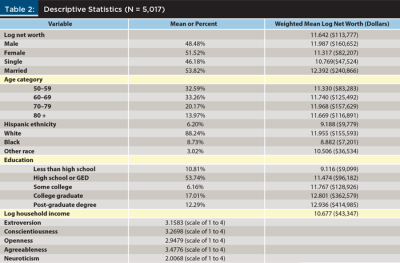

Age, gender, income, education level, race, and marital status represented control variables that were previously identified in past research literature associated with net worth. Measurement of these variables is shown in Table 2.

Statistical Analysis

A two-step hierarchical regression model was created to evaluate the association between personality and net worth.

First, a regression was conducted using an initial block of demographic control variables. Age, gender, income, education level, race, and marital status (as previously identified in the literature as being significantly associated with net worth) were incorporated at this stage of the analysis. Age was dummy coded as a nominal variable to better match the life-cycle hypothesis theory (Bryant and Zick, 2006), which suggests that age and net worth do not have a linear relationship but rather an inverse U-shaped relationship. Specifically, net worth should increase with age until retirement, then decline in later years.

Next, personality variables were added to the analysis as a way to identify the additional explanatory power offered by these variables. As outlined in the HRS guidelines, the Taylor Series linearization method was employed to incorporate the complex sampling design of the HRS data set. Complex sampling procedures are used when respondents have an unequal probability of selection based upon data stratification, data clustering, and weight functions (Aneshensel 2013; Nielsen and Seay 2014).

Results: Descriptive Statistics

Descriptive statistics for the sample are shown in Table 2. A total of 5,017 survey respondents were included in this study. All respondents were identified as the financial respondents for their respective households. Mean household net worth and household income (based on converted values from the natural log) was $113,777 and $43,347 respectively.

In regard to gender and marital status, households represented by a male financial respondent (48 percent of the sample) had a mean household net worth of $160,652, while households represented by a female financial respondent (52 percent of the survey) had a mean household net worth of $82,207.

Single households represented approximately 46 percent of the study, and married households represented 54 percent. Mean net worth levels of married respondents were noticeably higher. For example, married households had a mean net worth of $240,866 compared to a mean net worth for single households of $47,524.

As shown in Table 2, approximately 33 percent of respondents were between the ages 50 and 59; 33 percent were between 60 and 69; 20 percent were between 70 and 79; and 14 percent were 80 and older. Mean net worth was $83,283 for those between 50 and 59. In the 60 to 69 age category, mean net worth was $125,492. In the 70 to 79 age category, mean net worth was $157,629. Net worth decreased to $116,891 for those ages 80 and older.

Hispanics represented 6 percent of the sample’s ethnicity. Most respondents registered as whites (88 percent), followed by blacks (9 percent). Other races represented the remainder of the sample (3 percent). Hispanics and blacks had the lowest mean net worth of $9,779 and $7,201 respectively. Whites had the highest mean net worth of $155,593. Mean net worth for other races was $36,534.

Most respondents had a GED or high school diploma (54 percent). Those who had not attained at least a GED or high school diploma represented 11 percent of the sample. Respondents who at least attended college (6 percent), graduated from college (17 percent), or achieved a post-graduate degree (12 percent) represented the remainder of the education category variable.

Net worth increased with education. Mean net worth changed from $9,099, representing those without a high school diploma, to $96,182 for those whose highest education level was a high school diploma. Net worth increased to $128,926 for individuals with some college experience and further increased to $362,579 for college graduates. The mean net worth for those holding a post graduate degree was $414,985.

The independent variables of interest in this study were measured by personality traits on a scale from 1 to 4. Lower numbers represented lower trait levels, whereas higher numbers represented higher trait levels. Agreeableness was the most dominant trait with a sample mean of 3.48. The next highest trait, with a sample mean of 3.27, was conscientiousness. This was followed by the extroversion trait, which had a sample mean of 3.16. The openness trait was recorded at a mean of 2.95, and neuroticism was recorded at 2.01.

Regression Results

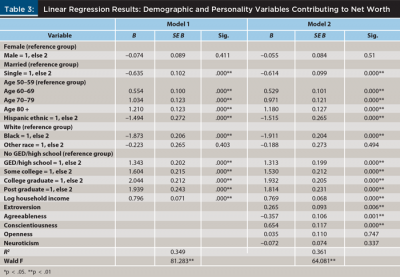

Results from the hierarchical regression can be found in Table 3. Results from the initial regression model using only demographic variables (model 1) were consistent with previously cited research. Marital status, age, ethnicity, race, education level, and household income were significantly associated with household net worth.

The analysis found married households reporting higher net worth values, controlling for all other variables, when using single households as a reference group. In addition, controlling for all other variables, age was positively associated with net worth. Higher age categories were accompanied with higher positive coefficient scores in this analysis.

Using whites as a reference category for race, blacks and other races had significant negative coefficient scores, controlling for all other variables. The Hispanic category also had a significant negative coefficient score, conveying lower net worth levels for this category when using non-Hispanics as a reference category for ethnicity and controlling for all other variables.

Finally, using no GED and no high school graduation as a reference category, all other higher education categories were found to be significantly associated with higher net worth values, holding all else equal.

Model 2 in this analysis included the same demographic variables in model 1, but this model also incorporated five additional personality trait variables. Overall, the addition of the personality traits increased the explained variance in net worth from 34.9 percent in model 1, to 36.1 percent in model 2. This represented an increase in modeling power; however, the effect size of the additional increase was small.

Three personality traits were identified as being significantly associated with net worth, holding all else equal. Extroversion and conscientiousness were positively associated with higher levels of net worth, while agreeableness was negatively associated with net worth. Specifically, holding all else constant, a one-unit increase in extroversion and conscientiousness trait scores was found to be associated with a 26.5 percent and 65.4 percent increase in net worth, respectively. Conversely, a one-unit increase in the agreeableness trait score was associated with a 35.7 percent decrease in net worth.

Discussion

Results suggest that the mental preferences related to the extroversion domain (facets such as outgoing, lively, and active) are associated with higher net worth levels. This is interesting because although previous research identified increased levels of extroversion to be associated with higher income (Roberts et al. 2007; Sutin et al. 2009; Viinikainen et al. 2010), other research has linked the extroversion trait with lower levels of total dollar savings (Nyhus and Webley 2001). Potentially, the higher income earned by those with higher extroversion scores offset their lower savings to increase net worth levels. Additional research in this area would be useful to further examine the dynamics between personality, savings behavior, and net worth.

Another potential reason for higher net worth levels being associated with increased extroversion scores could be related to risk tolerance. Higher return potential could exist with higher risk tolerance levels. Previous research has identified extroversion to be positively associated with risk tolerance (Filbeck, Hatfield, and Horvath 2005; Li and Liu 2008; Pompian and Longo 2004).

Additional research in this area would be benefical to further examine the relationship between extroversion, net worth, and risk taking. Specifically, it would be interesting to study how risk tolerance and extroversion are interrelated to influence net worth.

Consistent with previous studies, a significant positive association was found between an individual’s conscientiousness trait score and their net worth. Previous studies reported that the conscientiousness trait tends to be associated with higher lifetime earnings (Duckworth and Weir 2010) and higher levels of savings (Nyhus and Webley 2001; Verplanken and Herabadi 2001). This supports the notion that mental associations related to the conscientiousness trait domain (facets related to being organized, self-disciplined, and practical) are related to net worth.

An individual’s agreeableness trait score was found to be negatively associated with their accumulated net worth. Past research has shown a significant association between the agreeableness trait and income (Nyhus and Webley 2001). In this study, the agreeableness trait and net worth were inversely related. Still, this finding was consistent with other studies showing higher levels of agreeableness as being positively related to higher spending and lower savings behaviors (Verplanken and Herabadi 2001).

Conclusion

Previous studies documented the influence of personality on financial behavior and economic outcomes (Boyce and Wood 2011; Harrison and Chudry 2011; Nyhus and Webley 2001). The purpose of this study was to extend this literature by examining how personality affects wealth accumulation as represented by net worth. According to the doctrine of traits, personality is based upon how individuals obtain, focus, and process information, which can affect preferences and behavioral choices. The findings in this study identified three personality traits as significantly associated with net worth levels. Specifically, extroversion and conscientiousness traits were found to be positively associated with higher net worth, while the agreeableness trait was found to be negatively associated with net worth.

Because the extroversion and conscientiousness traits were positively associated with individual net worth, it would follow that mental choices that support extroversion and conscientiousness type behavior may potentially promote higher levels of financial wealth, as expressed by a client’s net worth level. For example, one attribute related to the extroversion trait is a higher capacity for adventure and uncertainty, while the conscientiousness trait is related with a preference for organization and responsibility. These attributes can be combined to facilitate implementation of financial strategies to build wealth that require financial risk in a responsible manner, such as risk strategies that involve a strong potential for gain while limiting potential downsides to one’s financial loss capacity.

In the case of the agreeableness trait, attributes associated with it include empathy, unselfishness, and generosity. The findings from this study indicate a negative association between this trait and higher levels of net worth likely exists. This finding conflicts with previous research that showed the agreeableness trait being associated with higher income levels (Nyhus and Webley 2001). Perhaps the goal of accumulated wealth may not be a top priority for individuals who score high in agreeableness. Instead, they may potentially be more concerned with the financial needs of others. Such areas of interest for these individuals may include life insurance planning for the care of dependents, educational funding for children and grandchildren, or charitable giving plans. Financial planning practitioners can help those who exhibit a high agreeableness trait preference by reminding them that they need to properly balance their own financial needs with those of others.

Preference and competency are two different issues that emerge from this study. It is important to note that personality is an outward reflection of mental preferences, not skill competencies (Briggs Meyers et al. 2009). For example, a salesperson or teacher may have a preference for introversion, but they may have also developed extroversion competency skills outside their preferences to interact successfully with customers or students. Understanding this difference is meaningful for financial planning practitioners when helping clients implement financial planning recommendations and promoting desired economic outcomes. If clients understand how their preferences (as expressed by their personality) potentially influence economic outcomes, they can make a conscious effort to focus on the preferences that support preferred outcomes, as well as developing behavioral competencies outside their behavioral and mental preferences that may further promote more advantageous results.

The research presented here can help financial planning practitioners better understand how personality theory can be used to help clients improve financial outcomes. It is important to remember that financial planners and their clients may have different mental preferences and predispositions from one another. These differences may create difficulties for planners in understanding their clients’ financial behavior and planning motivations in the area of wealth accumulation.

By considering how mental preferences and tendencies are expressed through personality traits, financial planners can better understand the mental predispositions driving the financial behavior and motivations in their clients. For planners who may be further interested in how personality is measured, additional information can be found in Lachman and Weavers’ (1997) research on personality measurement.

References

Ameriks, John, Andrew Caplin, and John Leahy. 2003. “Wealth Accumulation and the Propensity to Plan.” The Quarterly Journal of Economics 118 (3): 1007–1047.

Aneshensel, Carol. S. 2013. Theory-Based Data Analysis for the Social Sciences, 2nd ed. Thousand Oaks: Sage Publications.

Bensi, Luca, Fiorella Giusberti, Raffaella Nori, and Elisa Gambetti. 2010. “Individual Differences and Reasoning: A Study of Personality Traits.” British Journal of Psychology 101 (3): 545–562.

Bogg, Tim, Michelle W. Voss, Dustin Wood, and Brent W. Roberts. 2008. “A Hierarchical Investigation of Personality and Behavior: Examining Neo-Socioanalytical Models of Health-Related Outcomes.” Journal of Research in Personality 42 (1): 183–207.

Boyce, Christopher J., and Alex M. Wood. 2011. “Personality and the Marginal Utility of Income: Personality Interacts with Increases in Household Income to Determine Life Satisfaction.” Journal of Economic Behavior & Organization 78 (1–2): 183–191.

Briggs Myers, Isabel, Mary H. McCaulley, Naomi L. Quenk, and Allen L. Hammer. 2009. MBTI Manual, 3rd ed. Mountain View, CA: Consuling Psychologists Press.

Bryant, Kieth W., and Cathleen D. Zick. 2006. The Economic Organization of the Household, 2nd ed. New York: Cambridge University Press.

Campbell, Lori Ann, and Robert L. Kaufman. 2006. “Racial Differences in Household Wealth: Beyond Black and White.” Research in Social Stratification and Mobility 24 (2): 131–152.

Caplan, Bryan. 2003. “Stigler-Becker versus Myers-Briggs: Why Preference-Based Explanations Are Scientifically Meaningful and Empirically Important.” Journal of Economic Behavior & Organization 50 (4): 391–405.

Diaz-Gimenez, Javier, Vincenzo Quadrini, Jose-Victor Rios-Rull, and Santiago B. Rodriquez. 2002. “Updated Facts on the U.S. Distribution of Earnings, Income, and Wealth.” Federal Reserve Bank of Minneapolis Quarterly Review 26 (3): 2–35.

Duckworth, Angela L., and David R. Weir. 2010. “Personality, Lifetime Earnings, and Retirement Wealth.” Michigan Retirement Research Center Paper No. 2010–2235.

Duckworth, Angela, and David R. Weir. 2011. “Personality and Response to the Financial Crisis.” Michigan Retirement Research Center Paper No. WP 260.

Field, Andy. 2013. Discovering Statistics Using SPSS, 4th ed. Los Angeles: Sage.

Filbeck, Greg, Patricia Hatfield, and Philip Horvath. 2005. “Risk Aversion and Personality Type.” The Journal of Behavioral Finance 6 (4): 170–180.

Harrison, Neil, and Farooq Chudry. 2011. “Overactive, Overwrought, or Overdrawn? The Role of Personality in Undergraduate Financial Knowledge, Decision Making, and Debt.” Journal of Further and Higher Education 35 (2): 149–182.

Kihlstrom, John F. 2013. “The Person-Situation Interaction.” The Oxford Handbook of Social Cognition 786–806.

Lachman, Margie E., and Suzanne L. Weaver. 1997. The Midlife Development Inventory (MIDI) Personality Scales: Scale Construction and Scoring. Waltham, MA: Brandeis University.

Li, Shu, and Chang-Jiang Liu. 2008. “Individual Differences in a Switch from Risk-Averse Preferences for Gains to Risk Seeking Preferences for Losses: Can Personality Variables Predict the Risk Preferences?” Journal of Risk Research 11 (5): 673–686.

Lievens, Filip., Deniz S. Ones, and Stephan Dilchert. 2009. “Personality Scale Validities Increase Throughout Medical School.” Journal of Applied Psychology 94 (6): 1514–1535.

McCrae, Robert R. and Paul T. Costa, Jr. 1989. “More Reasons to Adopt the Five-Factor Model.” American Psychologist 44 (2): 451–452.

McCrae, Robert R., and Paul T. Costa, Jr. 2008. “The Five-Factor Theory of Personality.” In Handbook of Personality: Theory and Research, 3rd ed, edited by Oliver P. John, Richard W. Robins, and Lawrence A Pervin, 159–181. New York: The Guilford Press.

Mitchell, Terence R., and Amy E. Mickel. 1999. “The Meaning of Money: An Individual-Difference Perspective.” Academy of Management Review 24 (3): 568–578.

National Institutes of Health. 2007. Growing Older in America. National Institute of Health Publication No. 07-5757.

Nielsen, Robert B., and Martin C. Seay. 2014. “Complex Samples and Regression-Based Inference: Considerations for Consumer Researchers.” Journal of Consumer Affairs 48 (3): 603–619.

Nyhus, Ellen K., and Paul Webley. 2001. “The Role of Personality in Houshold Savings and Borrowing Behavior.” European Journal of Personality 15 (1): 85–103.

Ozawa, Martha N., and Yeoung H. Yeo. 2011. “Net Worth Accumulation by Different Quintiles of Older Adults Approaching Retirement Age and 10 Years Later.” Journal of Sociology and Social Welfare 38 (3): 9–30.

Pompian, Michael M., and John M. Longo. 2004. “A New Paradigm for Practical Application of Behavior Finance: Creating Investment Programs Based on Personality Type and Gender to Produce Better Investment Outcomes.” The Journal of Wealth Management 7 (2): 9–15.

RAND Center for the Study of Aging. 2011. RAND HRS data documentation, version L. Wahsington, DC: RAND.

Roberts, Brent W., Nathan R. Kuncel, Rebecca Shiner, Avshalom Caspi, and Lewis R. Goldberg. 2007. “The Power of Personality: The Comparative Validity of Personality Traits, Socioeconomic Status, and Cognitive Ability for Predicting Important Life Outcomes.” Perspectives on Psychological Science 2 (4): 313–345.

Rose, Gregory M., and Linda M. Orr. 2007. “Measuring and Exploring Symbolic Money Meaning.” Psychology and Marketing 24 (9): 743–761.

Ruel, Erin, and Robert M. Hauser. 2013. “Explaining the Gender Wealth Gap.” Demography 50 (4): 1155–1176.

Ryckman, Richard M. 2004. Theories of Personality, 9th ed. Belmont: Thomson/Wadsworth.

Sutin, Angelina R., Paul T. Costa Jr., Richard Miech, and William W. Eaton. 2009. “Personality and Career Success: Concurrent and Longitudinal Relations.” Journal of Personality 23 (2): 71–84.

Tang, Thomas L. 1992. “The Meaning of Money Revisited.” Journal of Organizational Behavior 13 (2): 197–202.

Verplanken, Bas, and Astrid Herabadi. 2001. “Individual Differences in Impluse Buying Tendency: Feeling and No Thinking.” European Journal of Personality 15 (1): 71–83.

Viinikainen, Jutta, Katja Kokko, Lea Pulkkinen, and Jaakko Pehkonen. 2010. “Personality and Labour Market Income: Evidence from Longitudinal Data.” Labour 24 (2): 201–220.

Citation

Nabeshima, George and Martin Seay. 2015. “Wealth and Personality: Can Personality Traits Make Your Client Rich?” Journal of Financial Planning 28 (7): 50–57.