Journal of Financial Planning: July 2015

Many financial advisory practices find it difficult to keep up with the changing times, particularly when it comes to lead generation and client acquisition. More often than not, this is a direct reflection of a firm’s marketing choices.

If your practice depends on traditional marketing tactics like cold-calling, paid advertising, or direct mail, it’s time to go digital—prospects and clients are looking for you online. What they find, or don’t find, often determines what happens next.

The myths, misconceptions, and mistakes presented here are some of the most common in the financial planning profession. Which of these financial marketing myths are you falling for?

Myth No. 1: My Leads Come from Referrals; Web Presence Doesn’t Matter

Today, you can expect about nine of 10 prospects (including referrals) to Google you before contacting you. The search engine results can make a big difference in what happens next: if your online presence appears credible, professional, and up-to-date, prospects are much more likely to take the next step (reach out by phone, email, etc.). If searchers can’t find you—or worse—don’t like what they find, they move on.

Although your website is only one part of your online presence, it’s the center point that connects all of the other moving parts, including social media profiles, directory listings such as FPA’s PlannerSearch, or Brightscope. The good news is that it doesn’t take a rocket scientist to put together a website that makes you look great online.

The mistake: A passive marketing strategy and outdated site. If you’re a financial planner who puts effort into client service, you will receive referrals from your existing clients. However, when referrals are the extent of your marketing plan, you have a passive marketing strategy.

This passive strategy feels productive in busy times, but it relies on the actions of others while you wait for the phone to ring. How long will you wait? Embracing the power of a website is one of the first steps to launching a proactive marketing strategy.

Today, it’s rare to find planners who don’t have any web presence. But it’s also common to see outdated, unprofessional financial websites that are template-based, static brochures filled with industry jargon, calculators, and stock tickers. These types of websites don’t help; in fact, they can do more damage than good.

The fix: Shift your mindset to your website being your marketing hub. Think of your website as a lead capture vehicle that is the catchall of your every effort in the marketplace. Your website works for you to screen and capture the right leads, to interact at your prospect’s “readiness level,” and to provide value to your clients.

Your website can be your No. 1 list-building marketing tool. When you design your site with your target audience’s needs first, the site will work best for you as you launch your proactive marketing efforts (see myth No. 4 for more).

Another fix: Plan for Google. Start where people are looking for you, and Google yourself. What does Google serve up in the search listings? You can’t take action until you know what your potential clients see.

Claim your Google business page. Most online searches begin with an engine like Google. Prospects search for your name or the name of your firm and make a first impression based on what results appear. A Google business page is a quick, easy, and free way to appear under key search terms.

Optimize for mobile. Recently, Google made a big change: websites that are not optimized for mobile will lose rank in the search engine’s results page. As a result, many financial planners are losing a majority of their website’s traffic because their site no longer appears in the search results.

Although mobile-friendly sites will continue to be ranked (for now), the best possible option is a fully responsive website (Google and web visitors love responsive sites). Responsive sites adjust their appearance depending on what device the viewer is on (desktop, smartphone, or tablet) and offer the best user experience.

To test your website, go to www.Google.com/webmasters/tools/mobile-friendly and enter your URL in the box. If your site is mobile friendly, you get a green bar. If not, Google offers up advice on how to make it so. Most likely you’ll need a new site if you haven’t updated it within the last few years.

Myth No. 2: My Target Audience? Everyone!

Many financial planners say, “I can work with anyone.” Some planners get nervous about pigeonholing themselves, so they keep their options open and do not commit to a target client.

The mistake: No defined ideal client. Imagine you’re at a barbeque and you respond to the inevitable question, “What do you do?” When you respond with a general financial planner answer, you’re immediately commingled with every financial professional the person has ever heard of; you don’t stand out. The same thing happens with a generic website that tries to speak to everyone.

When you try you speak to everyone, you speak to no one. You fail to make a connection; you waste money, resources, and time trying to bring more traffic to your site or vetting prospects that are not a match. You are unable to create systems and efficiencies because you are faced with too many one-off efforts.

The fix: Bring your target audience alive online. Upon arrival, every website visitor should be able to associate you with a very specific target audience and expertise. When you do, visitors make an immediate connection with you or they think of someone they know.

The faster and more clearly you demonstrate expertise by solving a very specific group of people’s problems, the sooner you’ll gain the momentum attracting the right leads and referrals.

Clarity on your brand and your target has to come alive through your website. Your goal is to send away the people who do not fit and bring in those who do. Here’s how:

Images. Imagery is a powerful way to connect with visitors in a matter of seconds. Instead of standard stock photos, find purpose and reason for the images you use online. Can your ideal client relate?

Logo and branding (including colors, design, typeface, and icons). This should also match your ideal client. Do your brand colors resonate with your audience? If you’re targeting millennials, does your website reflect that?

Messaging. Craft the language on your site to match your ideal client. Get rid of the financial jargon and replace it with relatable and easy-to-comprehend content. Make sure the welcome text a visitor sees when they land on your homepage focuses on the needs of your target client.

An effective way to communicate your understanding is through the use of clarifying questions such as, “Are you a ‘solopreneur’ who wants to retire within five years?” or “Do you worry about meeting payroll, paying the mortgage, and keeping your head above water?”

Calls-to-action. Calls-to-action encourage web visitors to take action. “Meet with me,” “Download this whitepaper,” and “Get your wealth assessment,” are common examples. These are usually displayed on a website as a button or image. Match your call-to-action and offer with your target audience. Different people respond to various calls-to-action in different ways. The more specialized your offer, the more likely your ideal client will take you up on that offer (see myth No. 3 for more).

Myth No 3: Web Visitors Will Reach Out When They’re Ready

You may assume that if someone is spending time on your website that they must be ready to sign up for a consultation. Why else would they bother to spend time there?

The mistake: Making it difficult to take action. A common mistake among financial planners is building a site that requires visitors to wind through a maze to find answers, making it nearly impossible to get to know you better. A recent study by Advisor Websites and WealthManagement.com revealed that fewer than 5 percent of financial planner websites reviewed had a strong, clear call-to-action. And, those that did, often forgot that people come to the site in different stages of readiness.

The majority of planners who do have a call-to-action offer just one option: sign up for a free introductory meeting. The web visitor is given an ultimatum right from the start—get a consult or nothing. Unfortunately, the perceived commitment of scheduling a discussion can scare many perfect clients away.

The majority of your visitors arrive during the early stages of consideration. Without specific, lower-hurdle ways to ease their way into a relationship with you, you spring an expensive leak in your website. Imagine if every month you lost two clients who would have worked with you, but you pushed them too soon. If you earn $4,000 per client per year, then your leaky site costs you nearly $100,000 in revenue.

The fix: Offer various engagement activities for every level of readiness. The essence of making your website the hub of your marketing plan is to give opt-in opportunities for web visitors at various levels of readiness. Although you do want an option to “schedule a meeting,” you also want to offer free education in exchange for a name and email address. This lead-generation vehicle—whether a video training series, a free report, or a downloadable checklist or questionnaire that addresses their needs—lets you begin to build trust and a relationship with the prospect over time through targeted messages designed to move them along in the process.

Finally, if you regularly publish content through a blog, podcast, or YouTube channel, make sure to offer this “lowest-hurdle” option to engage visitors into your marketing funnel where you’ll be able to educate, entertain, and inspire your viewers while they decide at their own pace when to deepen the engagement.

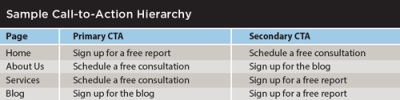

As you update your website, map out your call-to-action hierarchy for your designer. For each page, think about what action fits best with the content and determine the most likely action the reader will want to take. Assign each page a primary and secondary call-to-action. Use the table on page 30 for guidance.

Myth No. 4: Build It and They Will Come

You pour your heart and soul into developing a new website (not to mention energy, time, and money). You likely had tedious discussions about navigation, agonized over photo selection, and combed through copy to say just the right thing. With all of the resources you’ve dedicated to building the site, it only seems fair that prospects will come visit.

The mistake: Waiting for web traffic and leads (set it and forget it). Even the best websites in the world cannot generate the right leads without traffic.

The big mistake here happens when a financial planner falsely assumes that people will just know his or her website is there and will find it. Sure, some unique visitors accidentally arrive, but rarely will a perfect lead stumble upon your site without prompting.

The fix: A marketing plan that leverages your content. To get traffic to your website (and leads from it), visitors must have a reason to go to it in the first place. So, why should web users visit your website? What’s the incentive?

If you have a content strategy (such as blogging, videos, podcasts, and white papers), that’s a solid foundation. The next step is to help the right people find your content.

Distributing your content through a variety of channels is key. If you publish a new blog post twice a month, how do you let people know it’s there?

Social media. Share snippets of relevant, timely information from your website on Facebook, Twitter, and LinkedIn and make sure to link back to your website. Using social media to drive web traffic is one of the most effective (and free) boosters. Think about using a free tool like Hootsuite or Buffer to automate your social content push. Once it’s set up, a social message will automatically go out with a link back to your new content.

Email. Grow your email list and marketing funnel by asking web visitors to subscribe to your e-newsletter or blog to stay informed. Consider implementing an automated tool like Mailchimp (which is easy to integrate with your website and free for up to 2,000 subscribers) to send an email notification each time you publish a new piece of content. At the very minimum, talk about your new website content in your monthly e-newsletter and don’t forget to link back to it.

Word of mouth. Talk about your website. Tell clients, prospects, colleagues, and friends about the great resources you’ve created and how to find them. Include this as part of your client onboarding process.

Get Past the Myths and in to Action

If you’ve fallen for any or all of these myths, now is the time to take action. Embrace the mindset that your website is the foundation of all of your marketing initiatives. Follow the “fixes” outlined here to refresh, revamp, or launch your firm’s website. And remember, it is never too late to build your online presence. The faster you do, the more eager you’ll be to spread the word, confident that your website is working for you every step of the way.

Maggie Crowley is growth marketing manager at Advisor Websites where she manages the company’s online presence and helps advisers develop inbound marketing strategies designed to win more online traffic and leads. FPA members can get free website advice from an expert at AdvisorWebsites.com/FPA.

Kristin Harad, CFP®, is a marketing coach, trainer, and speaker. She is a regular contributor to the Journal’s Practice Management Blog (PracticeManagementBlog.OneFPA.org). She offers hours of free marketing training at kristinharad.com.

Sidebars

Bonus Mini-Myth

According to Nielsen Research Group, more than 87 percent of Americans have access to the Internet, and roughly 90 percent use the web to perform online research before buying new products and services. Everyone is online, including your target audience. And, they expect to find you there.

How to Claim your Google Business Page

- Go to www.Google.com/business.

- Click on blue “Get on Google” button in the center of the page.

- Type in your business name.

- Click on your business name. If it does not show up, enter your information.

- Google will ask you to verify your account. Request your verification code. (Google will mail you a code to ensure you are at the physical location).

- Customize your Google+ page. Follow the prompts to add a photo, a description, URL, profile picture, and more.

What Social Platform Should You Use?

If you have to limit your time to one social platform, choose LinkedIn. LinkedIn is the most used social network in the financial services industry (74 percent of advisers have a LinkedIn profile), and it seems to deliver the most value.

LinkedIn is “the professional network,” and users aren’t just there to be entertained. Financial planners who see the most success with LinkedIn by engaging referrals and prospects are actively finding ways to participate in conversations and find their niche.