Journal of Financial Planning: June 2013

Randy Gardner, J.D., LL.M., CFP®, CPA, is a professor of tax and financial planning at the University of Missouri–Kansas City and director of education for WealthCounsel and The Advisors Forum. (gardnerjr@umkc.edu)

Leslie Daff, J.D., is a state bar certified specialist in estate planning, probate, and trust law and the founder of Estate Plan Inc. in Orange County, California, and Johnson County, Kansas. (ldaff@estateplaninc.com)

Lew Dymond, J.D., is a principal of the WealthCounsel Companies. He is featured at www.estateplanning.com. (lew.dymond@wealthcounsel.com)

Julie Welch, CFP®, CPA, is the director of tax and a shareholder with Meara Welch Brown PC in Leawood, Kansas. (julie@meara.com)

The American Taxpayer Relief Act of 2012 (ATRA) retained the inflation-adjusted $5.25 million ($10.5 million for a couple) gift, estate, and generation-skipping transfer (GST) tax exclusion and the portable gift and estate tax exclusion for surviving spouses, but increased the gift, estate, and generation-skipping tax rate to 40 percent. As a result of these changes, the Tax Policy Center forecasts that 8,700 estate tax returns will be filed for the 2.6 million deaths expected to occur in 2013 (a 0.33 percent rate of filing, or three out of every 1,000 decedents). If the ATRA changes had not occurred, 101,800 returns would have been filed (a 3.86 percent rate of filing, or 39 out of every 1,000 decedents). How will this legislation change estate planning?

Planning for the 99.67 Percent

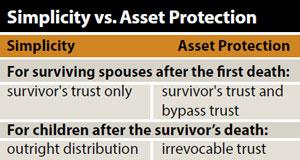

Those who are subject to estate tax (the 0.33 percent) will continue to take advantage of the high exclusions and other estate planning techniques that have not yet been repealed. With estate tax eliminated as a concern, the other 99.67 percent will choose between simplicity or asset protection as they design their plans. Clients seeking administrative convenience, freedom from oversight, and simplicity will avoid the traditional survivor’s trust/bypass trust (A and B trusts) combination, opting instead for a survivor’s trust only, or a survivor’s trust with the flexibility to disclaim to a bypass trust.

Among the most common complaints from surviving spouses are: “Why do I have to set up this bypass trust?” “Why can’t I just leave everything in the living trust?” “I do not know which assets to put in which trust.” “What do you mean my step-children can question what I am spending the bypass trust assets on?”

Mandatory allocations to survivor’s and bypass trusts were the norm for revocable living trusts created more than two years ago, but they are confusing to surviving spouses, can lead to squabbles with other beneficiaries, and may be overly complex in an environment where estate tax is not likely.

Planning tip: When reviewing clients’ estate plans, watch for mandatory allocations to bypass trusts based on the current tax exemption. Depending on the wording of the funding language, the trust may require that a bypass trust be created and possibly all of the trust assets be allocated to the irrevocable bypass trust rather than a revocable survivor’s trust.

Reasons to Create a Bypass Trust

Bypass trusts have the disadvantages of requiring an annual income tax return (Form 1041) and the loss of stepped-up basis on the second death, but they offer many advantages. If a bypass trust is not mandated, the surviving spouse should at least be able to disclaim survivor’s trust assets to a bypass trust in the right situation.

Creditor protection. The bypass trust is an irrevocable trust established by a third party. Thus, if an independent trustee has the discretion to limit distributions from the trust, a bypass trust can provide protection of the decedent’s and survivor’s assets from creditors. The surviving spouse’s choice to fund a bypass trust may be particularly important if the circumstances of the decedent’s death might trigger a lawsuit against the decedent’s estate, such as a car wreck or other accident. This creditor protection can be extended to the children’s generation by leaving the assets to the children in an irrevocable trust, such as a beneficiary-controlled trust.

Remarriage protection. Many blended families will continue to rely on bypass trusts because the first spouse to die can control where his or her assets go after the second spouse dies. Spouses in first marriages also may want to mandate the use of bypass trusts if they are concerned that their spouse may remarry and the assets may pass to a next spouse. A bypass trust can provide an effective excuse if the surviving spouse anticipates pressure from a next spouse to invade the assets from a prior marriage. Access to the assets in the bypass trust by the surviving spouse is possible through the use of “health, education, maintenance, and support (HEMS)” withdrawal language. Misuse of the withdrawal power can be avoided with the appointment of an independent trustee.

Potential law changes. Funding a bypass trust is a good idea if your client is concerned that the $5.25 million exclusion amount might decrease in the future. Although the current exclusion language is referred to as permanent by ATRA, Congress could change the law with the stroke of a pen.

Shortcomings of Portability Exemption

The 2010 Tax Relief Act introduced the concept of “portability” with respect to the unused portion of the applicable estate tax exclusion amount of a predeceased spouse. To take advantage of this provision, the surviving spouse must make an election on the predeceased spouse’s timely filed estate tax return (Form 706). The applicable exclusion amount for a surviving spouse is the sum of: (1) the basic exclusion amount ($5 million in 2011; $5.12 million in 2012; $5.25 million in 2013), and (2) the deceased spouse’s unused exclusion amount (DSUEA). The DSUEA is the lesser of: the applicable exclusion amount, or the applicable exclusion amount of the surviving spouse’s last deceased spouse, minus the amount with respect to which the tentative tax is determined on the estate of the deceased spouse.

Note: ATRA corrected the controversial “basic exclusion amount” of the last deceased spouse reference to the more accurate “applicable exclusion amount” of the last deceased spouse.

For example, Jack died in 2013 with $4 million in assets.

Option A: If Jack leaves the assets to his wife, Mary, in a survivor’s trust and makes an election to permit Mary to use any of his unused exclusion amount, Mary will have available $10.5 million in exclusion (Jack’s $5.25 million exclusion plus Mary’s own $5.25 million exclusion).

Option B: If Jack instead leaves $2 million in a survivor’s trust and uses $2 million of his exemption to fund a bypass trust, Mary will have available $8.5 million in exclusion (Jack’s unused $3.25 million exclusion [$5.25 million minus the $2 million transferred to the bypass trust] plus Mary’s own $5.25 million exclusion). The assets in the bypass trust will avoid estate tax, but will not receive a stepped-up income tax basis when Mary dies.

The portable exemption has several shortcomings. First, the portability provision refers to the applicable exclusion amount of the “last such deceased spouse.” This means generally “the most recently deceased individual who, at that individual’s death after December 31, 2010, was married to the surviving spouse.”

Continuing the example, assume Mary chose Option A, a survivor’s trust and Jack’s exclusion of $5.25 million. Further assume Mary marries a second spouse, Jerry, who predeceased her, leaving a taxable estate of $4 million. An election was made on Jerry’s estate tax return to permit Mary to use any of his unused exclusion amount. Although the combined unused applicable exclusion amounts of Jack and Jerry equals $6.5 million (Jack’s $5.25 million and Jerry’s $1.25 million), only $1.25 million is available for use by Mary’s estate, because Jerry is Mary’s most recently deceased spouse. Mary’s exclusion would have been reduced no matter which option she chose at Jack’s death, but Mary would have sheltered $2 million more from future estate tax by funding the bypass trust (Option B) after Jack’s death.

A second shortcoming of the portable exclusion is that it is not adjusted for inflation as the surviving spouse’s exclusion is. In other words, Mary’s exclusion will increase with inflation adjustments, but the exclusion received from her most recently deceased spouse remains constant.

Third, the portable exclusion can be used to avoid future gift and estate tax of the surviving spouse, but it cannot be used to increase the GST tax exemption. If the GST tax exemption is applied to a bypass trust, future gift, estate, and GST tax is avoided.

Planning tip: A surviving spouse whose deceased spouse’s estate made an election to preserve any DSUEA and who is contemplating remarriage should consider the ramifications of the portability rules with respect to multiple marriages. In particular, the surviving spouse should consider the potential benefits of making lifetime gifts to use the DSUEA left by his or her deceased spouse.

Estate planning will change as a result of ATRA. Less attention will be directed to transfer taxes, but there are still important issues to address, and every client’s estate plan should be reviewed to make sure the design and outcomes are what the client wants. With regard to the use of bypass trusts, clients will need to choose between the simplicity of the one-trust approach and the protections of the more complex two-trust approach.