Journal of Financial Planning: June 2019

Ryan Firth, CPA, CCFC, is the founder and president of Mercer Street Personal Financial Services | Business & Tax Services, which focuses on serving small business owners, young professionals, and growing families in the wealth accumulation phase of their lives.

Bobby Henebry, CFA, is founder of Henebry Blockchain and Cryptocurrency Consulting. He speaks globally to educate business groups about blockchain and cryptocurrencies, and consults with technology startups around the world.

Tyrone V. Ross Jr., is managing partner of NobleBridge Wealth Partners. He is as a financial consultant, early stage startup adviser, and cryptoassets

investment manager.

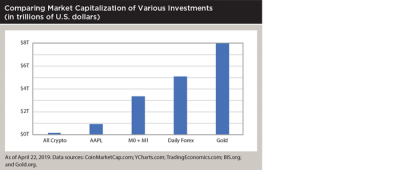

The world is still talking about cryptoassets such as bitcoin (BTC), ether (ETH), and Ripple’s XRP token, yet cryptos are virtually insignificant compared to other assets. In fact, the total market capitalization of all cryptoassets as of April 2019 is “only” $180 billion,1 which makes the coverage that cryptos receive from the financial press overblown relative to other investment options financial planners might consider for client portfolios.

To put that number in perspective, the total market capitalization of Apple (AAPL) is approximately $964 billion,2 the total narrow money supply (M0 + M1) in the U.S. is approximately $3.4 trillion,3 global trading in foreign exchange (forex) markets averages approximately $5.1 trillion per day,4 while all of the gold ever mined to date is worth approximately $8 trillion.5

Even at the height of crypto-mania in January 2018, when prices skyrocketed to all-time highs shortly after bitcoin futures trading began the month prior, the total market capitalization of all cryptoassets combined ($828 billion6) was still less than Apple’s market cap. Given the relative insignificance of cryptoassets’ total market capitalization compared to other asset types and its historical volatility, should financial planners even consider allocating a portion of their clients’ assets to cryptoassets? Following are some points to consider when thinking about an answer to this question.

Cryptoasset Investing

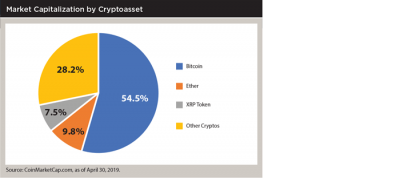

Bitcoin is the most well-known, oldest, and largest cryptoasset (based on both market capitalization and trading volume), so it is generally viewed as a bellwether for all cryptoassets. The pie chart below helps illustrate bitcoin’s dominance in this asset class, which is quite different from what financial planners may be accustomed to seeing in a traditional top-10 chart for a mutual fund, ETF, or other traditional index.

History. Bitcoin was conceived a little over 10 years ago during the Great Recession when an individual, or group of individuals, going by the pseudonym Satoshi Nakamoto issued a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” (view it online at bitcoin.org/bitcoin.pdf). A couple of months later, the first bitcoins were mined (i.e., created), and thus began the first use case of blockchain technology.

Almost all blockchain technology uses a network protocol, which describes how the blockchain should operate. In essence, the protocol dictates how the digital asset is created, transacted, and recorded on the network in a secure and reliable manner.

Related to the network protocol is the consensus algorithm, which is the mechanism used to carry out the procedures described in the protocol. For example, bitcoin was the first digital asset to be mined and recorded on a blockchain using cryptographic hashing as a proof of work consensus algorithm (specifically, Standard Hash Algorithm-256 created by the National Security Agency).

Today, more than 2,000 cryptocurrencies use various protocols and consensus algorithms, and trade on over 1,700 exchanges worldwide.7 Seemingly unlimited ideas are emerging around other applications of blockchain that have little or nothing to do with cryptocurrencies. Crytocurrencies, such as bitcoin, are just one application of blockchain technology and other distributed ledger technologies.

Correlation. Aside from stablecoins (the latest attempt by technologists and entrepreneurs to address the massive volatility of cryptoassets; see the sidebar for more), cryptoasset prices tend to move in tandem with each other; thus, they are highly correlated with one another. Interestingly, this high level of correlation amongst cryptoassets appears to be decreasing over time.8

Currently, constructing a diverse portfolio of different cryptoassets does not appear to reduce volatility very much. However, when compared to other asset classes such as fixed income or equities, it seems that bitcoin has not historically shown a significant degree of correlation to these other asset classes.9 Therefore, cryptoassets could potentially be viewed as an altogether new asset class that could help clients achieve greater diversification.

For clients who like risk assets and might enjoy having the occasional venture investment in their portfolio, crypto might be an intriguing possibility. However, risk exposure needs to be managed through position size, and as with any venture investment, there’s the potential for loss of part, or even all, of the investment.

Potential inflation hedge. An appealing feature of most cryptoassets is the limited supply of coins or tokens to be issued over time, which makes them inherently deflationary by nature. Bitcoin was created during the Great Recession, when there were ongoing debates around the Federal Reserve’s use of interventionist monetary tools like quantitative easing and the merits of going back to a gold standard were discussed. Some people who embrace bitcoin and hold bitcoins are supporters of Ron Paul’s End the Fed ideology; these individuals tend to have a strong Libertarian, even bordering on anarchist, view of the U.S. government’s monetary policies.

Bitcoins can be thought of as “digital gold” because there is a fixed supply. For example, under the current bitcoin protocol, only 21 million bitcoins can ever be mined.10 At its current rate, it is expected that the last bitcoin will be mined sometime in 2140.11 In this light, cryptoassets could be viewed as a potential inflation hedge against fiat currencies such as the U.S. dollar. However, it’s also worth noting that the main barrier to entry for any new cryptoasset contender is mass adoption and the related network effect (i.e., demand). So in theory, there is potentially unlimited supply in the form of newly developed digital assets, any of which could overtake the current cryptoasset incumbents and cause the incumbents to devalue relative to fiat currencies (i.e., lead to a significant price decline). But that would only happen if the current market finds value and utility in the new cryptoassets.

An abundance of capital and human talent worldwide is working to solve many complex issues in this ecosystem. It is akin to a new global venture fund attempting to disrupt and improve upon financial services in its current form. There is, of course, no guarantee that these efforts will pay off for investors.

Bitcoin ETFs. The first exchange-traded fund (ETF) was created in Canada in 1990.12 This financial product has grown precipitously since, expanding from equities into fixed income and beyond. Several bitcoin-based ETF proposals have been submitted to the Securities and Exchange Commission for approval, but none have been approved by the commission, as of this writing.

In the SEC’s most recent notice (in August 2018) regarding NYSE Arca Inc.’s bitcoin ETF filing, the commission cited the exchange’s inability to demonstrate how it will “prevent fraudulent and manipulative acts and practices” with respect to bitcoin markets.13 The SEC’s concerns are not unfounded: the 2017 run-up in crypto prices and the subsequent collapse, as well as cycles predating 2017, bear witness to this reality.

For some, whether or not the SEC ever approves a cryptoasset ETF is not important. In their eyes, development in blockchain and crypto will carry on regardless of SEC approval. For others, SEC approval would be seen as a potential watershed moment, as the floodgates would open for institutional money to pour into the space. As a dispassionate observer, it would be interesting to see how much more correlated bitcoin becomes with other asset classes such as equities, if a bitcoin ETF was to be approved.

Fee Models to Consider when Advising Clients on Cryptoassets

For those financial planners who choose to advise clients on cryptoassets (or would like to) and get paid for that advice, what does that fee model look like? There is no one-size-fits-all approach here.

Charging clients based on assets under management (AUM) is probably going to be difficult for planners to do, given there are limited institutional custody solutions for cryptoassets (and the ones that do exist tend to be quite expensive, versus the client buying crypto outright in a personal account). Charging clients on an assets under advisement (AUA) fee structure is probably better suited for cryptoassets, but only if the planner is actually providing competent advice to the client with respect to their crypto holdings.

Financial planners can help clients who hold cryptoassets address several issues—two important ones are taxes and estate planning. Investors who trade cryptoassets might need help accounting for their trades (which can be numerous). They also might need assistance integrating these assets into their personal records (which can comprise a significant portion of their wealth, in some cases). So being familiar with this asset class can potentially provide a lot of value to clients who have been investing in this space.

Fee-for-service pricing models such as hourly, project/limited-scope/fixed-fee, and retainer/on-going monthly subscription are becoming more prevalent in the financial planning profession. Clients who do not meet account minimums or don’t want to have someone only manage their investable assets may find these fee structures appealing. The fee-for-service model lends itself well to advising clients on cryptoassets, but it can be more difficult for planners to price appropriately and scale efficiently.

Although there are no crypto ETFs today, some over-the-counter products give investors access to cryptoassets, such as Grayscale’s Bitcoin Trust (GBTC). Additionally, an increasing number of crypto-focused hedge funds and venture capital funds are springing up, giving investors another avenue to get exposure to crypto. However, these alternative investment options typically come at a hefty price to investors in the form of high management fees and/or performance fees. Investors can also trade bitcoin futures contracts on the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

A strategy to gain exposure to cryptoassets indirectly includes buying securities of companies that are involved in, or tangentially impacted by, blockchain technology and cryptocurrencies. For example, the Reality Shares NASDAQ Blockchain Economy ETF (BLCN) had the following top-10 holdings as of May 9, 2019: SAP SE; SBI Holdings Inc./Japan; Accenture PLC; Microsoft Corp.; Advanced Micro Devices Inc.; Tencent Holdings Ltd.; JPMorgan Chase & Co.; Digital Garage Inc.; IBM; and Nasdaq Inc. Using a gold rush analogy: if crypto is the gold, then these companies are the ones selling the picks and shovels.

Tax Considerations

To date, the only guidance given by the IRS was issued in Notice 2014-21 (IRS.gov/pub/irs-drop/n-14-21.pdf). For a primer on the tax implications of transacting in crypto (or virtual currencies), see the April 2019 Journal article, “Cryptocurrencies: Issues and Best Practices,” by Ryan Firth.

With a few exceptions (e.g., the wash sale rules), cryptoassets held for investment purposes are treated similarly to equities and other securities from a tax perspective. When in doubt, seek guidance from a qualified tax professional.

Conclusion

Advising clients on cryptoassets ultimately comes down to prudent financial planning principles: understanding a client’s risk tolerance, investment time horizon, and desired funding goals.

Crypto is an emerging asset class with a significant amount of risk that can be managed by using small position sizes to lessen the potential impact of price swings on a portfolio. Cryptoassets could possibly provide an additional degree of diversification to a client’s portfolio, because they do not appear to be closely correlated with other asset classes.

The crypto scene is constantly changing. Planners and clients must do their research and due diligence to ensure a good understanding of cryptoassets. They are not for everyone due to volatility concerns and the potential for loss of invested principal. However, blockchain and crypto are increasingly becoming intertwined with our lives, much like the internet and mobile devices before it, so there’s potential for outsized returns over time as the technology becomes more broadly implemented and adopted.

Blockchain technology and cryptoassets are here to stay. Financial planners can either embrace this nascent technology, or they can choose to ignore it. For those planners that want to work in this space, there is an increasing need and opportunity to add value by helping clients navigate this new asset class.

Endnotes

- According to CoinMarketCap.com data, accessed April 22, 2019 at coinmarketcap.com/charts.

- As of April 22, 2019, according to YCharts.com, (ycharts.com/companies/AAPL/market_cap).

- As of April 22, 2019, according to Trading Economics.com (tradingeconomics.com/united-states/money-supply-m0).

- According to BIS data (bis.org/publ/rpfx16.htm).

- According to the World Gold Council (gold.org/about-gold/gold-supply/gold-mining/how-much-gold).

- According to historical CoinMarketCap.com data (coinmarketcap.com/charts).

- As of April 22, 2019, according to CoinMarketCap.com.

- See “Individual Crypto Assets Are Becoming Less Correlated with Entire Market,” posted April 12, 2019 on the bitcoin news site, News BTC. Available at newsbtc.com/2019/04/12/study-crypto-market.

- See “Is Bitcoin Correlated with the Stock Market? The Answer, in Charts and Graphs,” by Lucas Hahn, posted January 3, 2019 on the Bitcoin Market Journal. Available at bitcoinmarketjournal.com/bitcoin-and-stock-market.

- See the FAQs at Bitcoin.com (bitcoin.org/en/faq#what-is-bitcoin).

- See “When Will the Last Bitcoin Be Mined?” by Peter Wind, posted on cryptocurrency data site, CoinCodex. Available at coincodex.com/article/2401/when-will-the-last-bitcoin-be-mined.

- See “What Is the History of ETFs?” posted on the Vanguard site. Available at advisors.vanguard.com/VGApp/iip/site/advisor/etfcenter/article/ETF_HistoryOfETFs.

- See SEC Release No. 34-83904, p. 2 at sec.gov/rules/sro/nysearca/2018/34-83904.pdf.

SIDEBAR: What Are “Stablecoins”?

Cryptoassets tend to be highly volatile. For example, from January 2018 to December 2018, the total market capitalization of all cryptoassets declined by nearly 88 percent (according to CoinMarketCap.com data), and this was on the heels of the entire asset class rapidly rising some 30 to 40 times over the course of 2017 when the entire market capitalization of crypto went from $20 billion to $828 billion.

A new type of cryptoasset, called stablecoins, was introduced in 2014 to address issues related to price volatility. Stablecoins are analogous to money market funds. They are typically pegged to a government-issued fiat currency such as the U.S. dollar and can be asset-backed (i.e., collateralized) or not. Stablecoins (and bitcoin) are often the primary entry point for crypto investors; they usually sell their fiat currency for the cryptoassets on an exchange.

—R.F., B.H., and T.R.