Journal of Financial Planning: May 2016

Bill Harris, CFP®, is a co-founder and principal of WH Cornerstone Investments, a firm dedicated to empowering people to see their future as greater than their past. He is a member of the board of directors for FPA of Massachusetts and co-host of FPA’s Tax Planning and Tax Strategies Knowledge Circle. Follow him on Twitter @whcornerstone or @billmharris.

One of the most famous baseball comedy acts to ever take place was the classic exchange between William “Bud” Abbott and Lou Costello, called “Who’s on First.”

In the routine, Costello is talking to Abbott, who is playing the part of a baseball manager. Costello is suiting up to play catcher. Before Costello can take the field, Abbott wants to make sure he knows everyone’s name on the team. Their names are, of course, non-responsive answers (Who, What, I Don’t Know) to Costello’s questions.

The exchange creates massive confusion:

Costello: I want you to tell me the names of the fellows on the St. Louis team.

Abbott: Who is on first, What is on second, I Don’t Know is on third.

Costello: That’s what I want to find out.

Abbott: I say Who’s on first, What’s on second, I Don’t Know’s on third.

Costello: Well then who is on first?

Abbott: Yes!

The rules regulating how Simplified Employee Pension (SEP) IRAs and Savings Incentive Match Plan for Employees (SIMPLE) IRAs operate can be as confusing as the baseball player lineup was to Costello.

SEP and SIMPLE IRAs flip-flop between operating rules for IRAs and employer plan rules. If you’re an adviser dealing with business owners, knowing the subtle difference is extremely important. Certain aspects of the plans are often misunderstood—like the 25 percent tax penalty if you make a withdrawal within two years from when you first participated in the SIMPLE IRA plan, or the “still working exception” associated with employer plans.

Differentiating SEP from SIMPLE

What are SEP IRAs and SIMPLE IRAs? Are they IRAs or company-sponsored retirement plans? As Abbot would say, “Yes!” Do they follow employer plan rules or IRA rules? Lou Abbot would again say, “Yes!” And, as Costello would say, with frustration, “That’s what I’m trying to find out!”

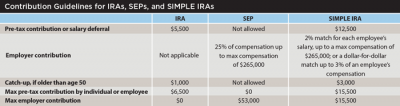

Contribution limits and allowable contributions differ dramatically between traditional and Roth IRAs, SEPs, and SIMPLE IRAs. SEPs operate like profit-sharing plans allowing only employer contributions. SIMPLE IRAs are more like 401(k) plans, allowing salary deferrals and company matches. The table on page 37 illustrates current contribution guidelines.

Traditional IRA and Roth IRAs must be opened and all deposits must be made by the tax-filing deadline. A tax-filing extension does not open the door for an extension on contributions. There is an exception for military personnel serving in combat. Military personnel have 180 days after they leave combat to make IRA contributions.

SEPs have until the tax-filing deadline, plus extensions, to open accounts and make contributions.

Unlike their IRA cousins that can wait for tax-filing dates, SIMPLE IRAs must be established prior to October 1. An exception exists if a business owner opens up business after October 1. In that case, the SIMPLE IRA must be set up by December 31. For SIMPLE IRAs, an employer must deposit employee deferrals as soon as reasonably possible but no later than 30 calendar days after the end of the month when the contributions were withheld. Like its cousin the SEP IRA, the deadline for the employer contribution, or match, is tax-filing day plus extensions.

SIMPLE IRA contributions go into a SIMPLE IRA account only, but SEP contributions could be deposited into either an employee’s traditional IRA (if the IRA agreement allows it) or a separate SEP IRA account. The IRS does not require a separate SEP IRA account to be established. However, many custodians will require a segregated SEP IRA account.

Unlike IRAs, contributions (employer and employee) are allowed after age 70½ for SEPs and SIMPLE IRAs. No age limit restrictions exist as long as an individual is working and meets plan eligibility rules. Unlike SEP and SIMPLE IRAs, traditional IRA contributions cannot be made for the year the client turns 70½ (or any year after). Contributions to Roth IRAs are allowed after age 70½ (assuming there’s compensation).

The Rules of the Game

SIMPLE IRAs and SEP IRAs follow the same required minimum distribution (RMD) rules as traditional IRAs. While there’s a “still working” exception for a 401(k) and other employer plans, this is one area where SEPs and SIMPLE IRAs do not follow plan rules, but rather IRA rules.

There is no exception for skipping RMDs if you participate in a SEP or SIMPLE IRA. Once you reach the year that you turn 70½, you must start taking RMDs. Lifetime RMDs begin no later than April 1 of the year following the year in which age 70½ is reached. Contributions can go into SEPs and SIMPLE IRAs after age 70½, but RMDs must always come out.

The “still working” exception never applies to SEPs and SIMPLE IRAs. This exception only applies if you are currently employed and participating in an employer plan.

Except for the 25 percent early withdrawal tax penalty associated with the SIMPLE IRA plan, the taxation of distributions from traditional IRAs, SEPs, and SIMPLE IRAs follow the same rules.

IRA-eligible exceptions used to eliminate the 10 percent early distribution penalties that apply to SEPs and SIMPLE IRAs (including the 25 percent SIMPLE IRA only penalty). The age 55 exception does not apply to SEP and SIMPLE IRAs. The age 55 exception allows certain individuals to take distributions from their employer retirement plans at 55 or older (instead of 59½) without being subject to the 10 percent penalty.

Employer plans, like 401(k)s, are generally fully protected if an individual files for bankruptcy. Luckily, SEPs and SIMPLE IRAs follow the same plan rules and are fully protected. However, an IRA’s (traditional and Roth) protection differs. As of April 1, IRAs are protected to a value of $1,283,025. This value is adjusted for inflation every three years, with the next adjustment date scheduled for April 1, 2019.

While SEPs and SIMPLE IRAs fall under plan rules for bankruptcy, creditor protection is another ball game. Employer plans governed by ERISA have unlimited creditor protection. With the exception of an ex-spouse or the IRS, most creditors will never penetrate the veil of protection offered by these plans. But because SEP IRAs and SIMPLE IRAs are not covered under ERISA, they are not as protected. Creditor protection for SEP IRAs and SIMPLE IRAs defaults to state law. Most states have strong creditor protection for IRAs, SEPs, and SIMPLE IRAs. However, for some states, the protection is not so good.

Are SEPs and SIMPLE IRAs employer plans or IRAs? I Don’t Know. Oh wait, he’s playing third!

Learn More

The amount of tax information a CFP® practitioner needs to know can often be unfathomable. Tune in to the Tax Planning and Tax Strategies Knowledge Circle call on the third Tuesday of the month at 2 p.m. EDT, where we “play ball” with these types of conversations on a regular basis. Visit Connect.OneFPA.org and click on “Knowledge Circles” for more information.