Journal of Financial Planning: November 2012

Executive Summary

- Money scripts—typically unconscious, trans-generational beliefs about money—are developed in childhood and drive adult financial behaviors.

- Three categories of money script have been found to have a negative impact on financial health: money avoidance, money status, and money worship. These belief patterns are associated with lower levels of net worth, lower income, and higher amounts of revolving credit.

- Money script patterns can predict disordered money behaviors, such as financial infidelity, compulsive buying, pathological gambling, compulsive hoarding, financial dependence, and financial enabling.

- Money vigilance beliefs, including themes of frugality, discreetness, and anxiety about money, appear to be protective factors against poor financial health and destructive financial behaviors. While they encourage saving and frugality, excessive wariness or anxiety could keep someone from enjoying the benefits and sense of security that money can provide.

- An individual’s profession can predict money script patterns and vulnerability to disordered money behaviors. Specifically, when compared to financial advisers, mental health professionals are more likely to be money avoidant, business professionals are more likely to be anxious and secretive around money, and business professionals, mental health professionals, and educators are more likely to avoid thinking about money, try to forget about their financial situation, and avoid looking at their bank statements.

- Once identified, money scripts can be challenged and changed to interrupt destructive financial patterns and promote financial health.

- Financial planners can assess client money scripts as a part of their data gathering process to provide a shared language to explore the impact of money beliefs on financial behaviors and to predict potential risks to clients’ financial health.

Bradley T. Klontz, Psy.D., CFP®, is a financial psychologist and an associate research professor at Kansas State University, director of research at H&R Block Dollars & Sense, and a planner with Personal Financial Consultants, a fee-only investment advisory firm in California and Hawaii.

Sonya L. Britt, Ph.D., CFP®, is an assistant professor and program director of the registered CFP Board programs at Kansas State University. She has an expertise in financial therapy and quantitative research methodologies in financial planning.

It is common knowledge that psychological traits may interfere with the financial planning process. Numerous popular media outlets post “quizzes” where the reader can answer a few questions and find out what money attitudes or hang-ups they carry. With a few notable exceptions (Furnham 1984; Tang 1992; Yamauchi and Templer 1982), there is a paucity of empirically validated assessments available to determine what psychological preferences may be affecting the financial planning process. The authors have developed two such assessments using sound research methodologies: the Klontz Money Script Inventory (KMSI) (Klontz et al. 2011) and the Klontz Money Behavior Inventory (KMBI) (Klontz et al. 2012). This study examines the association between money scripts and disordered money behaviors. By identifying the association between money scripts and financial behaviors, practitioners can quickly identify clients who may be at risk for disordered money behaviors based on an assessment of their money scripts. To further assist planners in identifying problematic money scripts and behaviors among their clients, we tested the association among respondents’ profession and their financial psychological profile.

Money scripts, a term coined by financial psychologists Brad Klontz and Ted Klontz (Kahler and Fox 2005), are core beliefs about money that drive financial behaviors. Money scripts are typically unconscious, developed in childhood, passed down from generation to generation within families and cultures, contextually bound, and often only partial truths (Klontz and Klontz 2009). When money scripts are developed in response to an emotionally charged, dramatic, or traumatic personal, family, or cultural financial flashpoint, such as significant losses during the Great Depression, parental abandonment, or financial bailouts by a family member, money scripts can become resistant to change, even when they are self-destructive (Klontz and Klontz 2009).

Recent research (Klontz et al. 2011) has identified four categories of money scripts, three of which are associated with poor financial health: (1) money avoidance, (2) money worship, (3) money status, and (4) money vigilance. Money avoiders believe that money is bad, rich people are greedy, and that they don’t deserve money. Money worshipers are convinced that more money will solve all of their problems, there will never be enough money, and that money brings power and happiness. Money status scripts equate self-worth to net worth and put a premium on buying the newest and best things. All three of these money script profiles are associated with poorer financial health, including lower net worth and lower income. In contrast, money vigilance scripts include themes of frugality, the importance of saving, being discreet about how much money one has or makes, and nervousness about making sure money is saved in case of an emergency. As previously reported in Klontz et al. (2011), younger, non-married individuals with lower levels of education, income, and net worth were more likely to identify with the money avoidance scripts. This is nearly the same pattern for the money worship scripts, except that money worshipers are also likely to revolve credit from month to month. Individuals identifying with the money status scripts tended to be younger and non-married with lower levels of education, income, and a lower socioeconomic status in childhood. Not carrying credit card debt from month to month was positively associated with the vigilance scripts. Gender was not significantly related to any of the money script patterns identified.

A second assessment tool developed by the authors, the Klontz Money Behavior Inventory (KMBI), assesses disordered money behaviors seen by financial planners and mental health professionals, including: (1) compulsive buying: irresistible urges to shop with negative financial and emotional outcomes; (2) pathological gambling; (3) compulsive hoarding: fear-based excessive accumulation of objects or money with negative psychological and/or health consequences; (4) workaholism: excessive preoccupation with work, accompanied by negative relationship, emotional, and/or health consequences; (5) financial dependence: relying on non-work income, with accompanying resentment, fear, and amotivation; (6) financial enabling: financial “help” that hurts giver and/or recipient; (7) financial denial: attempting to cope with money anxiety by rejecting/avoiding one’s financial reality; and (8) financial enmeshment: inappropriately involving minor children in adult financial matters.

Research by Klontz et al. (2012) found that compulsive buyers tend to have a lower net worth, as might be expected. Compulsive buyers and those with financial denial tended to be younger, non-married females with lower levels of education and income who grew up in wealthier households and currently carry credit card balances. Financial enablers tended to be younger, non-married individuals with lower levels of education and lower net worth. The same association was found for those with financial denial behavior. People living in financial denial were likely to have grown up in lower socioeconomic status households and currently carry credit card debt. Non-married men who grew up in wealthier households were more likely to identify with pathological gambling. Men were also more likely to be compulsive hoarders. Workaholics were more likely to be younger males with higher levels of income who carried credit card balances. Financial dependents tended to be non-married individuals with lower levels of education and income who grew up in wealthier households. Financial enmeshment behavior was most likely to be reported by men with higher levels of net worth (Klontz et al. 2012).

The purpose of this study was to examine the association between money scripts and financial behaviors to see what, if any, money scripts predict disordered money behaviors. Two additional research questions of interest were explored. First, we examined whether financial infidelity could be predicted from money scripts and financial behaviors. A 2010 survey by CESI Solutions revealed that an alarming 80 percent of individuals admit hiding money from their spouse. Women are much more likely to spend money on clothing and gifts for others without telling their husband, whereas men are much more likely to secretly spend money on alcohol and music. Surprisingly, a small number of spouses even hide money spent on dating websites (Dunleavey 2010). Given the prevalence of financial infidelity and its impact on the financial planning process, we explored whether money scripts can predict spousal money secrecy.

Second, we wanted to explore how an individual’s choice of profession was related to money script patterns and financial behaviors. Specifically, when compared to financial planners and businesspersons, we hypothesized that, based on the literature (Klontz et al. 2008; Trachtman 1999) and professional experience, mental health professionals (psychologists, social workers, and counselors) are more likely to hold money avoidance beliefs and engage in financial denial behaviors.

Methods

Participants. The results of the current study are based on a convenience sample of 422 individuals. The sample was gathered through the use of a web survey to a listserv of financial planners, coaches, and mental health providers with invitations to take the survey and pass it on to colleagues and clients. Links also were placed on a variety of online social networks, and invitations to take the test online ran in newspaper articles in the Midwest and Hawaii. The sample was largely composed of middle-aged (average age range 41–50), Caucasian (82 percent), highly educated individuals with an average income of approximately $65,000. Twenty percent of respondents were in business, 15 percent were mental health professionals, 12 percent were educators, 11 percent were financial planners, 6 percent were in the medical field, 3 percent were in the entertainment industry, and the rest identified their profession as “other.” Nearly 65 percent of the sample was female and 56 percent were married. Forty-eight percent of the sample had a net worth over $250,000, and 62 percent indicated that they grew up in middle, upper-middle, or wealthy households. Sixty percent of respondents indicated that they did not carry over credit card debt from the previous month, 72 percent were homeowners, and 93 percent had never filed for bankruptcy. While not representative of the United States population at large, the sample was similar to many of the characteristics of households that use financial planning services. For example, in a study by Elmerick, Montalto, and Fox (2002), which examined a representative sample of 4,305 U.S. households, individuals who used financial planner services were typically married (52 percent), middle aged (average age of 49), had some post-high school education, had an average net worth of $282,980, had an average income of $52,295, and were overrepresented by non-Hispanic whites (78 percent).

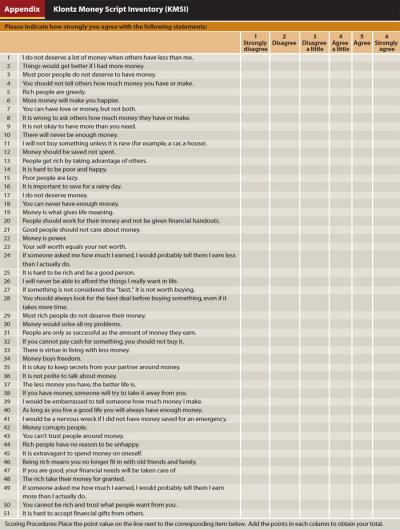

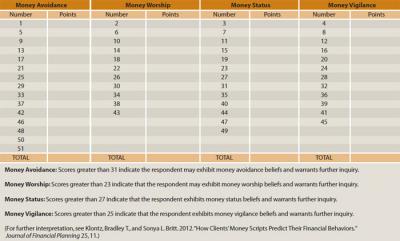

Four money scripts categories (money avoidance, money worship, money status, and money vigilance) were measured using the Klontz Money Script Inventory (KMSI).¹ Eight disordered money behaviors (compulsive buying, pathological gambling, compulsive hoarding, workaholism, financial dependence, financial enabling, financial denial, and financial enmeshment) were measured using the Klontz Money Behavior Inventory (KMBI).² Individual scale items for both measures were coded on a six-point Likert-type scale, where 1 = strongly disagree, 2 = disagree, 3 = disagree a little, 4 = agree a little, 5 = agree, and 6 = strongly agree.

Procedure. Four analyses were conducted to answer the research questions. First, a correlation analysis to examine the strength of the relationship between money scripts and money behaviors was conducted. A follow-up ordinary least squares regression was conducted to determine whether money scripts could be used to predict money behaviors. A multiple analysis of variance was conducted with professions and money scripts and behaviors to identify who may be at increased risk for developing problematic money scripts and behavior. Lastly, an ordinary least squares regression was conducted to determine the predictive ability of money scripts and money behaviors on a specific money behavior item—spousal money secrecy—a topic of interest for many financial planners and clients.

Results

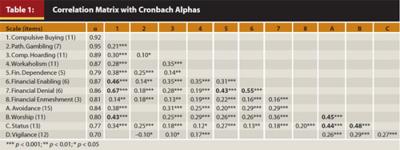

Relationship Between Money Scripts and Behaviors. Table 1 shows the intercorrelations between the money behavior and money script subscales, as well as the number of items contained within the scale and Cronbach’s coefficient alpha for each. According to standards put forth by George and Mallery (2003), all subscales showed a good internal consistency as indicated by alpha coefficients of 0.70 to 0.95.

An especially high correlation was found between compulsive buying and financial denial (r = 0.67, p < 0.001) indicating that individuals who engage in compulsive buying behaviors are also engaged in financial denial. Also of interest is that compulsive buyers tend to enable other people’s spending behaviors (r = 0.46, p < 0.001) and endorse money worship scripts (r = 0.43, p < 0.001).

A significant correlation between financial denial and financial dependence (r = 0.43, p < 0.001) and financial denial and financial enabling (r = 0.55, p < 0.001) was also observed. As such, people who try to avoid thinking about their personal financial situation tend to depend on others and/or financially enable others.

Money avoidance scripts are positively correlated with money worship (r = 0.45, p < 0.001) and money status scripts (r = 0.44, p < 0.001). And finally, money worship scripts are correlated with money status scripts (r = 0.48, p < 0.001). It is not surprising that people who adore money feel like it gives them more status. It is remarkable, however, that money avoiders—people who feel like money is bad or they do not deserve money—are also more likely to also hold money worship and money status beliefs.

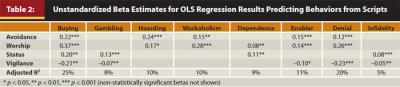

Prediction of Money Behaviors Based on Money Scripts. A common practice among therapists, using a cognitive-behavior theoretical framework (Beck 1995), is to help clients recognize the association between their beliefs and behaviors. Ordinary least squares regression analyses were designed to test whether this theory could apply to money scripts and disordered money behaviors. The specific model tested was how well the four money scripts (money avoidance, money worship, money status, and money vigilance) individually predicted the eight disordered money behaviors (eight regressions were conducted).

As shown in Table 2, all four money script patterns had predictive value in compulsive buying with the four script scales being able to predict 25 percent of the variability in compulsive buying behavior. Individuals who hold avoidance scripts (“rich people are greedy,” “it is not okay to have more than you need”), worship scripts (“money buys freedom,” “more money will make you happier”), and status scripts (“money is what gives life meaning,” “I will not buy something unless it is new”) are significantly more likely to exhibit compulsive buying behavior. However, money vigilance scripts (“you should not tell others how much money you have or make,” “it is extravagant to spend money on oneself”) negatively predicted compulsive buying.

The four money script patterns predicted 8 percent of the variability in pathological gambling behavior. As individuals scored higher on status scripts, their score on pathological gambling was likely to rise. Conversely, a higher score on money vigilance scripts was associated with a lower pathological gambling score. Compulsive hoarding and workaholism behavior each had 10 percent of their variability explained by the money scripts of avoidance and worship; both of which were positively associated with the behaviors. Nine percent of the variance in financial dependence behavior was positively explained by the scripts of money worship and money status. Money avoidance and money worship scripts positively predicted financial enabling and financial denial behaviors and vigilance scripts negatively predicted financial enabling and financial denial behaviors, explaining 11 percent and 20 percent, respectively, of the total variance in each behavior. Finally, 5 percent of the variance in financial enmeshment was explained by a positive association with money status scripts and a negative association with money vigilance scripts.

Predicting Money Scripts and Financial Behaviors Based on Profession. Based on existing literature and the professional experience of the authors, it was hypothesized that choice of profession can play a significant role in the prediction of money scripts and financial behaviors. To test this hypothesis, a multiple analysis of variance (MANOVA) was conducted with the following groups of professions: (1) financial advisers (n = 45), (2) business professionals (n = 85), (3) mental health professionals, including psychologists, counselors, and social workers (n = 64), and (4) educators (n = 50). All “other” professions (n = 178) were not included in the analysis because of the incongruent distributions in comparison to the identified categories.

Results for money script differences based on occupation indicated that mental health professionals (M = 43.06) score significantly higher on avoidance scripts compared to financial advisers (M = 38.42) (F = 2.81, p < 0.05), and business professionals (M = 44.49) score significantly higher on vigilance scripts compared to financial advisers (M = 40.93) (F = 3.56, p < 0.05). While “money vigilance” includes scripts associated with saving and frugality, it also reflects a heightened sense of anxiety and need to be secretive around money. Financial advisers may have scored lower in “money vigilance” because they are less anxious and secretive around money than the average business professional.

The only statistically significant difference based on profession for financial behaviors was with financial denial behaviors. Business professionals (M = 7.05), mental health professionals (M = 7.56), and educators (M = 7.26) all scored significantly higher than financial advisers (M = 4.84) on financial denial behaviors (F = 7.34, p < 0.001). As such, financial advisers are significantly less likely to avoid thinking about money, try to forget about their financial situation, and avoid looking at their bank statements. Our results show that financial advisers appear to have the healthiest relationship with money when compared to the other occupations studied, which is certainly good news for the profession.

Predicting Financial Infidelity. One item within the compulsive buying behavior factor (“I hide my spending from my partner/family”) has implications for couples even if individuals did not score highly on the compulsive buying scale. Acts of financial deception, also known as financial infidelity, can have devastating effects on relationships (Klontz and Klontz 2009). Therefore, a separate regression3 (F = 25.32, p < 0.001, Adjusted R2 = 0.59) was conducted to determine what demographic characteristics, money scripts, and financial behaviors predict money secrecy. Not surprising, the most predictive construct in relational money secrecy was compulsive buying disorder (b = 0.08, p < 0.001). Individuals who buy compulsively also hide their spending from their significant others and families. When controlling for compulsive buying behavior, the next most predictive item was respondent income, with those with lower levels of income being more likely to hide their spending (b = –0.16, p < 0.001). Individuals identifying with financial enabling behaviors were also more likely to hide spending (b = 0.02, p < 0.05), and those identifying with financial enmeshment behaviors were less likely to hide their spending from their partner (b = –0.04, p < 0.05). Among the other demographic variables hypothesized with financial infidelity, namely credit card debt, childhood socioeconomic status, gender, age, race, education, and net worth, the results indicated that none were statistically significant predictors.

Implications

Money scripts have a significant impact on financial behaviors and financial health. For most people, it is hypothesized that money scripts operate at an unconscious level (Klontz and Klontz 2009). In addition to financial counselors, coaches, and therapists, financial planners who work with clients in a holistic fashion, such as those who endorse the “life planning” approach, might benefit from assessing a client’s money scripts as part of the normal data gathering process. A Klontz Money Script Inventory worksheet is provided in the appendix.

Considering a client’s money scripts may be a practical action plan for helping clients gain insight into their financial behaviors and offers a conceptual frame from which changes can be made. Based on previous research and the results of the present study, the following is known about money script types and financial health and behaviors.

Money Avoidance. Individuals who score high on money avoidance believe that money is bad or that they do not deserve money. For the money avoider, money is seen as a source of fear, anxiety, or disgust. Money avoiders have a negative association with money, believe that people of wealth are greedy and corrupt, and believe there is virtue in living with less money. At the same time, money avoiders are likely to hold the conflicting beliefs that having more money could end their problems and improve their self-worth and social status. As such, they may vacillate between the extremes of holding great contempt for money and people of wealth and placing too much value on the role of money in their own life satisfaction.

Money avoiders may sabotage their financial success or give money away in an unconscious effort to have as little as possible, while at the same time they may be working excessive hours in an effort to make money. Not surprisingly, money avoidance is associated with poor financial health. Money avoiders tend to have less money and lower net worth. Money avoidance is associated with increased risk of overspending and compulsive buying, sacrificing one’s financial well-being for the sake of others, financial dependence on others, hoarding, avoiding looking at one’s bank statements, trying to forget about one’s financial situation, and having trouble sticking to a budget. When compared to financial planners, mental health providers may be at greater risk of holding money avoidant beliefs.

Money Worship. At their core, money worshipers are convinced that the key to happiness and the solution to all of their problems is to have more money. At the same time, they believe that one can never have enough money and they will never really be able to afford the things they want in life. The tension between believing that more money and things will make one happier and the sense that one will never have enough money can result in chronic overspending in an attempt to buy happiness. Money worshipers are more likely to have lower income, lower net worth, and be trapped in a cycle of revolving credit card debt. Money worshipers are also more likely to spend compulsively, hoard possessions, put work ahead of their family relationships, try to ignore or forget about their financial situation, give money to others even though they can’t afford it, and be financially dependent on others.

Money Status. People who hold money status scripts see net worth and self-worth as being synonymous. They may pretend to have more money than they do, and as a result are at risk of overspending, in an effort to give people the impression that they are financially successful. They believe that if they live a virtuous life, the universe will take care of their financial needs, and that people are only as successful as the amount of money they earn. They have lower net worth, lower income, and tend to grow up in families with a lower socioeconomic status. People with money status beliefs are more likely to be compulsive spenders, be dependent on others financially, and lie to their spouses about their spending. Holding the money status scripts is also predictive of pathological gambling, indicating individuals may gamble in an attempt to win large sums of money to prove their worth to themselves and others.

Money Vigilance. The money vigilant are alert, watchful, and concerned about their financial welfare. They believe it is important to save and for people to work for their money and not be given financial handouts. If they can’t pay cash for something, they won’t buy it, and they are less likely to buy on credit. As a result, the money vigilant have higher income and higher net worth. They also have a tendency to be anxious and secretive about their financial status with people outside of those closest to them, but are less likely to lie to their spouse about spending behaviors. Money vigilance appears to be a protective factor, in that the money vigilant are significantly less likely to spend compulsively, gamble excessively, enable others financially, and ignore their finances. While such an approach encourages saving and frugality, excessive wariness or anxiety could keep someone from enjoying the benefits and sense of security that money can provide.

Conclusion

Money scripts typically operate outside of conscious awareness, are often developed in childhood, and drive financial behaviors (Klontz and Klontz 2009). For many clients, developing an awareness of their automatic thoughts around money, and their origin, can be a profoundly transformational experience. Bringing to conscious awareness and linking, for example, money avoidant scripts such as “rich people are greedy” and “people get rich by taking advantage of others” to the experiences and teachings of a parent or grandparent can be quite freeing. Recognizing that this belief was passed down through the family, has had a negative impact on the family’s financial legacy, may have had a negative impact on the client’s income and net worth, and does not accurately depict a significant number of wealthy people, opens the door to helping the client create more accurate and functional money scripts.

Clinical trials have shown that financial therapy interventions aimed at identifying and changing money script patterns have been associated with significant improvements in financial health, money attitudes, and psychological distress, although more research in this area is needed (Klontz et. al. 2008). Planners who endorse a “life planning” approach might find tools such as the “Money Script Log” (Klontz 2011; Klontz, Kahler, and Klontz 2008) or the “Healthy Money Mantra” (Klontz and Klontz 2009) useful in helping clients recognize and rescript self-limiting money scripts.

Sometimes, insight into money script patterns and their potentially self-limiting or self-destructive effects may not be enough to change financial behaviors. This is often true when money scripts were developed in response to an emotionally charged or traumatic event or series of events. When money scripts are locked in place by intense emotion, they can become very resistant to change, even when they are self-destructive, the client has insight into their dysfunction, and the client is motivated to change (Klontz and Klontz 2009). When the client knows better but can’t do better, repeated attempts at change fail, and advising and coaching are not successful in sustaining change, a referral for financial therapy may be indicated.

Being able to accurately diagnose the cognitive basis of a financial problem can help the therapist develop a treatment plan and interventions. A financial planner can use the Klontz Money Script Inventory (in the appendix) to help identify client money scripts; educate clients regarding the impact of money scripts on financial behaviors and outcomes; and refer, collaborate, or consult with a financial therapist to address underlying psychological issues associated with the behavior, such as addiction, a history of trauma, family dynamics, anxiety, or depression.

Endnotes

- See Klontz, Brad, Sonya L. Britt, Jennifer Mentzer, and Ted Klontz. 2011. “Money Beliefs and Financial Behaviors: Development of the Klontz Money Script Inventory.” Journal of Financial Therapy 2, 1: 1–22, for details on instrument development.

- See Klontz, Brad, Sonya L. Britt, Kristy L. Archuleta, and Ted Klontz. 2012. “Disordered Money Behaviors: Development of the Klontz Money Behavior Inventory.” Journal of Financial Therapy 3, 1: 17–42.

- Table of results not shown.

References

Beck, Judith. 1995. Cognitive Therapy: Basics and Beyond. New York: The Guilford Press.

Dunleavey, M. P. 2010. “What Purchases Spouses Hide from Each Other.” CNN Money.

Elmerick, Stephanie A., Catherine P. Montalto, and Jonathan J. Fox. 2002. “Use of Financial Planners by U.S. Households.” Financial Services Review 11: 217–231.

Furnham, Adrian. 1984. “Many Sides of the Coin: The Psychology of Money Usage.” Personality and Individual Difference 5, 5: 501–509.

Kahler, Rick, and Kathleen Fox. 2005. Conscious Finance: Uncover Your Hidden Beliefs and Transform the Role of Money in Your Life. Rapid City, South Dakota: FoxCraft Inc.

Klontz, Brad. 2011. “Behavior Modification: Clients May Need Your Help Discovering the Childhood Beliefs Affecting Their Financial Decisions Today.” Financial Planning (April).

Klontz, Brad, Alex Bivens, Joni Wada, Richard Kahler, and Paul T. Klontz. 2008. “The Treatment of Disordered Money Behaviors: Results of an Open Clinical Trial.” Psychological Services 5, 3: 295–308.

Klontz, Brad, Sonya L. Britt, Jennifer Mentzer, and Ted Klontz. 2011. “Money Beliefs and Financial Behaviors: Development of the Klontz Money Script Inventory.” Journal of Financial Therapy 2, 1: 1–22.

Klontz, Brad, Rick Kahler, and Ted Klontz. 2008. Facilitating Financial Health: Tools for Financial Planners, Coaches, and Therapists. Cincinnati: The National Underwriter Company.

Klontz, Brad, and Ted Klontz. 2009. Mind Over Money: Overcoming the Money Disorders That Threaten our Financial Health. New York: Broadway Business.

Tang, Thomas Li-Ping. 1992. “The Meaning of Money Revisited.” Journal of Organizational Behavior 13, 2: 197–202.

Trachtman, Richard. 1999. “The Money Taboo: Its Effects in Everyday Life and in the Practice of Psychotherapy.” Clinical Social Work Journal 27, 3: 275–288.

Yamauchi, Kent T., and Donald J. Templer. 1982. “The Development of a Money Attitude Scale.” Journal of Personality Assessment 46, 5: 522–528.