Journal of Financial Planning: June 2024

Peter Lazaroff, CFA, CFP®, is the chief investment officer at Plancorp, where he is responsible for overseeing the development, implementation, and communication of investment strategy. Peter is also the author of Making Money Simple and host of The Long-Term Investor podcast. Learn more at www.peterlazaroff.com.

NOTE: Click on the images below for PDF versions.

Click HERE to read this article in the DIGITAL EDITION.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

In the evolving landscape of financial planning, the integration of environmental, social, and governance (ESG) investing represents a significant paradigm shift, drawing attention from practitioners and clients alike.

While ESG investing garners substantial interest for its potential to align financial strategies with ethical considerations and long-term sustainability goals, it also faces skepticism and hesitancy among financial advisers. This skepticism is often rooted in concerns over financial performance, the complexity of ESG criteria, and the perceived novelty of ESG methodologies compared to traditional investment approaches.

Acknowledging these concerns, this article seeks to provide a comprehensive overview of ESG investing, including an analysis of client demand, the diverse methodologies within ESG investing, a framework for building ESG portfolios, and practical guidelines for integrating ESG considerations into financial practices.

Client Demand and the Case for ESG Investing

There are a variety of surveys that illustrate a clear and growing demand for ESG investing among retail investors, with projections indicating a sustained increase in interest. Our focus will be on the Cerulli Associates’ U.S. Environmental, Social, and Governance Investing 2022 report, which delves into the specifics of these trends, analyzing the themes in ESG investing that resonate with different age groups, and the underlying motivations driving this demand.

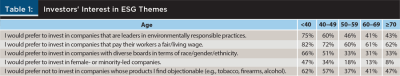

According to the Cerulli report, interest in ESG investing varies significantly across different age groups, reflecting distinct priorities and concerns. For example, 74 percent of investors under the age of 40 and 61 percent of investors between the ages of 40 and 49 say they would rather invest in companies that have a positive social or environmental impact. Meanwhile, only 39 percent of investors in their 60s and 31 percent of investors over the age of 70 feel the same way.

There is a similar dispersion in Table 1, which summarizes investors’ interest by a sample of ESG themes. By understanding these nuances, advisers can tailor their approaches to meet the diverse needs and interests of their clients.

While advisers are hesitant to initiate ESG conversations, 46 percent of clients would consider ESG goals if their adviser suggested them, whereas only 12 percent would not—so there seems to be little risk in at least gauging clients’ interest in ESG objectives. However, the Cerulli report suggests very few advisers discuss ESG proactively, and several barriers prevent advisers from fully embracing ESG strategies.

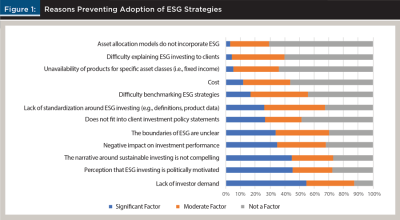

According to the Cerulli report, the biggest factor preventing adoption of ESG strategies appears to be the lack of investor demand, which seems to be the one thing that doesn’t align with other responses within the survey from retail and institutional investors, advisers, and asset managers.

Many of the other reasons preventing adoption can be addressed by implementing the right framework.

Six Different Ways to Be an ESG Investor

The diversity in ESG investing methodologies not only caters to different investment philosophies but also addresses the nuanced preferences of investors across the ESG spectrum. While some investors are drawn to the socially responsible side of ESG investing—a more emotionally driven, morals-based approach that aims to create a portfolio that aligns with the investor’s values—others approach ESG factors as a way to evaluate risks and opportunities and create more sustainable portfolios.

Because there are many approaches to ESG investing, each with very different objectives, understanding different ESG implementation methods is the next critical step in determining the best fit for your clients’ portfolios.

1. Negative/Exclusionary Screening

The most traditional form of ESG investing involves negative or exclusionary screening, wherein investors avoid companies or sectors that conflict with specific ethical standards. Common exclusion criteria include tobacco, firearms, fossil fuels, and companies with poor labor practices. While straightforward, this approach has faced criticism for oversimplification and the potential for limiting investment opportunities.

2. Positive/Best-in-Class Selection

In contrast to exclusionary screening, positive selection involves actively seeking out companies that excel in ESG practices within their industry or sector. This method focuses on identifying leaders in sustainability and governance, aiming to invest in businesses that not only avoid harm but also contribute positively to societal goals. Positive selection is predicated on the belief that companies with superior ESG metrics are better positioned for long-term success.

3. ESG Integration

The ESG integration approach examines ESG criteria alongside traditional financial analysis. This method recognizes that issues like climate change, social inequality, and corporate governance can affect a company’s long-term performance—but it doesn’t emphasize specific ESG-related goals. The point of the integration is to use ESG factors to pursue better risk-adjusted returns.

4. Thematic Investing

Thematic ESG investing targets specific ESG themes or issues, such as clean energy, sustainable forestry, female leadership, or good board governance. These funds seek to invest in companies that are most actively working to address the chosen issue while avoiding those that are not. This approach allows for investments that closely align with individual values and interests, even if they may lack diversification and may hurt long-term performance.

5. Impact Investing

Impact investing takes the concept of thematic investing further by seeking to generate measurable, beneficial social or environmental outcomes alongside a financial return. This approach often involves investments in projects or companies with explicit goals to address social issues (e.g., affordable housing, healthcare access) or environmental challenges (e.g., clean energy, sustainable agriculture). The focus here is less on generating a financial return and more on using capital to create positive change in the world.

6. Shareholder Engagement and Corporate Governance

Another avenue for ESG investors involves using shareholder power to influence company behavior and policies. This strategy includes voting on shareholder resolutions related to ESG issues, engaging in dialogue with company management, and advocating for changes that align with ESG principles. Through active engagement, investors can encourage companies to improve their practices and disclosures regarding ESG issues.

With an understanding of the diverse methodologies within ESG investing, advisers can navigate these options to define what ESG investing means to them and then build a portfolio that meets their clients’ needs effectively. Next, we’ll explore a framework for building ESG portfolios, offering practical guidance on integrating ESG considerations into portfolio construction and management.

A Framework for Building ESG Portfolios

Modern ESG investing strategies mark a significant evolution from earlier approaches centered on exclusionary screening and impact investing. Unlike these more client-led strategies, which prioritize individual values and desired social outcomes, investment led-strategies such as positive screening and ESG integration focus on the materiality of ESG issues to the investments themselves.

This shift toward an investment-led strategy emphasizes how companies address ESG issues likely to impact their financial performance and sustainability. By prioritizing material ESG factors, these strategies appeal to a broader audience, offering a foundation for inclusion in a wide range of investment portfolios without necessitating customization for individual investor preferences.

The first step in building an investment-led ESG portfolio involves establishing clear ESG policies and objectives. Advisers must define how ESG factors will be integrated into the investment process, determining the ESG issues of focus based on their materiality to investment performance and sustainability. Setting specific objectives for ESG integration is crucial, whether it’s enhancing risk management, identifying opportunities for sustainable growth, or aligning with broader investment themes.

Following the establishment of policies and objectives, the next step is to conduct a thorough review of rating agencies like MSCI ESG Research, Sustainalytics, RobecoSAM, FTSE Russell, CDP, Bloomberg ESG Data Service, and Refinitiv ESG Scores, which is crucial for financial advisers incorporating sustainable investing into their practice.

These agencies differ in methodologies, focus areas, rating scales, data sources, and sector-specific insights. Advisers should note these differences to select the most appropriate ratings that align with their investment philosophy and their clients’ sustainability goals:

- Methodology variance: Different agencies emphasize various ESG aspects, impacting company scores.

- Scope of evaluation: Agencies vary in the ESG factors they assess, with some focusing more on environmental issues, while others provide a broader ESG evaluation.

- Rating scales and benchmarks: Understanding the diverse rating scales and benchmarks is essential for accurate ESG performance interpretation.

- Data sources and transparency: The quality and transparency of the data used by rating agencies influence the reliability of ESG ratings.

- Sector-specific insights: Selecting agencies that offer detailed insights into specific sectors can enhance investment strategies.

Once the preferred ESG rating methodologies have been identified, the next step is to evaluate asset managers integrating those methodologies into investment products. Start by assessing the asset manager’s approach to ESG integration. This includes understanding how they incorporate ESG ratings from agencies as well as the criteria for ESG assessment and the weight given to various ESG factors.

When evaluating the investment performance of asset managers with a focus on ESG integration, it’s crucial to assess the tracking error relative to traditional benchmarks. There is no right or wrong amount of tracking error, but this is often the way to assess the balance between the dual objectives of financial growth and positive impact.

Lastly, look for asset managers who provide transparent reporting on their ESG investment process and outcomes. This includes detailed disclosures on ESG factor integration, voting policies, and the impact of their ESG investments. This will help you with the final step in the process of building ESG portfolios, which is ongoing monitoring and reporting of ESG factors within investment portfolios.

Establishing mechanisms for continuous monitoring, including regular reviews of ESG performance and materiality assessments, ensures that ESG considerations remain integral to investment management. Reporting on ESG integration outcomes, both internally and to stakeholders, highlights the impact of ESG considerations on investment performance and portfolio sustainability.

Next, we will explore how to practically incorporate these ESG investing strategies into financial practices, addressing the educational and client engagement aspects necessary for successful integration.

How to Incorporate ESG Investing into Your Practice

Incorporating ESG investing into a financial advisory practice goes beyond portfolio construction to involve education and client communication. Given the shift toward investment-led ESG strategies, advisers must adopt an approach to ensure both they and their clients are well-informed and aligned in their investment objectives.

Educate Yourself and Your Team

The landscape of ESG investing is rapidly evolving, influenced by global events, policy changes, and shifts in societal values. Staying informed about these developments is crucial for financial advisers. Regularly reading industry publications, attending conferences, and participating in webinars can provide valuable insights into emerging trends and regulatory changes affecting ESG investing.

Numerous organizations and industry groups are dedicated to advancing sustainable investing. Resources provided by these organizations, such as the Principles for Responsible Investment (PRI), the CFA Institute, and the Sustainable Investments Institute, can offer advisers comprehensive insights, tools, and data for integrating ESG considerations into investment strategies. These resources might include research reports, ESG data platforms, and case studies highlighting best practices in ESG investing.

For many advisers, investing in formal training or certification programs focused on ESG investing is the best way to gain confidence in the space. Programs like the Chartered SRI Counselor (CSRIC) offered by the College for Financial Planning or the Certificate in ESG Investing by the CFA Institute equip professionals with a comprehensive understanding of how to analyze and integrate ESG factors into investment processes. Earning such certifications not only enhances an adviser’s credibility but also signals their commitment to incorporating sustainable investing principles into their practice.

Communicating the Value of ESG Investing to Clients

Starting conversations with clients about ESG investing is key to aligning their portfolios with both financial and ethical goals. Advisers play a crucial role in clarifying the shift toward investment-led ESG strategies, which assess companies based on ESG factors that influence financial performance. This approach helps dispel the notion that ESG investing solely involves exclusionary practices or prioritizes impact over financial returns.

Addressing misconceptions is vital. Contrary to the belief that ESG investing compromises financial performance, evidence shows ESG-aligned companies often outperform, demonstrating superior risk management and resilience. Highlighting research and success stories where ESG investments have led to competitive returns and positive societal impact can bolster client confidence.

One notable example is “ESG and Financial Performance: Aggregated Evidence from More Than 2000 Empirical Studies” by Friede, Busch, and Bassen (2015). This meta-analysis is particularly influential, compiling results from over 2,000 individual studies and finding a positive relationship between ESG standards and financial performance in most cases.

Another useful example is “Corporate Sustainability: First Evidence on Materiality” by Khan, Serafeim, and Yoon (2016). The authors of this paper argue that companies that perform well on sustainability issues that are financially material to their success benefit from superior stock performance compared to firms that perform poorly on these issues or that invest in sustainability issues that are not material to their business.

Other key studies that have been highly cited in both academic and professional contexts include:

- Derwall, Guenster, Bauer, and Koedijk (2005), demonstrating higher equity returns for firms with robust environmental practices, suggesting the market values responsible environmental stewardship.

- Hong and Kacperczyk (2009), showing that “sin stocks” often face higher capital costs and lower valuations, highlighting the positive financial impacts of ESG alignment.

- Eccles, Ioannou, and Serafeim (2014) found that companies excelling in material sustainability issues outperform others in stock market and accounting metrics, linking good sustainability practices to superior risk management.

- Giese et al. (2019), providing evidence that high ESG ratings correlate with better operational performance and reduced risk.

These studies have significantly shifted ESG investing from a niche to a mainstream strategy, proving that incorporating ESG factors can enhance financial returns.

Emphasizing ESG investing’s broad benefits—from risk mitigation to societal contribution—is crucial. Advisers can illustrate how ESG strategies align with clients’ values and uncover opportunities in sectors poised for growth, like renewable energy. Tailoring these discussions to clients’ ESG familiarity and using clear language ensures a comprehensive understanding, fostering an appreciation for sustainable investing.

Integrating ESG into Onboarding, Review Processes

Incorporating ESG considerations into client onboarding is a straightforward way for advisers to align investment strategies with clients’ values and goals. By integrating ESG-related questions into onboarding questionnaires, advisers can discern clients’ ESG priorities and their openness to balancing financial returns with ESG impacts. This initial understanding enables the customization of investment strategies to reflect each client’s specific interests, such as environmental sustainability or social issues.

Customizing ESG strategies to match client concerns allows for a more targeted investment approach. Whether a client is driven by environmental factors, leading to investments in renewable energy, or social values, prompting investments in companies with strong labor practices, the goal is to align investments with client passions.

Crucially, maintaining open lines of communication about ESG investment performance and its broader impacts bolsters transparency and underscores the value of ESG integration. Reporting on both financial and ESG outcomes, such as carbon footprint reduction or diversity improvements, demonstrates the tangible benefits of ESG investing, deepening client engagement with ESG principles.

By following these steps, financial advisers can seamlessly incorporate ESG investing into their practice, meeting the growing client demand for investment strategies that not only generate financial returns but also contribute positively to societal goals. As ESG factors increasingly influence financial markets, advisers who effectively integrate these considerations into their practice will be well-positioned to serve their clients’ evolving needs and preferences, fostering long-term relationships and promoting a sustainable future.

References

Derwall, J., N. Guenster, R. Bauer, and K. Koedijk. 2005. “The Eco-Efficiency Premium Puzzle.” Financial Analysts Journal 61 (2): 51–63.

Eccles, R. G., I. Ioannou, and G. Serafeim. 2014. “The Effect of Corporate Sustainability on Organizational Processes and Performance.” Harvard Business School.

Friede, G., T. Busch, and A. Bassen. 2015. “ESG and Financial Performance: Aggregated Evidence From More Than 2000 Empirical Studies.” Journal of Sustainable Finance & Investment 5 (4): 210–233.

Giese, G., L.-E. Lee, D. Melas, Z. Nagy, and L. Nishikawa. 2019. “Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance.” The Journal of Portfolio Management 45 (5): 69–83.

Hong, H., and M. Kacperczyk. 2009. “The Price of Sin: The Effects of Social Norms on Markets.” Journal of Financial Economics 93 (1): 15–36.

Khan, M., G. Serafeim, and A. Yoon. 2016. “Corporate Sustainability: First Evidence on Materiality.” The Accounting Review 91 (6): 1697–1724.