Journal of Financial Planning: March 2025

NOTE: Please be aware that the audio version, created with Amazon Polly, may contain mispronunciations.

Randy Gardner, J.D., LL.M., CPA, RLP, CFP®, AEP (Distinguished), is the founder of Goals Gap Planning, LLC, and the Gardner Foundation.

Julie Welch, CPA/PFS, CFP®, AEP (Distinguished), is the managing shareholder of Meara Welch Browne, P.C. (https://mwbpc.com), an accounting firm in the Kansas City area. Together, Julie and Randy authored 101 Tax Saving Ideas (Eleventh Edition).

Creyton Vincent is a firefighter in the Air Force and a financial educator with the Gardner Foundation.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on the images below for PDF versions.

On January 5, former President Joe Biden signed into law the Social Security Fairness Act. This act, which has been working its way through Congress with bipartisan support for years, gets rid of the windfall elimination provision (WEP) and government pension offset (GPO). These provisions impact approximately 2.5 million individuals receiving Social Security workers’ benefits and spousal or survivors’ benefits.

The Congressional Budget Office estimates the average worker subject to the WEP will receive an additional $360 per month in Social Security benefits; the average spouse subject to GPO will receive an additional $700 per month; and the average surviving spouse subject to GPO will receive an additional $1,190 per month.1 The changes are retroactive to January 2024, meaning impacted recipients will receive lump-sum payments sometime in 2025. The act creates an important opportunity for advisers to help recipients use their lump-sum and ongoing payments to enhance their retirement situations.

Background

The Social Security system is a federal government safety net that has protected U.S. workers and their families since 1935. There are a few Social Security planning principles most workers take for granted. First, once you earn 40 quarters of coverage in employment or self-employment, you are fully insured and entitled to a Social Security retirement or, if applicable, disability benefit. Second, the higher your earnings and the more months of coverage you have (up to 420 months), the greater your benefit. Third, not only is the worker covered but, like an insurance policy, your spouse, ex-spouses (when the marriage lasted more than 10 years), children, and, in some cases, parents are entitled to benefits based on the worker’s earnings. Prior to 2024, the WEP and GPO distorted these principles.

Starting in 1977 when, similar to now, the Social Security system was facing financial challenges, Congress chose to restrict these basic principles for workers who earned compensation from employers who did not participate in the Social Security system (referred to as non-covered employment) and received retirement benefits from these employers or unions associated with the employers (referred to as non-covered pensions). These non-covered pension restrictions applied even if the workers met the conditions to be fully insured under traditional Social Security principles.

Many legislators, advisers, employers, and recipients felt these restrictions were unfair, but GPO was enacted in 1977 and WEP in 1984 to avoid the perception that these non-covered employees were “double dipping” in retirement benefits. The occupations most frequently affected were first responders, such as police officers and firefighters, and public and private school employees. The states with the most affected employees are California, Texas, Ohio, and Massachusetts.

A Closer Look at WEP and GPO

To better understand who will benefit from the changes made by the act, let’s take a closer look at how Social Security benefits are calculated.

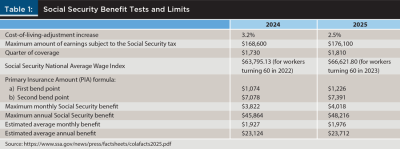

Table 1 shows some key figures from the 2025 Social Security Changes Fact Sheet. Most of the items change with inflation each year. The “bend points” formula used to calculate a worker’s Social Security benefit, referred to as the primary insurance amount (PIA) in the chart above, is also adjusted for inflation. The formula is applied to the worker’s average earnings over 35 years (420 months). The worker’s earnings from age 22 through age 60 are indexed for inflation based on increases in the National Average Wage Index. Thus, the average indexed monthly earnings (AIME) for each worker is calculated by taking the highest 35 years of indexed or non-indexed earnings over the worker’s lifetime and dividing by 420 months.2

The worker’s PIA for 2024 is the sum of three separate percentages of the AIME:

- 90 percent of the first $1,174 of AIME ($14,088 annually)

- 32 percent of the AIME over $1,174 and through $7,078

- 15 percent of the AIME that exceeds $7,078 ($84,936 annually)

with a maximum monthly benefit of $3,822 ($45,864 annually) based on 35 years of earning the FICA cap.

Note that this formula heavily favors lower earners. Individuals earning less than $14,088 of indexed earnings annually have 90 percent of their earnings replaced with a Social Security benefit at full retirement age (66 years and 10 months in 2025 for those born in 1959; 67 for those born in 1960 or later starting in 2026). Indexed earnings between $14,088 and $84,936 lead to an additional Social Security benefit at a 32 percent rate. Earnings in excess of $84,936 result in an additional Social Security benefit at a 15 percent rate. It is the 90 percent replacement ratio that was concerning to legislators because workers in non-covered employment could have low earnings in covered employment and have their Social Security benefits based on 90 percent of their pay.

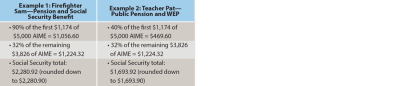

Example 1: Sam was a firefighter in New York for 35 years and earned a firefighter’s public retirement system pension of $4,000 per month. Sam also paid into the Social Security system. (New York public employees work in covered employment because they have Social Security withheld from their paychecks.) Sam’s AIME was $5,000. Sam’s PIA using the 2024 formula above was $2,280.90 [(($1,174 × 0.9) + ($5,000 − $1,174) × 0.32) rounded down to the next lower dime]. Because Sam was subject to Social Security withholding, Sam will have no WEP or GPO adjustment. Thus, Sam’s total benefits at retirement will be $6,280.90 ($4,000 + $2,280.90) per month.

Windfall Elimination Provision (WEP)

Example 2: Pat taught in California public schools for 35 years, prior to the passage of the Social Security Fairness Act, earning a California Public Employees’ Retirement System (CalPERS) pension of $4,000 per month. Pat worked in non-covered employment because the California school district did not withhold FICA. Over the years, in addition to teaching, Pat worked in covered employment for temporary and part-time employers who withheld Social Security from Pat’s paychecks. Pat’s AIME from these extra jobs was $5,000 (the same as Sam’s AIME in Example 1), and, by working 200 months (less than 20 years) in these jobs, Pat met the 40 quarters of coverage requirement to be fully insured under Social Security.

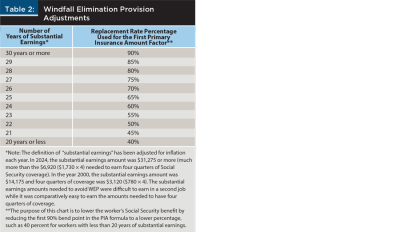

Nonetheless, because Pat was eligible for a non-covered pension from CalPERS, Pat was subject to the WEP adjustment. The adjustment applied to workers who earned a pension in any job where they did not pay Social Security taxes, and they also worked in other jobs long enough to qualify for a Social Security retirement or disability benefit. The WEP adjustment is the lesser of 50 percent of the non-covered pension or the recalculated benefit based on Table 2:

Returning to Example 2, the WEP adjustment for Pat is the lesser of:

- $2,000 (50 percent of the $4,000 benefit); or

- $587 ($1,174 × (0.90 − 0.40)), the recalculated first factor in the PIA formula.

Thus, Pat will receive a Social Security benefit of $1,693.90 ($587 per month less than the $2,280.90 monthly benefit Sam in Example 1 was eligible to receive). In 2024, Pat would have received retirement benefits of $5,693.90 ($4,000 CalPERS pension + $1,693.90 Social Security benefit). Under the Social Security Fairness Act, Pat is entitled to a refund of the 2024 penalty of $7,044 ($587 × 12) and will receive $2,280.90 per month, the same benefit as Sam, going forward.

Planning Tip for Non-Covered Employees

Pat in Example 2 made an effort to qualify for the non-covered teacher’s pension and Social Security by working more than 40 quarters in covered employment. Many non-covered employees have made no effort to qualify for Social Security benefits because they knew they would be subject to the WEP and GPO. This approach to retirement may change following the passage of the Social Security Fairness Act. The amount of earnings required to qualify for a quarter of Social Security coverage in 2025 is $1,810. The maximum number of quarters that can be earned in one year is four. If a non-covered worker could earn $7,240 ($1,810 × 4) in 2025, whether it is earned from one month of covered employment or 12 months of covered employment, the worker will have four quarters toward fully insured status in the Social Security system. With the Social Security Fairness Act’s elimination of WEP and GPO, earning an additional 40 quarters of coverage over at least 10 years will qualify a worker in non-covered employment for a Social Security benefit in addition to the non-covered pension they may have from their non-covered employment.

Government Pension Offset (GPO)

Generally, Social Security retirement benefits are available not only to a covered worker but also to the covered worker’s spouse. Similar to the WEP adjustment for the non-covered worker, the GPO offset was designed to avoid a double benefit for the spouse of the covered worker who had earnings in non-covered employment. The GPO reduced Social Security spouse and survivor benefits. If the covered worker’s spouse worked for a state or local government or other non-covered employment where Social Security taxes were not paid, the worker’s Social Security spousal and survivor benefits were reduced by two-thirds of the amount of the non-covered worker’s non-covered pension.

Example 3: Ann and Bill are married. Before retirement in January 2024, Ann was a corporate manager who worked 40 years in covered employment for a company that withheld Social Security from her paychecks. Her Social Security benefit was $4,000 per month.

Situation 1: If Bill was a non-working spouse or an employee covered under Social Security, Bill’s Social Security benefit would be at least $2,000 (50 percent of Ann’s $4,000) per month based on Ann’s covered earnings during retirement and $4,000 (100 percent of Ann’s pre-death benefit) per month if Bill survives Ann.

Situation 2: Assume instead that Bill works in non-covered employment as a city administrator, has a non-covered pension under a state public employees’ retirement system, and does not have any quarters of coverage under the Social Security system. If Bill’s public employees’ retirement system pension is $4,800 per month, two-thirds of that amount, or $3,200, must be deducted from his Social Security spousal benefits based on Ann’s covered employment record. In other words, if Bill is eligible for a $2,000 Social Security benefit based on Ann’s lifetime corporate earnings, Bill will receive no Social Security benefits because two-thirds of his pension ($3,200) is greater than the Social Security spousal benefit from Ann ($2,000). Prior to 2025, the GPO reduced Bill’s spousal benefit to zero. The Social Security Fairness Act eliminates this reduction. Bill is entitled to the full $2,000 in addition to Bill’s $4,800 public employees’ retirement system pension, and Bill is entitled to a lump-sum benefit from 2024 of $24,000 ($2,000 × 12 months).

Prior to the Social Security Fairness Act, the GPO was extremely harsh. Bill’s Social Security benefit based on Ann’s earnings was reduced, but Bill did receive his own public employees’ retirement system pension. The GPO reduced Social Security spousal and survivor benefits by two-thirds of the amount of the pension with no dollar cap. Unlike the WEP, the GPO could completely wipe out a Social Security benefit, and it did not have an exception for 30 years of substantial earnings.

Situation 3: If Ann passes away in December 2023 and Bill survives Ann and steps into 100 percent of Ann’s $4,000 per month benefit, prior to 2025, Bill would have received only $800 per month (Ann’s $4,000 reduced by two-thirds of his $3,200 benefit). After the Social Security Fairness Act, this reduction will not occur, meaning Bill will receive a survivor benefit of the full $4,000 per month, and Bill is entitled to a lump-sum amount for 2024 of $38,400 ($3,200 × 12 months).

Planning Strategies

1. Review your client files to see if you have any clients who were, or are, non-covered employees and notify them of the benefits they may receive.

a. If your clients are not yet receiving benefits, adjust your retirement projections to account for the additional monthly income they can expect to receive.

i. If your clients were abstaining from working in covered employment because of concerns about not receiving benefits or abstaining from working in non-covered employment because of the potential loss of benefits, advise them that the WEP and GPO no longer apply, and they may qualify for a government pension and Social Security benefits.

b. If your clients were already receiving reduced benefits due to the WEP or GPO, help them: calculate the retroactive lump-sum amount they can expect in 2025; project the additional monthly benefit they can expect throughout their retirement years; and evaluate their debt management or investment options with the unexpected income.

i. The Social Security Administration website says it is making the necessary adjustments, but if the changes expected by your client have not occurred by July 2025, recommend that your client contact the local Social Security Administration office.

2. If Congress enacts the tax-free Social Security benefits legislation President Donald J. Trump has promised, the lump sum and ongoing payments may be tax free. Otherwise, you should expect and advise your clients that up to 85 percent of the lump sum and increased Social Security benefits from the Social Security Fairness Act will be taxable because up to 85 percent of Social Security benefits is taxable dependent on the amount of income a person has.

a. When lump-sum Social Security benefits attributable to prior years are received, generally the option to reduce taxes by reporting the benefits as if they were received in the prior year is available. This approach does not involve amending returns for prior years but does allow one to potentially lower the taxable portion of the benefits by using the income from the earlier year to calculate the taxable amount.

3. Remember that the changes are retroactive to January 2024, and some of the affected beneficiaries may have passed away.

a. You can take steps with the beneficiary’s estate or descendants to claim the possibly substantial benefits of the deceased Social Security recipient.

4. According to the Congressional Budget Office, the cost of the Social Security Fairness Act is expected to be $195.65 million over the next 10 years,3 which may further burden the Social Security system that is supposed to start paying reduced benefits in 2035.

a. Keep your eyes on Congress to see if it responds with increased employment taxes, means testing, or delayed start dates, and help your clients adjust their Social Security claiming strategies accordingly.

i. For healthy clients, this may mean drawing after full retirement age and before age 70 to maximize benefits before the reduction.

ii. Unhealthy clients with life expectancies below age 78 may want to draw as early as age 62 in order to maximize benefits received. Watch out for the retirement earnings limitation test if they expect to earn more than $23,400 from wages and self-employment in 2025 and subsequent years before they turn 67.

The passing of the Social Security Fairness Act, besides being the right thing to do for the millions of workers employed in non-covered public service, provides advisers with the perfect opportunity to reach out to clients and revisit their retirement projections.

Endnotes

- See https://tonko.house.gov/uploadedfiles/010725_socialsecurityfairness_onepager.pdf for a fact sheet with some FAQs about the Social Security Fairness Act.

- For detailed examples of the calculation of AIME and PIA, see the Social Security website at www.ssa

.gov/oact/ProgData/retirebenefit1.html. - See www.cbo.gov/publication/60690.