Journal of Financial Planning: September 2024

Executive Summary

- In most conventional treatments, the advisability of a Roth conversion hinges on a comparison of present to future tax rates. If future tax rates will be higher, conversion is indicated.

- This paper argues that future tax rates are unknowable, and that this uncertainty needs to be incorporated into the decision process around Roth conversions.

- The time course over which tax savings accrue has also been ignored. For the mass affluent, conversions typically serve to reduce required minimum distributions. Because RMDs continue for life, tax savings from reducing future RMDs may take decades to accumulate.

- RMD-reducing Roth conversions fit the classic model for net present value analyses. There is a large one-time tax payment at conversion, followed by years and years of tax savings. Savings postponed until the distant future must be discounted. The conversion pays off only if the discounted value of future savings exceeds the cost to convert.

- This paper develops the implications of the long, slow, uncertain payoff for conversions. Clients need to be comfortable with a payoff that may not be complete until 20 or 30 years have passed, and which may be comparatively small in present value terms.

Edward F. McQuarrie is professor emeritus at the Leavey School of Business, Santa Clara University. His research focuses on market history and retirement income planning; working papers can be found at https://ssrn.com/author=340720.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on the images below for PDF versions.

In a Roth conversion, a retirement saver voluntarily and unnecessarily pays tax today on today’s account value, making a wager that the tax otherwise owed tomorrow would have been greater. This paper unpacks these elements to generate practical advice for planners about when a conversion should be recommended to clients, with how much caution, and with what caveats. Conversions emerge as a risky bet, often with small upside and substantial downside.

Literature Review

It is not conventional to analyze conversions as wagers—as bets on uncertain future outcomes. More typically, whether to convert is approached as a rational decision based on information about present and projected tax rates (Horan, Peterson, and McLeod 1997; Krishnan and Cumbie 2016; Reichenstein 2020; Reichenstein and Meyer 2020). If the future tax bracket is reasonably projected to be higher, conversion is recommended; if lower, conversion is ill-advised; and if tax rates seem likely to be constant, conversion may or may not take place depending on factors extraneous to projected rates, such as a desire for diversification across account types (Brown, Cederburg, and O’Doherty 2017).

Under the rational decisions model, the expected payoff from a Roth conversion can be calculated using simple arithmetic (McQuarrie and DiLellio 2023). The payoff equals dollars that would have been distributed multiplied by the difference between today’s conversion tax rate versus the tax rate that would have applied to the distribution(s).

This paper challenges the utility, to clients and planners, of the rational decision model. The conventional approach suffers from two problems. First, future tax rates cannot be known with certainty. The client’s situation may change, or Congress may change the tax law. Projecting a uniform tax rate throughout a multi-decade period is per se implausible.

Second, distributions may occur in the near or distant future, or they may be split into small distributions made over many years, as in required minimum distributions. Dollars in tax saved 10 years from now cannot be equated to dollars in tax paid today. An adjustment must be made for the time value of money. Prior work has not always discounted future values.

This paper contributes to the literature by recasting the Roth conversion decision as a problem in estimating net present value. The focus is the NPV of conversions intended to reduce future RMDs. In this case, a large one-time tax payment is made today to convert; after which, tax savings accrue year by year for as long as distributions would have continued. The tax paid today is entered as a negative value, and a positive payoff is received only if the discounted value of future tax savings exceeds the initial tax cost. The questions of interest are what discount rate to apply, over what horizon, and how to incorporate uncertainty surrounding future tax rates.

Net Present Value Analysis

Discounting Future Tax Savings

The proper discount rate must be the expected annualized rate of appreciation on the portfolio targeted for conversion. That is the rate that makes the client indifferent to paying tax now versus later (assuming constant tax rates throughout the distribution period). Here is an example: Suppose a $10,000 portfolio in a tax-deferred account is invested in stocks returning 10 percent and that the tax rate on withdrawals is 25 percent. If the account is converted today, tax of $2,500 will be due. If the account is liquidated after one year of appreciation, $11,000 will be withdrawn, and the tax due will be $2,750. Discounted at the portfolio rate of appreciation, paying $2,750 after one year is no different from paying $2,500 today.

If any lower rate of discount were to be applied to future tax savings (whether inflation, the risk-free rate, or no discount at all), then Roth conversions would always pay off spectacularly if held for long enough. Left in stocks for 30 years, that $10,000 portfolio has an expected future value of about $175,000; undiscounted, the future tax savings would be about $43,625. Absent any discounting, a rational taxpayer would always convert immediately, paying only $2,500 in tax today to save tens of thousands of dollars in future tax.

Clients in the top bracket are particularly vulnerable to this form of money illusion. In the top bracket, clients can convert an arbitrarily large amount at a single tax rate, say, $10 million at 37 percent, paying $3.70 million in tax today. Again, invested in stocks at 10 percent for 30 years, that conversion avoids a future distribution of $175 million, thus averting tax of $64.75 million. Who could resist saving over $60 million in tax through an immediate conversion?

By contrast, the rational taxpayer not subject to money illusion will discount tax savings not received until some future date, and will discount more heavily the more distant that future.

Time Horizon

The next requirement for the NPV analysis is to determine the time horizon. The focus on RMDs suggests a base case of life expectancy plus 10 years. RMDs continue for life, and under SECURE 1.0, most non-spousal heirs will have 10 years to distribute the account. Again, this will be the base case, allowing for comparison to alternative scenarios that assume a shorter or longer life, single or joint life expectancy, hasty distribution by heirs, etc.

Tax Uncertainty

Scenario analysis will also be used to explore the impact of uncertain future tax rates. Here the base case will be an increased tax rate on distributions that is avoided by converting today. Subsequent scenarios will explore changes in future tax rates. As an example of an unexpected change, the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), the tax cut legislation passed during the presidency of George W. Bush, was scheduled to expire after 2010. Ultimately, expiration was pushed out two years, and after 2012, only the top rate returned to its pre-EGTRRA value.1

More generally, the base case for the NPV analysis will assume a constant future tax rate higher than the conversion rate—say, the 25 percent to which the current 22 percent bracket is scheduled to revert after 2025 when the Tax Cuts and Jobs Act of 2017 (TCJA) expires. Given this scenario, under the rational decision model, conversion would be advisable. Simplified, to dispense with any discounting, a conversion of $100,000 at 22 percent in late December 2025, to avert a distribution in early January 2026 taxed at 25 percent, provides tax savings with an NPV of ([25 percent – 22 percent] × $100,000), or $3,000.

A key insight from the analysis will be to show that the $3,000 payoff is fixed in NPV terms, so long as the future tax rate is fixed at 25 percent. What needs to be probed is the time course over which that payoff is metered out and, hence, the impact of the timing of any unexpected changes to the future tax rate.

NPV Model for Conversions Intended to Reduce RMDs

- A $100,000 conversion taxed at 22 percent takes place at the end of the year the taxpayer turns 72, which is taken to be 2025; this incurs $22,000 of initial tax costs.2

- The conversion is assumed to be partial, i.e., RMDs on the remainder of the TDA, plus other income such as Social Security, will be sufficient to put the taxpayer in the indicated tax bracket once distributions begin and to keep them there. Tax savings come from reducing RMDs relative to what they would have been without the $100,000 conversion;3 the analysis focuses on this marginal reduction in income and tax.

- RMDs are taken according to the Uniform Life Table, beginning 12 months later at age 73, after one year’s appreciation on the portfolio. Because TCJA will have expired, the tax rate that applies to distributions in 2026 is 25 percent, not 22 percent. For this baseline case, there is no uncertainty or volatility in future tax rates; the 25 percent rate applies throughout the projection.

- RMDs continue until life expectancy is reached 17 years later;4 heirs, also in the 25 percent bracket, then distribute the portfolio over the following 10 years, after which the tax-deferred account would have been completely emptied, all tax savings have been booked, and the projection concludes.

- The portfolio in the tax-deferred account available for conversion is a conservative balanced mix of stocks and bonds with a projected return of 6 percent per annum. Future tax savings are discounted at this rate.

Base Case

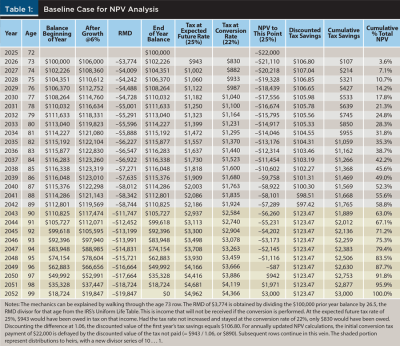

The baseline NPV analysis shows the time course over which tax savings are booked when distributions occur year by year in accordance with the RMD schedule (Table 1).

Briefly, at age 73 the first RMD is reduced by $3,774 because of the conversion.5 Taxes at 25 percent are about $943, versus the $830 that would have been owed at a rate of 22 percent. The booked payoff from the timely conversion in 2025 is the difference, about $113; discounted for one year at the portfolio appreciation rate, that is $106.80. Just that much of the $3,000 expected payoff has been booked in the first year of the projection.

After 17 years, the taxpayer dies at life expectancy in 2042. Distributions to the heirs begin on a substantially equal periodic basis across the following 10 years (shaded cells). Total distribution occurs at what would have been age 99 for the taxpayer. At that point, the discounted present value of all the tax savings accumulated across the 27 years in Table 1 adds up to $3,000—exactly the same as the value for an immediate distribution in the first days of 2026 as given by the formula, [(taxdist – taxconv) × avoided distribution(s)].

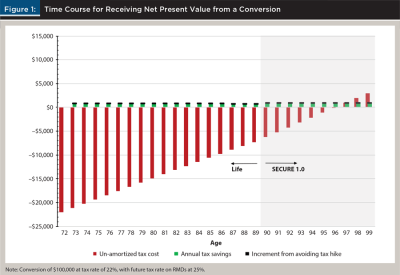

Next, Figure 1 provides a graphical analysis of how the payoff proceeds. It has been constructed to provide two alternative lenses on how RMD-reducing conversions pay off. On the one hand, a portion of the payoff is booked every year as the stream of discounted tax savings accumulates. These amounts are small (Table 1) because the distributions avoided by the conversion—the RMDs—are small, and because the avoided tax hike of 3 percent is itself small. But as shown subsequently, these savings are booked and remain on the books, even if future tax rates change in a way unfavorable to the conversion, as would occur if the applicable rate dropped back to 22 percent. Nonetheless, these are book entries only, not cash in hand; the total savings from conversion are not realized until distribution is complete, as seen in the rightmost red bar in Figure 1.

Viewed through a different lens, the tax paid up front to convert represents dollars out of pocket, not a book entry. This sum is defrayed yearly by the tax that doesn’t have to be paid on the RMDs that do not occur because of the conversion. Those are actual dollars that do not have to be paid going forward. Because RMDs are individually small, the $22,000 paid out of pocket up front takes a long time to be defrayed. In fact, when the taxpayer dies at life expectancy, about $7,000 remains to be defrayed. It is only when heirs are close to completing distribution, about when the taxpayer would have been age 97, that the initial outlay of $22,000 is totally cashed out. Only after that point is there received cash in hand from converting at 22 percent to avoid a tax hike to 25 percent. In short, all of the realized payoff from the baseline conversion goes to the heirs decades hence.

More Lucrative Conversions

In the base case, the taxpayer wagers on future tax legislation: that the TCJA will expire and stay expired so that a timely conversion averts a 3 percent tax hike. The difference in tax rate is small in absolute terms and small relative to the conversion tax rate (3 versus 22).

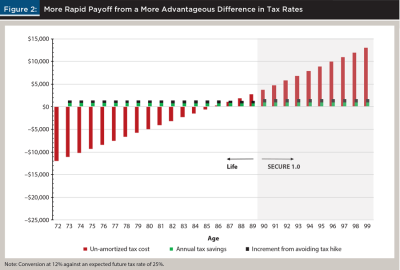

Taxpayers can also wager using knowledge of their personal situation, i.e., place a bet that their current income is low now, relative to what it will be later. This situation may be found among retirees in their 60s who are deferring Social Security. While working, these affluent individuals may have been taxed at 32 percent; later, after RMDs begin, they still expect to be in at least the 22 percent bracket; but today, able to live off savings for a year or two, they could potentially convert at 12 percent. Assuming for parallelism that the TCJA expires as scheduled, their conversion payoff (25 percent – 12 percent = 13 percent) is high in absolute terms and high relative to the conversion rate (13 versus 12).

Figure 2 shows how payoff proceeds on this much more advantageous conversion. The up-front cost is much lower, $12,000, but this tax cost is being defrayed annually by the same dollar amount as in Figure 1; accordingly, the red bars shrink much more rapidly in Figure 2. The NPV is 13/3 as large as in the base case.6 Net of the two, all of the up-front tax payment will be cashed out while the taxpayer can expect to be alive, at approximately age 86.

Implications

The conventional wisdom about Roth conversions requires an addendum. Yes, conversion may be advised if the tax rate today is lower than the anticipated future tax rate. But the conversions with the most rapid payoff will be those where the conversion tax rate is low in absolute terms, so that the tax gap can be high in relative as well as absolute terms.

Base Case with Varying Assumptions

The reader can verify the claims made in this section by downloading the spreadsheet and altering the assumptions as described.7 These alternative scenarios are presented briefly for the sake of completeness.

Time Course of Tax Savings

- The NPV does not change if the taxpayer lives long or dies young. It is keyed to the difference in tax rates.

- The pace at which the NPV is booked is set by the RMD schedule and is independent of the size of the NPV. The first-year accrual in the base case, of $106.80, will be 10/3 as large if the NPV is $10,000; equivalently, at a portfolio appreciation rate of 6 percent, it will always represent about 3.6 percent of the total NPV (Table 1).

- For small tax differences that are also small relative to the conversion rate (e.g., 3/22 as in the base case), the taxpayer will have to live to 100 or more to see any cash in hand.8

In sum, the payoff from an RMD-reducing Roth conversion proceeds slowly but steadily. These conversions represent a long-term wager that may be best suited for those focused on the well-being of their heirs decades hence (Young 2020).

Earlier Conversions

Few Roth conversions are postponed until age 72; this age was set to simplify the initial illustration of how discounted tax savings accumulate. A more typical case would be conversion when clients are in their 60s. However, given discounting within an NPV model, the timing of the conversion can be shown to make no difference to the expected payoff under the formula [(taxdist – taxconv) × distribution(s)]. What planners must emphasize to clients is that discounted tax savings do not get booked until distributions commence.

To illustrate, have a 67-year-old make a $100,000 conversion, i.e., set the time of the conversion five years earlier than in the base case. This will grow to $134,000 the year before RMDs begin (portfolio appreciation at 1.065).If everything else remains the same, the expected payoff will be $4,000, 134/100 as large as before. But this is misleading. Because discounting must begin at the time of conversion, the discounted present value of that $4,000 is $3,000. Likewise, first-year tax savings, and all subsequent years, will be the same proportion of the total—there is no difference in time course once distributions do begin. All that changes is the postponement of the onset of tax savings, as must occur when a conversion is made years in advance of RMDs.

Implications for Planners

Does the client understand how many years it will take to receive the full payoff from a Roth conversion? That is the first and most important caution that the planner must communicate to the prospective converter. It can be supported by a reminder that the total payoff, $3,000 in the base example, will not be received until after the client dies—unless the client would have taken a premature total distribution. When the avoided tax hike is small, 3 percent in the base case, even a very long-lived client will not see the initial tax payment cashed out until after age 99. None of this should be a problem for clients focused on leaving a legacy for their heirs; reducing heirs’ tax burden is one route to maximizing that legacy.

Other clients are motivated to convert because they expect to save money on their own taxes while alive. These clients need to be cautioned that RMDs are individually small, hence incur a correspondingly small tax obligation each year, which in turn allows for a yet smaller amount of tax savings (Table 1). In the base example, $100,000 was converted at the cost of an up-front tax payment of $22,000. The discounted tax savings in the first year equaled $107. That is 11 basis points of the converted amount, about half a percent of the tax payment, and 3.6 percent of the total expected payoff. Does the client understand how much patience will be required?

The prudent planner will make sure the client understands that the payoff from a Roth conversion designed to reduce RMDs is received drip by drip and may be quite small in the grand scheme of things, scaling with the gap between present and projected tax rates.

Tax Scenarios

This section looks first at unfortunate outcomes—future tax scenarios that depart from expectations in an undesired direction. These are followed by select rescue scenarios, to tease out the extent to which an initial unfortunate start can be overcome by subsequent favorable developments.

Unfortunate Outcomes

These fall into two broad groups: unanticipated changes in tax legislation and failure to correctly anticipate one’s own tax situation. Each reflects the enduring truth that the future cannot be known in advance.

Unexpected tax legislation

Suppose that expiration of the TCJA occurs as scheduled in 2026. However, 2026 is an election year; perhaps enraged taxpayers proceed to bombard candidates with objections. Beginning in 2027, the chastened new Congress restores all the lower rates, such as 22 percent, parallel to what happened with EGTRRA after 2012. Let the restored 22 percent rate hold constant throughout the remaining years of the projection.

Result? The total payoff from the 2025 conversion is a discounted $107, per Table 1. No further payoffs will be received after 2026. Total payoff on the $100,000 conversion is about 11 basis points—an annualized rate of return of 0.11 percent after that one year, a rate that steadily decreases as the years pass without any new tax hike.

Except that formulation is not quite right. The $22,000 paid to the government to convert in 2025 is not unwound just because expectations for avoiding a higher future tax rate have been set back. The $22,000 tax payment made in 2025 was, in all but name, a loan to the government. The loan amount amortizes over the years as taxes on future distributions, now at the same 22 percent rate as the conversion, would have been avoided. As shown in Table 1 and Figure 1, the loan is not fully paid until total distribution would have occurred. If the taxpayer dies at life expectancy, there will be about $9,000, less the $107 savings in 2026, not paid back as yet; the government undertakes to “pay” the remainder to heirs as their withdrawals accelerate under SECURE 1.0.

RMD-reducing Roth conversions are a risky bet. Payoff can be minimal as well as slow.

Unexpected change in taxpayer situation

This next scenario becomes more plausible if the conversion occurred some years before age 72, say in 2018, to harvest the new TCJA rate of 22 percent. The taxpayer, as before, turns 73 in 2026 and begins RMDs. The conversion was thus made seven years early, on the assumption that TCJA would expire.

Taxpayers who do not have a professional adviser often fail to grasp how income tax brackets adjust for inflation, and what this adjustment means for Roth conversion planning. Such an individual might have projected their future taxable income in 2026 to be about $46,000, proceeded to check that value against 2018 tax brackets, and noted that it falls comfortably within the 22 percent bracket, whose floor in 2018 was $38,700. They proceed to undertake a Roth conversion, confident that their tax rate on that income will revert to 25 percent after the TCJA expires. For this scenario, let the TCJA expire as scheduled and stay expired. Thus, the taxpayer correctly predicts tax legislative outcomes.

Unfortunately, they misunderstood their own situation. After the unexpected inflation of 2021 and 2022, and projecting forward to 2026, the floor of the 22 percent / 25 percent bracket should then be about $50,000.9 This taxpayer converted at 22 percent to avert what turned out to be taxation in the next bracket down, at a post-TCJA rate of 15 percent. This scenario will stand for the large class of conversions where either tax legislation or individual taxpayer error produce a future tax rate lower than the conversion tax rate. These conversions unexpectedly lose money; but how much, and over what time course?

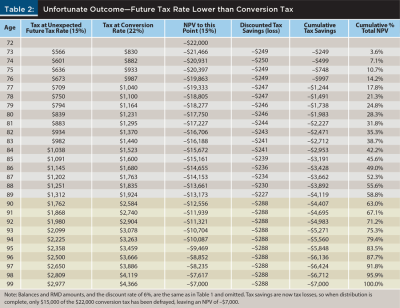

No alteration to the structure of Table 1 is required to handle losses on a conversion. However, to accommodate subsequent rescue attempts, Table 2 shows the NPV time course of this unfortunate conversion. Applying the customary formula, this conversion has an NPV of –$7,000. But over what time course? A taxpayer who finds themselves in this situation as RMDs begin will fervently hope that their applicable future tax rate is not constant over the entire 27-year span of the projection.

Fortunately for subsequent rescue attempts, the loss accumulates at the same slow pace as the gains in Table 1 (because the RMD schedule again drives the pace). The first-year loss is $250, which is 7/3 the first-year gain of $107 in Table 1. Likewise, at life expectancy only about 60 percent of the total NPV of minus $7,000 has been booked.

Roth conversions can lose money. Same as potential gains, the losses scale with the difference in future tax rates, here –7 percent versus the +3 percent in the baseline case. Likewise, realized losses accumulate at the same slow pace as gains—and the bleeding may stop if the future tax rate changes in some favorable way.

Rescue Outcomes

Here the goal is to calibrate how much of the expected payoff can be regained after a poor start, should favorable circumstances transpire. Two future developments of general interest are considered:

- Heirs occupy a higher tax bracket than the taxpayer.

- One member of the couple dies, and the survivor pays tax at the higher single rate.

Heirs in higher bracket

Consider again the case where the uninformed taxpayer converted at 22 percent to avert future tax that turned out to be only 15 percent (Table 2). This taxpayer will have a shortfall of about $4,000 at life expectancy. Two sub-scenarios are considered.

Suppose first that the heirs’ tax rate is made to be the 25 percent that the taxpayer was expecting to pay and attempting to avert. Over the 10 years of distribution to heirs, the conversion once again produces positive tax savings each year; these are the same dollar values as in the corresponding cells of Table 1. However, at only $123 each year in NPV, this turnaround ameliorates the stipulated loss accumulated by the taxpayer as of their demise but cannot overcome it. The total loss on the conversion after everything has been distributed would be about $2,900, which only looks good in comparison to the $7,000 loss that would have been booked if the heirs had not been in a higher tax bracket than the unfortunate converter.

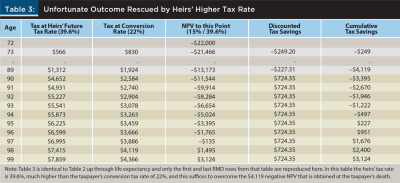

Next, put the heirs into the highest tax bracket expected after the TCJA expires, 39.6 percent (Table 3). Ten years of much greater tax savings (39.6 percent – 22 percent) suffice to overcome the loss experienced by the taxpayer while alive and produce a net payoff of several thousand dollars for the heirs. The spreadsheet set-up also makes it possible to calculate the breakeven tax rate for heirs—the rate that will cancel out any earlier loss experienced by the taxpayer. In this case, that is about 32 percent, a plausible rate for heirs in the professional or managerial class during their peak earning years.10

This first rescue attempt reveals an important feature of an NPV model that properly discounts the stream of future tax savings: each year’s tax savings is additive, and if changing tax rates produce a mix of positive and negative values, these net out as distribution continues. Initial losses from an ill-advised or unfortunately timed conversion can be overcome by subsequent gains if the applicable tax rate flips to being greater than the conversion tax rate. But again, until total distribution occurs, losses, same as gains, are only potential. The final outcome is determined by heirs’ tax situation and is received by heirs, not the taxpayer who converts.

Widowed survivor in a higher tax bracket

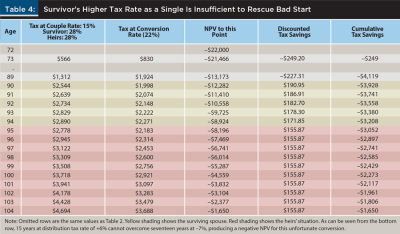

Roth conversions are sometimes pitched as a way to protect the surviving member of a couple, who may find themselves in a higher (single) tax bracket after the first spouse passes (McQuarrie 2023). Table 4 calibrates the extent to which moving into a higher tax bracket upon widowing can rescue an initially unfortunate conversion. For these scenarios, the expiration of TCJA is assumed.

The unfortunate scenario again provides the base case: conversion at 22 percent, distributions taxed at only 15 percent while both spouses are alive. The first spouse dies at life expectancy; the second spouse lives to joint life expectancy, which is an additional five years. During this period the survivor, filing as single, plausibly finds themselves in the 28 percent tax bracket post-TCJA. As can be seen from the table, five years of distribution at a tax rate of +6 percent cannot overcome 17 years of a distribution rate that is –7 percent relative to the conversion rate. After 22 years and the death of the survivor, the age 72 Roth conversion will have produced a negative NPV of just over $3,000. The survivor’s tax rate swung 13 percentage points relative to the couple’s, but it was not enough if one spouse lives to single life expectancy while the other survives only to joint life expectancy.

Next, let the heir(s) who begin SECURE 1.0 distributions also be in the 28 percent tax bracket, same as the surviving spouse. Their distribution span of 10 years, at a +6 percent rate, added to the spouse’s five years at +6 percent, still does not quite overcome the first 17 years of –7 percent, and the conversions show a loss of $1,600 after all distributions conclude.

This unfortunate scenario can only be rescued if heirs are in an even higher bracket than the widowed spouse. Alternatively, have the first spouse die prematurely, in their mid-70s, early enough that the several years in which the couple pays tax at –7 percent can be plausibly overcome by the widowed survivor who books enough years at +6 percent.

Summary

It seems likely that ill-advised or ill-timed Roth conversions can sometimes be rescued by later, favorable developments in the tax rate that applies as distributions continue. However, any rescue necessarily proceeds at the same very slow pace at which the initial losses had accumulated. If there aren’t enough years where tax rates flip to being favorable, or if the flip is not favorable enough, rescue will be incomplete, and the projection will conclude with a loss on the conversion.

Are Roth Conversions a Good Bet?

Here are a few rules of thumb—and they are only that—for when conversions are a good bet. Client situations are diverse, and as shown above, all conversions are risky. But some conversions carry less risk and/or have more upside than others. Conversions are least risky for:

- Clients who are focused on their legacy and have good reason to believe their heirs will be in a considerably higher tax bracket than applied to the conversion.

- Clients who were in a high tax bracket while working and built up a large tax-deferred account, but now temporarily find themselves in a low tax bracket, with no expectation of remaining there once RMDs from those large TDA balances begin.

- Clients who can convert at 12 percent or less today and have every reason to expect at least moderate amounts of taxable income in the future that might be taxed at 12 percent or more, as from a combination of Social Security, pension, and RMD income. Here the attractiveness lies not in the certainty of payoff, but in the low risk of loss: future income could fall a little short of expectation, of course, and be taxed at only 10 percent; or future tax legislation could further lower the 12 percent rate. But any drop is likely to be small, even as the odds are good that the future tax rate on the marginal dollar in RMDs will be higher than 12 percent.

- Clients who can convert at 0 percent, as in a backdoor Roth or mega-backdoor Roth. There is no loan to the government and every reason to suppose that in the absence of conversion, the underlying investments would later be taxed at some positive rate.

This last, painfully obvious rule is included as a reminder that Roth accounts are the most tax-favored of all accounts, and a wonderful thing to have—so long as the cost of obtaining such an account is kept within bounds.

Next, here is a set of circumstances where a Roth conversion becomes a high-risk, low-payoff bet.

- In general, the earlier the conversion, the more risky the bet; the future is necessarily uncertain, and the more distant the future the more so. Too much can change, legislatively or personally. No one who converted at the first opportunity in 1998, after the creation of Roth accounts, at the then 28 percent rate, had any reason to expect that income in that bracket would see a rate reduction first to 25 percent under EGTRRA and then to 22 percent under TCJA.11

- The higher the tax rate paid on conversion, the bigger the loan made to the government and the greater the vulnerability to a change in personal circumstances or in the legislative environment.12

- Conversions that represent a pure bet on future legislation—as in the baseline example of converting at 22 percent to avoid tax at 25 percent post-TCJA—typically have small payoffs, high uncertainty, and considerable downside risk. The taxpayer has to get both future congressional action and their own future tax situation correct, to win a modest payoff; if they get both wrong, the cost may be steep. Interestingly, converting at 24 percent to avert 28 percent post-TCJA is a somewhat safer bet. If this client gets both predictions wrong, they paid 24 percent to avert tax of 22 percent, a smaller downside.13

- Conversions intended to reduce RMDs and deliver a payoff during the client’s life are almost certain to be disappointing unless the conversion tax rate is in single digits and the tax gap is a multiple of it and in double digits. The base case in this paper violated both conditions. The middle bracket converter has to live long enough, with no untoward personal events or unexpected legislation, for a payoff to be received while alive. Most of the time, these conversions will represent a loan to the government not fully paid off even at the taxpayer’s demise, with any payoff going to the heirs.

Caveats and Cautions

Planners will encounter at least two types of clients when it comes to Roth conversions: the enthusiastic and the reluctant. The gist of this paper is to leave the reluctant be—do not advocate for a conversion against resistance. The more risk-averse and loss-averse the client, the less the appeal of Roth conversions. There are too many things that could go wrong, as illustrated earlier; these reluctant clients, even if they can’t construct a spreadsheet model, are probably responding based on their intuition about what could go wrong, and perhaps also making a judgment that the stakes at issue are too small for the bother. Their disinclination to convert may be well-founded; leave them be.

On the other hand, the planner may also encounter enthusiastic would-be converters who haven’t done the math, or who have succumbed to the simplest version of the rational decision model, in which higher future tax rates are a given, and no discounting is applied to future tax savings. Planners want to be particularly alert to clients who have succumbed to money illusion, as with the top-bracket taxpayer described earlier, who naively expects their large conversion today to save $60 million dollars in future income tax down the road. The planner should hammer home the point that it is imperative to discount future cash flows.

Net present value analysis will not be part of the toolkit of the typical client who seeks financial planning advice. The tables in this paper allow the planner to walk the client through the key points:

- It will likely be decades before all the payoffs from this RMD-reducing conversion will be in hand.

- The first-year payoff on a $100,000 conversion could be as little as $100.

- If anything changes over those decades, payoffs may cease; in the worst case, subsequent losses may erode initial gains.

- If the client fails to predict correctly the direction of future tax legislation and/or misjudges their own income trajectory, substantial losses may be on tap.

- If the client gets everything right, a small increment to after-tax wealth may be received by heirs some decades later.

Conclusion

If the future could be known with certainty, Roth conversions would not be a wager and there would be no risk of failure. The planner would array the known future tax rate against the known conversion rate, and then recommend or discourage conversion as indicated.

But future tax rates cannot be known with certainty. And dollars not received until decades hence are not worth the same as dollars paid to the government today.

Citation

McQuarrie, Edward F. 2024. “Net Present Value Analysis of Roth Conversions.” Journal of Financial Planning 37 (9): 76–90.

Endnotes

- A year-by-year record of tax brackets and rates, back to 1913, is maintained by the Tax Foundation at https://taxfoundation.org/data/all/federal/historical-income-tax-rates-brackets/.

- The 22 percent bracket may be wide enough to accommodate a $100,000 conversion in 2025; it is not today. Accordingly, $100,000 is an arbitrary amount used so that rounding to the nearest dollar in tables will not be misleading. Had smaller conversions certain to fit within a bracket been used, say $10,000, accuracy would have required table entries expressed to the penny and/or mill.

- A note on verb tense: technically, the subjunctive tense should be used throughout, as in “the distribution that would have occurred in the absence of a conversion.” However, strict adherence to this policy produced a more verbose exposition that was not any clearer. Hence, much of the time simpler verb forms are used, with an occasional reversion to the subjunctive tense to remind the reader that tax savings occur from not having to later distribute funds because a conversion was performed.

- This is annuitant life expectancy, as used by the IRS to construct the RMD tables. Life expectancy for the annuitant population is greater than for the general population as tracked by the Social Security Administration.

- Equal to $100,000 divided by the age 73 divisor of 26.5. RMDs are set by the prior year-end balance.

- This could be expressed as 4.33×. When I say 13/3, I keep the two tax rate differences visible: a conversion that saves 3 points on the tax rate (convert before TCJA expiration at 22 percent saving 3 points versus the 25 percent expected) versus a conversion at 12 percent now that saves 13 points relative to the expected post-TCJA rate of 25 percent). The idea is that the dollar amount of NPV across cases is exactly proportional to the difference in tax rate at the time of conversion versus the future tax rate that will apply. The same explanation applies for other fractions later in this paper.

- See www.edwardfmcquarrie.com.

- This age is greater than in Table 1 because the long-lived taxpayer does not accelerate distributions as occurs under SECURE 1.0; that pace (10 percent) is not reached for the living until age 93.

- The 2018 value comes from the archive at the Tax Foundation; $50,000 is derived by inflating the current 2024 bracket floor by 3 percent over two years.

- That bracket is scheduled to revert to 33 percent post-TCJA.

- The Tax Foundation also provides tables in constant dollars, allowing the reader to confirm that income in the middle of today’s 22 percent bracket would have fallen into the 28 percent bracket in 1998.

- This paper’s coverage is restricted to the mass affluent. Clients wealthy enough to be subject to estate taxation face a more complicated and doubly uncertain calculation of future tax rates, estate plus income tax, and their situation is not addressed.

- The risk of converting in the 24 percent bracket is incurring excess IRMAA; see McQuarrie (2024).

References

Brown, D.C., S. Cederburg, and M. S. O’Doherty. 2017. “Tax Uncertainty and Retirement Savings Diversification.” Journal of Financial Economics 126 (3): 689–712.

Horan, S. M., J. H. Peterson, and R. McLeod. 1997. “An Analysis of Nondeductible IRA Contributions and Roth IRA Conversions.” Financial Services Review 6 (4): 243–256.

Krishnan, V.S., and J. Cumbie. 2016. “Roth Conversion: An Analysis Using Breakeven Tax Rates, Breakeven Periods, and Random Returns.” Journal of Personal Finance 15 (1): 37.

McQuarrie, E.F. 2023. “Widow Tax Hit Debunked.” Journal of Financial Planning 36 (12): 62–74.

McQuarrie, E. F. 2024. “IRMAA: Resistance is Futile.” Available at SSRN: https://ssrn.com/abstract=4700784 or http://dx.doi.org/10.2139/ssrn.4700784.

McQuarrie, E.F., and J. A. DiLellio. 2023. “The Arithmetic of Roth Conversions.” Journal of Financial Planning 36 (5): 72–89.

Reichenstein W., 2020. “Saving in Roth Accounts and Making Roth Conversions before Retirement in Today’s Low Tax Rates.” Journal of Financial Planning 33 (7): 40–3.

Reichenstein, W., and W. Meyer. 2020. “Using Roth Conversions to Add Value to Higher-Income Retirees’ Financial Portfolios.” Journal of Financial Planning 33 (2): 46–55.

Young, R. 2020. “The Roth/Pretax Decision in Late Career Years: The Increasing Importance of Accumulated Assets in Light of the SECURE Act.” Journal of Financial Planning 33 (7): 59–68.