Journal of Financial Planning: April 2022

Executive Summary

- Historical differences in compensation may influence how representatives from broker-dealers, registered investment advisers, and dual registrants select funds.

- Evidence from advertising content suggests that active-fund families promote characteristics such as recent returns that are appealing to investors and reward commission-compensated advisors, but do not predict future performance.

- Using a survey that asks advisors to list the top three criteria they use when selecting mutual funds for a clients and their investment style, we find that registered representatives (from RIAs) favor more salient characteristics such as expense ratio while representatives from broker-dealers and dual registrants favor recent returns and active investing strategies.

- Registered representatives from RIAs are more likely to follow a passive investing strategy and consider expense ratio as an important fund characteristic, while there is no statistical difference between representatives from broker-dealers and dual registrants.

- These findings are consistent with the existence of conflicts that favor the promotion of active investing strategies among advisors who are regulated as fiduciaries.

Michael Finke is a professor of wealth management and Frank M. Engle Chair of Economic Security at The American College of Financial Services, and oversees the Wealth Management Certified Professional designation. He received the Montgomery-Warschauer Award from the Journal of Financial Planning in 2013 and 2014.

Aron Szapiro is head of Morningstar Investment Management’s Center for Retirement and Policy Studies, and chairs Morningstar’s Public Policy Council. His research has been covered in The New York Times, The Wall Street Journal, The Washington Post, The Journal of Retirement, and on National Public Radio. Follow Aron on Twitter: @AronSzapiro

David M. Blanchett, Ph.D., CFP®, CFA, is the head of retirement research for PGIM DC Solutions, and an adjunct professor of wealth management at The American College of Financial Services. He is the recipient of the Journal’s 2007 Financial Frontiers Award and its 2014, 2015, and 2019 Montgomery-Warschauer Award.

Editor’s Note: The authors make a distinction between advisor and adviser. “Advisor” refers to all advisory groups, while “adviser” is used specifically for RIAs.

NOTE: Please click tables below for PDF versions

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Financial advisors in the United States broadly fall within the category of registered investment advisers (RIA), with registered representatives usually compensated by asset fees, and representatives from broker-dealers compensated through the sale of financial products such as mutual funds. In 2020, actively managed mutual funds represented 60 percent of all fund assets, while 40 percent of fund wealth is held in passive index funds or ETFs (ICI 2021). Actively managed funds are most often distributed through broker-dealer representatives who receive payment from commissions; however, an increasing number of financial advisors employed by large broker-dealer firms are dual registrants and operate as both RIAs and broker-dealers and may be compensated both through commissions and asset management fees depending on the relationship with a client.

This study uses a propriety survey of advisors who are either broker-dealer representatives, dual registrants, or registered investment adviser representatives (whom we also refer to as registered representatives) to test whether advisor channel influences the value they place on fund characteristics. This study adds to our understanding of the underperformance of mutual funds preferred by brokers and dual registrant advisors in Boyson (2019), and provides additional insight into why financial advisors place greater importance on fund characteristics that do not predict future fund excess returns, such as performance relative to a benchmark, and consider more salient fund characteristics (such as fees) to be less important (Jones, Lesseig, and Smythe 2005). Results from the advisor survey allow us to explore whether advisor channel influences the value financial advisors place on salient fund characteristics when researching funds, and whether advisor channel is related to preference for a more active investment strategy. We find significant differences in investment preferences between broker-dealer representatives, who favor less salient fund characteristics and more active portfolio strategies, and registered advisers whose opinions are more closely aligned with objective evidence. There is no evidence that the fee compensation or fiduciary standard of care applied to dual registrant representatives results in fund or investment style preferences that differ from commission-compensated broker-dealer representatives.

Literature Review

The strongest predictor of future mutual fund performance in the empirical finance literature is the fund’s expense ratio (negative relation), followed by actions that increase fund expenses such as turnover and sales loads (Carhart 1997 and others). Prior returns provide no useful information about future fund performance. In a 2004 survey, financial advisors indicate that they place greater importance on fund characteristics that do not predict future fund excess returns, such as performance relative to a benchmark, and consider more salient fund characteristics such as loads and fees to be least important (Jones, Lesseig, and Smythe 2005).

Individual investors appear to hold similar misperceptions about the salience of mutual fund characteristics. More than half who invested in an actively managed fund did so because they believed performance would exceed a passive fund, and nearly half (48 percent) indicated that the influence of a financial advisor was important to their investment in an active fund (Choi and Robertson 2020).

Why do financial advisors and consumers hold inaccurate mutual fund beliefs? Actively managed funds often provide consumers and advisors with information about prior performance that gives the appearance of being useful. Mutual fund companies tend to feature non-salient fund characteristics such as recent performance in advertisements placed in the financial press. Print ads in Barron’s and Money Magazine highlight recent superior performance, resulting in an increase of subsequent investor inflows followed by no evidence of future outperformance (Jain and Wu 2000). Families spend more on marketing funds that have recently outperformed, and these heavily marketed outperforming funds draw excess inflows from investors (Sirri and Tufano 2002).

Mutual funds are either marketed through a broker intermediary or sold directly to investors by the fund company (direct channel). Nearly all funds sold through the broker-dealer channel are actively managed, and actively managed funds within the broker-sold segment underperform passive index funds by 1.12 percent to 1.32 percent per year (Del Guercio and Reuter 2014). Broker-dealer representatives may be compensated for their advising services through a portion of these fees.

Boyson (2019) estimates that dual registrants oversee 81 percent of assets managed by RIAs, and the remaining 19 percent are managed by RIAs that do not operate as dual registrants. Dual registrant representatives often sell institutional class mutual funds from the same families as broker-dealer representative-sold funds. Many of these funds offer revenue share agreements that offer incentives to the parent company, for example, payments for “research” from the brokerage firm, conferences, or promotion as a “preferred” fund provider by the brokerage firm. Boyson (2019) finds evidence that registered representatives acting as RIAs who work for dual registrants place significantly more client assets in mutual funds that offer revenue sharing agreements, and institutional funds that provide a revenue share with brokers significantly underperform other funds.

Fund performance information promoted by actively managed funds often highlights returns over a recent period relative to a benchmark. High returns may contain useful information about heterogeneous manager skill, although any economic rewards of possessing these skills appear to flow entirely to the fund manager and not the fund investors (Berk and Green 2004). There is a “disheartening” lack of persistence in excess fund returns among active managers, and even the most skilled managers who achieve gross outperformance are not able to provide alpha to fund investors net of fees (Fama and French 2010).

Return chasing by brokers may be rational if commission funds that have recently outperformed are easier to sell to naïve clients. Advisors and investors apply a representativeness heuristic to recent fund returns by investing more in funds after higher recent performance while failing to punish subsequent underperformance by withdrawing funds (Roussanov, Ruan, and Wei 2020). Active funds have an incentive to develop and promote funds that have recently outperformed since outperformance attracts investment dollars that remain in the fund, even if performance subsequently matches or even underperforms a passive index. For example, fund families incubate new funds by seeding them with modest initial capital investments and subsequently promote those that have randomly outperformed—drawing investor dollars that are insensitive to ex post underperformance (Evans 2010).

A cynical view of active fund marketing is that brokers are aware that consumers are attracted to high recent returns and take advantage of biased perceptions to sell lower quality investments. There is evidence that advisors who are compensated from commissions recommend mutual funds with lower investment performance. Christoffersen, Evans, and Musto (2009) demonstrate that variation in payments to independent broker-dealers from mutual funds influenced the recommendations their representatives made. The article’s findings were cited in the Department of Labor’s economic impact analysis of the 2016 rules package known as the “Fiduciary Rule,” which aimed to curb conflicts of interest in the market for advice to retirement investors (U.S. Department of Labor 2016).

An alternative explanation is that advisors are trained to value fund characteristics that make funds easier to sell, even if these characteristics are not useful as predictors of future returns. This view is supported by fund investments made by broker-dealer representatives themselves. Linnainmaa, Melzer, and Previtero (2018) find that financial advisors also invest in funds with high recent returns, frequently buy and sell funds, and underperform passive investments. They also continue to follow this return-chasing fund investment approach even after they leave the industry.

There is evidence from other professions that information sponsored by product manufacturers can supersede more objective information among professionals who face financial conflicts of interest. For example, drug manufacturers also distribute products through expert intermediaries who recommend pharmaceuticals to less informed clients. Pharmaceutical companies sponsor research and provide education at professional conferences, and research suggests that this information effectively creates beliefs about products that are not consistent with the scientific consensus.

Physicians hold attitudes about the effectiveness of pharmaceuticals that are closer to those provided by promotional materials than with the objective scientific evidence (Avorn, Chen, and Hartley 1982). Physicians are often unaware of the extent to which their opinions are influenced by marketing, and belief in their own expertise makes them overconfident in their ability to avoid holding biased opinions (Sah and Fugh-Berman 2013). Rather than rejecting one’s own biased beliefs formed through sponsored education in the face of contrary evidence, doctors will resort to behaviors that reflect cognitive dissonance including denial and rationalizations.

Prior research shows evidence that advisors who sell commission-compensated mutual funds place a greater value on fund characteristics often promoted by fund families. While most research has focused on broker-dealers and conflicts that manifest in recommendations made by broker-dealer representatives, many large broker-dealers also have RIA arms in which advisors are compensated through asset management fees.

Unlike broker-dealers, RIAs and their representatives are legally required to follow a fiduciary standard of conduct by putting their clients’ needs ahead of their own. If registered advisers genuinely believe in the saliency of fund characteristics promoted through education sponsored by fund families, it is possible that, like physicians who have a fiduciary responsibility to their patients, these advisors may hold biased beliefs that they maintain even when they share in the performance loss by charging asset management fees. These biased beliefs may be promoted by the broker-dealer that oversees adviser training and education.

Data

We use data from all 811 responses to a survey emailed to advisors who were registered with Morningstar.com in September 2020. Of the 811 responses, we evaluate the 459 respondents who identified themselves as either registered adviser representatives, dual registrant representatives, or representatives of a broker-dealer. The number of respondents among advisor channels is similar among representatives we surveyed—37.3 percent operate as RIAs, 33.8 percent are broker-dealers, and 29.0 percent are, or work for, dual registrants. The distribution does not reflect the total financial advisor channel distribution, which is approximately 48 percent broker-dealer only, 43 percent dual registrant, and 9 percent independent RIA (FINRA 2020). The sample likely reflects a more sophisticated clientele of professionals who use third-party information services to conduct independent research. Characteristics collected in the survey include advisor channel, tenure as an advisor, assets under management, number of clients, gender, and age.

Advisors were asked to list the top three criteria they use when selecting specific mutual funds for a client from among 18 possible choices, including expense ratio and return relative to a fund category. Advisors were also asked, “What investment strategies do you employ?” and could choose from active-only, mostly active blend, passive-only, and mostly passive blend. Our primary objective is to test the hypothesis that dual registrant representatives (who are acting as fiduciaries) and representatives from RIAs have preferences that differ significantly from broker-dealers.

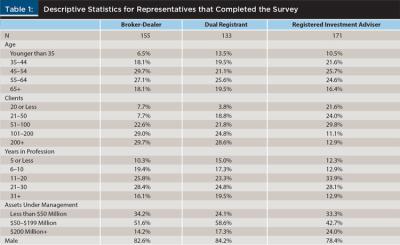

Table 1 shows characteristics of respondents in each advisor distribution channel. Representatives working for RIAs are slightly younger than other advisors and have fewer clients. More than 75 percent of both broker-dealers and dual registrant representatives have greater than 50 clients, and most have more than 10 years in the profession. A smaller percentage of broker-dealers (14.2 percent) and dual registrant representatives (17.3 percent) have more than $200 million of assets under management compared to representatives from RIAs (24.2 percent). Most respondents are men, with a higher percentage among dual registrants (84.2 percent) and broker-dealers (82.6 percent) than RIAs (78.4 percent).

Table 2 shows differences in investment strategies among representatives from broker-dealers, dual registrants, and RIAs. 37.3 percent more RIAs evaluate expense ratio when searching for mutual funds than dual registrant representatives (52.6 percent versus 38.3 percent), and representatives from broker-dealers are least likely to consider fund expense ratio (31.6 percent). 25.4 percent more dual registrant representatives consider return relative to a category when making fund recommendations to a client than RIAs (28.6 percent versus 22.8 percent), which is similar to the percentage of broker-dealers (27.1 percent) who value recent returns. A much higher percentage of registered representatives expect to select a passive fund as their next mutual fund (33.9 percent) than broker-dealers (13.5 percent) and dual registrant advisors (15.0 percent). 33.3 percent of RIAs build portfolios primarily from passive investments, which is more than twice the percentage of broker-dealers (16.1 percent) and dual registrant advisors (15.8 percent).

In order to evaluate possible differences in investment preferences by advisor distribution channel, we conduct four multivariate analyses that control for advisor characteristics. The analyses use categorical dependent variables and are modeled through a logistic regression to measure differences in the odds that an advisor values either expense ratio or returns relative to an investment category, plans to select a passive mutual fund as their next fund investment, and follows an investment strategy that is primarily passive. Omitted reference categories include advisor age younger than 35, fewer than 50 clients, five years or less of experience, less than $50 million of assets under management, and acting as a broker-dealer.

Results

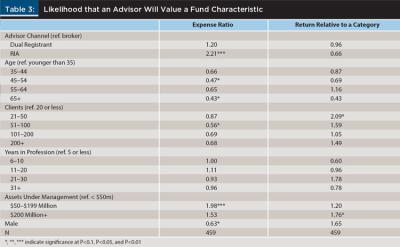

Table 3 shows the log odds ratios of advisor characteristic on the value placed on mutual fund attributes. A parameter estimate of 1 indicates no difference in predicted likelihood relative to the reference category, a number greater than 1 indicates an increased likelihood, and a number less than 1 indicates a lower likelihood of valuing a fund attribute.

The odds that representatives acting as RIAs consider expense ratio when recommending a specific mutual fund for a client are 121 percent higher than among broker-dealers, while there is no statistical difference between representatives from dual registrant or broker-dealer firms. The odds that registered representatives consider return relative to a benchmark is 34 percent lower compared to broker-dealer representatives, but the difference is not statistically significant. Lower odds of considering expense ratio when selecting mutual funds are observed among older advisors, men, and advisors with more clients and less than $50 million of assets under management. There are few statistically significant predictors that an advisor will consider return relative to a category when valuing funds.

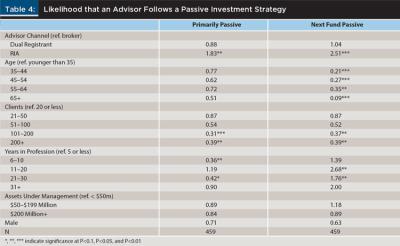

Table 4 shows preference for a passively managed investment approach. Similar to the regressions predicting the use of evidence-supported characteristics to select mutual funds, there is likewise no statistical difference in preference for passive fund management between broker-dealer and dual registrant representatives. Compared to broker-dealers, the odds are 83 percent higher that registered representatives follow a primarily passive investment strategy than brokers, and the odds are 151 percent higher that a registered representative will select a passive fund as their next mutual fund. Older advisors and advisors with a larger number of clients are more likely to prefer actively managed investments.

Conclusions

Prior analysis of funds recommended by dual registrant representatives by Boyson (2019) finds evidence of significant investment underperformance compared to independent RIAs. Using a survey that asks advisors what investment characteristics they value, we test whether there are significant differences in investment preferences between independent RIAs, dual registrant representatives, and broker-dealer representatives. Results from our analyses can help explain why this underperformance exists. Independent RIAs are far more likely to value information on the most important characteristic predicting future returns (expense ratio), to select passive funds, and to implement a passive investing strategy than broker-dealer representatives. We find no evidence that fund characteristics favored by dual registrant representatives differ from broker-dealer representatives when researching which funds to recommend to clients. Our results are consistent with prior findings that many advisors favor non-salient fund characteristics (Jones, Lesseig, and Smythe 2005), but our results suggest the phenomenon only exists among non-independent RIAs.

Dual registrant representatives act as fiduciaries when providing investment advice to individuals. However, dual registrants operate within a brokerage ecosystem that may influence how the advisors are trained to select fund investments and develop an investment strategy. If they are trained to favor a method of evaluation that promotes selection of actively managed mutual funds, then prior studies of fund performance predict that the investment portfolios of their clients will underperform by roughly the difference between the expense ratios on active and passive funds. This performance deficit is magnified when asset fees are added to the negative alpha generated historically by active funds.

This study can help inform advisors, parent firms, and regulators about the source of observed underperformance of funds recommended by dual registrants acting as RIAs. These advisors appear to be trained to avoid paying attention to fund characteristics that predict future returns, and to pay attention to fund characteristics that are also promoted by active fund families in advertising and have been shown to have no ability to predict performance. This is perhaps not surprising if the parent firm is incentivized through revenue sharing agreements that help support advisor training in portfolio strategies that encourage the use of actively managed funds, or if advisors who were trained as brokers transition into fee-compensated asset management as dual registrants.

This study has some limitations. Advisors who voluntarily completed the survey used in these analyses are not necessarily representative of the population of all financial advisors, and the sample size is modest. We also know nothing about differences in the level of formal education among advisors. Despite these limitations, the magnitude and significance of the results, coupled with the fact that 70 percent of the sample had at least 10 years of experience in the profession and use a third-party information service to conduct independent fund analysis, suggest a need for further research into the training and investment selection practices of dual registrant advisors.

Citation

Finke, Michael, Aron Szapiro, and David M. Blanchett. 2022. “Does Advisor Channel Influence Passive Fund Choice?” Journal of Financial Planning 35 (4): 68–77.

References

Avorn, J., M. Chen, and R. Hartley. 1982. “Scientific Versus Commercial Sources of Influence on the Prescribing Behavior of Physicians.” American Journal of Medicine 73 (1): 4–8.

Berk, J. B., and R. C. Green. 2004. “Mutual Fund Flows and Performance in Rational Markets.” The Journal of Political Economy 112 (6): 1269–1295.

Boyson, N. 2019, May. “The Worst of Both Worlds? Dual-Registered Investment Advisers.” Northeastern U. D’Amore-McKim School of Business Research Paper No.3360537. https://ssrn.com/abstract=3360537.

Carhart, M. M. 1997. “On Persistence in Mutual Fund Performance.” The Journal of Finance 52 (1): 57–82.

Choi, J. J., and A. Z. Robertson. 2020. “What Matters to Individual Investors? Evidence from the Horse’s Mouth.” The Journal of Finance 75: 1965–2020.

Christoffersen, S. E. K., R. Evans, and D. K. Musto. 2013. “What Do Consumers’ Fund Flows Maximize? Evidence from Their Brokers’ Incentives.” The Journal of Finance 68 (1): 201–235. www.jstor.org/stable/23324395.

Del Guercio, D., and J. Reuter. 2014. “Mutual Fund Performance and the Incentive to Generate Alpha.” The Journal of Finance 69 (4): 1673–1704.

Evans, R. B. 2010. “Mutual Fund Incubation.” The Journal of Finance 65 (4): 1581–1611.

Fama, E. F., and K. R. French. 2010. “Luck versus Skill in the Cross-Section of Mutual Fund Returns.” The Journal of Finance 65: 1915–1947.

FINRA. 2020. “2019 FINRA Industry Snapshot.” www.finra.org/sites/default/files/2019%20Industry%20Snapshot.pdf.

ICI. 2021. Investment Company Institute Factbook. www.ici.org/system/files/2021-05/2021_factbook.pdf.

Jain, P. C., and J. S. Wu. 2000. “Truth in Mutual Fund Advertising: Evidence on Future Performance and Fund Flows.” The Journal of Finance 55 (2): 937–958.

Jones, M.A., V.P. Lesseig, and T.I. Smythe. 2005. “Financial Advisors and Mutual Fund Selection.” Journal of Financial Planning 18 (3): 64–70.

Linnainmaa, J. T., B. T. Melzer, and A. Previtero. 2016. “The Misguided Beliefs of Financial Advisors.” The Journal of Finance 76: 587–621. https://doi.org/10.1111/jofi.12995.

Roussanov, H. R., H. Ruan, and Y. M. Wei. 2020. “Mutual Fund Flows and Performance in (Imperfectly) Rational Markets?” Jacobs Levy Equity Management Center for Quantitative Financial Research Paper. Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3744290.

Sah, S., and A. Fugh-Berman. 2013. “Physicians Under the Influence: Social Psychology and Industry Marketing Strategies.” Journal of Law, Medicine & Ethics 41 (3): 665–672.

Sirri, E. R., and P. Tufano. 2002. “Costly Search and Mutual Fund Flows.” The Journal of Finance 53 (5): 1589–1622.

U.S. Department of Labor. 2016. “Definition of the Term ‘Fiduciary’ Conflicts of Interest-Retirement Investment Advice: Regulatory Impact Analysis for Final Rule and Exemptions.” www.dol.gov/sites/default/files/ebsa/ laws-andregulations/rules-and-regulations/completedrulemaking/1210-AB32-2/ria.pdf.